In an old brick garage on an industrial street in Cambridge. Mass., a team of physicists and engineers are getting ready this month to flip the switch on a 10-ton magnet.

The vacuum chamber surrounding the magnet will be kept at 20 degrees above absolute zero. But the 40,000 amps of electricity spinning through hundreds of miles of superconducting tape will create a magnetic field able to contain a cloud of plasma at 180 million degrees, the temperature needed to fuse atoms – and throw off clean, abundant fusion energy.

“That’s what you need to do to build this next fusion machine,” Bob Mumgaard, CEO of Commonwealth Fusion Systems, a venture-funded startup that was spun out of the Massachusetts Institute of Technology in 2018.

This month’s magnet test is the key milestone in CFS’ plan to build, by about 2026, the first fusion reactor that generates more power than the energy required to start the reaction. Fusion has long been considered the holy grail of clean energy – a scalable, carbon-free source of power with none of the drawbacks of other energy sources.

But a viable fusion reactor has been 10 years away for decades – and still is. No fusion device has yet been able to generate such ‘net energy.’

What’s different now is the more than two-dozen venture-backed startups that have raised a combined $2 billion to commercialize fusion power from venture capitalists and individual investors like Bill Gates and Jeff Bezos. The Department of Energy on July 1 announced $2.1 million in grants for nine fusion projects, including CFS. Rep. Don Beyer of Virginia formed a “fusion caucus” in February to educate Congress members on the technology.

As in the race to map the human genome 20 years ago, the startups are competing with a global government-backed effort. The International Thermonuclear Experimental Reactor, or ITER, under construction in the south of France, is funded by China, the European Union, India, Japan, Korea and Russia, as well as the United States. The project, conceived in 1985, was not launched until 2007; construction began in 2013. In 2018, the U.S. Department of Energy said projected costs for ITER had ballooned to $65 billion. ITER says it is still on track to deliver the project for $22 billion

Despite its big budget and government backing – or maybe because of it – the project seems bound to be eclipsed by smaller, more nimble startups. Years behind schedule and billions over budget, ITER expects to produce net-energy fusion by about 2035. China also is making significant investments in fusion energy on its own.

The government projects are helpful in removing basic technology risks and provide a useful benchmark for measuring progress. As with artificial intelligence – also centered at MIT – decades of slow development is finally yielding something useful. Indeed, advances in increasing the heat, density and insulation of plasma have exceeded the pace of Moore’s Law, which drove cost curves for computer chip technology, Mumgaard says. CFS has published seven peer-reviewed articles in the Journal of Plasma Physics detailing the underlying physics of its system.

“This magnet that we’re going to turn on is something like a one hundred or one thousand times times extension of what’s been done before,” Mumgaard says. Fusion researchers have long known the material would someday enable the development of small, high-powered magnets that can produce a high magnetic field, he says.

“What we’ve done is snatch that from the future.”

High-temperature superconductors

Any plan to decarbonize the economy by 2050 relies on proven technology (think solar and wind) and incremental improvements (batteries) to roughly halve carbon emissions in the next decade. The second stage of decarbonization, through 2050, will require dramatic technology breakthroughs. Nuclear fusion is the biggest and most enticing and revolutionary of those breakthroughs.

Fusion is distinct from the separate track of activities to improve and modularize conventional nuclear power plants. Conventional nuclear power splits atoms – fission – to release energy. Fusion uses super-hot temperatures of 180 million degrees Fahrenheit or more to do the opposite: fuse atomic nuclei together and release energy in the same process that powers the sun.

Fusion has several advantages over fission and other energy sources. It produces little to no radioactive waste. There is no risk of nuclear meltdown; the fusion process simply shuts down when disrupted. Fusion relies on inputs such as hydrogen that are abundant, and generates no greenhouse gasses or pollutants. And fusion plants, which can be plugged straight into the existing grid, can be dialed up or down to provide reliable “baseload” to complement the intermittency of sources like wind and solar.

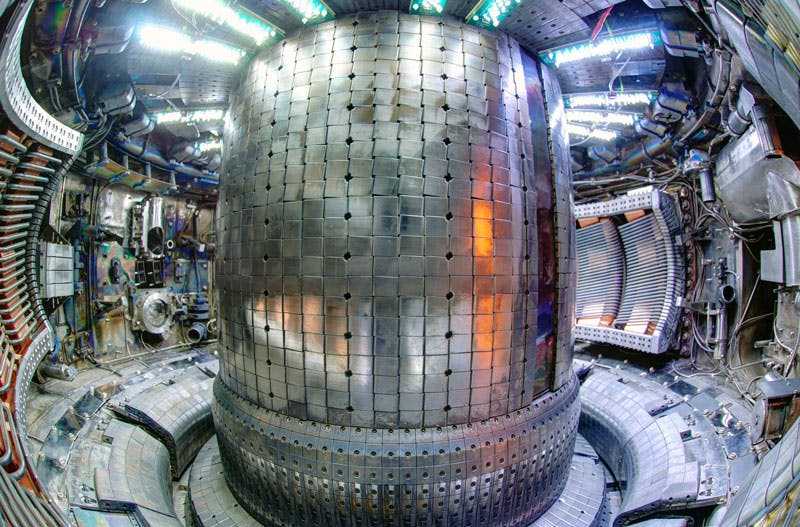

Without the sun’s gravity, mankind has resorted to magnets, lasers and other technology to create and constrain superheated matter, or plasma, in which fusion takes place. Like the government-backed ITER, the CFS design deploys a ‘tokamak,’ the donut-shaped bottle that contains the magnets.

CFS is taking advantage of the availability of a high-temperature superconductor that was not available for the government’s project. The breakthrough in materials won the Nobel Prize in physics for two German physicists in 1987, but only in the last few years has the material been available in quantity. The magnets CFS is testing use about half of the world’s total supply.

The high-temperature superconductors make possible higher magnetic fields with smaller magnets, dramatically shrinking both the size and costs of a viable fusion reactor. CFS is aiming to achieve a magnetic field of 20 teslas, paving the way for smaller, cheaper tokamaks that might be commercially viable. A 1,000-ton magnet on its way to ITER’s facility being constructed in the south of France will generate 13 teslas.

The small-size, high-field magnets, Mumgaard says, “is something that we have never done before, on Earth, out of this material, at those parameters, at that scale.”

Technology pathways

Fusion energy has become almost a punchline after decades of hype and broken promises. A 1989 announcement of the advent of “cold fusion” fell apart on closer inspection. A measure of the continued skepticism: Fusion was missing from the International Energy Agency’s Net Zero by 2050 energy roadmap released in May, and doesn’t figure in President Biden’s ambitious infrastructure and clean energy plans.

Investors are pouring money into a broad range of ventures, each pursuing a slightly different approach to solving fusion’s longstanding challenges.

“Solve nuclear fusion, solve a lot of the world’s problems,” says Future Ventures’ Maryann Saenko, an early investor in CFS. “If you’re not thinking really big-scale, you’re not thinking big enough.”

TAE Technologies, in Orange County, California, announced its own milestone in April: producing stable plasma in its proprietary compact reactor design. At the same time, TAE raked in $280 million in fresh funding from investors including Vulcan, Venrock, New Enterprise Associates, Wellcome Trust, Google and various family offices. The company, founded in 1998 and now on its fifth generation of fusion technology, has raised more than $880 million to date.

In Seattle, Zap Energy uses “sheared flow” technology rather than magnets. The approach was first developed by the University of Washington and Lawrence Livermore National Laboratory. Zap in May raised a $27.5 million Series B round led by Addition. Energy Impact Partners, GA Capital, Fourth Realm, Chevron Technology Ventures and LowerCarbon Capital.

Redmond, Wash.-based Helion Energy, has raised a total $78 million from Mithril Capital, Y Combinator, Capricorn Investment Group. The U.K. is home to University of Oxford spin-out First Light Fusion and Tokamak Energy.

And Canadian startup General Fusion, using magnetized target fusion, has hauled in nearly $200 million in capital from backers including Jeff Bezos, Chrysalix Energy Venture Capital, and Cenovus Energy.

Renaissance Fusion, based in France, is pursuing an alternative to tokamaks called a stellarator that, while complex to build, may prove better at sustaining fusion.

Soonest / Smallest

CFS spun out from MIT’s Plasma Science and Fusion Center in 2018 when cutbacks in federal funding spurred Mumgard and other scientists to develop plans for a privately funded initiative. The team, which called itself ‘the SPARC Underground,’ sought to use the newly available superconductor material to build on proven science with the speed of a tech startup.

That drove the decision to build on the decades-old tokamak technology that has already been used in at least 160 machines, but make it smaller, cheaper and higher-powered. SPARC originally stood for Soonest/Smallest Private-Funded Affordable Robust Compact fusion reactor.

The CFS team raised $100 million in seed capital from the billionaire-backed Breakthrough Energy Ventures, the Italian energy giant Eni, Future Ventures and others, with a plan to prove out the magnet technology in three years. The company’s 160 employees are augmented by another 130 researchers at MIT as well as other universities and national laboratories.

If this month’s magnet test is successful, the next step is building the first SPARC tokamak by 2026 and getting clean fusion energy into the electrical grid within a decade. CFS’ audacious goal for 2050: to build 10,000 fusion power plants around the world of around 200 megawatts apiece – each one capable of powering a small city.

CFS recently secured another $84 million from the Singapore sovereign wealth fund Temasek, alone with Equinor and Devonshire Investors, along with existing investors. The fresh funding will help CFS construct a 47-acre manufacturing and research facility in Devens, Mass., about 30 miles west of Cambridge.

The ability to raise money for research- and capital-intensive technologies like robotics or batteries makes it easier for moonshots like fusion. “What we’re seeing is that you can make really great companies out of areas that you wouldn’t have thought about before,” Mumgaard says.

With coal and gas-fired power plants being phased out over time, the push will be on for zero-carbon replacement plants that can plug into the grid and augment the distributed power of sources like solar and wind.

“We just have to find the next energy infrastructure that we’re going to deploy,” Mumgaard says. “And we think that fusion could be a really great candidate for that.”