Editor’s note: This guest post is sponsored by Impact Ventures by J&J Foundation, which supports ImpactAlpha’s Investing in Health coverage. In partnership with Impact Ventures, ImpactAlpha is exploring the market potential of impact investments in purpose-driven entrepreneurs working to improve health outcomes for underserved communities around the world.

“We’re still discussing if we should include healthcare under impact investing.”

While impact investing as a whole has experienced tremendous growth in recent years, we’ve heard this sentiment at impact investing conferences, group gatherings, and research discussions as lately as last year.

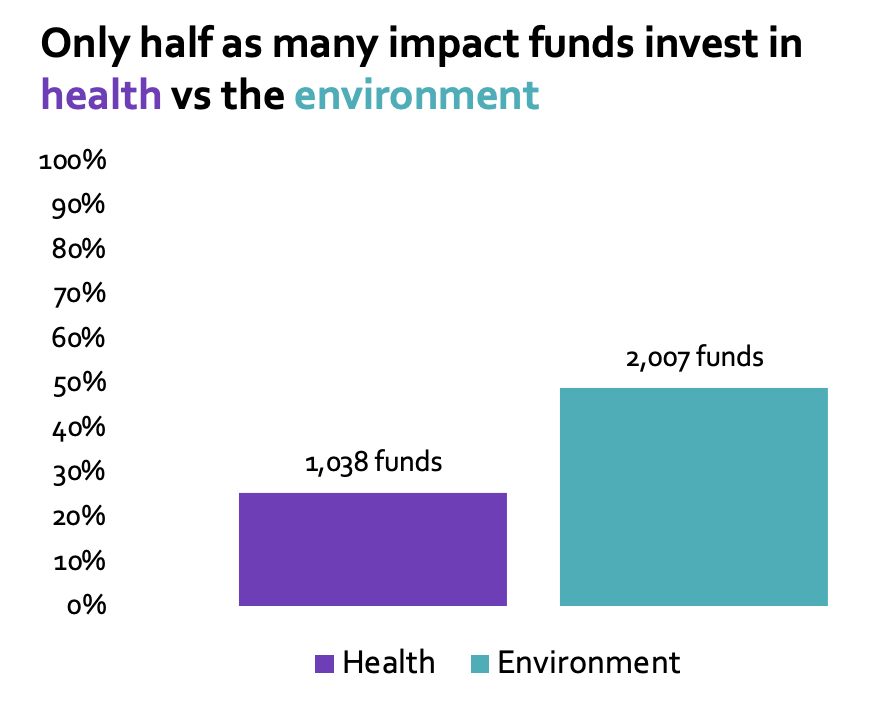

This disconnect between growth and uncertainty is apparent when looking at the number of impact funds investing in health compared to other impact sectors.

Going through investor data on PitchBook, we found that half of all impact-oriented funds cover environment as an impact category while only a quarter cover health. In 2023 alone, environment-focused funds raised $40 billion versus the $16 billion for health-focused funds.

The discrepancy extends to earlier funding as well, particularly in seed-stage ventures. Early-stage climate tech startups were able to secure $13.8 billion in funding globally, while those in healthtech drew in $10.1 billion.

The primacy of the Environment, Social, and Governance, or ESG, framework may be a contributor to this, becoming the north star for many impact investors. While the sectors are worthy of investment, it is also critical that health, especially given its connection to social welfare, not be sidelined.

A large and growing challenge

While funding levels are relatively low, the need and opportunity for investment in health only grows. In 2023, the World Health Organization and World Bank published their Universal Health Coverage Global Monitoring Report. Anyone on the fence about healthcare being an urgent and necessary priority for impact investing should read this report, which concludes that:

- About 4.5 billion people were not fully covered by essential health services in 2021,

- Over 1 billion people incurred catastrophic out-of-pocket spending in 2019, and

- Over 2 billion face severe financial hardship due to out-of-pocket health spending.

The devastating impact of these gaps in healthcare services and affordability is most felt in the lowest-income countries. Around the world, non-communicable diseases accounted for over 70% of the global deaths across both developed and developing countries, with 77% of that coming from low and middle-income countries.

The true nature of the challenge is evolving as well. Infectious disease continues to be a challenge in Sub-Saharan Africa (accounting for 63% of all deaths in children and adolescents) and to a lesser extent in South and Southeast Asia due to HIV, tuberculosis, and other tropical diseases.

However, developed countries are not immune to healthcare challenges. Whether it is the United Kingdom’s National Health Service facing a waiting list of 7.6 million patients at the end of 2023, or 1 in 4 Americans encountering problems paying for healthcare in the past 12 months, it is clear that something needs to change to put societies back on track in providing accessible, affordable, and reliable healthcare services to all.

Globally, healthcare systems are woefully overburdened, facing a crisis of resources and skyrocketing costs they cannot cover.

Investing in healthtech innovation

All this points to the vast opportunities for startups to bring forth new solutions and for investors to nurture this well-primed market — and a one-size-fits-all approach won’t work.

Through our work at Verge (a VC fund investing exclusively, and globally, in impactful healthcare technologies at the earliest stages), we are seeing the rise of remarkable, tailored, and community-specific applications of technology to healthcare challenges around the world. Some of the startups we invest in are practitioner-facing, helping augment their capability to provide better care through technology. Others are provider-facing, enabling enhanced access at lower cost to the end-patient. Another set is patient-facing, directly creating new services or addressing a key need for the healthcare consumer cheaper, faster, and better.

We’re starting to see startups that are combining elements of all three to create something truly novel, that would not have been possible without technology. One such example in our portfolio is reach52, which builds technology-enabled rural healthcare systems. The company’s digital platform connects community health workers and small pharmacies in rural areas to collect data, deliver targeted health campaigns, and make affordable health products available to fill gaps in government services.

Using reach52’s platform, the health workers collect data to identify health gaps in their communities, and re-engage specific households with content and activities in specific campaigns that drive positive health outcomes:

- Increased vaccinations: 78% of unvaccinated households reach52 engaged with got their essential childhood vaccines for Hepatitis B, MMR, polio, etc. within a month.

- Improved blood pressure: 65% of patients lowered their blood pressure within 3 months after engaging with reach52-enabled health workers.

- Improved patient adherence: patients enrolled in diabetes support programs who engaged with reach52 adhered to 98% of the treatment.

Originally started in the Philippines, the company has now expanded to seven countries across Asia and Africa including India, and onboarded more than 16,500 health workers across 2,500 communities that cover more than 1.8 million people. By providing a broad range of essential health services at an affordable price for the target population, they are helping to create access and drive outcomes in previously underserved communities.

The powerful impact for both individual health and healthcare providers

As seen with reach52, there is need, scale opportunities, and innovative startups worthy of investment in healthcare impact.

Further, investors have more confidence because of the increased ability to measure the true effect on outcomes and access of these startups. We’ve found success capturing the wide range of impact outcomes through our impact assessment framework, which includes:

- Number of lives touched – Measuring the number of touchpoints with patients or end users, which a healthtech solution has created or enabled, with an emphasis on tracking underserved communities or geographies reached where feasible.

- User engagement – Capturing the frequency of use and adherence to the prescribed usage of the product or service as a proxy for the daily impact on the user’s life.

- Clinical outcomes – Direct impact on hospitalizations, readmissions, mortality rates, disease management metrics, etc. to showcase their clinical impact.

- Cost savings – Capturing the effect of these solutions to reducing healthcare costs, increasing productivity, or both, improving healthcare system efficiency.

- Patient outcomes – Tracking the effectiveness on quality of life of the end patient by measuring any change in symptoms, functional status, or living conditions.

We supplement this quantitative assessment with a qualitative one, finding the context around the numbers and data especially informative for deeptech prototype startups, including those taking established but novel science, or pushing the boundaries of engineering, to bring new products to market that target a critical global healthcare problem. We take a macro view of the underlying healthcare problem the product aims to solve.

Does the startup make healthcare more affordable and accessible? Is it taking a new approach? What alternatives are already at-market? We also assess the motivations of founding teams. Are they passionate about bringing their products to everyone who needs it? Are they actively committing to make it happen as early as they can, not just as an afterthought? And finally, we look at accountability through regular reporting commitments and active board participation. We believe that this approach can truly enable innovation in driving impact in healthcare.

We fundamentally believe that by applying new technology or fresh approaches to healthcare, startups can push the boundaries of affordability and access to the benefit of underserved communities, regions, or countries.

And investors can reap tremendous reward and return. With healthcare, we don’t have to wait long to see the powerful, positive impacts of new innovation: it can truly change the trajectory of a community’s future within a generation.

Carl Nicholas Ng is a General Partner and Miguel Legarda is an Investment Associate at Verge HealthTech Fund, which is funded by Impact Ventures by J&J Foundation.