Editor’s note: ImpactAlpha is pleased to partner with Sustainable Research and Analysis to provide timely market snapshots of trends and developments affecting the sustainable investing market.

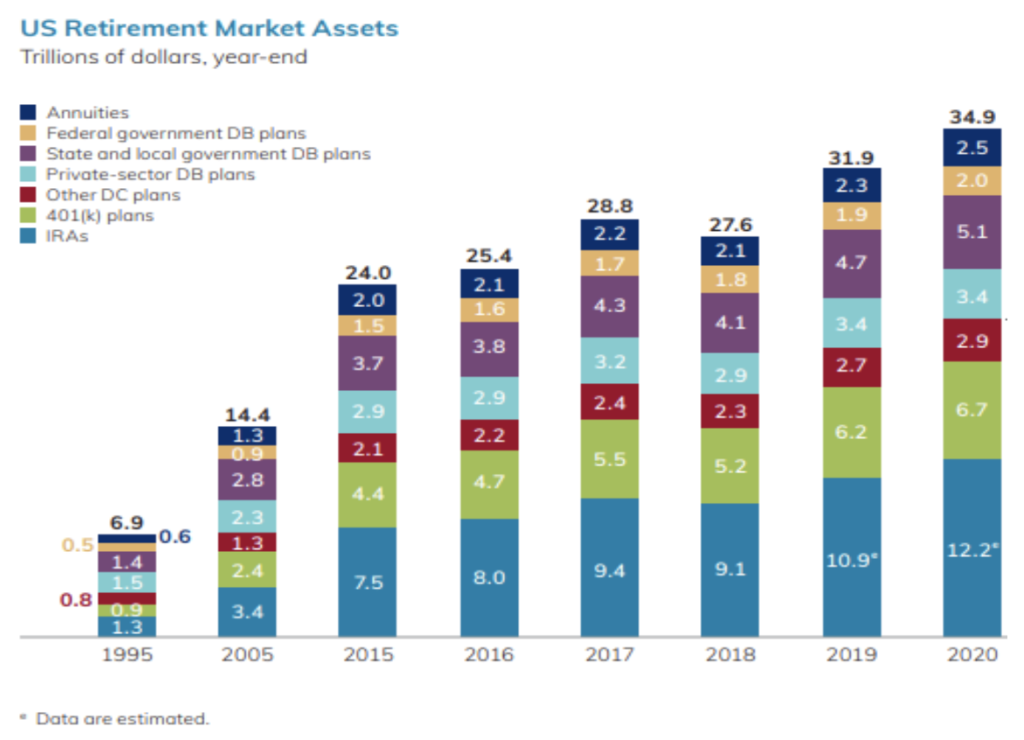

To stimulate the adoption of sustainable investing options in the $13 trillion qualified employer-sponsored retirement defined contribution U.S. marketplace (refer to Chart 1), legislation was introduced on May 20th in the U.S. Senate and House, referred to as the Financial Factors in Selecting Retirement Plan Investment Act, that will amend the Employee Retirement Security Act (ERISA) of 1974 and clarify that fiduciaries may consider environmental, social, governance (ESG) and similar factors in connection with carrying out investment decisions.

In its present form, the legislation does not attempt to clarify the growing confusion and increasingly common misunderstanding that have arisen, in recent years, on the part of stakeholders between values-based investing and environmental, social and governance (ESG) integration in the investment process. While this was not the intention of the legislation, in our opinion, parallel efforts should be undertaken to promote the adoption of standardized sustainable investing definitions, the creation and acceptance of an industry-wide mutual fund and ETF product classification framework, as well as the adoption of minimum reporting and disclosure standards for sustainable investment products.

We acknowledge this legislation alone will still not address a combination of issues that, taken together, will likely continue to restrict short-to-intermediate-term progress toward the adoption of sustainable investment choices in 401(k) plans. These include: (1) the confusion and misunderstanding that exist around sustainable and ESG investing, (2) the resolution of trade-offs that exist between adding one or more sustainable investment options and a growing recognition that the simplification of and reduction in the number of investment choices leads to better participants experiences, (3) the challenge of satisfying the values orientation or sustainable investing sentiments of large and diversified participant populations with a single or a selected number of investment options, and (4) the limited number of sustainable fund options available at this time with track records that extend to three-to-five years.

In the end, the impact of clarifying fiduciary concerns related specifically to ESG integration practices in DC plans may be overstated. The fundamental role of investment managers is to evaluate risks and generate acceptable rates of return for beneficiaries. To the extent that environmental, social and governance factors are relevant and material to investment outcomes, any such related risks and opportunities have likely been taken into account without necessarily labelling these as such. This is in line with their fiduciary obligations as well as the core competency of investment managers to evaluate companies or transactions and to identify risks and opportunities that may affect valuations or impair or enhance an issuer’s ability to service its debt obligations.

Henry Shilling is the founder and director of research at Sustainable Research & Analysis, which provides timely monthly snapshots of trends and developments affecting the sustainable investing market segment.