ImpactAlpha, June 16 – Oil major BP lowered its long-term price assumptions for oil and gas by almost one-third, and hiked its estimate for the price it will have to pay for carbon dioxide emissions in 2030 to $100 a ton, from $40. The result: the company will write off assets of up to $17 billion in the second quarter – about 20% of its market value.

It is BP’s largest write-off since the $32 billion hit it took for the Deepwater Horizon disaster in 2010, and the latest in a string of write-downs by Chevron, Repsol and other oil companies.

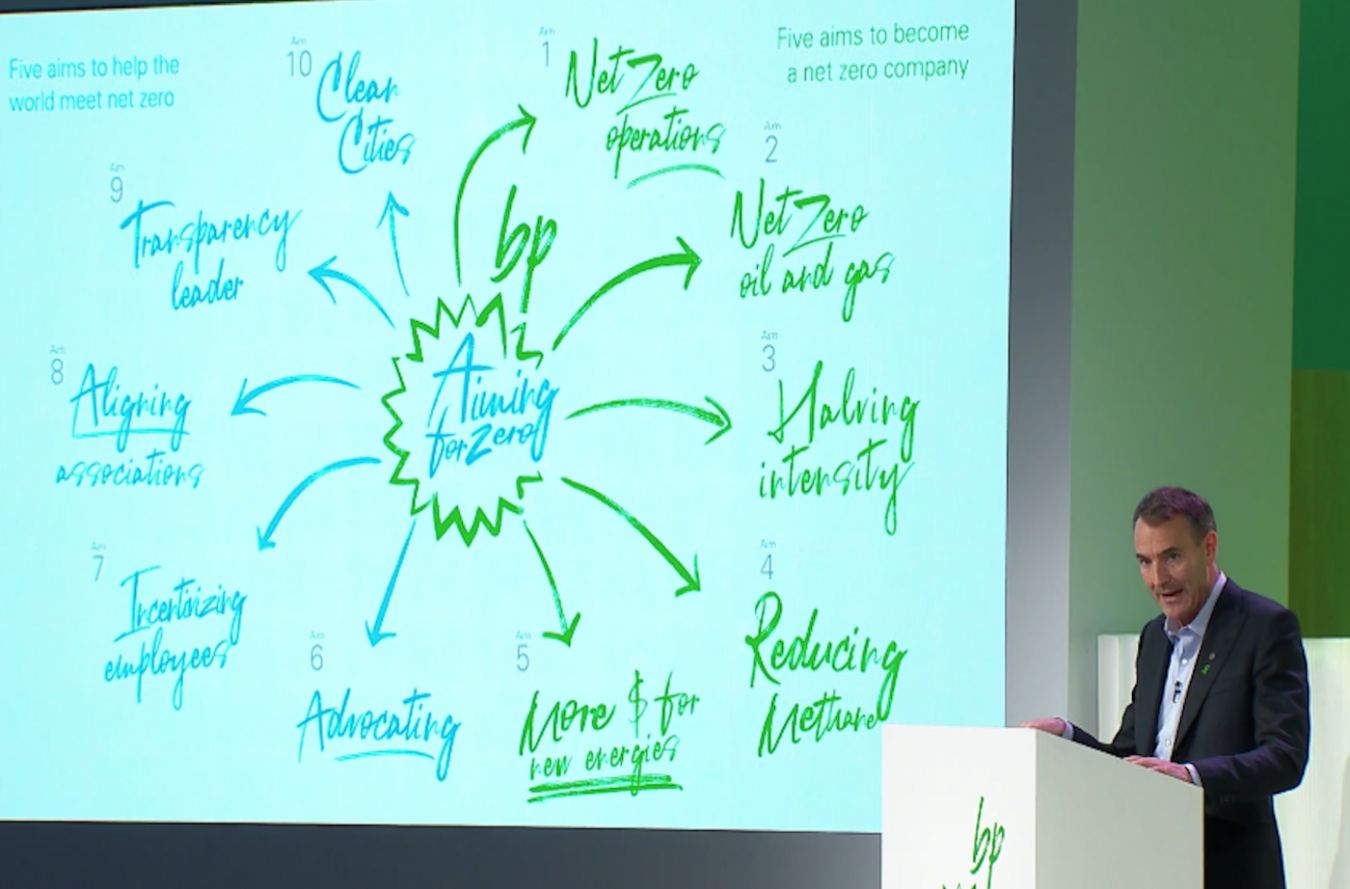

Driving the changes: the COVID pandemic’s “enduring impact” on energy demand and an accelerating transition to a lower carbon economy. The write-downs, said BP chief Bernard Looney, who in February charted a low-carbon strategy, “will better enable us to compete through the energy transition.”

Mispriced risk: The fossil fuel industry’s $100 trillion blindspot

Cascade of woes

In the relentless math of oil economics, falling price scenarios spell trouble for high-cost companies. Oil companies have tried to attract investors with lofty dividends that sometimes exceed earnings. Shell and Equinor have slashed dividends by two-thirds. BP and others may be forced to follow.

BP is cutting 14% of its workforce and Chevron up to 15%. More than three dozen US oil and gas companies have cut capital expenditures by $41 billion, or 36%, in 2020, according to S&P Global. Oil and gas companies will have to shrink production by more than a third to meet the goals of Paris climate agreement, according to Carbon Tracker.

Transition or bust

Banks continue to fund oil companies despite the efforts of climate activists to “stop the money pipeline.” For oil companies that fail to plan for a transition, “their banks will lose faith in them and they will have no future,” wrote CarbonTacker in its recent “Decline and Fall” report (see chart).