Editor’s note: ImpactAlpha is pleased to partner with Sustainable Research and Analysis LLC to provide timely market snapshots of trends and developments affecting the sustainable investing market.

A very hot, some argue overvalued, market for Special Purpose Acquisition Companies (SPACs) may be attracting some sustainability-oriented investors. Commonly referred to as blank check companies, SPACs have two years to search for a private company with which to merge or negotiate an outright acquisition and in that way bring the company public.

According to research conducted by Sustainable Research and Analysis LLC that was compiled from SPAC prospectus documents, the SPAC universe consists of 533 listed entities with a combined deal value of $171 billion.

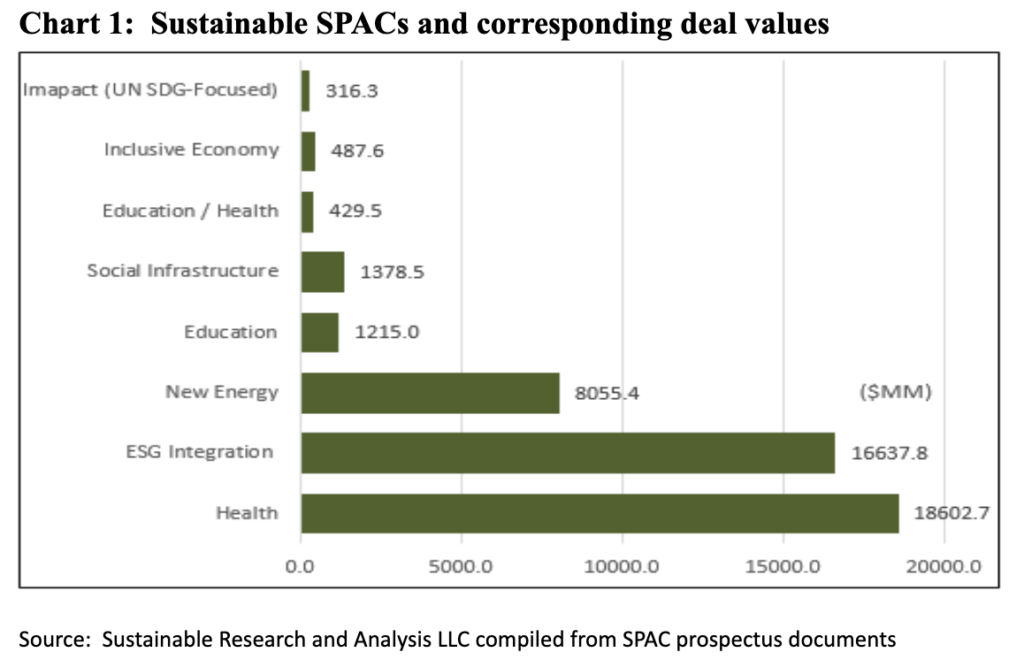

Of these, 163 SPACs, or 31% outstanding SPACs as of mid-March 2021 based on deal value, pursue business strategies that are aligned either partially or entirely with sustainable investing strategies that fall into three broad categories that include social and environmental themes, the achievement of impact as well as the integration of ESG in the investment process. These are further subdivided into the following eight sub-categories: Health, ESG integration, new energy, education, social infrastructure, education/health, inclusive economy and impact (UN SDG-Focused).

Within these eight sustainable investing-labelled categories, the largest three categories account for 91.9% of deal value. Within this segment, the health sector-oriented SPACs dominate, with a total of 79 SPACs and $18.6 billion in deal value, followed by ESG integration that has been adopted by 42 SPACs and new energy that make up 27 SPACs and $8.1 billion in deal value.

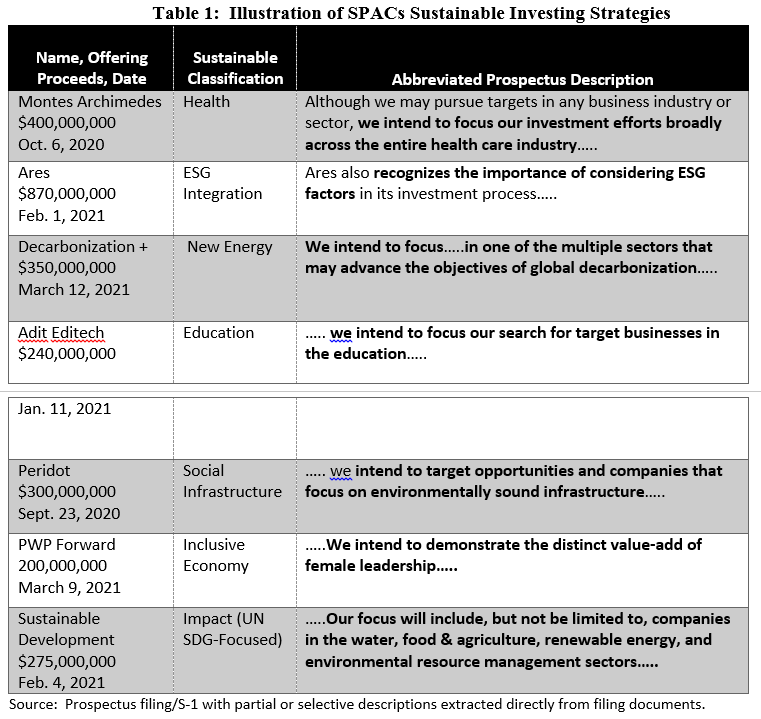

While definitions and commonly accepted industry standards for categorizing investment products and providing related disclosures to investors are still evolving, a review of SPAC prospectus disclosures combined with proposed classification framework, served as the basis for cataloguing the existing universe of sustainable SPACs.

All other considerations aside, the fulfillment of a given SPAC’s business objectives may not ultimately align with the expectations of sustainable investors.

Henry Shilling is the founder and director of research at Sustainable Research & Analysis LLC, which provides timely monthly snapshots of trends and developments affecting the sustainable investing market segment.