Editor’s note: ImpactAlpha is pleased to partner with Sustainable Research and Analysis LLC to provide timely market snapshots of trends and developments affecting the sustainable investing market.

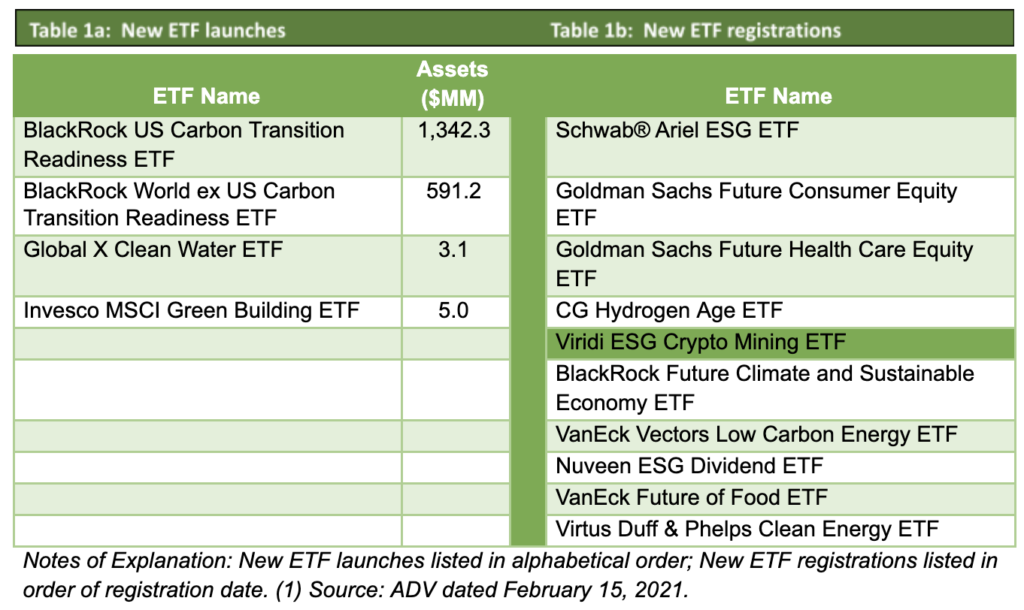

Four new thematic sustainable exchange-traded funds, or ETFs, with $1.9 billion in assets launched during the month of April. Another ten new sustainable ETF SEC filings were also recorded during this interval.

One of these, in particular, caught our attention because the product attempts to combine two hot themes into a single actively managed ETF offering: crypto and environmental, social, and governance, or ESG, integration. A launch date has not yet been established.

Alpha Architect ETF Trust registered its intention to launch the Viridi ESG Crypto Mining ETF. According to the registration statement, the ETF seeks to generate capital appreciation by investing in U.S. and non-US equity securities of companies actively involved in the entire spectrum of cryptocurrency mining, from producers of computer chips, to manufacturers of computer equipment, to directly investing in market participants creating cryptocurrency themselves. The fund intends to invest in approximately 15-30 companies and considers itself to be non-diversified. The fund will not itself invest directly in cryptocurrencies.

All fund investments will be screened on the basis of certain environmental, social and corporate governance impact criteria, and selected cryptocurrency industry companies will emphasize companies that maintain robust and sustainable ESG policies.

The fund’s strategy will rely on an internal evaluation and ranking strategy for determining a company’s ESG policies. Given the high energy usage of the crypto mining industry, a primary ESG focus will be reducing negative environmental impacts of mining and promoting environmental sustainability. More specific details regarding the nature of ESG policies and how such policies are scored, for one, are not provided in the registration statement.

The fund will be managed by Empowered Funds, LLC, a Broomall, PA based firm with 11 employees and one client with $1.02 billion in assets. Empowered is 100% owned by Alpha Architect LLC which is, in turn, 100% owned by Empirical Finance, LLC.

The fund is to be sub-advised by New Gen Mining, an Issaquah, WA-based firm about which limited information is available.

Henry Shilling is the founder and director of research at Sustainable Research & Analysis LLC, which provides timely monthly snapshots of trends and developments affecting the sustainable investing market segment.