TGIF, Agents of Impact!

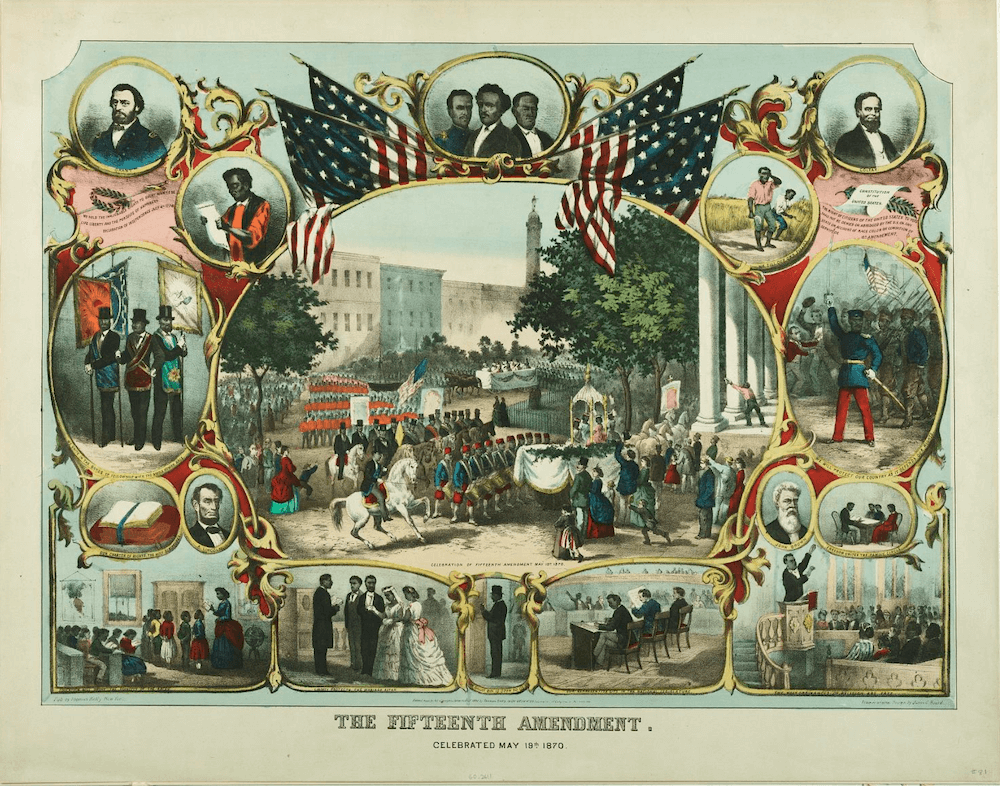

🗣️ Historical parallels. This week’s Agents of Impact Call showed how the dozen members of the New Capitalism Project’s “design team” have been able to bridge diverse agendas and contrasting strategies (see below). Our special showing of playwright Gene Bruskin’s musical, The Moment Was Now, in advance of our next Call, depicts an earlier effort to reimagine capitalism across the race, class and gender divides. The play’s imagined gathering on the eve of an 1869 labor convention represented the New Capitalism Project of its day, as Frederick Douglass convened Black and white labor leaders and women’s advocates to forge their own multi-movement engine for systemic change. The historic Reconstruction resonates in today’s efforts to expand voting rights, empower stakeholders and establish multi-racial prosperity. Melissa Bradley of 1863 Ventures, ImpactAlpha’s Monique Aiken, Bill Fletcher Jr., ex- of TransAfrica Forum, and other Agents of Impact will join Bruskin to take a cut at The Reconstruction This Time on Call No. 36, Tuesday, Dec. 14 at 10am PT / 1pm ET. RSVP now.

Probably not available 150 years ago were algorithmic “robo-advisors” to help retail investors cost-effectively construct sustainable portfolios. SustainFi’s Anna Yen reviewed a dozen providers and found that “no robo-advisor offers a perfect sustainable portfolio – yet.” In a sponsored post, Johnson & Johnson’s Michael Sneed called for impact investments to advance health equity. The muni bond team at AllianceBernstein made the case for munis as the original impact investments. ImpactAlpha’s Jessica Pothering checked in on the business climate on the Navajo Nation and Amy Cortese heralded the convergence of impact measurement and reporting standards. Past, present and future, ImpactAlpha has you covered. – David Bank

🎧 Impact Briefing. On this week’s podcast, host Brian Walsh and roundtable regulars Imogen Rose-Smith and David Bank take up the corporate trend du jour: spinning off high-flying green business units, or ReNewCos, from legacy dirty assets. They also chew over prospects for a “multi-movement engine” for corporate accountability (see below). Plus, the headlines. Tune in, share and follow us on Apple, Spotify or wherever you listen.

The Week’s Call (Recap and Replay)

Call No. 35: Building a multi-movement engine to hold corporations accountable and reimagine capitalism (video). The New Capitalism Project has over the past two years dissected the failings of the current economic system and crafted a vision of a better future. Next up for the project’s diverse “design team” of a dozen leaders and activists: a set of concrete ideas to overcome barriers to a more inclusive system. Among the ideas in play: making workers, consumers, communities and other stakeholders full partners in corporate governance, and accelerating the flow of capital to inclusive and sustainable business models.

- Stakeholder governance. “There’s no transforming capitalism without confronting harmful corporate behavior, and there’s no confronting corporate behavior without taking on the structures of how we hold corporations accountable,” said Majority Action’s Eli Kasargod-Staub, who is championing support for a “multi-movement engine” to enforce corporate accountability. Kasargod-Staub joined other participants from the New Capitalism Project for an exclusive briefing for ImpactAlpha subscribers on Call No. 35: Capitalism Reimagined.

- Read the recap and watch the replay of the third Call in our series with Omidyar Network, Capitalism Reimagined. Catch up with our recaps of earlier calls, “Universal owners aim to turn shareholder power into real-world impact” and “Capitalism reimagined for fair gainsharing and equitable prosperity.”

The Week’s Dealflow

Spotlight: Commercializing fusion. Venture-backed fusion energy startups are amassing giant war chests to commercialize fusion, the elusive holy grail of clean energy. Cambridge, Mass.-based Commonwealth Fusion Systems this week raised $1.8 billion in the largest investment round yet for a fusion energy company. The MIT spin-off expects to successfully generate commercial power from a fusion plant by the early 2030s (for background, see “Long coming but slow to arrive, fusion energy approaches a milestone on path to commercial deployment”). “Everything is science fiction until someone does it, and then all of a sudden it goes from impossible to inevitable,” said Commonwealth’s Bob Mumgaard.

- Fusion frenzy. Vancouver-based General Fusion last week raised $130 million. Everett, Wash.-based Helion Energy secured $500 million in early November, with the potential to unlock another $1.7 billion if it hits performance milestones.

Alt-proteins. Impossible Foods raises $500 million for plant-based products and global expansion… San Francisco-based New Culture secures $25 million in Series A funding, backed by S2G Ventures, to make animal-free cheese. Slovenia’s plant-based steak startup Juicy Marbles scores $4.5 million in seed funding… Berlin-based Perfeggt snags $2.8 million to make plant-based eggs using fava beans.

Clean energy. Energy market access provider Leap secures backing from Japan Energy Fund, a $100 million clean energy fund… Woman-led Mainstream Renewable Power raises €90 million to build out gigawatt-scale wind and solar facilities in Latin America, Africa and Asia… Italian energy-storage tech company Energy Dome scores $11 million to build a demonstration facility in Sardinia.

Electrify everything. Arc secures $30 million to electrify boats… Ionity raises $700 million for EV charging with a boost from BlackRock… Forum Mobility snags $7.5 millionto expand a heavy-duty decarbonization and electrification program for fleet operators.

Financial inclusion. Jefa raises $2 million for fintech services for women in Latin America… GajiGesa secures $6.6 million to provide fintech services for unbanked workers in Indonesia… German development finance institution DEG backs India’s Annapurna Finance to provide microloans to women borrowers.

Impact tech. Tiamat Sciences, a woman-led biotech startup, raises $3 million to manufacture plant-based biomolecules… TELUS’s $100 million Pollinator Fund for Good adds three portfolio companies… Breakthrough Energy Ventures backs metal recycler Sortera Alloys.

Returns on inclusion. A partnership between Kiva and Gardner Capital will provide loans for BIPOC-owned small businesses in Texas… Cincinnati Development Fund secures $50 million in development finance to build affordable housing in the city.

Small businesses. Indifi raises $40.7 million to provide loans to restaurants and small businesses in India… Indonesian small business fintech Investree secures $10.5 million from responsAbility and Accial Capital… Nigerian B2B marketplace Sabi raises $6 million to support Africa’s informal businesses.

Education and skills. Dutch loan fund links better terms to better educational outcomes… Bangalore-based edtech Vedantu will buy back $3 million in shares from its employee stock ownership plan.

Impact M&A. Microfinance lender MicroVest is acquired by development company DAI.

Independent media. MDIF backs Pluralis to invest in independent media in Europe.

The Week’s Talent

Robert Eccles of Oxford’s Said Business School, Ford Foundation’s Roy Swan, Nat Keohane of the Center for Climate and Energy Solutions, and other experts are joining KKR’s sustainability advisory council… Cathryn Peirce, ex- of Compass, becomes Carbon Zero Financial’s co-founder and CEO… EnerNOC’s David Brewster joins the board of advisors at Leap… Shariq Syed and Vishnu Amble join Energize Ventures as chief financial officer and head of investor relations and capital markets, respectively.

Koen Popleu and Monika Kumar, both ex- of Candriam, join Lazard Asset Management as portfolio managers on the firm’s sustainable investing and ESG team… Janney Chang Lucki, ex- of Spring Mountain Capital, joins Arctaris Impact Investors as director of investor relations… Danielle Deane-Ryan, ex- of Libra Foundation, joins Bezos Earth Fund as director of equitable climate solutions.

The Week’s Jobs

Candide Group is looking for a managing director of its climate justice fund… NYSERDA seeks a vice president of building decarbonization in Albany or New York City… The Natural Resources Defense Council is hiring an equitable building decarbonization advocate in New York… Aligned Climate Capital is recruiting a director of investor relations and other roles.

Kresge Foundation is hiring a portfolio manager of social investment practice… Bridges Fund Management is looking for an associate of portfolio management… Ceres is recruiting a senior manager of Climate Action 100+ and other roles… Mission Investors Exchange is hiring a programs and initiatives coordinator.

Opportunity Finance Network is looking for a research director and to fill other roles in Washington, D.C… Also in D.C., Georgetown University’s Beeck Center for Social Impact and Innovation is hiring a student engagement manager… PwC is recruiting a senior associate of sustainability… Alt-protein investor CPT Capital seeks a venture partner in London.

That’s a wrap. Have a wonderful weekend.

– Dec. 3, 2021