Editor’s note: ImpactAlpha is pleased to partner with Sustainable Research and Analysis LLC provide timely market snapshots of trends and developments affecting the sustainable investing market.

The growth of green bonds has been accompanied by the rise of green bond funds, thematic funds investing in corporate, municipal, sovereign and structured bonds issued to fund environmental projects.

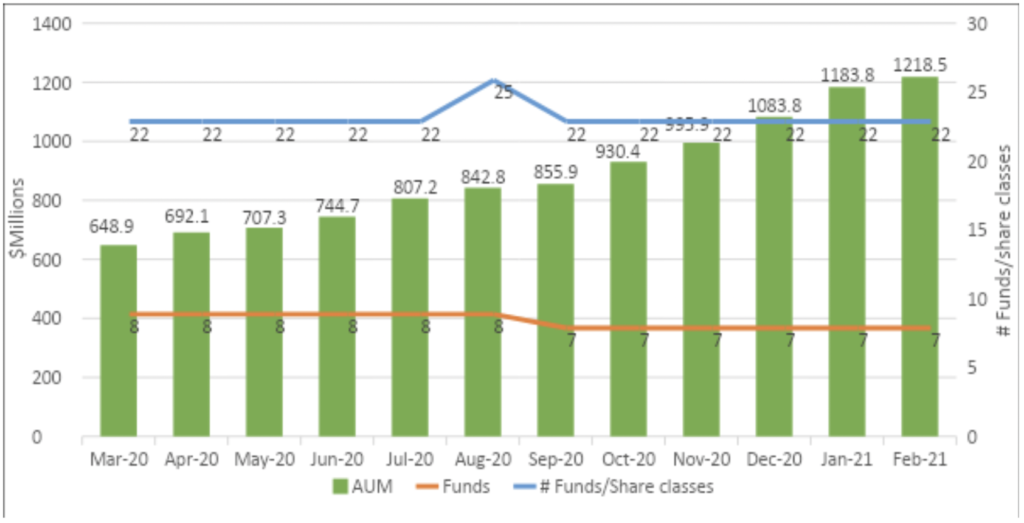

Green bond funds, including five mutual funds and two ETFs added $34.6 million in net assets last month, largely from institutional investors, to reach $1.2 billion at the end of February (see chart). This marked the eleventh consecutive monthly gain in assets for green bond funds.

According to preliminary data compiled by Sustainable Research and Analysis LLC, about $87.6 billion in social and sustainable bonds, including $32.5 billion in green bonds, were issued in February worldwide. First launched in 2007, green bonds continue to play an important role in motivating issuers and investors to shift capital and direct investments to projects intended to drive a transition to a low carbon economy. Use of proceeds aside, green bonds are no different than conventional bonds and they are therefore exposed to credit and interest rate risks.

Growth of social bonds

While green bonds continue to grow modestly, the issuance of social and sustainability bonds grew rapidly in 2020 response to the COVID-19 pandemic, with these instruments crossing the $300 billion level and overtaking green bonds. Should this trend continue, green bond funds may be challenged to keep fully invested in green bonds as their volumes get squeezed out. In the intermediate-term, this development may lead to the expansion of the mandate of green bond funds to also include social and sustainable bonds.

A new peak assets level was reached by green bond funds last year, with the largest and oldest of the seven funds, the Calvert Green Bond Fund, reaching $840.6 million in assets. The Calvert Green Bond Fund led the pack in February , by adding a net of $30.6 million, largely attributable to institutional investors, followed by the VanEck Vectors Green Bond ETF with its net gain of $5.8 million. BlackRock’s iShares lost a net $3.5 million in assets, which it regained in March.

Rising interest rates in February influenced the returns of taxable green bond funds, which posted an average decline of -1.30% versus -1.44% recorded by the Bloomberg Barclays US Aggregate Bond Index, and -1.86% per the ICE BofAML Green Bond Index (Hedged USD).

Henry Shilling is the founder and director of research at Sustainable Research & Analysis LLC in New York. As senior vice president at Moody’s Investors, Henry led efforts to expand disclosure around environmental, social and governance (ESG) risks and to assess green bonds worldwide.