ImpactAlpha, July 15 – Greece’s largest power utility put itself on the hook to reduce its carbon emissions with its €500 million ($591 million) bond issue this week. The bond’s coupon rate will increase if the company fails to meet its carbon-reduction goals. The issuance by Public Power Corp. is the latest in a breakout year for “sustainability-linked bonds,” which tie interest payments to investors directly to environmental, social and governance targets. Corporations so far in 2021 have tapped bond markets for a record $72.8 billion in sustainability-linked debt and are expected to issue as much as $150 billion by the end of the year.

All told, corporations and governments have issued more than $575 billion in green, social, sustainability and sustainability-linked bonds so far this year– already topping last year’s total by more than $100 billion. Total issuances are expected to top $1 trillion in 2021 (see, “Countries and companies tap fixed-income market with ‘social bonds’ for COVID relief”). “What began with ‘Why should I issue?’ is now ‘Why aren’t you?’” Marilyn Ceci of JPMorgan Chase, one of the largest underwriters of sustainable bonds, told Bloomberg. “Your absence in the market says something now.”

Opportunity and risk

Sustainability-linked debt can drive sustainable business practices “while introducing a new cohort of issuers to sustainable finance,” Lori Shapiro of S&P Global Ratings writes in a guest post on ImpactAlpha.

https://impactalpha.com/bringing-transparency-to-the-growing-market-for-sustainability-linked-debt

Sustainability-linked instruments are distinct from other types of sustainable debt in that they tie the coupon rate to sustainability performance. The bonds do not, however, require issuance proceeds to be allocated to defined projects. That flexibility has made the instrument attractive to companies at the beginning of their sustainability journeys or those in hard-to-abate sectors, such as industrials or materials, It also puts the instrument at “distinct risk of ‘ESG-washing,’” she says, and demands “greater transparency and refined reporting practices.”

Growing footprint

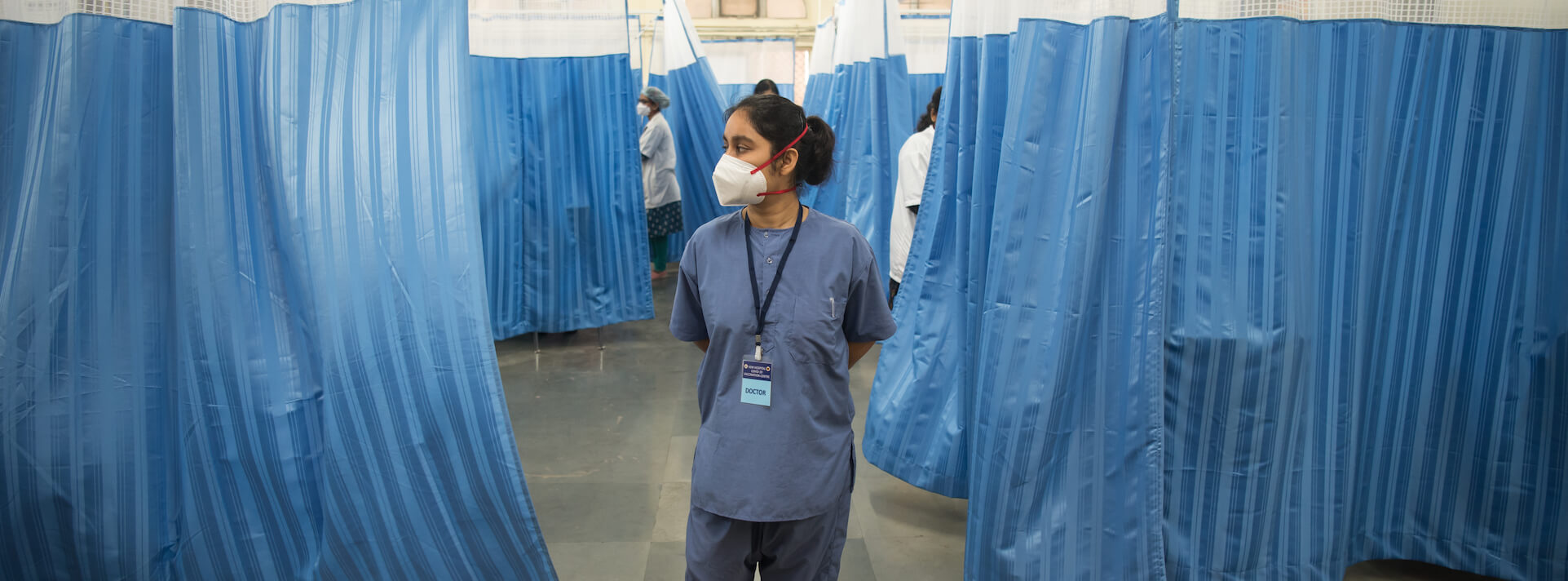

Companies can use sustainability-linked debt even when they don’t have sustainability projects that would qualify for other green, social, or sustainability bonds (see, “An incentive for companies that deliver on sustainability: lower-cost capital”). European health care companies, for example, have issued a raft of sustainability-linked bonds, at least €6.3 billion as of May, to finance the post-pandemic recovery.

Boise, Idaho-based Micron Technology closed $3.7 billion in sustainability-linked loans in May. Italian energy major Enel and beer maker Anheuser-Busch InBev have each used sustainability-linked instruments to raise more than $10 billion in 2021. “We felt that the moment was right for us to be behind these instruments,” AB InBev’s Fernando Tennenbaumexplained at a Bloomberg conference this week. As companies green their operations, there may be less room for improvement, he says. “The market is maturing.”