TGIF, Agents of Impact!

🗣 Time machine. The Copernican Revolution played out over the course of more than a century. Midway through, the Catholic Church summoned Galileo to the Roman Inquisition and banned “De revolutionibus orbium coelestium,” Copernicus’ 1543 treatise on Earth’s orbit around the Sun. It’s not clear what vested interests are threatened by this week’s further uprooting of our place in the universe with the first public pictures from the James Webb Space Telescope. The fan favorite was probably Carina Nebula (above), with its dramatic peaks seven light years high carved by intense radiation and stellar winds from hot young stars. But it is SMACS 0723 that really stretches our horizons, with its crisp images of hundreds of galaxies, each with billions or trillions of stars, reaching us after more than 13 billion years. “We can see possibilities no one has ever seen before,” said U.S. President Joe Biden. “We can go places no one has ever gone before.”

Things change. So, too, does our understanding. The impact revolution, at its core, posits a new conception of value, a new purpose for capital, new possibilities for what an economy could be. Shareholder advocates are calling out the backsliding on climate action by major asset managers like BlackRock and Vanguard, as Majority Action’s Eli Kasargod-Staub explains in his postmortem of the year’s proxy resolutions. Fund managers like Trill Impact, Bain Capital Double Impact, Finance in Motion, LeapFrog and Nuveen are raising the bar on impact performance management, as Dennis Price reports. Jessica Pothering gets the lowdown from Mansoor Hamayun of off-grid solar pioneer Bboxx on growth strategies for serving rural and low-income customers. Spring Point Partners’ Margot Kane shares strategies for making the most of catalytic investment in emerging fund managers (listen in to this week’s podcast). And the Gates Foundation’s Steve Davis offers six strategies for scaling social innovation. Contributing editor Imogen Rose-Smith raises another ruckus with her counterintuitive defense of HSBC’s Stuart Kirk, and Jessica dissects the myths surrounding Sri Lanka’s political and economic crisis. Agents of Impact in 2022, like Galileo in 1616, know that revolutions take awhile. Resistance can be fierce. And yet, it moves. – David Bank

🎧 Impact Briefing. Spring Point Partners’ Margot Kane joins host Monique Aiken to talk family offices, emerging managers and catalytic capital. Plus, the headlines.

- Listen to this week’s episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

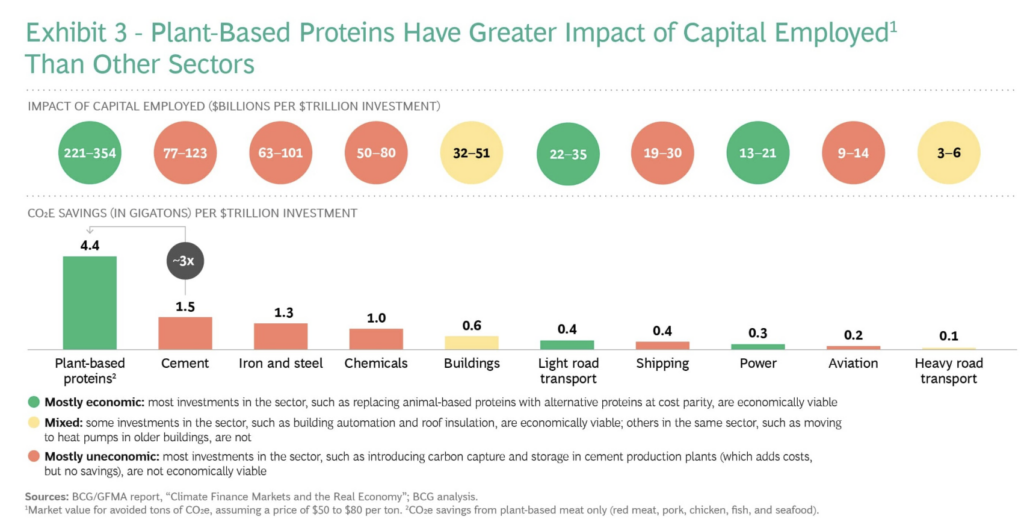

The Week’s Chart

The outsized climate impact of alternative protein investments. Replacing meat and dairy with plant-based and other alternative proteins gets you the most gigatons for your buck. Alt-protein investments have “an impact of capital employed that is magnitudes greater than corresponding decarbonization investments in other high-emitting sectors of the economy, such as transportation or buildings,” according to Boston Consulting Group. “The Untapped Climate Opportunity in Alternative Proteins” calls out gaps in investments in sustainable foods, which still represent only a fraction of the capital committed to other sectors.

The Week’s Dealflow

Deal spotlight: How we live now. Climate news got you down? New media outlets are putting a consumer spin on climate action (complementing ImpactAlpha’s solutions-focused investment news). The Cool Down invites you to “consider us your in-the-know friend” to help sort out sustainable living strategies. TCD, as it calls itself, this week raised $5.7 million from Upfront Ventures, Revolution’s Rise of the Rest Seed Fund and others for its move into e-commerce. Pique Action, which claims 100,000 followers on TikTok, scored $1 million from climate-focused VC firm Amasia and others to produce short-form videos to inspire climate action. “We are the opposite of doomscrolling,” said Pique’s Kip Pastor. Another outlet offering consumer climate advice: Hothouse Solutions. Read up.

Clean energy transition. Budderfly, a provider of energy-efficiency-as-a-service, secured a $500 million investment from Partners Group, which will acquire a majority stake in the company… Iceotope Technologies raised £30 million in a round led by ABC Impact to reduce the energy and water needed to keep data centers cool… VECKTA snagged $3.3 million in seed financing to expand a digital energy marketplace that connects companies with capital, equipment and distributed energy services… Apollo Global Management acquired a $175 million stake in community solar provider Summit Ridge Energy… Solar Panda secured $8 million from Oikocredit and the Electrification Finance Initiative for pay-as-you-go solar home installations in rural Kenya.

Agrifood investing. Agtech startup Blue Ocean Barns raised $20 million in Series A financing for its seaweed-based feed that reduces methane emissions from cattle… Fyto raised $15 million to reuse farm waste for duckweed-based animal feed, which also reduces “cow burps”… Argentinian agtech startup SIMA raised $2 million to help farmers boost yields… FACES, a microfinance institution in Ecuador, will use proceeds from a $5 million green bond arranged by Symbiotics to finance small-scale farmers using climate-smart agriculture.

Fund news. Boston-based private equity firm Partners Capital closed a $143 million environmental impact fund to invest in net-zero and energy-transition tech businesses… KKR raised nearly $1.5 billion for its second global impact fund… Tosca Debt Capital secured £20 million from British Business Investments for an impact fund to lend between £1 million and £5 million to small businesses in the U.K… Women-led venture firm Maya Capital in Sao Paulo is looking to raise $100 million to invest in Latin American tech companies solving the continent’s most pressing issues.

Impact tech. Ankur Capital backed impact tech ventures Vegrow and String Bio… Circ secured $30 million to recycle textile waste… Five Black tech founders join Northwestern Mutual’s accelerator… Simplifyber scored $3.5 million in a seed round led by At One Ventures to make sustainable apparel from liquid cellulose.

Low-carbon future. Blackstone invested $400 million in Xpansiv, an environmental commodities marketplace for trading carbon offsets, renewable energy credits and low-carbon fuels… CleanO2, which captures carbon from HVAC systems and turns it into fertilizers, soaps, shampoos and other products, snagged seed funding in a round led by Regeneration.VC.

Affordable housing. Enterprise Community Partners secured $341.5 million for a low-income housing tax credit fund that will create and preserve nearly 3,000 affordable homes in 15 U.S. states.

Climate tech. British International Investment committed up to $250 million to Indian EV venture… Persistent raised $10 million to scale its climate venture building model.

Community finance. Crossroads Impact raised $180 million in equity to boost climate finance, impact real estate investments, and small business lending in underserved U.S. communities.

Investing in health. Mexican health tech startup Prosperia snagged $2 million in seed funding to help prevent blindness from diabetes.

The Week’s Talent

Leon Saunders Calvert, ex- of LSEG, joins ESG Book as chief product officer… Benjamin Attia, previously with Wood Mackenzie, joins BlackRock Sustainable Investing as research lead for energy, climate and sustainability… Energize Ventures promotes Katie McClain to chief operating officer; Hannah Magnuson, ex- of APTIM, joins the firm as content marketing strategist; Adam Katz, ex- of Golub Capital, joins as head of legal; and Honour Masters, previously a fellow with Union Square Ventures’ Climate Fund, joins as senior investment associate.

Nathaniel Bullard, formerly chief content officer at BloombergNEF, joins Voyager Ventures as a venture partner… Otis Rolley, previously with Rockefeller Foundation, is named head of social impact at Wells Fargo… Paulina Stannard, ex- of Align Impact, joins CI Financial as head of impact… Symend co-founder Tiffany Kaminsky is named the company’s chief impact officer… Terviva’s Naveen Sikka joins Elemental Excelerator’s board of directors.

The Week’s Jobs

BlackRock seeks a sustainable investing research and strategy associate in New York or Washington state… Manulife Investment Management is looking for an associate director to lead forest carbon projects for its timber and agriculture group in Springfield, Mass… Nia Impact Capital is hiring an equity analyst and a growth and development professional… The McKnight Foundation seeks multiple program officers for its Midwest climate and energy program… KKR is hiring an impact/ESG senior manager in New York.

SVX Mexico is hiring a principal for its Regenera Ventures fund… Impak Finance seeks several remote junior impact analysts… The Union of Concerned Scientists is looking for a full-time remote/hybrid director for its climate and energy program… Beneficial Returns seeks a full-time remote fund manager… Colorful Capital is looking for a director of investments… Blue Earth Capital seeks a private equity analyst/associate in New York… Pro Mujer is looking for a remote partnership and development associate for health and wellbeing in Latin America.

That’s a wrap. Have a wonderful weekend!

– July 15, 2022