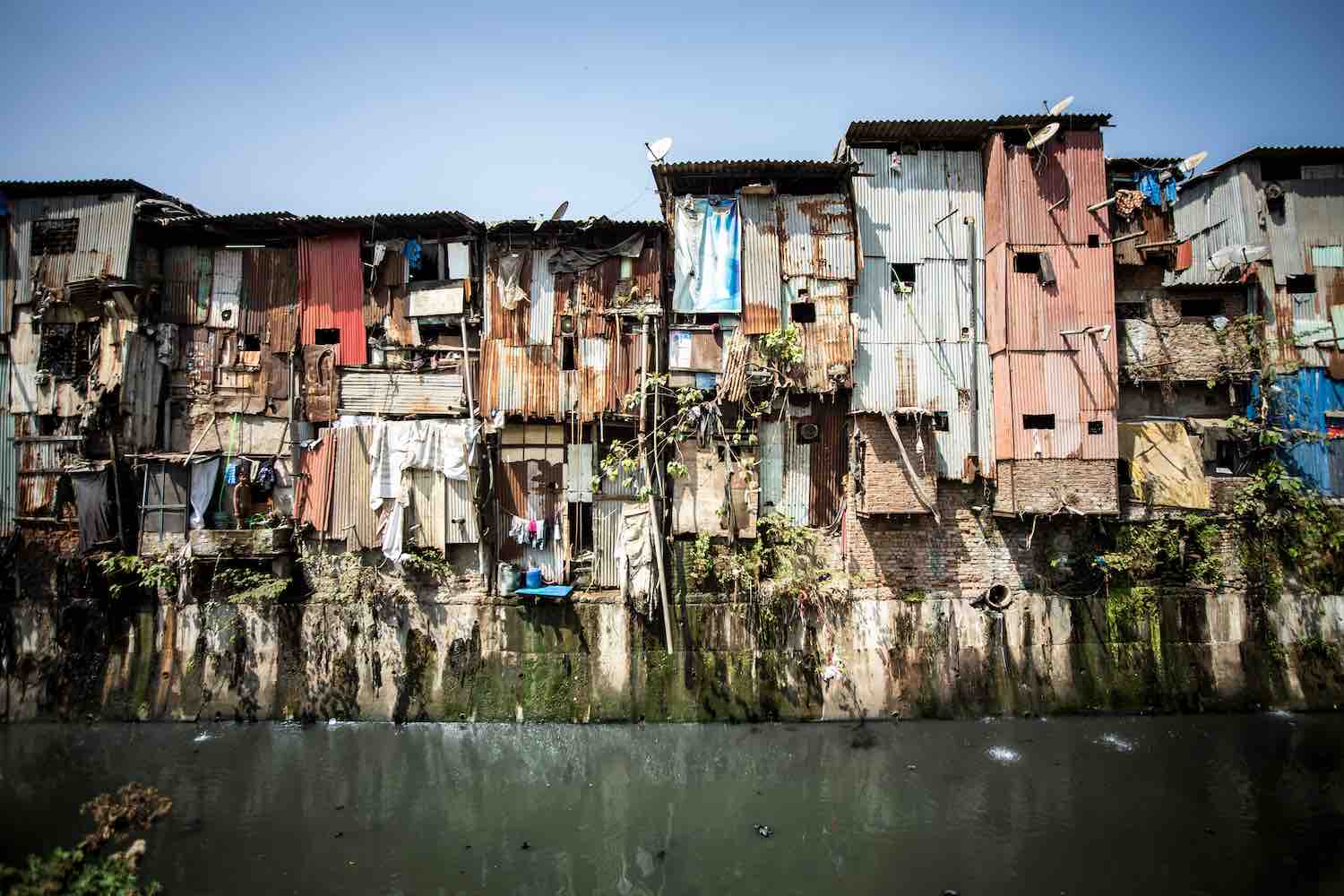

More than one billion people around the world live in urban areas without formal access to basic infrastructure such as potable water, sewage, and electricity. The UN predicts that this number will continue to rise, with as many as three billion people living in slums and informal settlements by 2050.

There is a clear case for public-private sector partnerships to invest in the rehabilitation of informal urban areas. That case is built on strong community focus and engagement, the potential for social value creation, and the need to avoid massive, long-term social costs to be faced if nothing is done.

For example, Argentina’s government in 2016 partnered with a broad range of social sector organizations to conduct the country’s first census of slums and informal settlements. The census revealed that almost 10% of Argentina’s population (roughly four million people) lived in informal urban areas.

The census produced a rich dataset that in 2018 was helpful in passing a law to create a special land titling scheme, a socio-urban integration program, and a dedicated public-private trust fund to deliver better solutions at scale. Though there have been challenges in its deployment, Argentina’s first-of-its-kind impact fund aims to pool public resources with private and institutional investment to address an investment gap estimated at $26 billion – almost 400 times the historic annual public investment in this area.

Patterns of rapid urbanization, partly fueled by climate- and conflict-driven migration, will continue to put pressure on cities already struggling to absorb incoming populations, particularly in the Global South, where urban informality prevails.

The Covid-19 pandemic exacerbated this issue, as millions of informal and precarious workers in the Global South lost their jobs and incomes. No longer able to afford formal or stable forms of rent, many were forced to seek informal habitat solutions. In aggregate terms, the recession stressed public budgets globally, increasing the overall SDG financing gap by up to 70% to over $4 trillion a year.

Building the business case

The proliferation of informal settlements has been historically linked to and driven by economic volatility and hardship, growing inequality, poor economic performance, as well as inadequate responses from the public sector and a lack of affordable market-driven solutions.

Responses to territorial inequality and marginalization have typically been left to governments only, which lack funding and capacity. Even with the long-standing support of multilateral development banks, it’s clear that public budgets alone will never be sufficient to fund the necessary investment to rehabilitate and upgrade slums and informal settlements at scale – with a total funding gap estimated at $6 trillion globally to tackle this issue area.

The growth rate of people living in slums has outpaced the public sector’s ability to generate solutions.

And despite multi-dimensional implications for development, urban informality has also historically received little attention from the private sector. Investors are largely unaware of the issue. In the Global North there is investment in affordable housing, yet urban informality is a “non-issue” in most OECD countries. In emerging and developing economies the lack of enabling policy environments and suitable financing vehicles, coupled with misaligned incentives, have led to limited engagement.

Slum-dwellers have limited or inadequate access to education or health services, leading to lower skill levels, fewer and poorer quality job opportunities, poorer health outcomes, and lower income. In emerging economies with young populations – typically higher in slums where under-15s can be more than 45% of the total population – these problems will be compounded over the next decades, with devastating economic and social consequences.

There are also significant environmental concerns, with slum-dwellers being disproportionately vulnerable to climate-related hazards such as flooding, as well as environmental threats given the prevalence of open-air waste disposal or the contamination of natural systems. Multi-dimensional solutions to urban informality are therefore critical for achieving a just transition.

Valuing and monetizing the long-term impacts of the status quo, and sizing the social and economic gains to be made through the socio-economic integration of the most vulnerable urban communities, can lay the foundations of the business case for investing in slum upgrading at scale. We need to make policymakers, investors, and society at large aware that our cities and societies cannot reach their full potential with current levels of territorial segregation.

Sustainable debt

To transform the perception of informal settlements as urban liabilities, we need to quantify and communicate the potential of these areas to drive societal value creation.

Effective public-private collaboration is paramount to delivering high-impact policy and financial solutions to tackle urban informality. To boost capital mobilization towards slum upgrading programs, governments could issue thematic place-based sustainable debt instruments. These instruments could target public markets with issuance structured as special-purpose vehicles, e.g. trust funds.

Institutional investors like pension funds, insurance companies, and investment banks, are increasingly interested in sustainable debt vehicles that deliver both financial return and measurable impact, which correlates with the fast-growing global market for green, social, sustainable, and sustainability-linked, or GSSS, bonds. Public-sector-led thematic issuances can be tagged as GSSS, leveraging regulation and incentives.

Long-term champions of habitat development like multilaterals and development finance institutions also have a key role to play, not only by deploying their capital in a more catalytic way, but by putting in place guarantees and de-risking mechanisms to leverage resources from the private sector at scale.

Community voice

Collaboration must also include and be driven by stakeholders who understand the local context. Community voice ensures that solutions are tailored to the specific needs of the communities they serve, whilst creating a foundation of trust and ownership, leading to more sustainable, long-term success.

There is tremendous potential for collaboration between governments and investors to make rapid progress on addressing this issue while also achieving socio-economic development and environmental progress, in line with the goals set in the UN’s 2030 agenda.

Investors, policymakers, and urban experts alike can no longer afford to overlook informal settlements, nor ignore that to deliver solutions at scale, investment schemes cannot rely on public and development finance alone. The social, economic, and environmental costs of inaction are high.

_____________________________________________________________________________

Sebastian Welisiejko is Chief Policy Officer at the Global Steering Group for Impact Investment.