Editor’s note: ImpactAlpha has partnered with HIP Investor to highlight upcoming bond issues with social and/or environmental significance. Disclaimer: Nothing in this post or on ImpactAlpha.com shall constitute an offer to sell or solicitation of an offer to buy bonds.

- CUSIP bond identifier: 882667CM8

- Issuer: Texas Private Activity Bond (PAB) Surface Transportation Corporation

- Obligor: NTE Mobility Partners Segment 3 LLC

- Impact entity rated by HIP: Transportation District of Dallas-Fort Worth-Arlington, TX

- Muni sector: Transportation

- Closing date: November 20, 2023

- Bond amount: $286 million

- Coupon: 5.5 %

- HIP Impact Rating: 55.0 of 100, connoting “Net-Positive”

- Opportunity Zones located in the issuing entity: 7 Opportunity Zones in Tarrant County, Texas, encompassing 32,460 residents

- Climate Threat Resilience Rating: 5 of 100, connoting “Very High Climate Risk” for the geographic county

North Texas transportation bond

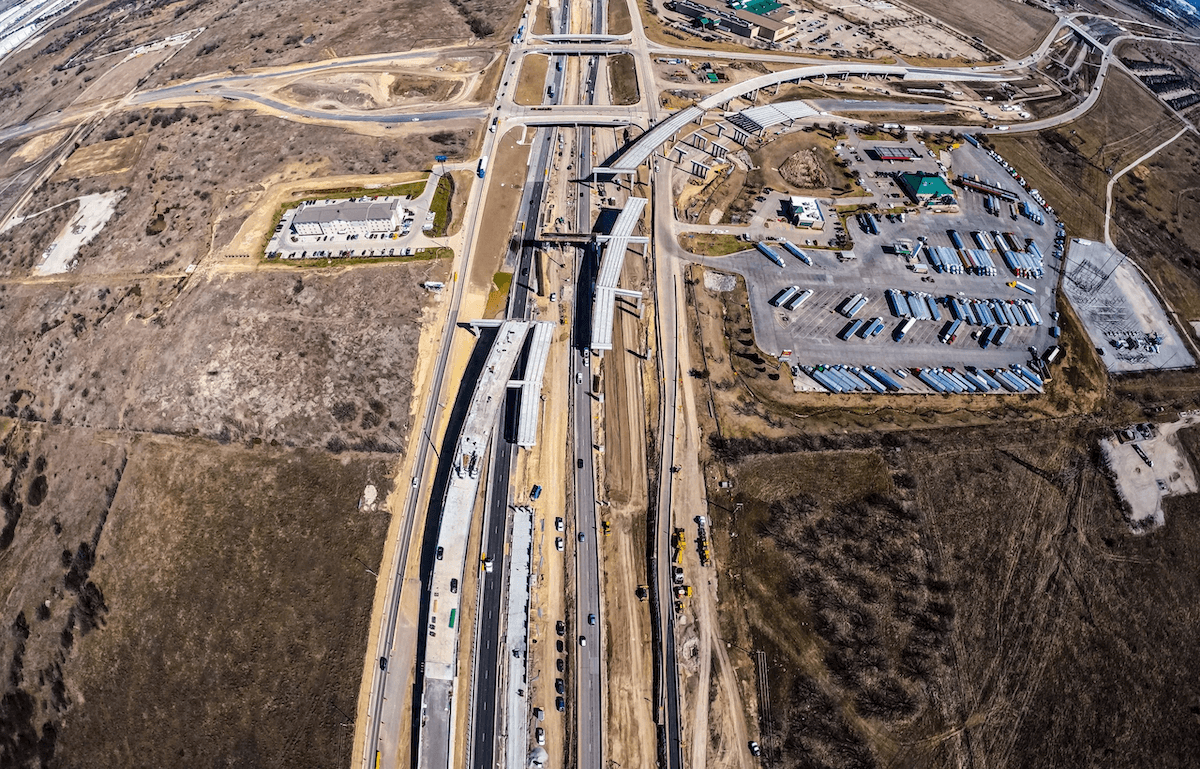

The Texas Private Activity Bond Surface Transportation Corporation is issuing $286 million of private activity bonds (PABs) to refinance the costs related to the designing, constructing, financing, operating and maintaining portions of the Interstate 35W corridor (I-35 West) within the Dallas-Fort Worth region (DFW) in the State of Texas. Private activity bonds are municipal bonds that can be used to attract investment for qualified projects that have some public benefit; while some can be stadiums or golf courses, this bond is for roads.

Population surge

The new U.S. Census Bureau data underscores North Texas as the fastest-growing metro area in the United States. DFW witnessed a surge of over 170,000 new residents from 2021 to 2022, and Fort Worth stands out with the largest numeric population gain among all U.S. cities.

As North Texas embraces the influx of residents and job seekers, it becomes imperative to address the ensuing challenges in managing the flow and maintaining the urban infrastructure, particularly the escalating daily issue of congestion.

The I-35W corridor, a critical commuter route facilitating access from Fort Worth to the DFW International Airport and the Fort Worth Alliance Airport, has historically been one of the most congested traffic corridors in Texas. According to the newest study by INRIX, a transportation data and analytics company, an average DFW driver loses 56 hours per year (or more than an hour per week) in congestion that equates to $953 per person in lost time in 2022, surpassing the national average of 51 hours per person.

The inefficiencies caused by congestion, such as prolonged idling and constant changes in speed, will also result in a higher fuel consumption rate. Studies indicate that fuel consumption can surge by up to 40% in dense traffic compared to free-flowing conditions.

Traffic capacity expansion

According to forecasts from the North Central Texas Council of Governments, the region’s population is expected to reach 11.4 million and traffic counts on segments of I-35W will double in 2045. Anticipating this, Texas’s Dept. of Transportation (TxDOT) partnered with the U.S. Department of Transportation’s Federal Highway Administration and project funders to initiate the I-35W Improvement Project as a part of the North Tarrant Express (NTE) Projects.

These NTE projects comprises a series of public-private partnership express-toll-lane initiatives in Dallas and Fort Worth, demonstrating a reduction in congested time in the general-purpose lanes by 60 percent to 73 percent. The NTE 35W project aims to double traffic capacity by reconstructing lanes and introducing two TEXpress Lanes with tolls in each direction. Beyond alleviating the immediate congestion concerns, this project holds the promise of improved air quality and accommodation for future traffic growth in one of the country’s fastest growing metropolitan hubs.

HIP Impact Assessment

HIP’s Impact rating is based on data-driven metrics across 455 road authorities and entities nationwide. Transportation District of Dallas-Fort Worth-Arlington earns an overall HIP rating of 55% on a 100 point scale, comprising Health (55.3%), Wealth (48.3%), Earth (41.8%), and Trust (91.1%) pillars, where above 50 is “net positive.”

DFW’s transportation district excels in the Trust pillar, particularly in the metric of Legislative Oversight of Capital Projects and Funding, which affirms its commitment to transparent governance and responsible financial management.

One of HIP’s Earth pillar metrics centers on the commute time to work. On average, DFW commuters spend 27.3 minutes traveling to work, whereas the national average is 25.9 minutes. Additionally, the DFW region exhibits a lower energy consumption efficiency in transportation than other areas, contributing to a below-average performance in the HIP Earth pillar. However, the introduction of new managed lanes will potentially improve these environmental metrics.

HIP’s impact and risk analysis is based on the most granular available data, but that is typically concentrated at the 927 U.S. core-based statistical areas (CBSAs) and counties; Texas state has 71 CBSAs. This specific bond’s scope is not yet reporting sufficient granular data to the National Highway Traffic Safety Administration (NHTSA), Federal Highway Administration (FHWA), Dept. of Housing and Urban Development (HUD), or Environmental Protection Agency (EPA). As such, HIP is applying our geographic-based impact entity (Transportation District of Dallas-Fort Worth-Arlington, TX) to this bond.

Yet, when the project can produce more specific and quantitative answers about its impacts and risk factors, HIP can produce a project-specific report. A recent assessment of another nearby Texas toll road included metrics such as Estimated Reduced Emissions From Decreased Idling, Equitable Pricing, and Construction Impacts.

HIP Climate Threat Resilience Rating – “Highly Risky”

HIP Climate Threat Resilience Ratings gauge the prospective investment risk and region-specific capacity to withstand climate challenges, including vulnerability of residents to natural hazard events, the preparedness of state policies addressing climate risk, and the resilience of the built environment.

Dallas and Tarrant Counties, TX, are two of the top U.S. major counties facing the greatest future climate risk. Extreme weather events, like severe thunderstorms, flooding, tornadoes, or ice, have frequently disrupted mobility on road networks in the DFW area. The 2012 Fort Worth Tornado is a notable disruption.

Texas is one of the U.S. states most vulnerable to climate change. Yet calls for crucial reform from environmental advocates in Texas were largely disregarded by legislators during this year’s legislative session.

Impact Rating Summary = “Net Positive”

This impactful bond is refinancing the North Tarrant Express interstate 35W project in the Dallas Fort Worth, Texas, region for the purpose of congestion reduction on a vital corridor to speed traffic and minimize air pollution from wasted fuel burning of stop and go traffic. HIP Investor rates this bond as 55 on our 100 point scale, or “Net Positive,” for more efficient mobility in the face of evolving environmental risks.

Liana Lan is an ESG Impact Investing Analyst at HIP Investor Ratings LLC

DISCLOSURES: HIP Investor Inc. is a state-registered investment adviser in several jurisdictions, and HIP Investor Ratings LLC is an impact-ratings firm evaluating impact and ESG on 123,000 municipal entities, 263,000 muni-bond issuances, and 12,000 corporates for equities and bonds. HIP Impact Ratings are for your information and education – and are not intended to be investment recommendations. Past performance is not indicative of future results. All investments are risky and could lose value. Please consult your investment professionals to evaluate if any investment is appropriate for you, your goals, and your risk-return-impact profile.