ImpactAlpha, Sept. 12 – Where is capital most impactful in combating climate change? What kind of capital is needed where? And who is already funding what?

Eric Berlow, a ”social impact data scientist,” was working with a couple of foundations developing funding strategies to respond to the urgency of climate change. When he couldn’t find the answers, he set out to find them for himself – with data.

The result is the Climate Finance Tracker, an interactive data-driven map of climate finance flows developed by Berlow’s Vibrant Data Labs and hosted on ImpactAlpha. The goal is to make it easier for philanthropic, private and public funders to see who is funding what and where the gaps are. And then to steer the right kind of capital – from grants to catalytic capital to VC to project finance – that is needed to take solutions to scale.

For Berlow, the challenge was too good to pass up. “How do you synthesize all of the private funding for a field when that field, like climate, has fuzzy boundaries?” he asks.

Spoiler alert: The data-driven takeaway from the Climate Finance Tracker is that commercial investors, including venture capitalists, have embraced clean energy, electric vehicles and other mature sectors, especially for wealthier demographic groups and developed markets. But solutions for low- and moderate-income communities and emerging and frontier markets remain capital-short.

Climate adaptation and resilience – which most directly affect lives and communities – still gets short shrift compared to ‘mitigation’ of carbon and other greenhouse gas emissions.

The prototype of Climate Finance Tracker, launching this week, was developed by Vibrant Data Labs and ImpactAlpha, in collaboration with Crunchbase, Candid, Primer.ai, Sideporch and One Earth. Vibrant Data and ImpactAlpha are working with RTI International to extend the map’s data sets to Africa, Asia and Latin America.

ImpactAlpha’s Amy Cortese caught up with Berlow to get the backstory on data-driven climate-finance mapping.

ImpactAlpha: How are identifying the gaps in climate finance?

Berlow: One of the things that’s been really interesting about blending both the philanthropic and the private investment funding is you start to see what kinds of capital are going where and what might be the gaps.

There are some really amazing syntheses of global climate finance that look at how broad flows of capital are flowing to broad buckets. Our focus was on tracking the flows of money to the ground, specifically who’s funding exactly what companies and what nonprofits. Where? And what are they doing?

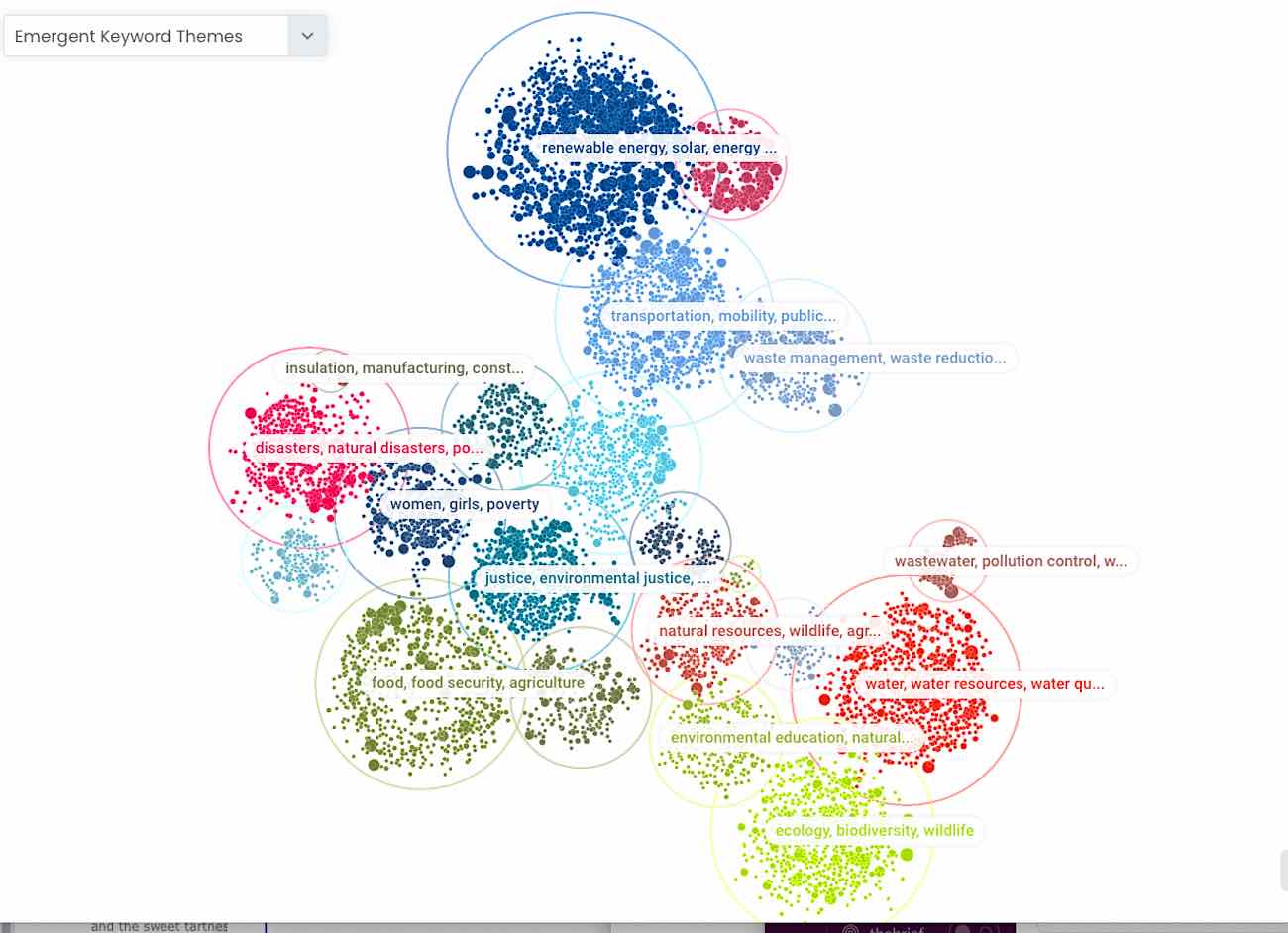

By using the language of how everybody describes what they do – from the CrunchBase profile, from their LinkedIn, from their candidate profile, from the grant summaries – we’re using that to identify the themes of who’s funding what. As those themes emerge, and you overlay where the venture capital is going, versus where the grants are going, you start to see that venture tends to go towards one corner of the problem.

That tends to be, as we’d expect, tech, and it tends to be renewable energy, electric vehicles, where there’s really hot market activity. And you see that there’s a big gap in private investments, especially venture, in areas that are more focused on climate equity – things around food security, water security and poverty alleviation that are related to climate.

You can only see the gap when you include a broader swath of data, like the grants versus the investments.

ImpactAlpha: Can you give us an example?

Berlow: In the venture funding, there’s a high concentration of venture that goes to renewable energy and solar technology, batteries and electric vehicles. If you look in the language of how those entities describe what they do, very few of them mention anything related to equity, access of that technology to low-income communities, to rural areas, etc.

When you look at the scattering of philanthropic activity that is in that venture donate area, it typically is around trying to get the technology accessible to the poor to the bottom of the pyramid. So there is a gap where we need more, either more philanthropic support, to get the tech accessible to the poor, to the bottom of the pyramid, to support low income livelihoods, for energy independence, in that case of mobility, independence.

At the same time, potentially, there are collaborations between the philanthropic and the investment sector to try to build technology that’s already designed for the bottom of the pyramid so that it might be easier to make it accessible to broader audiences.

And as we know, we will never solve this problem if only 1% of the population has access to emissions reduction technology or renewable energy. Scaling to the bottom of the pyramid is something that venture funding currently is not doing. It’s solely on the shoulders of philanthropy to try to make the tech accessible. That’s one example of a gap that we found where the different types of capital serve different needs.

ImpactAlpha: Climate equity includes adaptation, right? The effects of climate change are already here, and falling most heavily on some of the most vulnerable communities and emerging markets. What are you seeing there?

Berlow: The carbon problem is so clearly defined and unidimensional that it’s really easy for investments to go to that, and for the technology to be measured by how much carbon are you sequestering, or how much are you not emitting. But that’s a very tiny corner of the problem space.

And there’s so much happening now in the world of adaptation. For a lot of people, and for me, adaptation was a very overwhelming idea. What does climate adaptation mean? What popped out to me from the data is that climate adaptation is this problem where as the stressors increase – not just temperatures, but more extreme events – in some areas, the world will be uninhabitable. It boils down to water, either too much water or too little water. Both of those have effects – flooding, etc. – that leads to crop failures or disaster or physical damage.

And when those things are not addressed, they lead people to migrate because they can’t live where they live. So the biggest thing we’re trying to mitigate against is the largest forced displacement of humanity in the history of civilization. Which will, as we know, cause cascading crises of – refugee crisis, political instability, likely war, supply chain disruptions.

And even if it’s coming from parts of the world that are vulnerable that we are not in, we will all be affected by it through mass migration and through supply-chain disruptions. The core things are how do you empower the most vulnerable people, in the most climate vulnerable places, to continue to survive and thrive in the face of these external stresses? That’s climate adaptation in a nutshell. And resilience is, how do you give them the tools to do that, so that they can maintain their livelihoods or improve them in the face of these changes?

In the philanthropic landscape, a lot of it has to do with food security, water security, energy, independence, mobility, independence – meeting basic human needs. It turns out that there are many actors in the philanthropic space that have worked for years on these low-income livelihood issues.

They are absolutely relevant for climate mitigation and adaptation if you just put a climate lens to it. Where are those populations that are the most vulnerable to these climate stressors? And so we have a whole battery of climate-relevant philanthropy and actors that are poised to help address this problem from the social sector.

ImpactAlpha: The big funders want to come in and do this kind of top-down investment in mitigation projects. But what developing countries and communities want and really need is adaptation, and resilience. There are models on the ground, and people working on this. They just need the funding.

Berlow: It’s a rethinking that those things can go in somebody’s climate portfolio, they are relevant. Is a solar-powered water pump climate mitigation or adaptation? It’s an adaptation thing to empower smallholder farmers to grow crops under dry conditions, or to be resilient to some dry years. Those are critical for mitigating not just against climate change, but against the migration disasters that are going to happen if we don’t help out. It is in everybody’s self interest to empower the most vulnerable in the most vulnerable regions to survive and thrive.

ImpactAlpha: And even in this country we will have climate migration and crop failures.

Berlow: This is not just in those other regions of the world. The initial version of this climate finance tracker is U.S.-based companies and nonprofits. The data from CrunchBase and GuideStar were strongest there. Next, we are expanding the tracker for emerging markets and for Europe and the U.K.

ImpactAlpha: What went into building the tracker?

Berlow: I’m an empiricist. I’m a data person. My background is ecology, but from an empirical perspective. And so my question was: Where’s the data and how to get the data? We tried to get data on the language that is used in climate mitigation and climate adaptation. Then we could search the funding databases for any grantee or investee that mentions those terms.

I literally scraped Wikipedia for any page that mentions climate mitigation or climate adaptation or climate resilience – hundreds of Wikipedia pages. With the help of one of our partners, Primer.ai, which is a natural language processing company, machine-ran all those Wikipedia pages to surface terms that were relevant to those topics.

We went to some of the big reports – like the Climate Policy Initiative’s reports on the global state of climate finance, the Project Drawdown website, Paul Hawken’s regeneration website that focuses a lot on climate resilience – and looked at the terms that they use to summarize that field. We generated a list of over 150 search terms to search CrunchBase, our partner for investment data, and Candid.org, for all the philanthropic grants.

That resulted in a dataset of about 24,000 grantees and investees, which we thinned out using machine learning to about 6,000 companies and 6,000 to 7,000 nonprofits.

This is our first public launch. We know that there are going to be some errors in the data, where something missing that should have been in there that was funded, or there’s something funded in there that shouldn’t be there. We’ve included a feedback button that people can use to provide input to help us clean up the data or to suggest things.

ImpactAlpha: Walk us through how someone might use the map and what they can zoom into.

Berlow: Imagine if you had data on all of the private funding for climate efforts in the United States, and it was like shopping for shoes on Zappos. You could filter and query visually and see the results. Or like looking on Kayak for flights.

There are four main use cases. One is to see a big picture view, the different topics that are funded, and which are more or less than others.

Another is to search through any topic, like regenerative agriculture, and see instantly who was funded where, what are the topics that they’re working on, and who are the top investors and the top donors.

Related to that would be: if I want to know who to talk to, like on regenerative agriculture, it’d be very easy to quickly query that, see the top executives, the top founders, top donors. If I wanted to convene a group or talk to them for leads, or due diligence, or shared learnings.

And then the final one was the question we talked about before, to see where there are gaps.

ImpactAlpha: You describe yourself as a social impact data scientist. Is that a thing?

Berlow: I don’t know. My goal is to reverse the brain drain from ad tech to climate. So far we’ve nabbed three or four of them to help out on this effort, brilliant people who before were using data science to help to make people buy shit they don’t need. And now we’re trying to redirect that talent towards climate. There’s going to be trillions of dollars in investments in climate over the next decade. If we can bring evidence and data to bear on those decisions to be more strategically impactful, then, that’s our goal. Just like a hedge fund is trying to use data to figure out how to make better investment decisions.

Vibrant Data Labs is a social data science group. We focus on simplifying complexity to help tackle complex social challenges using the arsenal of data tools and network theory and complexity science. We support philanthropic and social impact efforts to bring data to bear on their decisions.

ImpactAlpha: It takes a village, as they say, and there are a lot of partners in this initiative. You mentioned some of the data partners. And of course, the Climate Finance Tracker will be hosted on ImpactAlpha.

Berlow: It was a huge collaborative effort. Like I said, I don’t know anything about climate finance. I have a background in ecology from years ago. I know a fair amount about climate change, but more as an ecologist. We’re just here to try to provide the data science backbone to it.

I’m just so excited to partner with ImpactAlpha to host it because you guys can tell the stories and the insights in a way that is relevant to the funders and investors. Our goal is behavior change in the end, to change how the money is flowing.

One Earth is our fiscal sponsor, and they have this amazing evidence-based approach to how to simplify and point the hose at the right solutions, as well as rally philanthropy towards climate efforts on the ground. CrunchBase has been really generous with providing free access to their data. Both CrunchBase and Candid have been amazing. Cisco Foundation was a supporter early on.

Our goal is to collaborate because, just like the climate crisis, we can’t do this alone.