ImpactAlpha, March 23 – Votes on climate action, corporate political influence and reproductive rights will liven up this spring’s corporate annual general meetings. And this year, the reflexive management opposition to such shareholder proposals is compounded by a coordinated outside attack on environmental, social and governance, ESG, investing.

The Utah state treasurer has called ESG part of “Satan’s plan,” and 18 states, led by Florida’s Gov. Ron DeSantis have formed an alliance to combat “the pernicious effects of the ESG regime.” This week, President Biden vetoed a bill that would have repealed a Labor Department rule allowing pension fund managers to consider ESG factors.

“A small band of well-funded zealots is trying to inject politics and a ‘culture war’ into basic business,” said Andy Behar of As You Sow, in presenting its annual Proxy Preview this week. “The capital markets work best when shareholders and corporate executives make their own investment and business decisions.”

Climate crisis

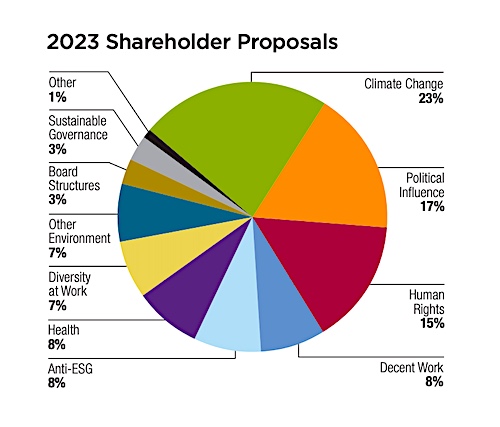

Of the 542 shareholder resolutions filed to date, 160 call for greater climate action or disclosure (that doesn’t count dozens of related requests about corporate political spending, board oversight and climate justice). Underscoring the urgency, the Intergovernmental Panel on Climate Change issued its latest warning this week that time is running out to stave off the worst effects of global warming.

One new proxy twist: shareholders are asking oil companies such as ExxonMobil and Chevron to exclude assets they sell off or transfer from their emissions calculations for more accurate greenhouse gas accounting. Exxon has reported Scope 1 and 2 emissions reductions of roughly 10% since 2016, for example. Yet it has sold more assets than any other American oil and gas company except Chevron, making it difficult to assess its true reductions, notes As You Sow, which filed the resolution.

Reproductive rights

A flood of reproductive rights issues are on the ballot in the first proxy season since the Supreme Court struck down Roe v. Wade. Rhia Ventures has spearheaded a series of such proposals, double last year’s tally. UPS, Coca-Cola and Lowes are among the companies being asked to explain how they are addressing the risks imposed by new restrictions. Companies including Alphabet, CVS, Meta, Walmart, Mastercard, and PayPal are fielding requests to strengthen guardrails to protect women’s privacy.

Other shareholders seek disclosures about racial disparities in maternal and general health.

Anti-ESG

Anti-ESG proposals have surged by 60% this year, to 47. With proxy season yet to kick into high gear, that number could go as high as 70. Shareholders have generally shunned such proposals to date, with an average 5% approval rate.

Proxy season “is a laboratory. It’s a test case,” says Heidi Welsh of the Sustainable Investments Institute, one of the authors of the report. “It gives a good signal to management and to investors about what kinds of issues have traction and which ones don’t.”

Everybody in

More shareholders are having their one say. BlackRock clients representing $500 billion in assets under management have taken up the company’s vote-your-own-proxy option, Voting Choice.

New tools and apps are helping individual investors to vote with their values as well (see, “Retail investors get new tools to flex their collective power as engaged shareholders”). As You Sow is readying a retail version of its As You Vote ESG-aligned voting tool. It is also working with startups including Iconik in the U.S. and Tumelo in the U.K. to make it easier for individual investors to participate in proxy voting.

“There is no way for asset managers to vote these ballots without angering a significant percentage of their investors,” Iconik’s Alex Thaler told ImpactAlpha. “The only logical solution to this mess is to flip voting control back to the investors and have fund managers vote proportionally according to investor preferences.”