ImpactAlpha, Nov. 16 – Billions of dollars in venture capital are pouring into climate tech. And hundreds of organizations, initiatives, coalitions and conferences are calling for climate justice and equity.

There’s virtually no overlap.

How do we know? The Climate Finance Tracker, developed by Vibrant Data Labs’ Eric Berlow and featured on ImpactAlpha illuminates a full spectrum of more than 6,000 U.S.-based climate-relevant companies and nonprofits that received over $230 billion in private investments and grants in the past five years. The Tracker makes visible patterns that are impossible to see simply by visually scanning thousands of companies.

“It’s more than a data visualization,” Berlow said in presenting the Climate Finance Tracker at last month’s SOCAP conference in San Francisco. “It’s also a map to see funding gaps and opportunities for impact.”

To demonstrate the tool’s utility, Berlow took as a starting point a 300-page, peer-reviewed model, commissioned by One Earth, a nonprofit philanthropy collaborative that is supporting the development of the Climate Finance Tracker. The model identified three “pillars of action” that can limit global warming to 1.5° Celsius above historical levels in one generation.

The pillars include the energy transition, with access for all to 100% renewable energy; nature conservation, with preservation and restoration of 50% of our lands and oceans; and regenerative agriculture, namely the shift to net-zero systems for food and fiber. In his presentation, Berlow used the map to identify current gaps in each of the three solution pillars, and opportunities for social capital to fill them.

“Why do we care about gaps?” he asked. “Because all of this needs to happen – if any one fails, we all lose – so the highest impact thing to do is whatever is missing.”

Climate taxonomy

To initially populate the Climate Finance Tracker, Vibrant Data Labs partnered with Crunchbase and Candid to search for investments or grants that mentioned climate-relevant terms in their profiles, using more than 150 search terms spanning climate mitigation and adaptation.

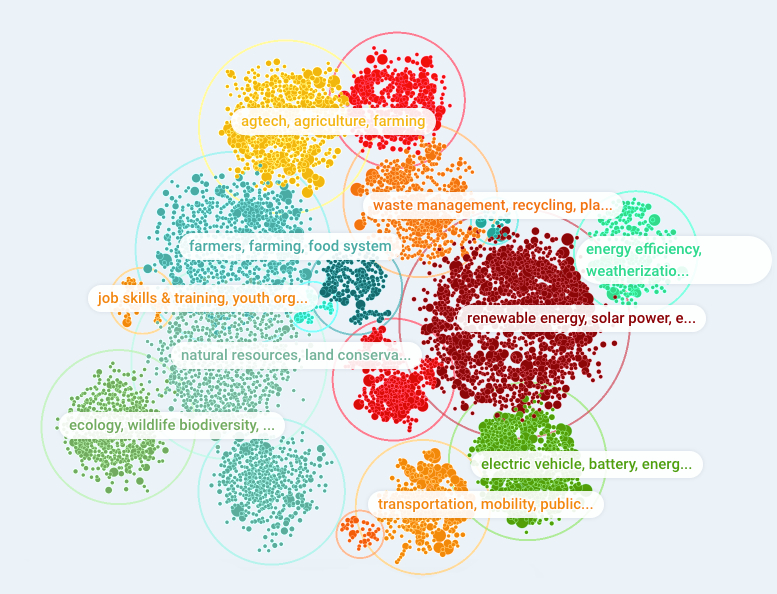

Berlow extracted text descriptions of each entity and partnered with the artificial intelligence firm Primer.ai to machine-read the language and build a custom taxonomy of climate-relevant keywords, like “solar,” or “energy storage.” By tracking intersectional themes like “social justice” and “climate equity,” along with approaches like technology, policy and activism, the bottom-up taxonomy grew to more than 2,000 climate-relevant terms.

These climate-keyword “signatures” allow similar organizations to self-cluster into themes like renewable energy, electric vehicles and natural disasters. Network theory and machine-learning reveal patterns as the links act like springs and pull similar organizations together, Berlow explained. Importantly, the distillation comes from the bottom-up, that is, from the language the companies and organizations themselves use to describe what they do, not from what the funders say they are doing.

As Berlow filtered the results, “To the right, we can see the concentration of venture investments in electric vehicles, batteries, and renewable energy, as well as in ag-tech and plant-based food tech,” he said. “Higher up means the bubble has a higher fraction of companies that explicitly mention climate equity terms.”

“We already can see a glaring gap in the upper right,” he continued, “where there are NO venture-dominated themes that regularly mention climate equity.”

Three Opportunities

The results suggest at least three opportunities to bridge the climate-financing gap and accelerate climate action in service of the 1.5° Celsius limit.

To achieve 100% renewable energy and mobility by 2050 requires a vast expansion of access to lower- and middle-income populations in the U.S. and around the world. “We will never get there if only 1% of the people can afford it,” Berlow said. “Here climate equity is not just the right thing to do. It’s the only way to achieve 100% energy transition.”

The map helps identify outliers like the Rural Renewable Energy Alliance, which are explicit about making solar energy accessible to everyone to address energy poverty.

“So the major opportunity here is to support and grow more organizations like this to scale access,” he says. “And to support business models that intentionally design the tech for the bottom of the economic pyramid.”

The gap in efforts to protect and restore 50% of Earth’s lands and oceans, the gap is in the lower left corner, where mostly grant-funded organizations clustered around nature-based themes tend not to explicitly mention social or economic equity.

“This is one main reason why conservation efforts fail – they protect the land but screw the people,” said Berlow, an ecologist by training.

“Here the opportunity is to help scale conservation and restoration globally by simultaneously supporting low-income livelihoods on the ground. Again, climate equity again is not just the right thing to do – it’s the solution. We need to empower everyone to help.”

The Climate Finance Tracker further suggests that shifting agriculture to a net-zero production of food and fiber requires progress in three areas. Advanced ag-tech solutions need to be made accessible to 100% of small scale producers. Plant-based diets – a once-hot investment area that has recently cooled – need to be accessible to all, not just wealthy consumers. And finally, small-scale and community-based regenerative food solutions, which are still mostly grant-funded, need help in attracting commercial capital.

“There are some interesting positive deviants of early venture-backed, regenerative food outliers that also mention climate equity,” Berlow said. “So the opportunity here is to nudge this bubble to the right by supporting more investable business models.

“Remember that this is where electric vehicles were 20 years ago.”