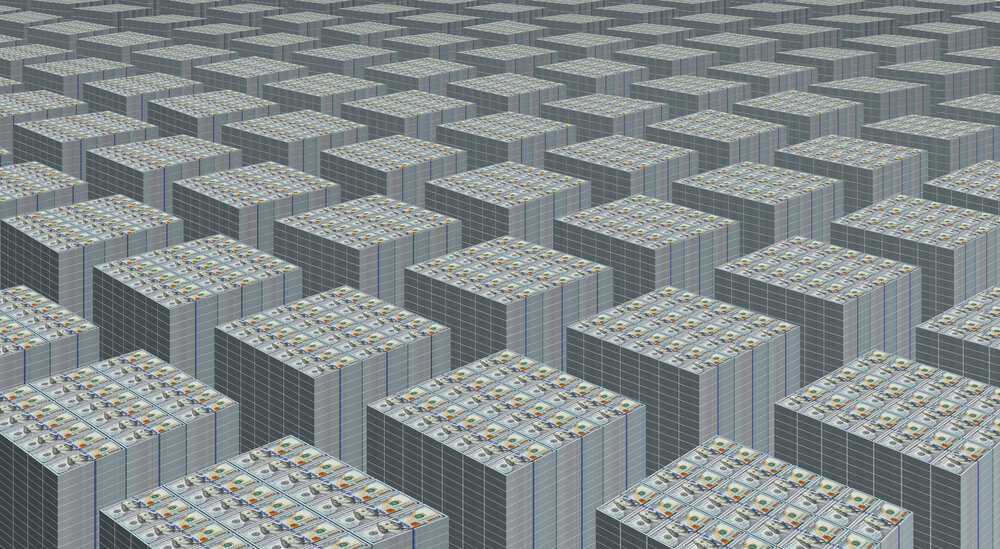

I had the privilege of being part of last month’s launch of the SDG Loan Fund, the $1.1 billion vehicle that is one of the best examples to date of aligned partnership among commercial institutional investors, development finance institutions and foundations.

In this fund, Allianz Global Investors, FMO (the Dutch development finance institution) and the MacArthur Foundation came together, playing to their respective strengths, tools and roles. Institutional investors responded to this credible partnership by investing $1 billion into three essential sectors in emerging and frontier markets – affordable energy, financial inclusion and sustainability agriculture.

Together, these partners demonstrate that mobilization at scale is possible. The example proves that collaboration, co-creation and constructive problem solving among three different types of market actors can attract private commercial investors to deploy significant capital into emerging markets, markets that have been challenged by investor outflows over this past year, and to invest in themes that are highly relevant to the end-users of the capital in these under-invested markets.

Much has been written about the promise and potential of mobilizing private institutional capital for investing in emerging markets around one or more of the SDGs, from the G7 Impact Taskforce to the Center for Global Development and the insights generated through the Catalytic Capital Consortium.

Despite this growing awareness and repeated calls to action, examples of replicable vehicles in the market remain few. During a briefing luncheon hosted by MacArthur, I asked: Can the launch of the SDG Loan Fund kickstart a phase of momentum for others?

As a sell-side advisor, catalytic capital partner, and board member of a development finance institution, I am convinced the answer is yes. My confidence derives from three foundational principles of this deal.

Build partnerships that play to your strengths – and stick to them

Each of the partners recognized their respective strengths and stuck to them, respecting what the others brought. Allianz Global Investors knows the institutional investor market. They were focused and tactical, attracting a pool of institutional insurance companies to participate in the deal. They listened to the constraints these investors cited and responded by shaping the first loss layer of the deal in a straightforward manner avoiding the structuring temptation of complexity.

FMO operates exclusively in emerging markets and brings its track record, origination channels, and investee monitoring capabilities. Combining the credibility and commercial market acumen of AGI with the credibility and emerging market lending capacity of FMO sits at the core of the fund’s success, with AGI serving as fund manager and FMO serving as portfolio manager, both in a fiduciary role relative to the investors. In addition, FMO also brought risk-seeking capital into the deal to unlock the institutional capital through its first-loss investment.

The MacArthur Foundation played its increasingly recognized role as the market catalyst, able to provide an unfunded guarantee instrument to solidify the first loss contribution from FMO, which, in turn, unlocked the institutional commitments. Each partner brought something specific that was understood and respected by the other parties and, most importantly, was valued by the market.

Catalytic capital is a critical ingredient to be used sparingly

Catalytic capital has captured numerous headlines over the past year and has been the topic of many investor convenings. The Catalytic Capital Consortium Learning Labs, which I helped organize and facilitate, brought together more than three dozen investors over 15 months to look at real deals and consider how to use catalytic capital more efficiently and effectively to unlock impact investments from others.

One of the recurring themes in these discussions is the scarcity of catalytic capital – capital with greater risk tolerance and enhanced flexibility applied with patience by its providers – to be used sparingly to achieve meaningful results.

The catalytic capital and mobilization ratios of this deal are impressive: $25 million in an unfunded guarantee from a foundation, unlocks $111 million of first loss capital from a DFI that mobilized $1 billion from private institutional investors. And all of this capital is invested in emerging markets to advance a few critical investment themes among the SDGs: financial inclusion, agriculture and renewable energy.

Size and scale require simplicity

In our discussions about mobilization, practitioners often get stuck on the size and scale point. This deal is an example of how to get unstuck.

For institutional investors, size and scale matter for a number of reasons including diversification, exposure limits, and transaction costs. As a practitioner who has spent years locked in structuring dens, one of the disciplines of smart structuring is to keep things simple. This is particularly needed in blended finance structures in which you have different parties bringing different types of capital to the same solution. Why are we blending and what amounts are really needed are the repeat questions that need to be answered and re-answered throughout the deal.

The iterative process in this deal resisted the impulse to add layers of complexity; rather its strength lies in the simplicity.

We need more of these vehicles. While we may expect AGI, FMO and the MacArthur Foundation to bring further deals to market, we should be looking to others to take a page out of the SDG Loan Fund playbook and replicate some or more of the features of this deal. All three of the partners have committed to sharing the structure as well as the lessons they learned along the way. Replication should reduce the design gestation period. Learning from experience, we should challenge ourselves to shorten the through-put of bringing new mobilization vehicles to market.

While we need institutional engagement for effective partnership, at the end of the day, institutions are made up of people. The team leading each of the partners through the long and winding road to get this deal into the market demonstrated strong alignment, flexibility, and unwavering commitment over several years. This is one where the whole is indeed bigger than the sum of its parts. I applaud the teams for their tenacity in getting this deal over the finish line.

I, for one, am hopeful that this transaction and the learnings that come from it will motivate others – institutional investors, development finance institutions and foundations – to step up. This deal proves that investment capital into emerging markets can move in the right direction – in!

Laurie Spengler is CEO of Courageous Capital Advisors, an impact investing advisory firm. She serves as a non-executive director of British International Investment (the UK DFI), SIFEM (the Swiss DFI), Lendable and BRAC Uganda Bank Limited. She is an impact advisor to EQT’s Future Fund.