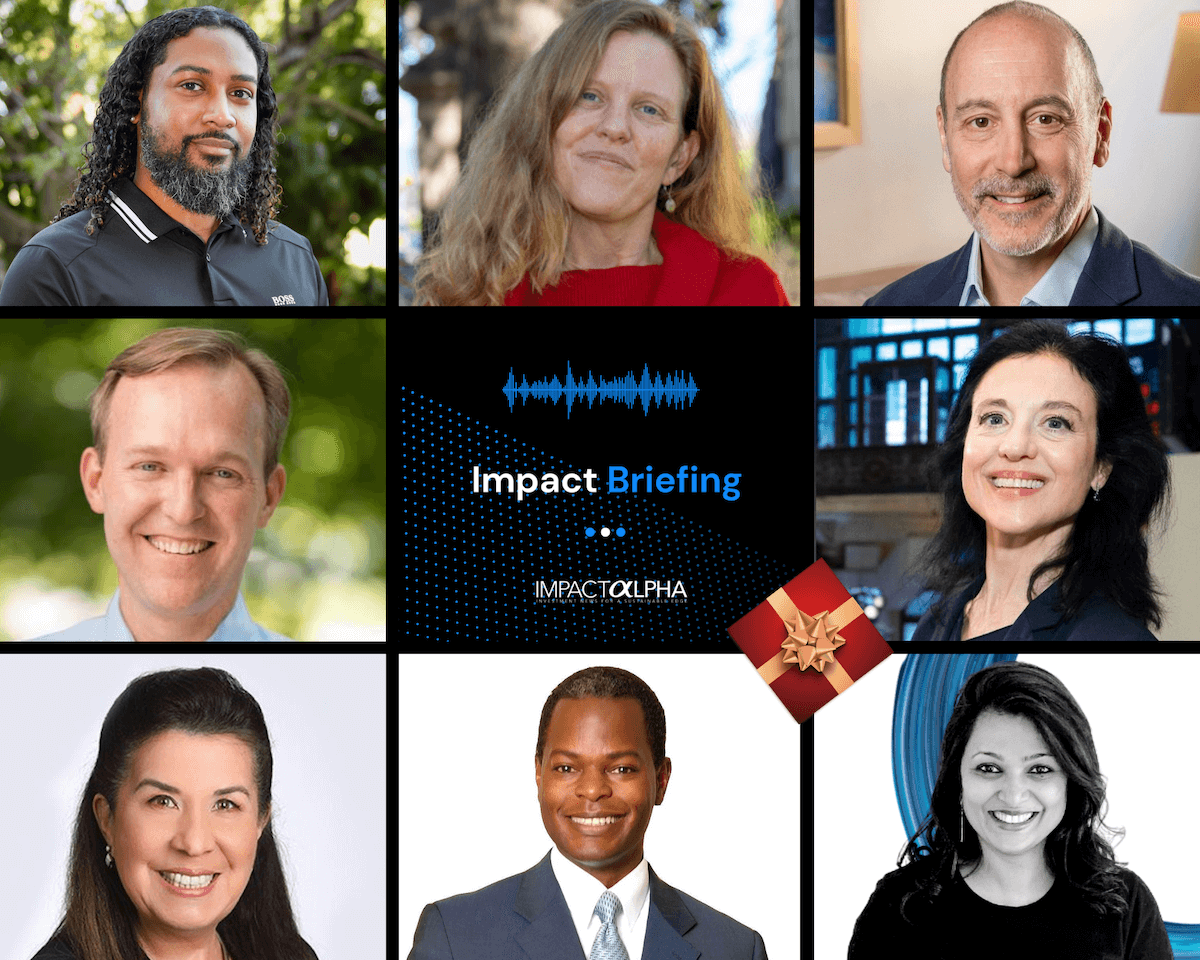

ImpactAlpha, Dec. 23 – Bold leaders. Taking action. Driving impact. That’s the tagline we’ve used for the dozens of Agents of Impact we profiled this year. It could just as well apply to all of the Agents driving impact across sectors, stages, asset classes and geographies.

The 2023 movers and shakers below are just a sample of the bold leaders deploying capital in overlooked markets, transforming staid asset classes for equity and powering inclusive prosperity along with the low-carbon transition.

And much, much more. We’re gratified and humbled that thousands of Agents of Impact rely on ImpactAlpha for news, context, commentary and community. To all of you Agents of Impact, we salute you.

Here’s a dozen to watch in 2024:

Amy Duffuor, Azolla Ventures

Bridging climate gaps with catalytic capital

Many investors look at promising new climate solutions and say, ‘Great, come back to me when you have traction.’ Azolla Ventures is more likely to say, ‘How can we help you get there?’ “We’re really trying to peel back the layers and find those diamonds in the rough and the climate verticals that are falling through the cracks,” says Azolla’s Amy Duffuor. The daughter of immigrants from Ghana, Duffuor grew up in Philadelphia. She joined Prime Coalition to manage the Prime Impact Fund then co-founded Azolla, which has raised $239 million.

- Read Amy Cortese’s Agent of Impact profile of Amy Duffuor.

Ben McAdams, Sorenson Impact

Marrying public real estate and private capital

After his single term in Congress, the former mayor of Salt Lake County is helping cities repurpose underutilized public real estate for public-private development projects. McAdams’ “Putting Assets to Work” incubator is working with Atlanta, Cleveland, Annapolis, Chattanooga, Lancaster, Calif., and Harris County, Texas, which have found billions in underused parcels, parking lots and buildings.

- Read David Bank’s Agent of Impact profile of Ben McAdams.

Lourdes Germán, Public Finance Initiative

Tilting the muni bond market toward racial equity

Attorney and academic Lourdes Germán recognized the power of public finance in years working at Fidelity Investments and Breckinridge Capital Advisors, among others. She launched the Public Finance Initiative to help players in the $4 trillion municipal bond market prioritize racial equity and environmental justice while steering capital toward schools, water systems and other determinants of community health and well-being.

- Read by Dennis Price’s Agent of Impact profile of Lourdes Germán.

Su Sanni, Dollaride

From dollar-van commuter to urban-mobility entrepreneur

In Brooklyn and Queens, Su Sanni grew up in transit deserts where convenient public transportation is scarce. The first generation Nigerian-American helped launch Brooklyn-based tech startup Dollaride in 2018 to digitize payments and transit routes for dollar van drivers and their customers. Next up: electrifying dollar van fleets.

- Read Roodgally Senatus’ Agent of Impact profile of Su Sanni.

Andrea Armeni, NYU

On a quest to transform finance

For Andrea Armeni, it’s not enough to interrogate the practices of legacy finance. The co-founder of the nonprofit Transform Finance and now a prof at NYU’s Wagner School, Armeni has a reputation for making impact investors uncomfortable as well. “At the root of all things is, ‘Who makes the decisions?” Armeni tells ImpactAlpha. “Where does the wealth end up being built?”

- Read David Bank’s Agent of Impact profile of Andrea Armeni.

Laura Ortiz Montemayor, SVX Mexico

Stewarding capital for Mexico’s regenerative economy

Laura Ortiz Montemayor thrives on helping investors untangle nature’s complexity and see the opportunity in investing in healthy, balanced ecosystems and communities. At impact advisory firm SVX Mexico, her team has directed $45 million into the “regenerative economy.” With Regenera Ventures, she’s looking to raise $25 million to make equity investments in regenerative land projects throughout Mexico

- Read Jessica Pothering’s Agent of Impact profile of Laura Ortiz Montemayor.

Aina Abiodun, VertueLab

Centering community in climate tech

Nigeria-born climate entrepreneur and “professional nomad” Aina Abiodun is bullish on place-based climate innovation, not least in the Pacific Northwest. “There is nothing more urgent than when you’re living the disaster,” Abiodun tells ImpactAlpha. The head of Portland-based nonprofit VertueLab, which has funded climate tech in the Pacific Northwest for 15 years, says, “Let’s tackle this thing from a local perspective and see how we can build it out.”

- Read Dennis Price’s Agent of Impact profile of Aina Abiodun. And catch Aina’s video conversation with Sherrell Dorsey in ImpactAlpha’s Plugged In series on LinkedIn Live.

Monica Brand Engel, Quona Capital

Taking on the messy work of financial inclusion

Monica Brand Engel’s advice to impact investors: “Authentic impact is about accepting imperfection and actually getting things done.” Engel and her team at Quona Capital have invested in 72 companies with products and services that have reached nearly 145 million people. The firm’s investment thesis: Use technology to “radically improve lives” in emerging markets.

- Read Jessica Pothering’s Agent of Impact profile of Monica Brand Engel.

Samuel Yeboah, Mirepa Investment Advisors

Helping Africans invest in Africa

Local investors are key to unlocking capital for Africa’s economic growth, says Samuel Yeboah, who is tapping local pension funds, insurance companies and other investors to help plug Ghana’s $5 billion small-business financing gap. Mirepa has raised much of its targeted $10 million first fund from local investors. Yeboah is working with Impact Investing Ghana on a fund of funds to direct domestic institutional capital to local impact fund managers.

- Read Jessica Pothering’s Agent of Impact profile of Samuel Yeboah.

Laurie Spengler, Courageous Capital Advisors

Structuring and designing finance for impact

A small-business lender in the Mississippi delta. A microfinance bank in Uganda. A global development finance institution in London. Laurie Spengler is often the person to call to structure a transaction or design a financial vehicle to move capital toward impact. “I care deeply about alignment between the source and the use of capital,” Spengler told ImpactAlpha. “Not just the quantum, but the terms and conditions for the capital to enable the impact to be realized.”

- Read David Bank’s Agent of Impact profile of Laurie Spengler.

Andrew Crosson, Invest Appalachia

Catalytic capital for community impact

With a targeted $40 million fund, Andrew Crosson is looking to support initiatives like a Kentucky substance abuse recovery and workforce development project and a downtown revitalization project in West Virginia that will house solar and zero-waste social enterprises. “What I brought was a vision and an understanding of the ways this fund needed to function if it was going to benefit the region,” says Crosson. Invest Appalachia is taking a community-based approach to reverse decades of disinvestment and extraction.

- Read Roodgally Senatus’s Agent of Impact profile of Andrew Crosson.

Mindy Lubber, Ceres

Making the business case for responsible investing

Mindy Lubber’s success can be measured in the backlash. She’s grown Ceres from a scrappy band of investors and environmentalists into a network that includes 220 institutional investors managing more than $60 trillion in assets. That has brought attacks from House Judiciary Chairman Jim Jordan and others. Lubber has worked the levers of power in corporate offices, investor boardrooms and on Capitol Hill in support of climate goals and helped marshal business buy-in for the 2015 Paris climate accord and the US Inflation Reduction Act.

- Read Amy Cortese’s Agent of Impact profile of Mindy Lubber.