“One million lives touched.” “800 jobs created.” “50,000 acres of land restored.”

Capital allocators often see these types of punchy headlines in the impact reports impact fund managers provide to them, but what effect do they have on investment decisions? What effect should they have?

Impact Frontiers, with support from The Rockefeller Foundation, facilitated a year-long public consultation with more than 350 impact fund managers, capital providers, and third-party groups such as independent reviewers and civil society organizations. The key question: what information should be included in impact performance reports to make them more decision-useful?

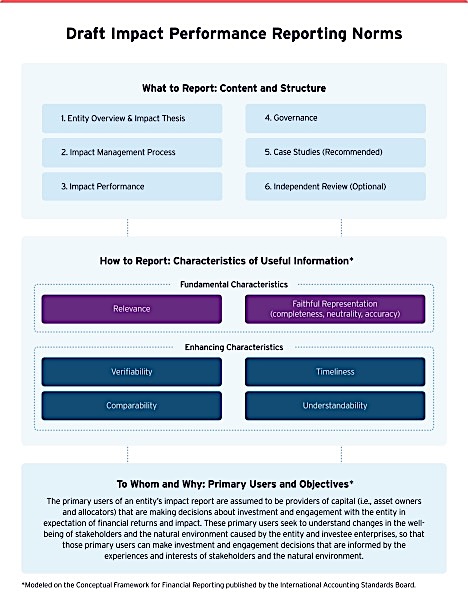

These points of feedback have now been synthesized and published as a set of Impact Performance Reporting Norms, which can serve as a voluntary “social contract” among all involved. The Reporting Norms synthesize emerging consensus on what to include in an impact performance report, how and to whom to report it, and why.

As illustrated by the above diagram, the Reporting Norms have two parts. Part 1 synthesizes the information that participants in the public consultation agreed is relevant for an impact performance report. Part 2 provides guidance to follow in producing and using impact performance reports.

Elements of an impact report

The Reporting Norms suggest that impact reports cover the following content:

- Entity Overview & Impact Thesis: Who you are, and what you are trying to do

- Impact Management Approach: How you are trying to do it

- Impact Performance: What actually happened (this is the meat of it!)

- Governance: How impact is reflected in governance policies and practices

- Case Studies: In-depth examples of the impact of the entity’s investments

- Independent Review (Optional): This could be assurance or verification, if sought

(This Executive Summary provides more detail on the recommended content within each section and for further guidance).

The launch of the Reporting Norms marks an exciting point of agreement among investors on how to elevate impact performance reporting. Now comes the hard work: implementation. Where should investors interested in the Reporting Norms begin?

Here are six tips based for investors to keep in mind:

1. The first report following the Reporting Norms will be the hardest! Start with what you can and take your time

The Reporting Norms are intentionally aspirational. Many asset managers will not be able to provide all of the suggested content at first. You can begin preparing your impact performance report using the data you have available and complete each section to the best of your ability.

As you draft each section, take note of any additional information you need and create a plan to begin gathering it. You can also engage with your report users (i.e., your limited partners or other capital providers) to clarify expectations and discuss and agree on data needs with investees. Most investors would be able to make significant progress in filling in the gaps over two to three years.

After you have prepared your first report, sections 1, 2, and 4 may not need to be updated unless material changes have occurred. New reports may simply link to or reference the relevant sections of a previous report, and you can focus on just updating the performance section and, if desired, case studies.

2. Let the Guiding Principles help you customize your report to users’ needs

Fortunately, investors in the public consultation largely agreed on the information they’d like to see in an impact performance report. We have synthesized this information in “3.2 Performance.” They also expressed that methods of impact measurement, analysis, and reporting are too diverse for any standardized reporting template to be suitable for everyone. This is why we haven’t reduced it to a table or form that everyone can fill out.

You can think of the Reporting Norms as a high-level recipe, codifying expectations around the content and structure of impact performance reports while leaving appropriate flexibility for your individual circumstances (i.e., “comply-or-explain”).

When writing impact reports – and especially if not everything is standardized – asset managers will have to make judgment calls. These are often context-specific, based on the specific impacts experienced by stakeholders and the natural environment, the needs of report users, and the impact objective(s) committed to. The guiding principles in Part 2 can provide consistency and structure to these judgment calls.

Don’t take our word for it – the guiding principles are based on the Conceptual Framework for Financial Reporting of the International Financial Reporting Standards (IFRS) Foundation and on European Sustainability Reporting Standards 1: General Requirements. We’ve just adapted them to the context of impact performance reporting, based on feedback provided by investors.

Once you decide what information you will include in your report and how you will present it, help your report users follow your thinking. Explain the choices you have made in your report. This includes descriptions of your chosen metrics, frameworks or thematic taxonomies, data sources, assumptions, calculations, and other methodological notes.

3. Engage stakeholders to look beyond outputs and intended impacts

Investors in the public consultation strongly felt that the Reporting Norms should encourage reporting on performance as far down the impact pathway as possible, meaning outcomes or ideally impacts as opposed to proxy metrics based on activities or outputs. You likely already have a good understanding of the outputs resulting from your investee activities. Reporting outcomes and impacts will require understanding the changes in well-being for stakeholders or the natural environment. Engage with affected stakeholders (either directly or indirectly) to gather this information. It sounds obvious, but basically everyone agreed that more representation of stakeholder voice in impact reports would be a good thing.

4. Embrace qualitative data

The Reporting Norms recommend a combination of qualitative and quantitative information, with neither being preferable to the other. Including both qualitative and quantitative data can strengthen reporting by balancing the limitations of each.

While qualitative data analysis is well established and widely used in the social sciences, it is an emerging practice in the field of impact management. Qualitative data can help you understand complexities and nuances of stakeholder experiences that might not be possible to capture with numbers. Qualitative analysis can be just as rigorous as quantitative. Consider including qualitative data in your report to provide in-depth insights into stakeholder perspectives.

5. Move beyond the highlight reel

The Reporting Norms are intended to facilitate clear, complete reporting on impact performance that can help users (i.e., asset owners and allocators) make better decisions. For some preparers, this means a shift in approach from impact reports that are created primarily for the purposes of marketing and communication.

Go beyond reporting positive headlines to tell the complete story of performance including positive, negative, intended, and unintended impacts. If a marketing report presents a “highlight reel” of an entity’s impact performance, this type of impact performance report will be closer to the uncut footage—containing the full picture, without the “special effects”.

The “uncut footage” of impact performance might not always be pretty, but it will be authentic. It will be decision-useful. Financial accountants have to report good and bad alike. Our trust in them to do so is the foundation of capital markets. Is impact any different? A balanced, candid depiction of impact will lend credibility to your report, build users’ confidence that the report is complete and unbiased, and help GPs and LPs to have more focused and useful conversations about impact. You can use section “3.1 Management Commentary” to elaborate on learnings and plans for improvement.

6. Consider the Reporting Norms a living document – one that you can participate in the ownership and evolution of

The Reporting Norms represent emerging consensus on what an impact performance report should be. They will evolve along with the market. As you implement the Reporting Norms, take note of areas that could benefit from further guidance or user needs that are not sufficiently addressed and share it by emailing [email protected]. Your experience and perspective can help shape future iterations of the Reporting Norms and ensure their continued relevance.

Next Steps

The Norms target a leverage point in the impact investing system: impact reporting. They promise to change the “rules of the game,” eliciting greater clarity and integrity in reporting by fund managers and greater incorporation of impact into decision-making by asset owners and allocators. This will result in capital being channeled more efficiently and effectively to achieve integrated financial, social, and environmental goals across a financial market now estimated at more than $1 trillion.

To support asset managers, asset owners, allocators, and independent reviewers in this transition, Impact Frontiers is planning an implementation phase spanning mid-2024 to mid-2026.

This phase will have four workstreams. The first, termed “Piloting,” will support interested GPs, LPs, and providers of assurance and verification with monthly virtual convenings for discussion and peer sharing, working groups to co-create best practices for common challenges and focus issues, and voluntary capstone presentations of the next generation of impact performance reports. The program will commence in summer 2024, and participants will share a goal of producing their first Norms-aligned reports in 2025 and 2026.

The second workstream, “Deepening,” will tackle challenging areas in which norms do not yet exist, such as: 1) use of qualitative data and case studies, 2) incorporation of stakeholder voice, 3) portfolio-level aggregation and synthesis of impact performance, and 4) consistency of criteria across independent reviewers to enhance transparency.

The third workstream, “Broadening,” will adapt the Reporting Norms to adjacent market segments including development finance institutions and multilateral development banks, listed equities, funds-of-funds, and foundations.

Finally, the fourth workstream, “Educating,” will accelerate impact management skill-building for GPs preparing impact performance reports and for LPs evaluating and making decisions informed by those reports. This may include, for instance, an open-access Coursera course and certificate tailored to GP and LP perspectives, as well as a resource website with example reports, case studies, webinar recordings, and translations of the Norms.

If you are interested in participating in the pilot program, or if you would simply like to offer your feedback on the Reporting Norms or the implementation phase, please contact [email protected]. We want to hear what you think!

_______________________________________________________________________________

Rathi Ramasamy is Manager, Nao Sudo is Director, and Mike McCreless is Executive Director of Impact Frontiers.