ImpactAlpha, December 8 – Within the United Arab Emirates’s new $30 billion Altérra climate fund is a $5 billion carveout that could represent an unprecedented infusion of catalytic capital. The Altérra Transformation Fund will provide risk-mitigation capital, such as first-loss reserves, to incentivize private climate investment in least-developed countries and small island states.

The other $25 billion is earmarked for the Alterra Acceleration Fund, which has already committed $6.5 billion to climate funds managed by BlackRock, Brookfield Asset Management and TPG. Together, the UAE aims to mobilize $250 billion in institutional capital for the transition to a net-zero economy.

Blended finance – the layering different sources of capital with different risk, return and impact expectations – is crucial for building markets and unlocking money for places and sectors it otherwise wouldn’t go. The new SDG Loan Fund, for example, leveraged a $25 million guarantee from the MacArthur Foundation into a $111 million first-loss reserve from the Dutch development bank FMO that brought in $1 billion from Allianz Global Investors and other European insurance companies for small businesses, resilient agriculture and climate solutions in emerging markets.

Complex structures

Blending finance to address the climate crisis, however, is in worrying decline. Blended financing flows for climate projects dropped to $5.9 billion between 2020 and 2022, compared to $7.1 billion between 2017 and 2019, according to the latest report from Convergence, the Toronto-based blended-finance network. Climate blended finance flows fell at a steeper rate than total blended finance, reaching a 10-year low.

“These trends are symptomatic of larger macroeconomic challenges impacting financing flows to emerging and developing economies, characterized by inflationary pressures, mounting debt burdens, and geopolitical instabilities,” Convergence noted in the report.

Convergence and the Climate Policy Initiative are working to seed new blended finance approaches to unlock new streams of climate capital. Their Catalytic Climate Finance Facility granted $2.4 million to test, structure and launch six new ideas, including impact-linked debt for Indigenous and Amazon-based conservation organizations and guarantees for pay-as-you-go solar in Africa.

Initiatives announced at COP28 may help speed that flywheel. Allied Climate Partners’ secured $825 million from the IFC, Soros Economic Development Fund, Three Cairns Group, Bezos Earth Fund and others to develop and de-risk climate projects in the Global South. The fund’s partners hope to draw in $11 billion in private capital to a portfolio where two of five investments are expected to fail.

“In the absence of sufficient flows from North to South, getting leverage out of the pockets of blended finance is really vital,” the IFC’s Jamie Fergusson told Reuters.

Commercial capital

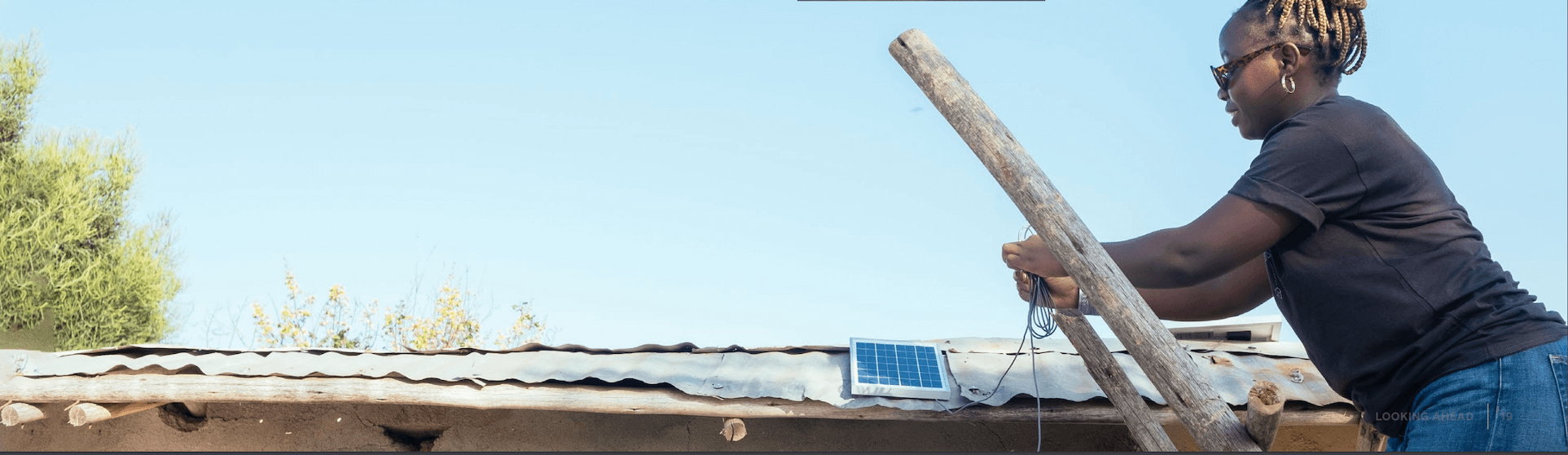

Acumen rolled out its Hardest to Reach energy access initiative at COP with $65 million from the Green Climate Fund. The impact fund manager is looking to raise $250 million to deliver clean energy products to first-time users in 16 of Africa’s least-invested countries, including Somalia, Niger and Chad.

The program will offer a mix of grants, equity and working capital loans to help clean energy ventures, like cookstove maker BioLite, enter and build traction in new markets in partnership with local businesses. Enterprises funded with working capital will get the added bonus of below-market interest rates, which will be canceled out completely if they hit specified impact targets.

USAID Power Africa, the Global Energy Alliance for People and Planet, commercial investor Shinhan Bank and others have signed on alongside Green Climate Fund to support the program’s different capital pools.

“The blended finance structure definitely helps” with fundraising, Acumen’s Jiwoo Choi told ImpactAlpha. Early backers were enticed by the program’s focus on adaptation, which attracts only 5% of climate capital. “And we have a very clear and simple impact target: first-time energy access customers,” she added.

Development finance institutions – a key potential source for climate resilience financing – have yet to commit, says Choi. “Our risk-based return doesn’t work for them.”

Choi said that having one commercial investor already signed on, however, could signal to DFIs “more possibility and probability to mobilize more private capital.”