Editor’s note: ImpactAlpha is pleased to partner with Sustainable Research and Analysis LLC to provide timely market snapshots of trends and developments affecting the sustainable investing market.

J.P. Morgan Chase last month launched a new Empower money market fund share class exclusively to support minority-owned and diverse led financial institutions. The Empower product, applicable to four of the firm’s money market funds, will be distributed exclusively by Minority Depository Institutions and diverse-led Community Development Financial Institutions and will feature annual donations from J.P. Morgan Chase to support community development.

Such liquidity management investment options for both institutional and retail investors continue to expand, giving sustainability-oriented institutional investors, in particular, additional choices for investing cash balances on a short-term basis with reduced risk exposure.

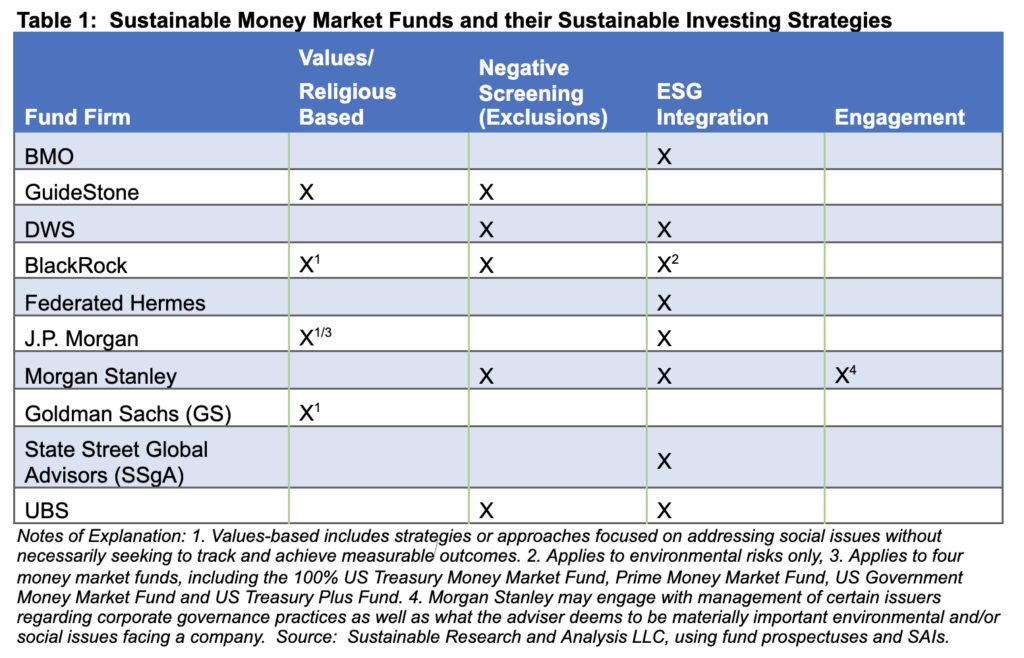

Including J.P. Morgan, at least ten firms that now offer sustainable money market funds with a choice of investing options that include a values-based orientation, negative screening and/or ESG integration, according to Sustainable Research and Analysis research. Options include individual securities such as Treasury bills, unsecured commercial paper and Asset Backed Commercial Paper (ABCP) programs as well as asset-backed securities, qualified by each investor on the basis of credit, liquidity and operational risk tolerances alongside relevant sustainability parameters.

In one case, ESG integration combines negative screening and issuer engagement (see Table 1).

As reported in September of 2019, J.P. Morgan Asset Management amended the prospectuses of 12 money market funds to explicitly reflect the onboarding of environmental, social and governance factors as part of its security selection strategy, joining a limited but growing list of money market fund management firms that have adopted sustainable investing strategies (refer to notes of explanation).

The Empower offering is part of the firm’s recently announced $30 billion commitment to advancing racial equity and will be making an annual donation of 12.5% of revenue received from the 18 basis point management fees on Empower share class assets to support community development. Google is anchoring the program’s launch with an intent to invest $500 million.

Henry Shilling is the founder and director of research at Sustainable Research & Analysis LLC, which provides timely monthly snapshots of trends and developments affecting the sustainable investing market segment.