Tracking the Climate Finance Ecosystem

The climate crisis is an all hands on deck problem, and all the hands need to be aware of what the others are doing. The following Climate Finance Trackers are designed to help climate funders and ‘ecosystem builders’ better collaborate by exploring: who is funding what, who to talk to for shared learnings, where are the gaps, and what type of capital could be most effective where.

As an open-source project, we are actively updating and improving the tracker. Share your email to stay connected as we expand our data sets, sharpen our tools and spot emerging trends.*I agree to receive marketing emails from ImpactAlpha, its affiliates, and accept our terms of use and privacy policy.

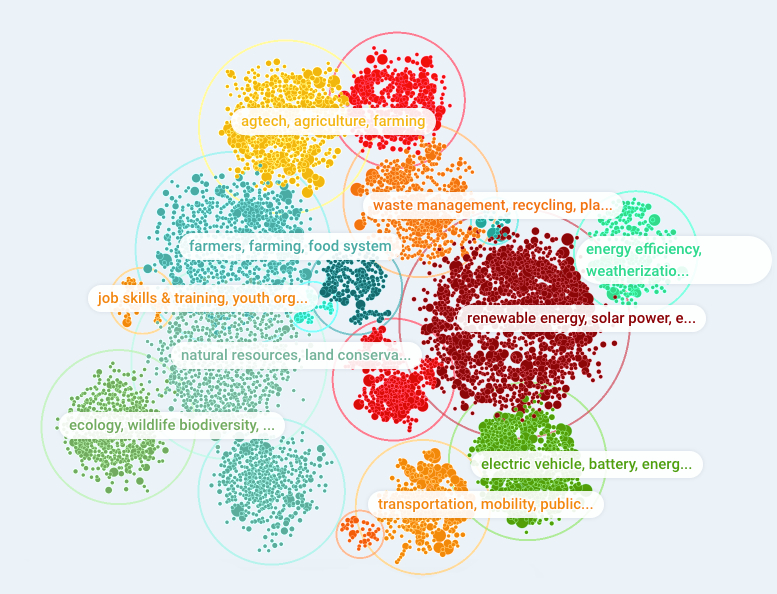

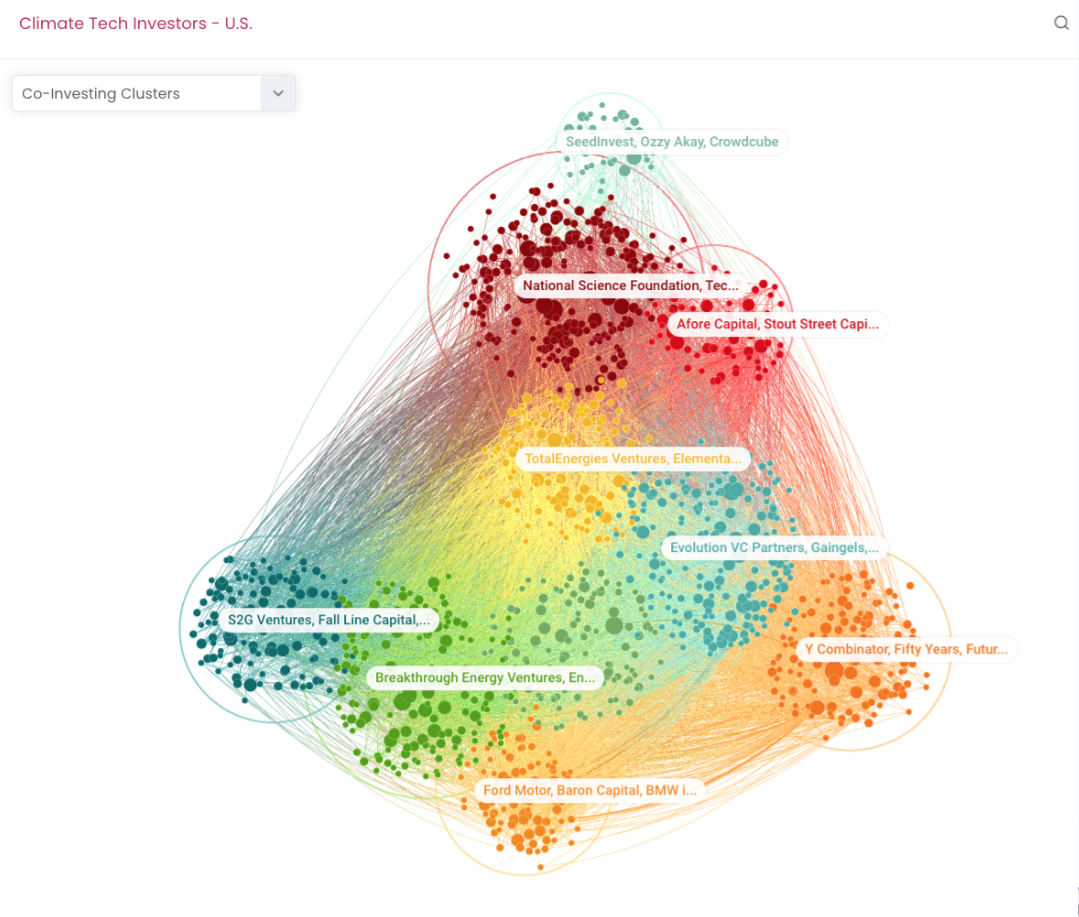

Climate Co-Investor Tracker

The Climate Co-Investor Tracker shows patterns of co-investments to US-based companies whose descriptions mention terms relating to climate mitigation or climate adaptation. Investors were included if they invested in at least two companies and linked if they co-invested in at least one company together. Colored clusters are groups of investors that co-invest with each other more than expected by chance.

Due to the nature of the climate crisis and the interdependence of solution components, climate investors need to consider not only de-risking their own investments but also de-risking the whole solution system at large. Herd investing could leave crucial solution components underfunded. Climate investors need to see the big picture, spot gaps, redundancies, and opportunities, and work together to secure our future.

Related Coverage:

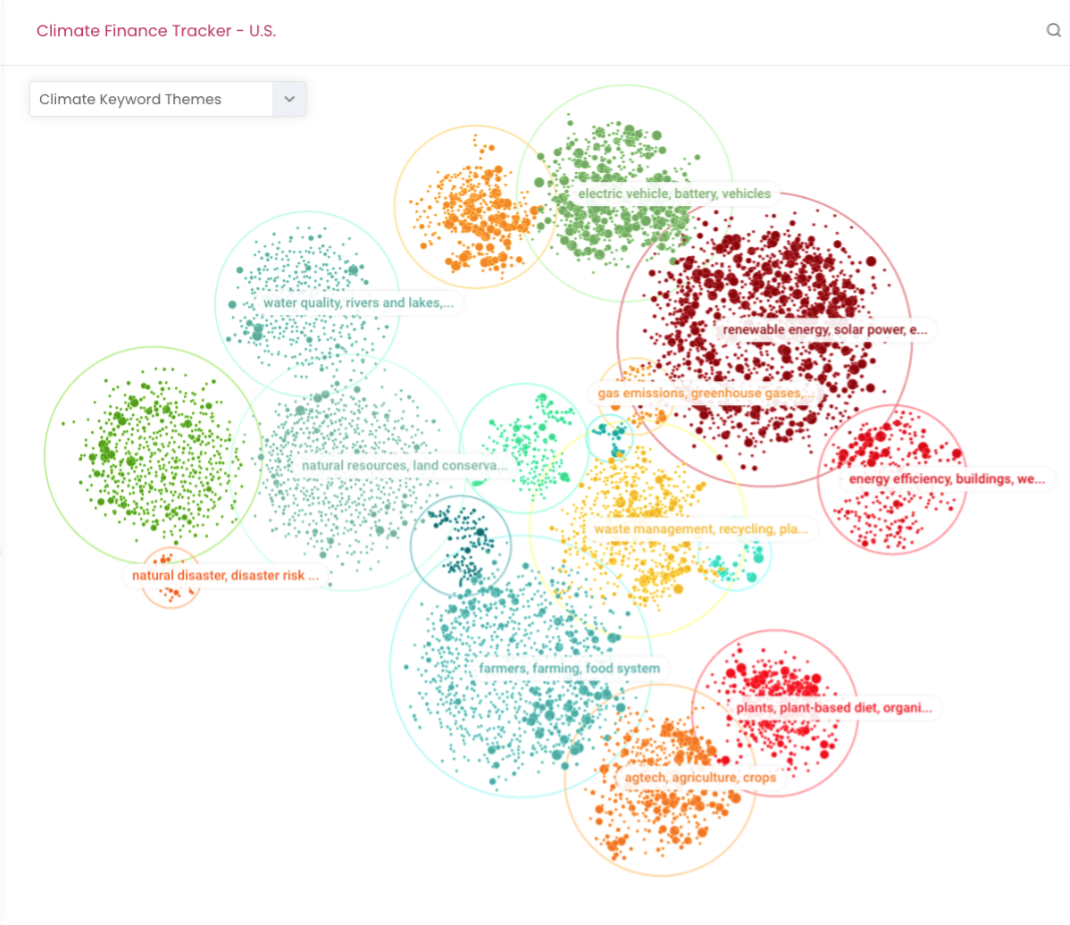

US Climate Finance Tracker

The Climate Finance Tracker - U.S. shows flows of private funding to US-based companies and non-profits whose descriptions mention terms realting to climate mitigation or climate adapation. The funding data span private investments (provided by Crunchbase) and philanthropic grants (provided by Candid).

In the next decade, trillions of dollars in investment will be made in climate solutions. But how can we ensure this capital is distributed effectively? What kind of capital is needed where, and when? To help inform these decisions, climate funders need to be looking at the bigger picture, getting ahead of emerging opportunities, and working together to bridge the gaps.

Related Coverage:

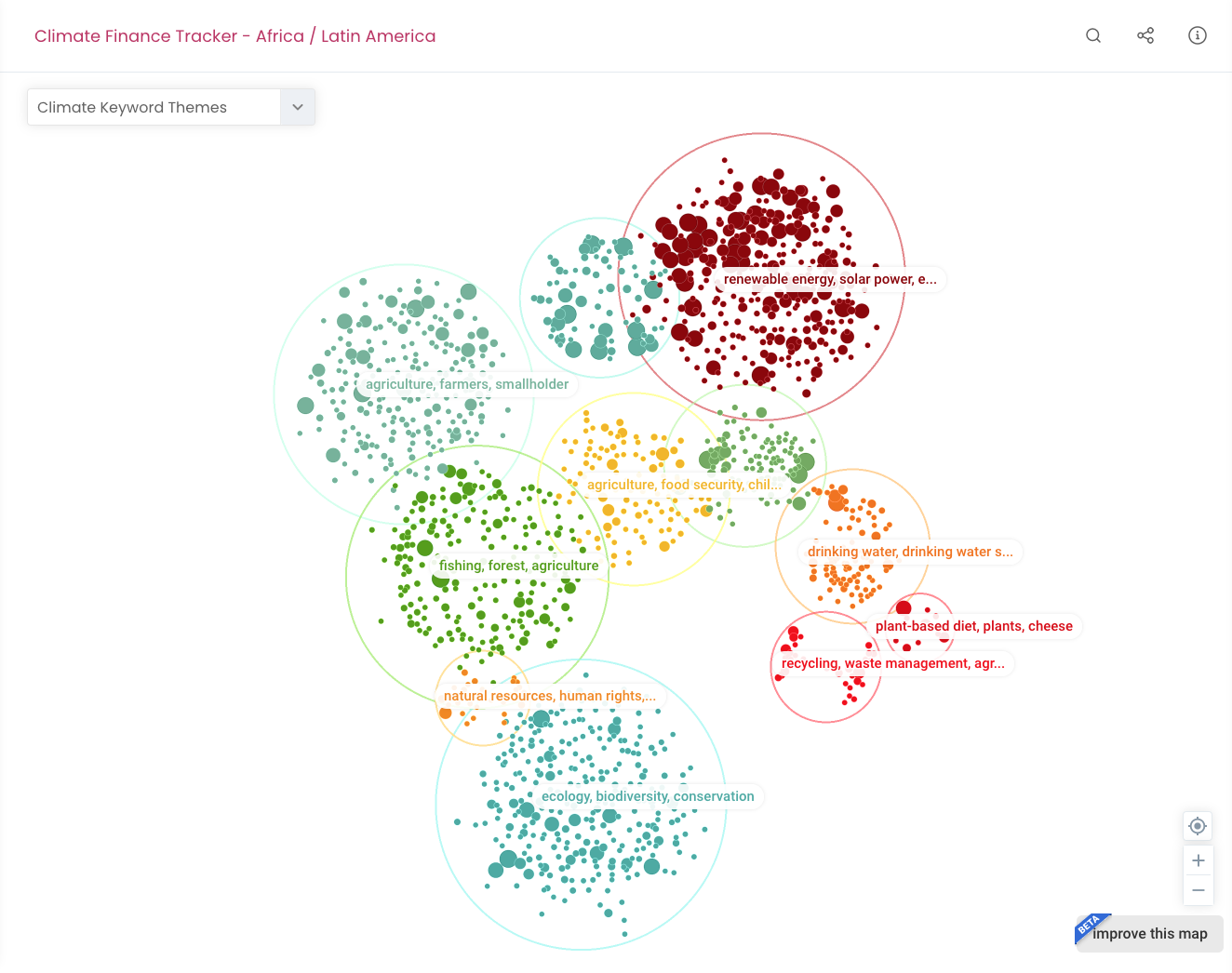

Africa & Latin America Climate Finance Tracker

The Climate Finance Tracker - Africa / Latin America shows flows of private funding to companies and non-profits that are either based in - or work in - Africa or Latin America and whose descriptions mention terms relating to climate mitigation or climate adaptation. The funding data span from 2019 to 2022 and includes private investment data (from Crunchbase, GPCA, and Africa: The Big Deal), philanthropic grant data (from Candid and OECD), and Blended Finance data (from Convergence).

Climate change is disrupting the most foundational aspects of human life - food and agriculture, water and sanitation, public health, education and livelihoods, urban infrastructure and energy access, migration and social cohesion. While enterprises and investors are stepping up to meet the climate emergency, solutions for low-income communities and frontier markets remain capital-short. Those most impacted by climate change are getting the least amount of support. As interconnected as our world is, if we neglect these communities and economies, we all fail.

More Info

These Climate Finance Trackers were developed in partnership with Vibrant Data Labs, with support from several partners and collaborators.

For more information, watch the videos in the Learn More carousel or visit our FAQ.

These tools are still in development, and we'd love to hear from you if you have ideas, thoughts, or feedback. Get in touch with us via the Contact Form below!

FAQ Contact FormLearn More

Watch the video above for an overview of the Climate Finance Tracker from Eric Berlow, ecologist, network scientist, and founder of Vibrant Data Labs. Learn more on our FAQ page. Explore the CFT.

After reviewing findings from the CFT that demonstrated the gap in equitable climate solutions, the founder of Vibrant Data Labs, Eric Berlow, challenged artist Benjamin Von Wong to create an art piece that explains Climate Equity. Learn more here.

CATALYTIC CAPITAL

All Hands on Deck

Enterprises from small to large, and investors from philanthropic to commercial, are stepping up to meet the climate emergency.

Some strategies, like electric vehicles and utility-scale solar and wind, can tap well-established capital flows. Venture capital is embracing climate innovation.

But solutions for low-income communities and frontier markets remain capital-short. Climate adaptation and resilience – which most directly affect lives and communities – get short shrift.

Climate change is disrupting public health, food and agriculture, water and sanitation, urban infrastructure and energy access, education and livelihoods, migration and social cohesion. All investors are climate investors now.

Catalytic investors are making emerging solutions investable. Institutional financing is starting to take them to scale.

Follow ImpactAlpha’s coverage for breakthrough business models, innovative financing mechanisms and high-impact dealmaking. And please use the Climate Finance Tracker to map your own climate impact.

Full CoverageClimate Finance News

Deploy! | April 22, 2024

Greening down payment assistance to create better homes and better mortgages

Editor’s Note: Community Finance Brief is a newsletter from Matt Posner of Court Street Group, occasionally syndicated on ImpactAlpha. An enduring and perhaps …

Low-carbon transition | April 22, 2024

Science Based Targets Initiative meets realpolitik on the path to Net Zero

An apparent reversal by one of the main arbiters of corporate climate action plans has roiled climate activists and advocates and highlighted tensions …

Deploy! | April 22, 2024

For this Earth Day, the White House delivers a $7 billion message: Solar for All

“Cheaper, faster, better” is not just for affluent households or wealthy neighborhoods. Hundreds of millions in annual cost-savings from ever-cheaper solar energy, not …

Climate Finance | April 18, 2024

A ‘dual debt-climate challenge’ for the world’s poorest nations

The Atlantic hurricane season looms large this year, following 2023’s record number of billion-dollar disasters in over four decades of data collection. For …

Climate Finance | April 18, 2024

Spring Meetings yield green shoots of development finance reform at the World Bank

It’s been less than a year since Ajay Banga took over as president of the World Bank; he immediately faced intense pressure to …

Smallholder Agriculture | April 15, 2024

For these tech startups and investors, the next big thing is climate adaptation for smallholder farmers

In India, Mati Carbon is providing smallholder farmers with crop inputs that fertilize plants and sequester carbon. In Kenya, SunCulture is helping farmers …

Climate Finance | April 11, 2024

Insurance companies are fueling climate risks that threaten their business

Climate change is driving more frequent and intense storms, droughts and floods – causing insurers to pull out of entire areas. Yet that …

Deploy! | April 10, 2024

With bridges, buses and bike lanes, Reconnecting Communities rebuilds ‘civic muscles’ along with neighborhoods

The Biden administration’s Reconnecting Communities and Neighborhoods program was conceived with goals as lofty as any in recent memory – to stitch together …

Deploy! | April 4, 2024

Investors ready products to amplify US ‘green bank’ funding

The Biden administration’s “national green bank” program will come into focus today as vice president Kamala Harris and EPA chief Michael Regan are …

Deploy! | April 3, 2024

EPA set to announce Greenhouse Gas Reduction Fund awards for $20 billion ‘green bank’

It’s finally here. The Environmental Protection Agency is expected to announce key awards for its $27 billion Greenhouse Gas Reduction Fund tomorrow at …

Low-carbon transition | March 29, 2024

Deal spotlight: Trickle of financing to phase out coal

Predictions of peak coal have come and gone as global efforts to phase out the dirty fossil fuel founder in regions reliant on …

Deploy! | March 28, 2024

EPA’s new partners plot a $27 billion path to a US green bank

The announcement of the winners of “green bank” funding under the Inflation Reduction Act is so close at hand that the Environmental Protection …

Climate Finance | March 28, 2024

How a $75 million ‘basket bond’ is catalyzing climate lending to small businesses in emerging markets

Local and community lenders in the US have been preparing for a windfall of financing from the federal government to support communities—particularly underinvested …

Ownership Economy | March 26, 2024

Wealth-building and community ownership in the next stage of The Great Deployment

Later this year, solar panels will be installed on the roof of the Brooklyn Army Terminal. Like thousands of emerging green projects across the …

Muni Impact | March 22, 2024

How green banks are blending finance for community infrastructure and greenhouse gas reduction (video)

In New Orleans, the city’s housing finance agency has become a “green bank” to underwrite community solar, water treatment projects, and resilience hubs. …

Climate Finance | March 21, 2024

Leveraging the carbon markets for clean cooking, climate justice and social impact

Nairobi’s slums are dotted with little aqua blue signs alerting residents to top-up points for cooking fuel. Many households don’t have electric stoves …

Corporate Impact | March 20, 2024

This proxy season, shareholders will have their say on AI, biodiversity and corporate political activity

Ethical guidelines for artificial intelligence and biodiversity protections for deep sea mining are among the newcomers among the environmental and social issues on …

Deploy! | March 19, 2024

Bringing standards and certainty to financing for community infrastructure and the green transition

Organizations across the US are anticipating the announcement – expected any day – of who will get to manage parts of the Greenhouse …

Deploy! | March 19, 2024

How the Loan Programs Office is supporting state clean energy projects

The Department of Energy’s Loan Programs Office is best known for providing loans and guarantees to innovative climate tech solutions and manufacturing from …

Deploy! | March 18, 2024

In Cleveland, stakeholders mobilize to deploy climate funds for community infrastructure

A few years ago, officials at the Cleveland and George Gund foundations were lamenting the lack of a state-wide green bank in the …

Climate Finance | March 14, 2024

Happy Returns: Elaborate spoof takes aim at Vanguard’s retreat from climate commitments

Climate change can be stressful, including for investors profiting from fossil fuels in the face of record-breaking temperatures around the world. Climate activists …

Clean Energy | March 13, 2024

The path to universal energy access is local, inclusive and women-led

In Zimbabwe, Agriput Solar leverages a network of local women to sell solar home products in rural communities. Women-led Grean World in Ethiopia …

Policy Corner | March 7, 2024

New SEC rules may be just enough to push climate action from disclosure to accounting

ImpactAlpha, Mar. 7 – First Europe. Then California. And now, the US Securities and Exchange Commission. The SEC on Wednesday enacted long-awaited rules requiring …

Climate Finance | March 7, 2024

Gates Foundation seeds Africa Water Facility with $6 million grant for urban sanitation

ImpactAlpha, March 7 — Africa Water Facility, launched by the African Ministers Council on Water and managed by the African Development Bank, aims …

The Liist | March 5, 2024

Every day is International Women’s Day for female fund managers driving climate solutions (The Liist, March 2024)

Women running companies and asset management firms continue to raise less than 2% of total invested capital. Nevertheless, they persist. This month’s Liist …

Inclusive Economy | March 4, 2024

Overheard at Sankalp: Public equity for African small businesses, accelerating circular enterprises, financing women-led ventures

ImpactAlpha, March 4 – The theme of the Sankalp Africa Summit in Nairobi was “igniting Africa’s potential for a just transition.” As always, financing …

Climate Finance | February 29, 2024

Can the UK’s market for trading nature credits deliver ‘biodiversity net gain’?

The global economy is built on natural capital. Without an abundance of water, soil, and biological diversity, businesses and societies can’t function, much …

Impact Investing | February 21, 2024

Impact investing at a crossroads

ImpactAlpha, Feb. 21 – “First they ignore you. Then they laugh at you. Then they fight you. Then you win.” Mahatma Gandhi never said …

Climate Finance | February 8, 2024

California’s climate-risk pioneer Dave Jones on our march ‘toward an uninsurable future’ (Q&A)

Dave Jones was California’s state insurance commissioner eight years ago when the then-novel idea of fossil fuel “stranded assets” caught his attention. The …

Good Jobs | February 1, 2024

Upskilling Africa’s workforce for green jobs in renewable energy and resilient agriculture

ImpactAlpha, February 1 – National commitments to decarbonize economies and mitigate climate change are spurring a global green jobs boom, as countries race …

Climate and Clean Tech | January 31, 2024

Is the EV glass half-full or half-empty?

ImpactAlpha, Jan. 31 – “Nobody said it was easy,” as Coldplay reminds us. “No one ever said it would be so hard.” That’s how …

Clean Energy | January 29, 2024

Pumpjacks and natural gas rigs start to make way for photovoltaics and windmills

ImpactAlpha, Jan. 29 – Oil and gas fields are good places to produce energy – from wind turbines and solar panels. The often-lengthy permitting …

Community Finance | January 24, 2024

LISC’s Michael Pugh on navigating legal challenges to community development finance (Q&A)

ImpactAlpha, January 24 — After 100 days at the Local Initiatives Support Corporation, Michael Pugh is getting down to business. At the top …

Clean Energy | January 23, 2024

Energy spinoff GE Vernova may have a bigger carbon footprint than GE claims

This article originally appeared on Climate & Capital Media. At a seminal moment in the historic breakup of U.S. corporate giant General Electric, …

Impact Investing | January 23, 2024

The pivotal role of financial inclusion in climate adaptation and resilience

On the opening day of the COP28, the loss and damage fund to help vulnerable countries cope with the impact of climate change …

Signals | January 18, 2024

World Economic Forum 2024: If every billionaire is a policy failure, what’s a trillionaire?

ImpactAlpha, January 18 — The world is woefully behind on achieving climate and sustainable development goals by 2030. But one area where we’re …

Deploy! | January 17, 2024

Justice40: Frontline communities step up to deploy historic federal climate funding

ImpactAlpha, December 17 – When the Federal Highway Administration last week announced $623 million in grants to install public charging stations for electric …

Climate and Clean Tech | January 11, 2024

The Week’s Chart: Tripling renewables by 2030

Oops, they did it again. The International Energy Agency has upped its perennially conservative five-year forecast for renewable energy by 33%, or 728 …

Climate Finance | January 3, 2024

The opportunity to engage conservatives on climate

ImpactAlpha, Jan 3 – Taxing carbon can drive emissions reductions. Technology is fundamental to the energy transition. We can, in fact, solve climate change. …

Looking Ahead to 2024 | December 22, 2023

Next Year in impact investing: Betting on the future

🗣 All in. It’s not hyperbole to say everything is at stake next year. There have been enough jeremiads about the dangers to …

Impact Investing | December 21, 2023

At Stake in ‘24: Playing climate offense to scale up and phase out

ImpactAlpha, Dec. 21 – The transition to a low-carbon economy is a “mega force,” as BlackRock declares in its 2024 outlook. How quickly …

Emerging and Growth Markets | December 19, 2023

At stake in 2024: From financial inclusion to women to health, investing in emerging markets requires a climate lens

ImpactAlpha, December 19 – In Africa, fintech data is exposing climate vulnerabilities. In Latin America, investing in smallholder farmers means investing in regenerative agriculture. …

Impact Investing | December 15, 2023

At A Loss About the Loss and Damage Fund? Here’s What You Need to Know

One of the unequivocal wins at the COP28 climate summit in Dubai was the agreement, on the first day of the conference, to …

Low-carbon transition | December 14, 2023

Renewables’ improved performance and falling costs doom fossil fuels, even if COP28 didn’t

ImpactAlpha, Dec. 14 – Consensus, Margaret Thatcher once said, is “the process of abandoning all beliefs, principles, values and policies.” That may be …

Climate Finance | December 12, 2023

In community with food, champions of regenerative agriculture gather in Kauai (videos)

If you think regenerative agriculture is merely an elite affectation of modern foodies, you might want to pay a visit to the 600-year-old …

Climate Finance | December 12, 2023

The impact entrepreneurs and investors putting the UN’s food framework into action

ImpactAlpha, December 12 – Food, from farm to table, is responsible for nearly 40% of greenhouse gas emissions, due to carbon-intensive livestock rearing, …

Climate Finance | December 11, 2023

India’s private investors lean green despite the country’s competing climate and development agendas

ImpactAlpha, December 11 – The debate over how to categorize the most populous country in the world’s climate actions and needs was on full …

Climate and Clean Tech | December 7, 2023

AI’s killer app: Guiding humanity through the climate challenge

ImpactAlpha, Dec. 7 – Ask not what artificial intelligence can do for the climate. Ask what the climate challenge can do for AI. …

Climate Finance | December 7, 2023

The Russell Family Foundation offers up $3.5 million for sustainable food, energy and infrastructure

ImpactAlpha, December 7 – Gig Harbor, Wash.-based Russell Family Foundation has committed $3.5 million to sustainable forestry, green infrastructure and new food initiatives. …

Catalytic Capital | November 29, 2023

Allianz’s SDG Loan Fund leverages a $25 million guarantee to catalyze $1.1 billion

A novel financing mechanism has stacked a small guarantee and a larger first-loss reserve to raise $1 billion from the German insurance giant …

Climate Finance | November 29, 2023

From “carve-outs” to “aligners,” five archetypes for family office climate investing

ImpactAlpha, Nov. 29 – Wealthy families are feeling the pull of climate investing. CREO, a nonprofit that for more than a decade has …

Climate Finance | November 28, 2023

From carbon markets to curbing methane, the case for climate optimism at COP28

ImpactAlpha, Nov. 28 – The dueling narratives of climate change will face off at COP28, the two-week global climate gathering that begins Thursday …

Climate + Gender | November 17, 2023

To be effective, climate solutions need a gender lens (video)

ImpactAlpha, November 17 – That women are more adversely affected by climate change is well established (in impact and development circles at any …

India | November 15, 2023

Impact investors brave Delhi’s smog to champion climate finance in India

ImpactAlpha, November 15 – Impact investors in India gathered last week in Delhi’s hazardous smog to strategize ways to raise, and deploy, more …

Climate + Gender | November 14, 2023

These fund managers are putting climate + gender strategies into action

ImpactAlpha, November 14 – It’s early days, but investors are waking up to the outsized impact potential of investing at the intersection of …

Sponsored | November 8, 2023

Women as agents of change: How Heading for Change invests in climate solutions with a gender lens

What does investing at the nexus of climate and gender really look like? This is the question at the heart of Heading for …

Oceans | November 6, 2023

Ocean-based startups ride a wave of funds seeking opportunities in the blue economy

ImpactAlpha, November 6 — Less than a decade ago, the number of ocean-focused impact funds could be counted on one hand. Now, a …

Deploy! | October 31, 2023

DOE awards $1.3 billion to ease transmission bottlenecks

ImpactAlpha, Oct. 31 – Electric vehicles factories and renewable energy plants are rapidly rising across the US, thanks to federal tax incentives. Not …

Climate + Gender | October 30, 2023

Doubling down on guarantees, MCE Social Capital is unlocking capital for climate + gender

ImpactAlpha, October 30 – Impact investors know the challenges that come with building a market. Moving capital to address both climate change and …

Deploy! | October 26, 2023

The US is finally getting a national green bank. Here’s what to expect.

ImpactAlpha, Oct. 26 – Hurry up and wait. Lenders, community groups and consortiums of nonprofits that met this month’s deadline to apply to …

Corporate Impact | October 25, 2023

Investors push corporations to better manage increasingly scarce water resources

ImpactAlpha, October 25 – Corporations are the largest consumers of water globally, which sets them up for conflict and risk as water scarcity …

Gender Smart | October 24, 2023

Gender lens investors at SOCAP23 look beyond the ‘business case’ to move capital to women

Don’t ask permission, ask forgiveness. That adage captured the mood shift among gender lens investors at this week’s SOCAP23 in San Francisco. Investors …

Gender Smart | October 19, 2023

Through a gender lens in Latin America, investors see opportunities for impact and alpha (videos)

Oct. 19, Medellín – The women of Comuna 13, a sprawling neighborhood in the hills above downtown Medellín, turned to graffiti art, hip-hop music …

Water | October 11, 2023

Come hell or high water: Building community resilience to floods, droughts and water contamination

ImpactAlpha, Oct. 11 – Water — too little, too much or too dirty — isn’t simply emerging as a climate consideration. It’s forcing …

Muni Impact | October 11, 2023

Mispriced risks in bond markets mean Black communities pay more for climate resilience

ImpactAlpha, Oct. 11 – A community’s racial makeup, irrespective of economic variables, affects its cost of capital in the $4 trillion US municipal bond …

Plugged In | October 6, 2023

Plugged In: Building equitable food systems with reparative capital and community (video)

ImpactAlpha, Oct. 6 – How we grow our food matters, but for over a century, “who” gets a fair shot at owning and profiting …

Smallholder Agriculture | October 5, 2023

Investors are bullish on digitizing Africa’s agricultural supply chain

ImpactAlpha, Oct. 5 – When Desmond Koney inherited his father’s farm, he discovered firsthand the challenges of smallholder farmers in Ghana and much …

Inclusive Economy | October 4, 2023

Road to justice for Black farmers leads through flexible finance

ImpactAlpha, Oct. 4 – More than 150 years of discriminatory lending and land heists have left a generation of Black farmers with little access …

Emerging and Growth Markets | October 3, 2023

Bboxx snags $17 million World Bank subsidy for clean cookstoves in Rwanda

ImpactAlpha, October 3 — Cooking with firewood or coal is dangerous to human health and the planet. In Rwanda, more households are looking …

Europe | October 3, 2023

Germany’s Traceless Materials raises €36.6 million for a plastic alternative

ImpactAlpha, October 3 — Hamburg-based Traceless Materials has developed a bio-based, low-emission plastic alternative made from agricultural waste, such as rice and wheat …

Deploy! | September 28, 2023

With catalytic climate financing, Energy Department looks to demonstrate, deploy and decarbonize

ImpactAlpha, Sept. 28 – “We’re the government and we’re here to help.” The Department of Energy is trying to turn the old punchline …

Climate Finance | September 21, 2023

In the Climate Week mix: Policy tailwinds, green banks, talent pipeline

ImpactAlpha, September 21 — Hard choices have to be made… about which of the hundreds of Climate Week NYC events to attend. As …

Impact Management | September 20, 2023

The $100 billion opportunity in climate-finance accountability

ImpactAlpha, September 20 – Developed nations have pledged (but not delivered) $100 billion annually to help low and middle-income countries adapt to climate …

Climate Finance | September 20, 2023

Climate Week NYC: Write it down

ImpactAlpha, September 20 – Oil may be nearing $100 a barrel again, but long term prospects for fossil fuels are less rosy. Coal …

Climate Finance | September 18, 2023

From scientific to doomsday, the five climate change narratives shaping discourse and decisions

ImpactAlpha, September 18 — The climate discourse by individuals and groups typically involves five narratives about the import and response to climate change. Some …

Climate Finance | September 14, 2023

Protesters and private investors to pressure global leaders at Climate Week NYC

ImpactAlpha, Sept. 14 – When world leaders jet into New York for the annual UN General Assembly this weekend, it will be hard …

Impact Investing | September 10, 2023

Climate protestors step up their game as climate action falters

ImpactAlpha, Sept. 11 – Tomato soup on Van Gogh’s sunflowers. A blockade of Burning Man. This weekend, climate protestors staged their latest stunt …

Climate Finance | September 7, 2023

Hit hard by climate change, African nations lean into opportunities in the green transition

ImpactAlpha, September 7 – African countries top the list of the world’s most climate-vulnerable places, despite having contributed little to the greenhouse gas …

Climate Finance | August 29, 2023

Letter from Italy: Our seriously sunny summer

Parma, Italy – As I pen these words, Italy is caught in the clutches of the third heatwave of this seemingly unending summer. …

Institutional Impact | August 28, 2023

Wall Street CEOs fiddle while Maui burns (and the world bakes)

Editor’s note: ImpactAlpha contributing editor Imogen Rose-Smith, a longtime senior writer for Institutional Investor, contributes a bi-weekly column on the policies, practices and strategies of …

Water | August 28, 2023

Water security climbs the climate agenda at World Water Week

ImpactAlpha, Aug. 28 – The fire that ravaged western Maui this month exposed simmering tensions over rights to dwindling water supplies. In fast-growing …

Inclusive Economy | August 24, 2023

In Maui, investing in future resilience and community stewardship after the fires

ImpactAlpha, Aug. 24 – From firefighting resources to land use planning to water rights to electric grid maintenance to community finance, this month’s …

Emerging and Growth Markets | August 17, 2023

Small vehicles have investors thinking big about India’s e-mobility transition

ImpactAlpha, August 17 – American electric car makers like Tesla are making headlines over plans to bring their cars to India. But it …

Climate Finance | August 16, 2023

African leaders want a bigger slice of a bigger market for voluntary carbon credits

ImpactAlpha, August 16 – Africa needs $250 billion a year to finance climate mitigation and adaptation initiatives. Yet the vast continent of nearly …

Deploy! | August 15, 2023

Clean energy investors are not waiting for Inflation Reduction Act’s billions to flow

ImpactAlpha, Aug. 15 – For Caelux Corp., investing in building a new solar factory outside Los Angeles was a no-brainer. Tax credits in …

Conservation | August 10, 2023

Revived South American alliance takes steps to protect Amazon forests and communities

ImpactAlpha, Aug. 10 – There was no grand pledge to halt deforestation, as Brazil’s President Luiz Inácio Lula da Silva had urged. Nor …

Conservation | August 9, 2023

Revival of Pakistan’s mangroves provides a blueprint for global restoration

ImpactAlpha, Aug. 9 – Less than 20 years ago, Keti Bandar, a coastal town in southeastern Pakistan, had barren shores. Today, it’s a …

Green Infrastructure | August 8, 2023

Hybar snags $700 million in debt and equity for recycled steel plant in Arkansas

ImpactAlpha, Aug 8 – Electric vehicle, battery and chip factories are rising in the US south and midwest. Hybar’s planned mill in Osceola, …

Deploy! | July 27, 2023

Catalytic grants aim to ready communities to deploy historic clean energy funding

ImpactAlpha, July 27 – When the Covid pandemic hit, philanthropic organizations mobilized with relative lightning speed to address the crisis and its impact …

Green Infrastructure | July 17, 2023

Managers vie for the mandate to stand up a national “green bank”

ImpactAlpha, July 17 — Green banks, credit unions, community development financial institutions, or CDFIs, and other nonprofit lenders are scrambling for the mandate …

Climate Finance | July 5, 2023

Sequestering carbon in America’s family forests

ImpactAlpha, July 5 – Tim Stout was thrilled when, a few years ago, he inherited 175 acres of northern boreal woodland surrounding his …

Climate Finance | June 26, 2023

New global financial pact advances innovative financial solutions and commitments to system change

ImpactAlpha, June 26 – World leaders took steps to upgrade the global financial architecture that has saddled low- and middle-income countries with debt …

Signals | June 23, 2023

An EV supply chain takes shape

ImpactAlpha, June 23 – A flood of funding and tax incentives championed by the Biden administration is remaking American manufacturing. The latest signal: …

Climate Finance | June 21, 2023

Could a ‘New Global Pact’ wring catalytic capital from the World Bank and development finance institutions?

ImpactAlpha, June 21 – In the year since Barbados’ Mia Mottley floated “The Bridgetown Agenda,” the need for 21st century institutions for financing …

Africa | June 15, 2023

Zola, Sun King and M-KOPA offer three paths to Africa’s off-grid energy future

ImpactAlpha, June 15 – For a decade, access to affordable, reliable and modern energy increased by roughly 100 million people a year – until …

Impact Investing | June 9, 2023

The Week’s Chart: Wildfires drive home costs of climate inaction

ImpactAlpha, June 9 – The past eight years have been the warmest on record, the World Meteorological Organization has declared. It should not …

Institutional Impact | June 5, 2023

Forget ESG. The greening of the global economy is a boon for institutional investors.

Editor’s note: ImpactAlpha contributing editor Imogen Rose-Smith, a longtime senior writer for Institutional Investor, contributes a bi-weekly column on the policies, practices and strategies of …

Climate Finance | May 30, 2023

Packard and Ford foundations back Nusantara Fund to bolster climate resilience for Indonesia’s Indigenous communities

ImpactAlpha, May 30 – Indonesia is among the world’s small number of “mega bio-diverse” countries – and has one of the world’s highest …

Catalytic Capital | May 23, 2023

Appalachia emerges as a climate refuge – and its community infrastructure feels the strain

ImpactAlpha, May 23 — With its mountainous terrain, water resources and ecological diversity, the Central Appalachia region across West Virginia, Kentucky, North Carolina …

Impact Investing | April 26, 2023

How Biden’s climate policies are driving a clean energy transformation

ImpactAlpha, April 26 – The trio of climate and economic legislation signed into law by Joe Biden in the first two years of …

Keep up with the Climate Finance Tracker

As an open-source project, we are actively updating and improving the tracker. Share your email to stay connected as we expand our data sets, sharpen our tools and spot emerging trends.

Help us help you

What’s missing? What do you need? Send your deals, data and feedback to improve the tracker. Let us know if you can be a user-tester or participate in a focus group.

Partners

The Climate Finance Tracker was built by Vibrant Data Labs in partnership with Candid, The Cisco Foundation, Crunchbase, Hopper-Dean Foundation, ImpactAlpha, One Earth, Primer.ai, RTI International and Sideporch with all data coming from Crunchbase, Candid, Convergence, GPCA and LinkedIn.

Candid

Candid connects people who want to change the world to the resources they need to do it.

The Cisco Foundation

The Cisco Foundation supports solutions to power our regenerative and inclusive future.

Crunchbase

Crunchbase is the leading platform for professionals to discover innovative companies, connect with the people behind them, and pursue new opportunities.

ImpactAlpha

ImpactAlpha is a media and information-services platform purpose-built to serve the investors and entrepreneurs, intermediaries and practitioners, activists and influencers who are optimizing business and finance for positive social and environmental impact.

One Earth

One Earth accelerates collective action to solve the climate crisis.

Primer.ai

Primer delivers mission-ready AI to those who protect our security and democracy.

Sideporch

An advisory firm helping good people do hard things that make a difference.

Vibrant Data Labs

Combining data science and network theory into visual interfaces to power change for complex social challenges.

Convergence

Convergence is the global network for blended finance. We generate blended finance data, intelligence, and deal flow to increase private sector investment in developing countries.

RTI

RTI International is a global research institute and leading international development organization that co-creates smart, shared solutions for a more prosperous, equitable, and resilient world.

GPCA

The Global Private Capital Association is a non-profit, independent membership organization representing private capital investors who manage more than USD2t in assets across Asia, Latin America, Africa, Central & Eastern Europe and the Middle East.