Editor’s note: ImpactAlpha is pleased to partner with Sustainable Research and Analysis to provide timely market snapshots of trends and developments affecting the sustainable investing market.

Sustainable Research & Analysis publishes three SUSTAIN Indexes on a monthly basis that cover domestic equity sustainable funds, domestic fixed income sustainable funds and foreign equity sustainable funds.

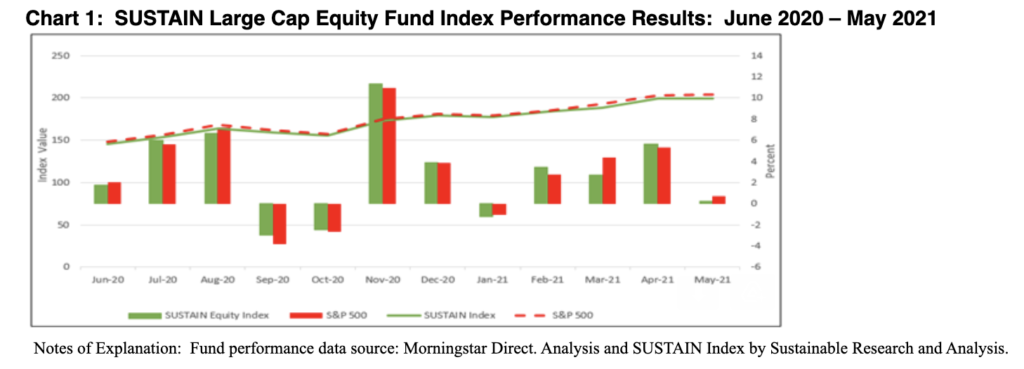

Registering the smallest monthly increase since the end of January, the Sustainable (SUSTAIN) Large Cap Equity Fund Index added 0.21% in May but lagged the S&P 500 Index by 50 bps. The conventional index posted a gain of 0.70% which only five of the ten sustainable funds that comprise the SUSTAIN equity fund index were able to match or exceed. The best performing constituent fund in May was the Pioneer Fund A, up 1.93%, while the worst performing fund was the Eventide Gilead Fund I, ending the month at -2.57%. While the SUSTAIN equity fund index also lags the S&P 500 along intervals up to one-year, it excels for the trailing 3-years 18.5% versus 18.0%, calculated on an average annual basis. Refer to Chart 1.

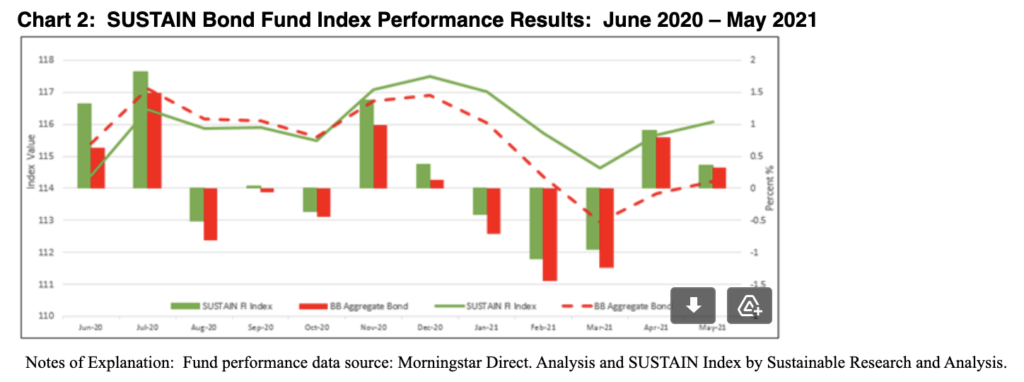

The Sustainable (SUSTAIN) Bond Fund Index eked out a 4 bps advantage relative to the Bloomberg Barclays US Aggregate Bond Index, posting a gain of 0.36% versus 0.33%, and recording its 14th consecutive month of outperformance. Six constituent funds contributed to the benchmark’s outperformance with returns that ranged from 0.37% to 0.46%. The best performing fund in May was the Morgan Stanley Institutional Core Plus Fixed Income Institutional Fund that added 0.46% while the BlackRock Total Return Institutional fund brought up the rear with a return of 0.24%. The SUSTAIN Bond Fund Index is ahead over the three year trailing period 5.6% versus 5.1%. Refer to Chart 2.

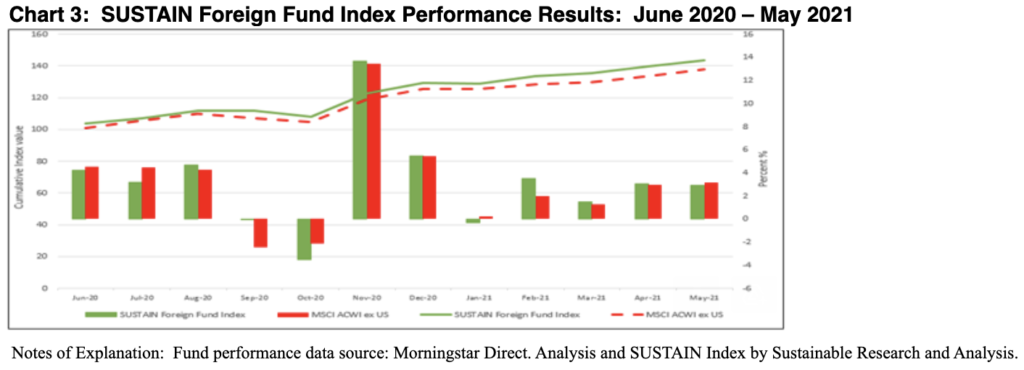

The Sustainable (SUSTAIN) Foreign Fund Index gained 2.92% in May, but that fell short of the 3.13% posted by the MSCI ACWI ex US (Net) Index. Still, the SUSTAIN fund index remains ahead for the trailing 3 and twelve month intervals. Six of the ten constituent funds trailed the conventional index while the remaining four funds generated returns ranging from 3.36% to 3.95%, with the best total return delivered by GMO International Equity Allocation Fund III. At the other end of the range was the Federated Hermes International Equity Fund IS with a total return of 1.91%. Refer to Chart 3.

Henry Shilling is the founder and director of research at Sustainable Research & Analysis, which provides timely monthly snapshots of trends and developments affecting the sustainable investing market segment.