Editor’s note: ImpactAlpha has partnered with HIP Investor to highlight upcoming bond issues with social and/or environmental significance. Disclaimer: Nothing in this post or on ImpactAlpha.com shall constitute an offer to sell or solicitation of an offer to buy bonds.

- CUSIP bond identifier: 717868HV8

- Issuer: Philadelphia Redevelopment Authority

- Impact entity rated by HIP: Philadelphia City, PA

- Muni sector: Government – Cities

- Closing date: 05/25/2023

- Bond amount: $79,395,000 (Series A)

- Coupon: 5.59%

- HIP Impact Rating: 64.1% connoting “net positive” (higher than 50 on 100-point scale)

- Opportunity Zones located in Philadelphia County: 82, equaling 295,227 citizens (of 1,567,258 citizens in Philadelphia)

Philadelphia social bond

The City of Philadelphia is issuing a “social bond” of nearly $100 million to fund affordable housing and inclusive economic development through the city’s Neighborhood Preservation Initiative (NPI).

With these specific impact purposes, the muni bonds align with the Social Bond Principles established by the International Capital Markets Association. These principles include: affordable housing infrastructure, access to essential services (including healthcare, education, and financial services), as well as socioeconomic advancement and empowerment.

Neighborhood preservation

The Neighborhood Preservation Initiative is a significant, transformative investment aimed at bolstering affordable housing and small-business commerce within the “City of Brotherly Love.” With an expected fund of $400 million, the NPI aims to address the pressing challenges faced by low-income communities and promote sustainable development in this 340-year old city.

This initiative recognizes the importance of preserving the character and affordability of neighborhoods – to avoid gentrification – while seeking to foster economic growth and to improve living conditions.

The NPI aims to create vibrant, inclusive, and thriving neighborhoods throughout Philadelphia. So far, the Initiative has utilized $41.7 million to provide assistance to 93 businesses and facilitate the creation of 5,905 housing units, benefiting a total of 4,000 households.

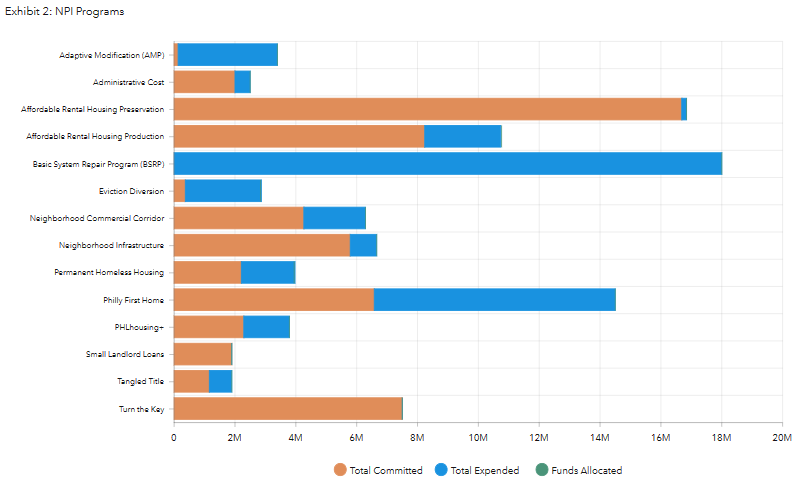

NPI Program Funding (Committed and Expended)

* Funds move to total committed when a project budget has been approved and awarded for specific projects.

* Funds move to total expended when invoices are submitted and NPI funds are released.

Source: Neighborhood Preservation Initiative (NPI) dashboard, City of Philadelphia

The NPI will be funded by multiple muni bond issuances, to be repaid through two means: a 1% Development Impact Tax on residential construction, and a 10% reduction in the real estate tax abatement for commercial construction.

HIP Impact Analysis

HIP evaluates governments at the City, County, and State levels. The City of Philadelphia earned a 64.1% overall rating, compared to a total of 31,616 cities, towns, and census-designated-places in the U.S. Based on HIP’s assessment of 33 material metrics for governments.

As of 2021, Philadelphia residents have a median household income of $36,764, which is lower than the national average of $40,428. A significant proportion of Philadelphia citizens, 28.1%, live below the poverty level, which is higher than the national average of 13.6%. Additionally, the city has a GINI inequality index of 0.52, indicating a higher level of income inequality compared to the US national average GINI index of 0.45.

When examining wealth equality by race and gender, HIP utilizes a computed index to measure income disparity among different races and genders. The results reveal that Philadelphia has a larger income inequality among races but lower disparity among genders, in comparison to the national average.

Furthermore, Philadelphia experienced an unemployment rate of 8.9% in 2021, surpassing the national average of 5.8%. While there has been some improvement, with the rate decreasing to 4.1% as of March 2023, it remains higher than the overall U.S. unemployment rate of 3.5%. These statistics suggest that Philadelphia lags in terms of residents’ income, income equality, and employment opportunities when compared to peer cities.

Despite Philadelphia’s current challenges in terms of income, income equality, and employment, the issuance of social bonds demonstrates the city’s dedication to tackling pressing socioeconomic issues such as poverty, disparities in income and wealth, and racial inequalities.

The social bond issuance highlights Philadelphia’s commitment to addressing these concerns and implementing measures to improve the well-being of its residents.

Ripple effects

Neighborhood revitalization is one of the city’s place-based economic development strategies. Philadelphia is promoting inclusive growth and the revitalization of neighborhoods by:

- Offering direct support and investment opportunities for businesses and entrepreneurs;

- Investing in the capabilities and resources of community organizations and business associations;

- Allocating funds towards enhancing the physical environment and infrastructure of commercial districts within neighborhoods.

Philadelphia has identified approximately 300 commercial corridors throughout Philadelphia. Eighty specific corridors have been earmarked for focused support and investment. These 80 areas are characterized by their neighborhood-based nature, emphasis on pedestrian and transit accessibility, and a high concentration of commercial spaces, with an average of 100 businesses located within each 3 to 4 block radius.

The NPI is the largest and most significant investment ever made in Philadelphia neighborhoods by the city. “City Council has developed a better New Normal and will aggressively invest in neighborhoods and our residents to ensure real inclusion and equity in our recovery and our growth … neighborhood development is key to ensuring diverse, mixed-income neighborhoods and a better, more equitable Philadelphia,” said Councilmember Maria D. Quiñones Sánchez (7th District).

With a GDP of $116 billion in 2021 and tax revenue of $4.4 billion in 2022, the program is projected to stimulate a significant surge of economic activity within Philadelphia, estimated at a value of $2.5 billion. Additionally, the NPI is anticipated to generate $71 million in new tax revenues within the initial four-year period. The program is also expected to have a positive impact on employment, supporting over 14,700 jobs and contributing $765 million in wages.

Summary: “Net Positive”

The issuance of the social bond by the City of Philadelphia reflects a commitment to addressing its crucial socio-economic issues. Through the NPI, the city aims to revitalize neighborhoods, promote affordable housing, and support small businesses.

Despite the challenges faced by Philadelphia in terms of income, inequality, and unemployment, the NPI’s allocation of funds to businesses and housing initiatives demonstrates a dedication to inclusive growth and improving the well-being of residents.

Stella Yao is ESG impact investing analyst at HIP Investor.

HIP Investor Inc. is a state-registered investment adviser in several jurisdictions, and HIP Investor Ratings LLC is an impact-ratings firm evaluating impact and ESG on 123,000 municipal entities, 250,000 muni-bond issuances, and 12,000 corporates for equities and bonds. HIP Impact Ratings are for your information and education – and are not intended to be investment recommendations. Past performance is not indicative of future results. All investments are risky and could lose value. Please consult your investment professionals to evaluate if any investment is appropriate for you, your goals, and your risk-return-impact profile.