Greetings, Agents of Impact!

You’re receiving ImpactAlpha Open, our free weekly newsletter. Upgrade to a paid subscription to get full access to ImpactAlpha’s award-winning coverage of impact investing and sustainable finance – and connect with peers and partners to advance your career. Subscribe today to get 25% off.

In this week’s newsletter:

- Outperforming on impact management

- Inclusive franchise ownership

- Dissing dollar stores

- Green nukes

Let’s jump in. – Dennis Price

Must-reads on ImpactAlpha

- Impact management leaders. The impact verification firm BlueMark is benchmarking funds’ practices for managing impact, including through a leaderboard of top-performing firms, I report.

- Neil Gregory, ex- of the International Finance Corp., shares tips on assessing risks to impact, while Snowball’s Jake Levy offers five ways to advance impact measurement and accountability.

- To help investors better leverage ESG data for impact, Kieger’s Panagiota Balfousia makes a plea for transparency and traceability in ratings and scores.

- Aunnie Patton Power and Riannah Burns argue for compensation structures that better align fund managers with the impact outcomes they profess to deliver.

- Inclusive franchise ownership. As part of our ongoing coverage of the ownership economy, Roodgally Senatus reports on efforts to democratize fast-food franchising as a strategy for racial wealth-building.

- Reimagining slums. Sebastian Welisiejko of the Global Steering Group for Impact Investment makes the case for infrastructure investments in the informal settlements, aka slums.

- Commercially-viable fusion. Microsoft last week contracted with Helion to receive fusion power in 2028, with penalties for late delivery, Amy Cortese reports.

Upgrade to All-Access

⚡ Take 25% Off

Subscribe today to get full access to thousands of deeply reported stories and exclusive impact investing deals to help you achieve your goals.

Agents of Impact

🏃🏿♀️ On the move

- Goldman Sachs promotes John Goldstein to global head of sustainability and impact solutions for its asset and wealth management business. Kara Succoso Mangone will become head of the investment bank’s sustainable finance group.

- LeapFrog Investments promoted Michael Jelinske to director of investments and Rebecca Kwee to impact officer.

- Kate Ahern, ex- of Cartica Management, joined Sandoz as head of ESG in Munich.

Charting an Inclusive Economy

📈 From employees to owners

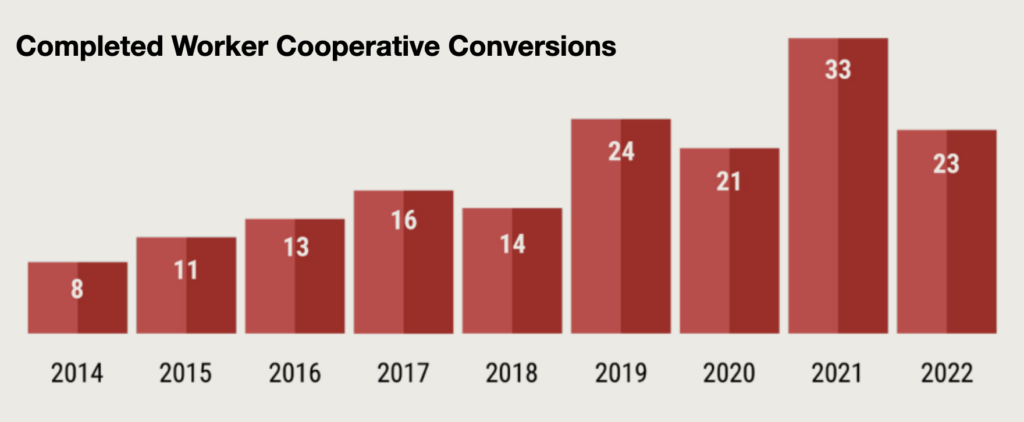

Bipartisan legislation introduced last week would create an investment facility to mobilize private investment for employee-owned businesses. The Employee Equity Investment Act would ease employee ownership conversions by providing loan guarantees for investment funds devoted to expanding employee ownership via the SBA’s Small Business Investment Company program (see, “Policymaking for workers and communities in the Year of the S”). “American workers are the driving force behind the U.S. economy’s strength, dynamism and resilience,” said Fran Seegull of the U.S. Impact Investing Alliance. “With the right tools, investors can help empower them further. ” (Image credit: Asset Funders Network.)

Impact Briefing

🎧 On the podcast

Eunice Ajim, founding partner Ajim Capital, speaks with David Bank about her personal journey to launch the fund and her mission to support tech entrepreneurs in her native Cameroon and across Africa. Host Monique Aiken has the headlines.

- Listen to the latest episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

Deal Spotlight

💸 Odyssey raises $15 million to cut obstacles to renewables in emerging markets

Commercial and industrial solar for business facilities, factories and shopping centers is growing in places without reliable grid connections. In many emerging markets, supply chain, logistics and financing obstacles prevent installments from keeping pace with demand. “The way we can be most impactful is to cover the end-to-end process and be a system of record for projects from the moment they’re conceptualized through operation,” observed Emily McAteer of energy tech venture Odyssey. Less than a year after its seed round, Odyssey raised $15 million in Series A financing from Union Square Ventures, MCJ Collective, Climate Venture Capital and others.

Six Signals

👩🏽🦱🧑🏼🦱👨🏾🦲👩🏻 Business and racial justice. When employees see their employer making progress addressing racism and racial inequities, they are far likelier than those who see no progress to want to stay for many years. (Edelman)

💼 Inclusive procurement. Minority-owned firms saw a big jump in Massachusetts state contracts last year. The increase comes after the state agency tasked with supplier diversity got more enforcement teeth and other agencies got tools to track their own progress. (WGBH)

💲 High cost of dollar stores. Black ministers in Ohio are pushing back against the expansion of dollar stores, which have been shown to stifle economic growth and exacerbate food insecurity – part of a wave of local efforts to restrict Dollar General and Dollar Tree. (Capital B)

🌱 Seed-stage climate tech. Climate tech companies on Carta that raised seed-stage funding in the first quarter received higher valuations and higher round sizes than the general startup population. The downside: not a lot of rounds raised (only 10 in the three month period). (Peter Walker / Carta)

⚡ Nuclear pipeline. The US Department of Energy’s Loan Programs Office, led by Jigar Shah, has received $16.6 billion in loan applications for nuclear projects (The New York Times calls Shah “a swaggering clean-energy pioneer”). Shah says the loans program “is uniquely situated to help support key parts of the advanced nuclear value chain, in order to reach our decarbonization goals.” (Jigar Shah / Accelerating Climate Wealth)

🎥 Climate and culture. Climate change is getting screen time at film festivals, at the cinema, on television, and in video. Future Forward, by The Climate Pledge, sets itself apart with a focus on climate solutions in transportation, farming, flight, buildings, water and forests. (World Economic Forum)

Get in the Game

💼 Step up

- Wetherby Asset Management seeks an impact management analyst in San Francisco.

- Global Partnerships is recruiting a Latin America portfolio impact officer in Bogota.

- MSCI is looking for a senior ESG researcher and vice president in Singapore.

Don’t miss dozens of other impact jobs curated this week on ImpactAlpha.com.

🤝 Meet up

Don’t miss these upcoming impact investing events:

- June 20-22: Asian Venture Philanthropy Network Global Conference 2023 (Kuala Lumpur)

- July 13-14: Africa Impact Summit, hosted by GSG, African national advisory boards for impact investing, and the University of Cape Town’s Bertha Center (Cape Town)

- August 27-30: Latimpacto’s 2023 Conference (Rio de Janeiro)

📬 Get ImpactAlpha Open in your inbox each Tuesday

Don’t be a stranger. Connect with us. Tell us who you are and what you’re up to. Share your news, tips, data points, introductions and high-impact ideas, to [email protected].

‘Til next Tuesday!

Partner with us, including by sponsoring this newsletter. Get in touch.

Get ImpactAlpha for Teams. Save with substantial group discounts. Start here.