The private equity industry, known for its focus on efficiency improvements and earnings growth, has expanded dramatically in the past decade, tripling assets under management (AUM) from $2 trillion to $6 trillion between 2010 and 2020. Assets are expected to double again by 2025.

Private equity firms control companies employing millions of people across various industries, often holding majority control over their portfolio companies.

A company’s valuation and long-term viability is determined by its profitability and growth potential, highlighting the importance of balancing short-term cost-efficiency improvements with efforts to sustain long-term revenue growth. The private equity ownership structure brings an increasing responsibility for the General Partner to ensure the long-term viability of the assets, rather than focusing on short-term value extraction. Sustainability strategies can serve as growth levers that can unlock value within organizations, drive top-line growth, and tackle material risks to prevent future value destruction.

NYU Stern Center for Sustainable Business (CSB) has launched a research program aimed at supporting private equity’s transition towards sustainable investing practices. As part of this program, CSB collaborated with Arthur D. Little to conduct interviews with over 35 stakeholders, including General Partners (the PE firm’s managers), Limited Partners (the investors), industry associations and NGOs, to assess the current state of play and identify areas for improvement.

As discussed in our previous article , our research found that GPs often struggle to approach sustainability as a strategic value driver, instead treating it as a reporting and compliance issue. However, many GPs believe that there is indeed value to be created from sustainability – they just need better tools. This article presents sustainability value creation tools designed for GPs, addressing their expressed needs from interviews.

These tools assist GPs in assessing strategic value drivers related to material ESG issues, defining value-creating sustainability strategies, and providing monetization methods to demonstrate financial benefits at exit.

The tool has a two-part structure that aligns with the key phases of GPs’ investment cycle:

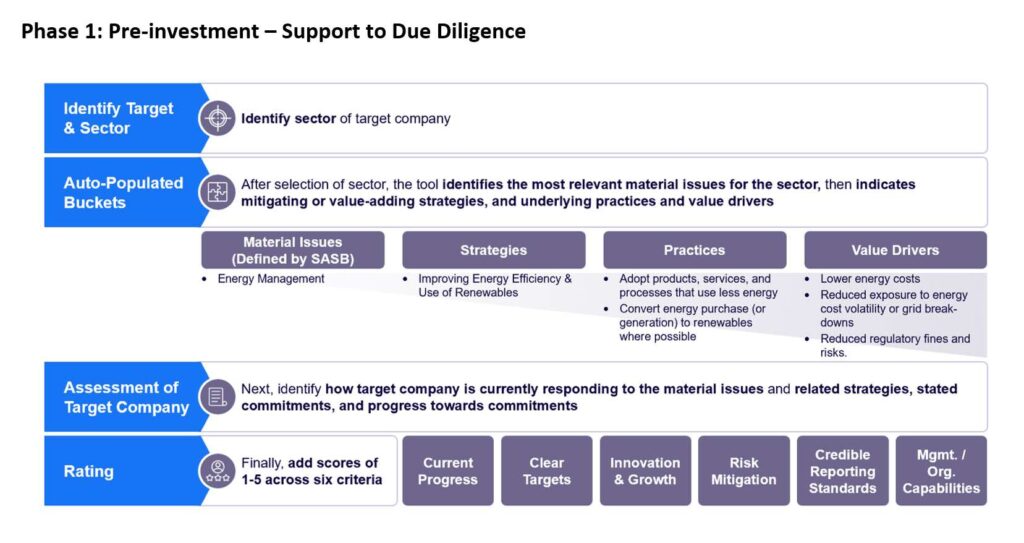

- Phase 1: Due Diligence (pre-investment): In this phase, the tool provides a high-level assessment of ESG-related risks and opportunities that can drive improved financial performance.

- Phase 2: Holding Period (post investment): In this phase, the tool helps to prioritize sustainability issues that can drive future upside benefits or mitigate downside risks, provides an assessment of level of effort and investment, and then provides a database of sustainability KPIs and financial metrics that will track related financial performance to help with management during the holding period and providing a grounded narrative of value creation at exit.

Phase 1: Due Diligence (pre-investment)

During the due diligence stage, the objective is to provide an assessment of the current performance of the target on material sustainability issues, together with related value drivers. After selecting the sector, the model automatically populates the relevant material issues specific to the sector (using the SASB standard) as well as NYU CSB-defined strategies, practices, and value drivers. The tool then guides the assessment of the target portco across several criteria, including ESG commitments, current progress, innovation and growth, risk mitigation, credible reporting standards, and management/ organization/board capabilities.

This assessment assigns scores of 1-5 for each criterion, establishing a pulse check on the target company’s performance across the spectrum of material issues and identifying any significant red flags or upside opportunities.

During our feedback sessions with GPs, they expressed their appreciation for the efficiency of the tool in managing a process that is usually very time consuming – acknowledging that GPs are under significant time constraints (approximately three weeks in total duration) when conducting due diligence.

Case illustration: The model automatically sorts and ranks the issues and strategies

Phase 2: Holding Period (post investment)

The second stage of the tool is designed for initial implementation during the 100 days of managing a newly acquired portfolio company. This period allows GPs to conduct in-depth research on material issues and strategies, as well as develop specific KPIs for the sustainability strategies they intend to prioritize.

Conducting this analysis at the beginning of the holding period allows GPs to:

- Identify and prioritize the sustainability strategies that will drive the most impact and financial value

- Begin tracking robust sustainability and related financial KPIs from the start of the holding period to establish a record of sustainability improvement throughout the investment’s lifetime, enabling the GP to showcase a sustainable growth narrative within the target company upon exit.

Issue Prioritization Analysis

This phase helps prioritize sustainability strategies through providing a set of questions to assess the risks and financial opportunities associated with each material ESG issue and related strategy within the broader market context. This helps determine where to allocate resources. A detailed guidance framework calibrates the scoring process to ensure a reliable assessment. This analysis enables users to compare and contrast each sustainability strategy and set of practices (together with associated value drivers) through a scatterplot analysis that groups strategies into quadrants depending on their upside and downside potential.

KPI Development

After selecting the top 3-5 sustainability strategies, users will be prompted to define practices and KPIs for each. The tool facilitates this process by providing examples of best practices in sustainability KPIs as well as KPIs that track the return on sustainability investment (ROSI KPIs drawn from NYU Stern CSB’s ROSI methodology).

Output

Finally, the user may generate a summary output sheet to obtain a comprehensive view of prioritized issues and strategies, along with their associated sustainability and ROSI KPIs. This equips GPs with a robust foundation for value-driven strategic initiatives, which can be adjusted as needed on an ongoing basis. KPIs should be consistently monitored throughout the investment’s lifetime, serving as examples of sustainability improvement upon exit.

Many GPs and LPs are just starting their sustainability value creation journey, which presents an opportunity for enhancing societal impact and increasing financial returns. Following our previous article summarizing the initial findings of this research phase, this article presents the sustainability value creation tools we have developed for GPs.

These tools assist in assessing strategic value drivers related to material ESG issues, defining value-creating sustainability strategies, and providing monetization methods to showcase financial benefits upon exit. Our next article will discuss the sustainability value creation tools we have developed for LPs. We will unveil these tools at an NYU Stern conference on private equity and sustainability value creation on December 12.

Footnotes:

There is a consensus on the fact that good ESG performance brings higher valuation (e.g. ~1.2x EV/EBITDA):

- Using regression analysis, we find that a 10-point higher ESG score is associated with an approximate 1.2x higher EV/EBITDA multiple;

- “Companies with higher ESG scores tend to enjoy lower cost of capital (Neuberger Berman);

- “More recently, during the market upheaval stemming from the coronavirus pandemic, a UBS study found that 60% of the largest sustainable and ESG-focused mutual funds and ETFs lost less market value than the S&P 500”

- The results of the empirical analysis suggest that companies with superior ESG performance perform better financially and are valued higher in the market compared to their industry peers.

Note: NYU Stern would like to thank Arthur D. Little for providing a pro bono secondment to support this research, InvestIndustrial for contributing grant funds and expertise, and ClimateWorks for providing a grant for the development of these tools.

Tensie Whelan is a clinical professor for business and society and founding director of the Center for Sustainable Business at NYU Stern.

Florent Nanse is a principal and ESG lead at Arthur D. Little.

Julien Marchese is a researcher at the Center for Sustainable Business at NYU Stern and formerly a consultant at Arthur D. Little.