ImpactAlpha, Sept. 14 – Public finance investors buy hundreds of billions of dollars in municipal bond issuances each year, providing much needed capital for schools, roads, energy utilities and other critical infrastructure. Many, if not most, of those purchases are blind to mounting risks from extreme weather events and their disproportionate impact on vulnerable communities.

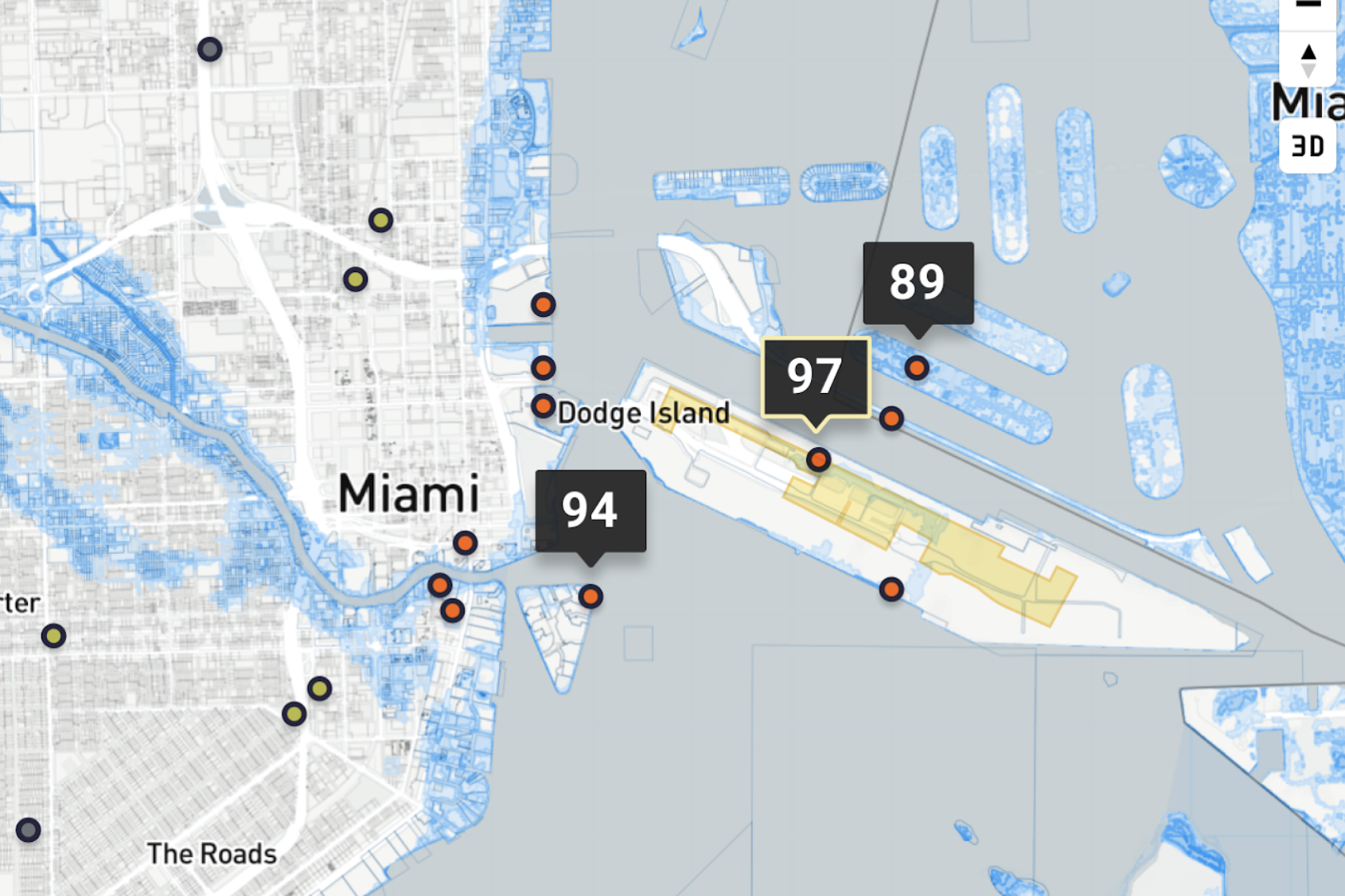

Assured Guaranty, a major insurer of U.S. municipal bonds, has partnered with the intelligence platform UrbanFootprint to create Municipal Bond Insights, a data tool for assessing environmental, social and governance, or ESG, risk in municipal bond markets.

“The ability to integrate climate and community vulnerability data will help to ensure that we are prepared to manage risk from these growing threats,” said Assured’s Dominic Frederico.

Community resilience

Resilience to climate change is more than a levee.

Insuring municipal bonds requires pricing long-tail risk over decades. “Understanding the extent to which the community is not just at risk, but the extent to which the community is resilient to that risk, is mission critical,” UrbanFootprint’s Joe DiStefano told ImpactAlpha.

UrbanFootprint’s data platform tracks bottom-up indicators of the ability of a community to respond to climate threats, such as the portion of a community that is under economic stress, unemployed, renting their homes or elderly. Once weaknesses are known, Assured can work with communities to address vulnerabilities and reduce default risk.

Hook or crook

Community resilience is increasingly a target of regulators and a directive for federal investments in clean energy and energy efficiency, clean transit, sustainable housing and other resilience categories.

The California Public Utilities Commission, for example, requires utilities to address affordability issues in energy, water and broadband projects.

Public finance investors won’t act on climate and community risk overnight, says DiStefano. “There’s a learning curve that you can get through by actually exposing people to defensible, deep data.”