Stuart Kirk has had enough.

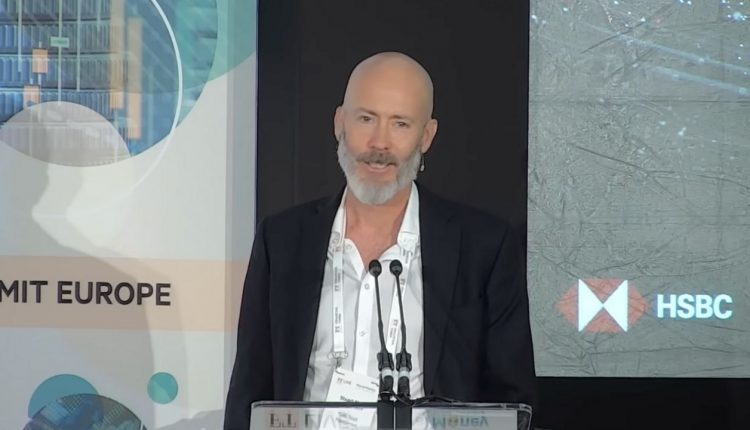

Last week, Kirk resigned as HSBC’s head of sustainability, saying his position had become unsustainable. The news wasn’t exactly a surprise. In May, Kirk was suspended by HSBC after a video of his speech at the Financial Times’ Moral Money conference went viral.

In a keynote address entitled, “Why investors need not worry about climate risk,” Kirk suggested central banks should not be in the business of regulating climate change. He insinuated that Mark Carney, former Bank of England head and an authority on climate risk, might be a bit of an egotist. We are all getting a bit too glum about the climate crisis, Kirk argued.

“There’s always some nut job telling me about the end of the world,” Kirk said.

My take: It was a mistake for the bank to suspend Kirk. And unfortunate that he felt forced to resign.

ESG is not a religious doctrine, or some kind of precious garden that needs to be protected. I didn’t clutch my pearls and faint when Kirk said that the economy was likely not going to be negatively affected by climate risk, or that central banks would be better off worrying about things like inflation. I welcomed the discussion, and others should too.

ESG does best, and will thrive, when it is subject to rigorous and intense (good faith) debate. We do not know many of the answers to these tough questions. These are important issues worth fighting about. The alternative, holding ESG up as an unimpeachable orthodoxy, runs the danger of greenwashing and intellectual stagnation. We can’t afford that.

Muddling through

Take a watch of the YouTube video of Kirk’s speech. I thought it was funny. Kirk made some valid points. He was also kind of a jerk. I know, right? Shocking for a banker. It may have been the tone of his delivery, rather than his substance, that caused the outrage.

Kirk’s point is that there is too much doom-mongering around climate change. That technology and innovation will out. That humanity, and the capital markets, have a history of innovation and overcoming challenges. It is a mistake to think that the entire economy is going to fall off a cliff as a result of the climate crisis, he argues. Climate change, while serious, is not a financial risk.

“Human beings have been fantastic at adapting to change, at adapting to climate emergencies and we will continue to do so,” Kirk told the Moral Money crowd. “Who cares if Miami is six meters under water in 100 years? Amstandam has been six feet under water for ages, and that’s a really nice place.”

By way of illustration, Kirk references Y2K (remember when we thought that the turn of the millennium was going to be an epic techno-disaster? Turned out to be a big nothing burger. Good times.)

Despite two world wars, an oil crisis, the financial crisis, and a global pandemic, the S&P 500 has continued on a long term trajectory of 6.5% annual growth. “That will continue for as long as toast is toast,” Kirk predicts. There’s no reason to believe the climate crisis will be any different, he says. In fact, quite the opposite. So why all the glum faces?

Kirk is hardly the only person to be making such arguments. I’ve heard similar arguments from academics and investors. It might not be a majority opinion, and I understand the argument that it suppresses the need to act. But it’s a valid take.

So why the suspension? HSBC after all presumably knew what its head of sustainability thought. This likely wasn’t the first time he’d busted out the funny, or his PowerPoint slides. As a previous writer of the FT’s Lex Column, he may have felt a bit too relaxed back on his old stomping ground. It’s just that this time he was caught on tape.

But, by god, at least he was provocative. And backed it up with data. An alternative headline for Kirk’s appearance might have been, “Banker Says Something Interesting at an ESG Conference.” Which may have been more along the lines of what Kirk was shooting for.

What he did not say is that climate change isn’t real. Rather he disputed how we as investors and capital market participants are reacting to the crisis. Kirk is making an important point: Climate change is complex, and we don’t have all the answers. Just as with investing more broadly there are multiple different perspectives. And so it should be with ESG.

In his LinkedIn post announcing his resignation, Kirk decried, of course, cancel culture. “If companies believe in diversity and speaking up, they need to walk the talk.” Investing is hard, he said. “So is saving our planet. Opinions on both differ. But humanity’s best chance of success is open and honest debate.”

I agree with him. Kirk says he is working with a crack group of like-minded individuals “to deliver what is arguably the greatest sustainable investment idea ever conceived. A whole new asset class,” to be announced later this year.

In the meantime, I hope he got a big fat settlement out of the bank that threw him under the bus.

Mining for batteries

ESG investing, and indeed all investing, is hard.

Take Tesla. Is Tesla an ESG investment or not? It depends on what investors are solving for.

If we are talking about E (for environment), S (social) and G (governance) and we hold all three to be some kind of equal, then clearly Tesla struggles with the G and the S.

This is a company where Musk has been forced to pay its board members’ insurance out of his own, considerably deep, pockets after his Twitter shenanigans caused the company to pay a $20 million fine to the Securities and Exchange Commission (plus another $20 million payment from Musk himself.)

In May, Standard & Poor’s dropped Tesla from its sustainability index. As The New York Times explained, “S&P cited claims of racial discrimination and poor working conditions at Tesla’s factory in Fremont, Calif.” That prompted a lawsuit by a state agency, which Tesla is contesting. S&P’s decision was also influenced by Tesla’s handling of an investigation by the National Highway Traffic Safety Administration into deaths and injuries linked to the company’s Autopilot driver-assistance system.

Musk took the news calmly, saying he was disappointed but understood the judgment. Just kidding. The bombastic billionaire blasted S&P, posting on Twitter (of course), “Exxon is rated top ten best in world for environment, social & governance (ESG) by S&P 500, while Tesla didn’t make the list! ESG is a scam. It has been weaponized by phony social justice warriors.”

“@SPGlobalRatings has lost their integrity,” he added.

Musk has a point.

If you just focus on the E, and you believe that Tesla is doing great things to enhance electric vehicles and battery technology, then the car company seems like a pretty solid bet. Tesla itself, in its annual impact report, eschews the term ESG. “As the world needs to strive for a substantial positive impact, we won’t be referring to ESG in this report,” Tesla writes in the forward. “Instead, we’ll talk about Impact.”

Nonetheless, many ESG funds have profited immensely from Tesla’s share price rocketship ride over recent years. Of course, a handful of prominent impact investors made money, and their reputations, when Tesla was a privately held company. Capricorn Investment Group, the family office of billionaire Jeff Skoll, and one of the pioneering impact investors, is also an early investor in Musk’s space company SpaceX.

So Musk’s ties to impact run quite deep, even as he posts nonsense on Twitter about the changing political landscape of America.

One way of looking at this is to say, Tesla is an ESG friendly play but its founder and CEO is not. But is Exxon really a better ESG business than Tesla? Or, for that matter, the tobacco manufacturer Phillip Morris, which is in the Dow Jones Sustainability Index? A company whose product, cigarettes, literally kills people.

But even beyond the integrity of sustainability indexing, defining a “good” ESG investment can be a challenge. Look at Glencore.

If I was building an ESG index, two companies I would almost certainly screen out would be Glencore and Rio Tinto. These mineral extractors do alot of bad things. And, in Glencore’s case, continue to have significant fossil fuel holdings.

When I was at the investment office of University of California (where I was an investment fellow from 2017 to 2019, working on ESG and sustainable investing) it irritated me immensely that when we were screening for thermal coal in our equity portfolios Glencore, despite being one of the largest exporters of thermal coal, was not included in the screens because the fuel made up less than 10% of the company’s revenues.

In May, the Anglo-Swiss commodities company announced that it would pay at least $1.2 billion in fines relating to investigations into its business dealings, including corruption probes into its activities in Brazil (an investigation known as “Operation Car Wash”) and in Africa. There was a subsequent announcement of a settlement agreement in the U.K, relating to activities in Africa. A sentencing hearing is expected in November. Investigations by the Swiss attorney general and Dutch prosecutors are ongoing.

So, not ESG?

Not so fast, Glencore is seeking to portray itself as the best-positioned among large mining companies to capitalize on a global push to decarbonize transportation and energy, according to The Wall Street Journal article announcing the May settlement. The settlement “removes a distraction” from Glencore’s increased focus on mining for the metals and minerals associated with the clean energy transition. Glencore’s production of cobalt, copper and nickel are seen as vital to electric-vehicle batteries and electricity transmission. More recent reports suggest that a lack of spending by metals and mining companies, including Glencore and Rio Tinto, could have a negative impact on the clean energy transition.

So, if your focus is the clean energy transition, maybe the Glencores and the Rio Tintos of this world are a great ESG investment. The goal of your shareholder engagement should be to encourage the company to mine more (though maybe knock off the destruction of indigenous sites).

Diana Propper de Callejon of The Cranemere Group likes to point out that impact investors and clean tech investors have a tendency to overlook the extractive costs, especially in terms of human rights, associated with the clean energy economy.

We all have blood on our hands.

Against greenwashing

Just because the definition of ESG is difficult, however, does not mean greenwashing is not a thing. Or that greater regulation and scrutiny is not required.

The more investment managers, or asset allocators, burnish their ESG credentials, and the more they make ESG seem like some precious untouchable thing, the more skeptical I become. And the more I suspect that ESG and DEI (for diversity, equality, and inclusion) are more for the purposes of show and marketing than they are reality.

DWS Group, for example, took ESG extremely seriously in terms of its public profile but not, says its former head of sustainability-turned-whistleblower Desiree Fixler, when it came to actually doing very much work around integrating ESG into the firm’s investments. Rather it was focused on ESG optics, and ESG fundraising, not the investment process itself. When Fixler made a fuss she was, she claims, fired.

DWS pushed back against Fixler’s explanation of events. And earlier this year, she lost an arbitration hearing in Germany.

Nonetheless, last year the Securities and Exchange Commission announced that it was investigating the $907 billion Frankfurt-based asset management business for greenwashing.

In May, German authorities raided DWS and the Frankfurt headquarters of its majority owner, Deutsche Bank, over allegations of greenwashing. Hours after the raid, the CEO of DWS Group Asoka Woehrmann announced his resignation. And Deutsche Bank has started its own internal investigation of the greenwashing allegations at DWS.

And DWS is not the only asset management firm under investigation or being fined for green- (or ESG-) washing.

Not questioning ESG orthodoxy makes greenwashing more, not less, likely.

If ESG cannot be challenged, if the impacts of climate change, in particular, can not be questioned and interrogated, it is more likely to become a box-checking exercise, something that people nod their heads in agreement to, but do not actually implement in any robust way.

The same is true, perhaps not coincidentally, of diversity training. Studies show that such training can actually lead to less rather than more inclusion at organizations and in the workplace.

This is not to say that managers and investors should ignore ESG. Or that we do not need robust regulation to protect against climate risk, or should not push back against greenwashing. But true ESG investing is, just like investing more generally, subject to diverse perspectives and points of view.

Time for honesty

An interesting ESG panel right now would include Stuart Kirk, Desiree Fixler and maybe Simon Clark, the co-author of The Key Man, the book on the collapse of The Abraaj Group, the one-time impact investing and emerging markets success story.

It’s not that I hate ESG, or that I’m trying to be a curmudgeon (I come by that quite naturally). Rather, I think we need to challenge, and keep challenging, ourselves to think differently. Questioning our beliefs and expectations. How we actually do well by doing good, how we can best deploy our capital to avoid global catastrophe and mitigate inequality, is hard. And we don’t yet have good answers.

The last thing I need to hear is another lead investment manager telling me that ESG is important. Or a ratings agency or accounting firm informing us of how we’re all going to fall off a cliff, just not quite today. We’ve known this for decades now. And yet the slow walking continues.

Many of the banks, and asset managers, that preach the gospel of ESG investing so eloquently are still financing the fossil fuel economy, helping clients to avoid taxes, and ripping poor people off. So maybe they could start thinking about doing a little bit less of that, before they start acting like the ESG police. Many of the accounting and consulting firms that are now developing large ESG practices were also up until recently doing big business in Russia.

It’s time to stop being so precious and to start being truthful about what we do.