Institutional investors – aka, limited partners, or LPs – are increasingly integrating sustainability into their investment processes for private markets.

That requires managing a variety of issues including fiduciary duty, risk compliance and reporting, value creation strategies, and ongoing performance management – all while juggling different frameworks, performance metrics, and reporting metrics.

Our research into private equity’s sustainability performance finds that many private market investors focus on ESG and sustainability as a simple compliance or risk mitigation exercise, leaving value creation opportunities unfulfilled. (A smaller number have developed sophisticated approaches).

For institutional investors (see here for our research and tools for GPs), our research and interviews found:

o LPs had difficulty assessing how mature General Partners (GPs) are from a sustainability perspective

o They exhibited a lack of follow-through on ESG due diligence for GPs

o They did not know what to do with ESG data reported by GPs and portfolio companies other than to include highlights in their own reports

On the other hand, according to Private Equity International’s LP Perspectives 2023 Study, 88% of LPs “take evidence and consideration of ESG into account during manager due diligence” and 69% “believe adopting a strong ESG policy will lead to better long-term returns in their private markets portfolio.”

There is clearly an opportunity for improvement, and thus we have developed tools to enhance LPs’ ability to assess the sustainability maturity of GPs and monitor performance-oriented KPIs that measure the actual impact and financial benefits of specific sustainability strategies, rather than the typical binary yes/no compliance exercise (e.g. the existence of a DEI policy does not mean the company necessarily has a more diverse employee base that is driving higher productivity and retention).

LPs have two major touchpoints with GPs during the investment cycle – the first during due diligence regarding the GP and its fund(s), and the second if and when they ask for or review ESG reporting metrics on the fund or portfolio companies’ performance.

Due diligence tool

Most US-based LPs use a version of the Institutional Limited Partners Assoc.’s 500-question due diligence questionnaire to assess GPs. It includes a wide range of questions, about a fifth of which are related to responsible investment themes. Some LPs use additional Principles for Responsible Investment or ESG Data Convergence questions as well as their own ESG topics.

We heard from LPs and GPs alike that the questionnaire process is somewhat perfunctory – there is little or no discussion on the responses. Some LPs will meet with the GPs to gather information more directly and will be guided in their decision-making by their responsible investing policy. They may also require side letters in ESG topics with the GPs.

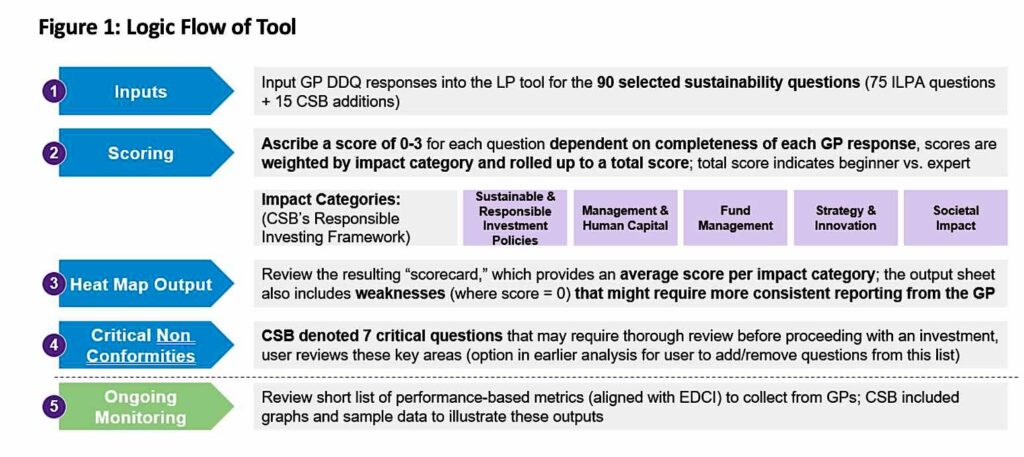

To help LPs better assess the sustainability maturity of GPs as well as provide them with the tools for ongoing performance review, we have developed an LP-focused tool that draws on the existing ILPA due diligence questionnaire process. It extracts 75 core sustainability questions from the ILPA framework (creating no additional work for GPs/LPs), and adds 15 additional questions. Each question is assigned to an impact category (developed through our earlier work on a responsible investing framework for PE).

If LPs use the ILPA DDQ questionnaire, they can extract the recommended questions from the questionnaire responses. If they don’t use the ILPA questionnaire, they can provide the GP with the 90 recommended questions from our tool, alongside other due diligence tools. The LP then scores each response on a scale of 1-3 (with option to input “N/A” if question is not relevant).

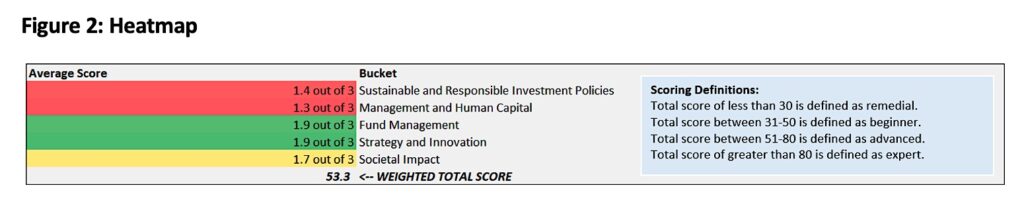

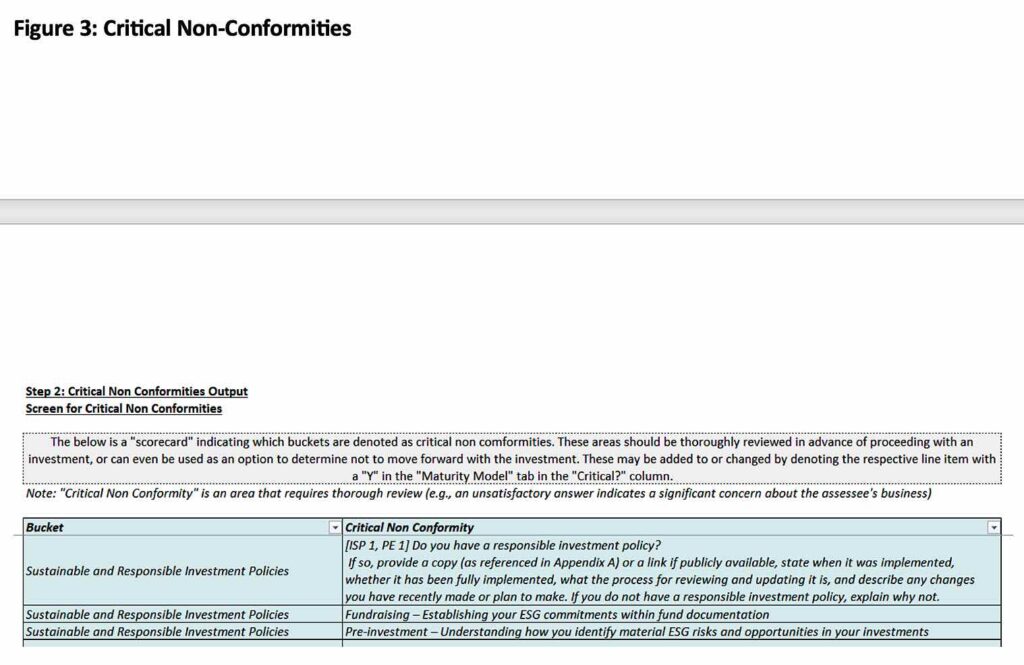

The scores auto-populate a heatmap which spotlights GP performance across responsible investment categories and generates a short list of “Critical Non-Conformities” – areas that require thorough review and discussion. The heatmap is a simple visualization of how the GP is performing across impact categories and provides a high-level assessment of the GP’s sustainability maturity.

The responses are graded and mapped into a few key areas (e.g. management and human capital, fund management, societal impact, strategy and innovation) so that a heatmap can demonstrate areas of strength and weakness (see Figure 2).

Finally, the tool generates a list of the most important questions to be monitored – should these be answered unsatisfactorily, there is likely a material concern about the GP’s operations (see Figure 3).

Continuous monitoring

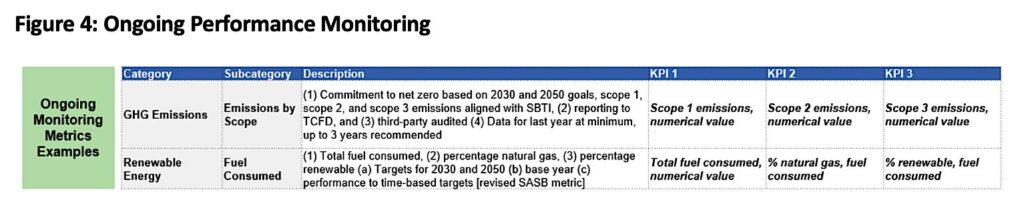

The work doesn’t stop at the initial due diligence. Part 2 of the LP tool address the continuous monitoring of fund/portfolio company ESG performance. For private equity, LPs should focus on performance- and outcome-based KPIs rather than process-based compliance reporting KPIs that typically dominate investor conversations. Compliance-based reporting focuses on outputs such as policies and number of people trained, rather than metrics that assess outcomes – e.g. reducing water and greenhouse emissions and associated cost savings.

GPs have a unique ability to drive better sustainability and financial performance in their portfolio companies if they put the right investments, strategies and KPIs in place. Moreover, using consistent performance-based metrics across portfolio companies enables better benchmarking and long-term tracking. By adopting these practices, LPs are better positioned to realize the financial benefits of sustainability, aligning with the growing body of evidence that links strong sustainability performance to improved financial returns.

One interviewee noted that “establishing consistent metrics that any GP could report on would be helpful, in order to establish a minimum baseline and allow for aggregation.”

Stage 2 of the LP tool moves beyond the basic reporting metrics to provide performance-based metrics (aligned with the Sustainability Accounting Standards Board, or SASB, and the ESG Data Convergence Initiative, or EDCI) that include specific commitments and targets (see Figure 4). This will provide the LP with more meaningful data to assess and report.

LPs increasingly recognize the value of integrating sustainability into GP selection and ongoing monitoring. LPs can use this two-part tool to assess the “sustainability maturity” of a GP. Enhanced transparency, performance-based metrics, and financial tracking of sustainability investments allow for stronger business cases that more accurately capture the financial value of sustainability investments.

We will be unveiling the LP tool, GP tool (discussed in our previous article), and related research at an NYU Stern CSB conference on PE and sustainability value creation on December 12th.

Note: NYU Stern would like to thank Arthur D. Little, which provided us as a pro bono secondment to support this research; InvestIndustrial, which provided grant funds and expertise; and ClimateWorks which also provided a grant for the tools we are developing.

Tensie Whelan is Clinical Professor for Business and Society and Founding Director Center for Sustainable Business at NYU Stern.

Julien Marchese is a Researcher at the Center for Sustainable Business, at NYU Stern.

Jessica Weiss is an MBA Candidate at NYU Stern.