TGIT, Agents of Impact – this is Dennis Price, ImpactAlpha’s chief impact officer, with this week’s ImpactAlpha Open.

The ImpactAlpha team huddled in New York this past weekend. Top of our conversation: How we can better amplify your impact. Have an idea? Shoot me an email at [email protected].

In this week’s newsletter:

- Climate Week + mapping climate finance;

- ESG hits back;

- Patagonia exits to stakeholders; and

- The investor case for worker organizing.

Know someone that should be reading Open? Please forward them this email and let them know they can sign up for free at ImpactAlpha.com. Ok, let’s get to it. – Dennis

Must-reads on ImpactAlpha

- Climate Week preview. After a season of undeniable extreme-weather events, global energy insecurity, and clarion calls for climate justice, the theme at Climate Week in New York is “Getting it done,” reports ImpactAlpha’s Amy Cortese.

- ESG hits back. Agents of Impact are reclaiming the ESG narrative as pro-business and pro-worker, writes Fran Seegull of the U.S. Impact Investing Alliance. (Open)

- Muni impact. ImpactAlpha’s Dennis Price explains how a major insurer of municipal bonds is tapping data on community vulnerability to manage climate risk.

- Climate and crypto. The Ethereum “merge” points the way to a carbon-free blockchain, reports ImpactAlpha’s newest team member, Dan Keeler. (Open)

- Impact in India. India’s pledge to meet half of its energy needs with renewables by 2030 is driving a climate investment boom, ImpactAlpha correspondent Shefali Anand reports from Delhi.

- More India ink. Altogether, equity capital, green bonds and other types of climate investments in India surged to roughly $20 billion in 2021, reports ImpactAlpha’s Jessica Pothering. Notable: Only one-quarter of India’s climate investors identify as impact investors.

Stakeholder media for stakeholder capitalism

⚡ Upgrade to a 12-month, all-access ImpactAlpha subscription for less than the price of a one-day conference.

- What you get: Daily, actionable news and community connections to stay ahead of the curve in impact investing and sustainable finance.

- Subscribe today and take 25% off – that’s $100 in savings.

Agents of Impact

📐 BlueMark’s Christina Leijonhufvud: Creating a benchmark for impact integrity

With questions about impact investing’s potential for financial returns largely settled, attention has shifted to whether the impact is real. The creation of a baseline for impact integrity is something of a life’s work for BlueMark’s Christina Leijonhufvud.

- Keep reading, “Christina Leijonhufvud, BlueMark: Creating a benchmark for impact integrity,” by David Bank, and like the story on Instagram.

🏃♀️ On the move

- Jackie VanderBrug, ex- of Bank of America and a well-known figure in the gender-lens investing movement, joins Putnam Investments as head of sustainability where she’ll lead stewardship, engagement, and partnerships, and ESG strategy and integration.

- Anna Lerner Nesbitt, ex- of World Bank Group and Meta, joins the Climate Collective as CEO. “The core tenets of web3 — transparency, coordination, trust, decentralization, and scalability — all have significant roles to play in combating the climate crisis,” says Lerner Nesbitt.

- Christopher Harris, ex- of TIAA, joins Zevin Asset Management as a client portfolio manager and will join the firm’s investment committee.

Introducing the Climate Finance Tracker

Mapping climate opportunities

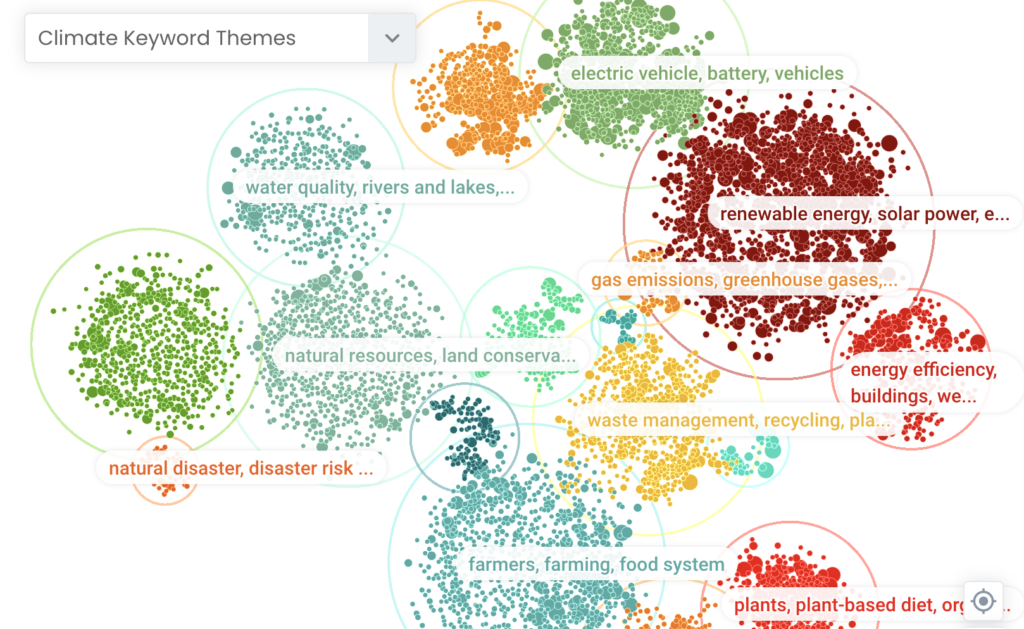

Where is capital most impactful in combating climate change? What kind of capital is needed where? And who is already funding what? Using machine learning and network theory, Vibrant Data Labs and ImpactAlpha, in collaboration with Crunchbase, Candid, Primer.ai, Sideporch and One Earth developed the Climate Finance Tracker to help answer those questions.

- For more on how Vibrant Data Labs’ Eric Berlow built the Tracker, read his Q&A with ImpactAlpha’s Amy Cortese.

- Explore the Climate Finance Tracker.

Deal Spotlight

💰 Patagonia founder exits to stakeholders

Patagonia founder Yvon Chouinard and his family have given away the $3 billion outdoor apparel company. The new owners will earmark the company’s roughly $100 million in annual revenue for climate action and environmental preservation. “If we have any hope of a thriving planet 50 years from now, it demands all of us doing all we can with the resources we have,” said Chouinard, the Yosemite rock climber-turned-businessman who launched Patagonia almost 50 years ago.

- How it works: The Patagonia Purpose Trust will own all of the company’s voting stock (2% of the total stock). The Holdfast Collective, a new nonprofit organization, will own the other 98% of non-voting stock. Profits not reinvested into the business will transfer as dividends to the collective to finance nature-based solutions and biodiversity protection. Ventura, Calif.-based Patagonia will remain a B Corp. and continue to donate 1% of sales to grassroots activists.

- Keep reading, “Deal Spotlight: Exit to stakeholders,” by ImpactAlpha’s Roodgally Senatus.

Six Signals

👷🏾♀️ Balance of power. The investor case for supporting worker organizing rights. (Trillium Asset Management)

⚖️ Racial wealth equity. Bloomberg Philanthropies launched a racial wealth gap database to help cities tackle disparities. (Axios)

🌲 Carbon credits. U.S. forest carbon market NCX launched a carbon credits map showing landowner generated carbon credits available for purchase across the United States. (NCX)

⚡ Equitable electrification. Early findings from a rental partnership between Uber and Hertz suggest lower access barriers for drivers hoping to utilize electric vehicles. (Uber Under the Hood)

📆 30 days of impact. Investment advisor Capshift is tallying 30 ideas over 30 days to help investors to align their investments with their values. (Capshift)

👋 Keep it simple. How ESG finance professionals explain their job to their kids. (Jérôme Tagger)

Get in the Game

💼 Step up

- Bain Capital is looking for an ESG and sustainability manager in Boston.

- Anheuser-Busch is looking for a director of community impact in New York.

- Boston Consulting Group is looking for an associate or consultant for climate and sustainability in New York.

🤝 Meet up

Don’t miss these upcoming ImpactAlpha partner events:

- Phenix Capital is hosting “Impact Summit America” featuring Fran Seegull of the US Impact Investing Alliance,Rockefeller Foundation’s Thomas Belazis, ImpactAlpha’s Amy Cortese and other guests, Wednesday, Sept. 28 in New York. Asset owners and institutional investors can apply for a complimentary ticket.

- GIIN Investor Forum 2022 takes place Oct.12-13 in The Hague with Roopa Kudva of Omidyar Network India, Yalin Karadogan of LeapFrog Investments, Ian Simm of Impax Asset Management and others. Register here to get 10% off.

- The Regenerative Food Systems Investment Forum is set for Oct. 12-13 in Denver with Darren Baccus of Biome Capital Partners, Tripp Wall of Trailhead Capital, Cody Hopkins of Grass Roots Farmers’ Co-Op and other guests. Get 15% off with code IMPACT.

- SOCAP22 is back in person, Oct. 17-20 in San Francisco with CapEQ’s Tynesia Boyea-Robinson, Noramay Cadena of Supply Change Capital, Bronze’s Stephen DeBerry and other guests. Save $250 with code s22_ImpactAlpha.

📧 Get ImpactAlpha in your inbox each Tuesday

Sign up for FREE at ImpactAlpha.com.

Don’t be strangers. Connect with us. Tell us who you are and what you’re up to. Share your news, tips, data points, introductions and high-impact ideas, to [email protected].

See you back here next Tuesday!