TGIF, Agents of Impact! We’re taking a Brief summer break next week. We’ll be back in your inbox Monday, Aug. 9 (in the meantime, happy birthday, Amy Cortese!)

📢 Impact and ESG. Tune into this ImpactAlpha partner event, “Truth in Impact: Getting to Clarity on Sustainable Investment Labeling,” hosted by Tideline, Wednesday, Aug. 4. RSVP today.

🎧 Impact Briefing. On this week’s podcast, host Monique Aiken checks in with David Bank, who has been in South Carolina’s Lowcountry exploring the history of the original Reconstruction. We get some of that history in David’s conversation with Penn Center’s Gardenia Simmons-White, and a preview of Black Philanthropy Month from Philanthropy Unbound’s Renee Joslyn. Plus, the headlines. Tune in, share and follow us on Apple, Spotify or wherever you listen.

The Week’s Agent of Impact

Elizabeth McCluskey, CMFG Ventures. This is what an impact investing career path looks like. McCluskey was working at UBS, first in investment banking and then in wealth management, when the Great Financial Crisis wiped out nearly $10 trillion in household wealth. “I got to see firsthand how fragile our financial institutions were and how vulnerable so many Americans were during that time,” McCluskey told ImpactAlpha. She went to Northwestern’s Kellogg School of Management to figure out “how I could integrate impact into capitalism.” McCluskey joined Chicago-based Impact Engine and helped it grow from an accelerator for social impact startups into a venture capital and private equity firm managing $63 million in assets. Now, McCluskey has been tapped to head CMFG Ventures’ Discovery Fund, a $15 million open-ended vehicle that will provide venture funding for early-stage fintech startups led by under-represented founders, especially women and people of color.

The 36-year-old native of Washington, D.C. says her experience at Impact Engine taught her to always ask, “How do I have the most positive impact with the dollars that I’m helping to deploy?” Every dollar has an impact, she says. “It’s just about being intentional about that impact.” CMGF Ventures is the venture arm of CUNA Mutual Group, a $4 billion financial services company that works with credit unions in the U.S. The Discovery Fund will deploy $500,000 on average to 15 to 30 companies. It will also make follow-on investments. Investments in the fund include AI-powered mortgage advisory startup Home Lending Pal, emergency lending app Line, and Pulsate, which offers digital banking tools for banks and credit unions and their customers. McCluskey’s goal is to help increase the representation of women entrepreneurs and founders of color in the fintech ecosystem. “I’m looking for companies that are producing products and services that are actually improving the lives and financial health of everyday Americans, particularly low and moderate-income consumers and those who have been underserved by the traditional financial system.” – Roodgally Senatus

The Week’s Big 6

1. Year of the Climate Fund. In a single day, announcements of more than $12 billion in institutional capital committed to climate solutions signaled a step-change in climate finance. TPG Rise Climate’s $5.4 billion fundraise and Brookfield Asset Management’s $7 billion fund, along with a parade of other 10-digit green and climate funds, belie a more sober reality. As impressive as the new funds are, Climate Policy Initiative’s Barbara Buchner says what’s remarkable is that “we are not seeing more action to close the trillion-dollar climate investment gap.” Go deeper.

- What we’re watching: opportunities at the intersection of climate and inclusion. Energy Impact Partners’ Elevate Future Fund raised more than $60 million for climate startups led by diverse founders. That intersection is giving investor members of Greentech Noir an early edge.

- Climate shock, Volcker-style. In the 1980s, U.S. Federal Reserve chairman Paul Volcker addressed the disconnect between wage and profit expectations and economic realities by dramatically raising interest rates to tame inflation. In a guest post, Volans’s Richard Roberts argues that a similar shock is needed to instill credibility in today’s climate policy. Otherwise, “businesses and investors will not adjust capital allocation and business models in line with what’s needed” to limit global warming. Get his take.

2. Stakeholder capitalism in emerging markets. When investors resisted a pay increase for waste pickers at Ghanian recycling company Coliba, the founder bought them out. In its “Inclusive Business Playbook,” Acumen explores how stakeholder models pioneered by social enterprises in Asia, Africa and Latin America can create value and drive impact in the broader economy. Get smart.

- Impact funds of funds. In a guest post, Kanini Mutooni of the Draper Richards Kaplan Foundation explores how funds of funds like Oryx Impact are unlocking capital for first-time and innovative impact fund managers in Africa. Learn how.

- Sustainability leaders. China, South Africa, Brazil and other emerging market countries offer ESG investors “opportunities not only for corporate governance risk mitigation but increasingly for alpha generation,” writes Liz Su of Boston Common Asset Management. Hear her out.

- Data-driven inclusive growth. The shortage of reliable economic data in Africa “encourages misallocation of resources,” says Teddy Roux of Entrepreneurial Solutions Partners in a guest post. Needed: “a coordinated and harmonized data-driven plan that directs, monitors and evaluates the flow of resources.” Do the numbers.

3. The Reconstruction: Philanthropy unbound. Institutional foundations represent just one type of philanthropy. Also needed are giving circles, volunteerism, mutual aid – and impact investing. On The Reconstruction podcast, Philanthropy Unbound’s Renée Joslyn argues for reimagining the many forms of investing to express the true meaning of philanthropy: love of humanity. Tune in.

- Q&A with Goldman Sachs’ Asahi Pompey. “We wanted to do something that was big,” said Pompey, who leads corporate engagement at Goldman Sachs. She helped the investment bank launch its $10 billion One Million Black Women initiative following the murder of George Floyd. Pompey shared with Monique Aiken how Goldman is responding to calls for racial and gender equity. Read the full interview.

4. Dealflow spotlight: Climate-smart farms. Climate resilience for smallholder farmers got an investment boost this week. Acumen raised $58 million to invest in African agri-businesses helping smallholder farmers build climate resilience. Chennai-based farmer finance firm Samunnati is issuing a $4.6 million certified green bond to help India’s farmer producer organizations adapt farming practices for a changing climate.

5. Green bonds or greenwashing? Norwegian farmed fish giant Mowi ASA last year made a splash when it launched the first green bond for the seafood industry. A new report criticizes the company for raising €200 million “for nothing more than business as usual” and calls for more stringent policies, reporting and disclosure practices for investments in aquaculture, which could reach $300 billion by the end of the decade. Smell test.

6. Policy corner. ImpactAlpha is working with the U.S. Impact Investing Alliance to keep Agents of Impact apprised of policy developments. This week’s update:

- Beyond coal. The American Rescue Plan in March allocated $3 billion through the Commerce Department’s Economic Development Administration to support workers and underserved communities hit hardest by the pandemic. Among the plans: a $1 billion Build Back Better Regional Challenge and $300 million for new opportunities in coal communities.

- Native housing. The House Financial Services Committee hosted a hearing on increasing access to safe and affordable housing for Indigenous communities through the reauthorization of the Native American Housing Assistance and Self Determination Act.

- Banking the unbanked. That Black, Native and rural communities pay more due to lack of access to the nation’s payment systems, “is not a problem of technology. It’s a problem of policy,” UC Irvine’s Mehrsa Baradaran said at a House hearing. The Comptroller of the Currency said it would rescind its Trump-era CRA rules and work with the Federal Reserve and the Federal Deposit Insurance Corp. to strengthen and modernize the CRA. Share.

The Week’s Dealflow

Clean energy. Soltage closes a $130 million debt facility to finance a distributed utility-scale portfolio of projects across the U.S… CrossBoundary backs PowerGen to develop mini-grids in Nigeria… Hydropower developer Natel Energy closes $20 million in financing led by Breakthrough Energy Ventures and Chevron’s corporate venture arm… Bright Power clinches $24.5 million to help commercial building operators and owners manage their energy and water usage… Benin-based small-scale, off-grid solar provider MyJouleBox secures €3 million to expand to Burkina Faso, Senegal, and Togo.

Small businesses. South African fintech Yoco raises $83 million for small business lending… South Africa’s Akiba Digital, which facilitates loans for small businesses and individual borrowers, raises $1.1 million in pre-seed financing… REGMIFA secures $10 million to back financial institutions lending to small businesses and low- and middle-income households in Africa… Squire scores $80 million to help barbershops manage their businesses.

Financial inclusion. Brazilian impact investor Vox Capital re-ups with Celcoin in the fintech’s $55 million round… Huruma Fund raises €120 million to invest in microfinance institutions, banks and agricultural cooperatives in emerging markets… Estonia-based PayQin raises €300,000 ($356,000) to offer digital cross-border payments to underbanked West Africans.

Fund news. Voltron Capital launches to cut early checks to Africa’s homegrown tech startups… Hamilton Lane reaches a $149 million first close on its second impact fund… Belgium-based Incofin closes a $60 million fund to invest in India’s agrifood sector, financial inclusion and rural entrepreneurship.

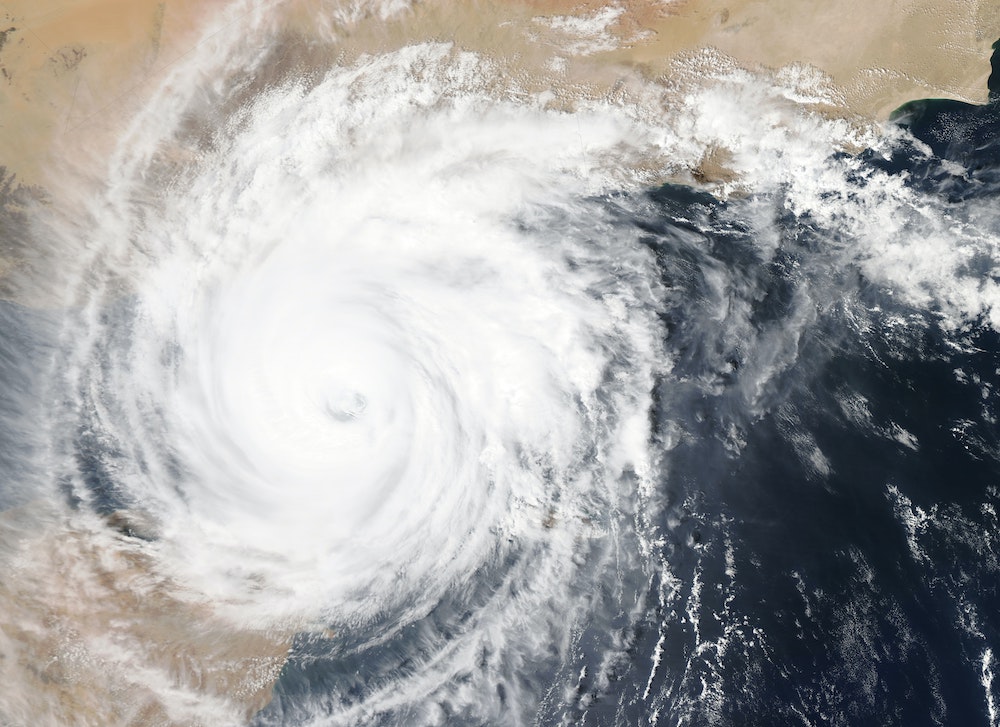

Impact bonds. The Royal Bank of Canada raises $750 million from a green bond by working with diverse-owned broker-dealers… World Bank catastrophe bond for Jamaica to cover up to $185 million in disaster relief… Sri Lanka-based Seylan Bank issues a $15.1 million green bond to finance renewable energy projects of up to 25-megawatts across the country.

Low-carbon transition. Singapore’s sovereign wealth fund GIC commits $240 million to Arctic Green Energy to decarbonize the buildings sector… Rivian rakes in $2.5 billion to commercialize electric pickups and SUVs… Hartree Partners and Wildlife Works tap voluntary carbon markets to finance forest protection.

Catalytic capital. Impact management gets a boost from the Tipping Point Fund on Impact Investing… Catalytic Capital Consortium seeks best practices for flexible finance… Nigeria-based RxAll secures $3.2 million to counter fake pharmaceuticals with a handheld scanning device.

Climate tech. Swedish startup Ignitia raises $4.2 million to expand its tropical weather forecasting platform to Brazil and Africa… Yamaha Motor is launching a $100 million fund for technologies to help the company meet its 2050 net-zero carbon goals.

Impact tech. Chilean plant-based food producer NotCo raises $235 million… Class Technologies bags $105 million to improve virtual learning on Zoom… AppHarvest secures a $91 million construction loan from Equilibrium Capital to build a 60-acre greenhouse in Richmond, Ky.

Inclusive communities. International Finance Corp. lends $250 million to HDFC to finance green, affordable housing in India… New York Life commits $50 million to IMPACT Community Capital to preserve affordable housing in the U.S.

The Week’s Talent

Pembrook Capital Management brings on municipal finance attorney David Baker Lewis and affordable housing advisor Ghebre Selassie Mehreteab as advisors on racial and economic equity in affordable housing lending… Amber Kuchar-Bell, ex- of CDFI Fund, joins Opportunity Finance Network as chief strategy and operations officer… Emma Sissman is promoted to director of portfolio acceleration at SJF Ventures.

Robert Wall, ex- of Federated Hermes, joins Lazard Asset Management as managing director and head of sustainable private infrastructure… Jim Baek, ex- of Deutsche Bank, joins LOCUS Impact Investing as executive director of its community investment guarantee pool… Patricia Decker from the USC Marshall School of Business and Jeremy Soares from Yale School of Management join Mendoza Ventures’ fellowship program for diverse MBA students.

Troy Perry, ex- of Franklin Square Group, joins Omidyar Network as director of policy and advocacy… Tonna Obaze is promoted to chief of staff and investor at Harlem Capital. Melody Hahm, ex- of Yahoo Finance, joins Harlem Capital as platform and community manager… William Brent, ex- of Power for All, joins Husk Power Systems as chief marketing officer.

The Week’s Jobs

RBC Capital Markets is looking for an analyst for its sustainable finance group in New York… Omidyar Network is recruiting a principal for its Reimagining Capitalism team in Washington, D.C… Mission Driven Finance is looking for an investor relations coordinator… Convergence is hiring an associate director of content and thought leadership and a digital communications associate in Toronto or Washington, D.C.

Peloton seeks a senior manager of ESG strategy and operations In New York… Village Capital seeks an economic opportunity practice lead in Washington, D.C… The Open Society Foundations has an opening for a special advisor, based in New York… Rippleworks is hiring a capital portfolio manager… Pacific Community Ventures is recruiting a business advising director, credit analyst for small business lending and a people and culture manager.

That’s a wrap. Remember, no Brief next week.

– July 30, 2021