When Fred van Eck, a New York investment manager, purchased 9,400 acres of Northern California and Oregon forest for timber production in the 1960s and 1980s, he had no idea his forests would become a critical part of the solution for combating climate change.

With the help of sustainable, conservation-based management, van Eck’s forests today have absorbed carbon dioxide (CO2) at levels equivalent to taking 405,613 cars off the road while also providing 800,000 reams of paper and enough timber to frame over 3,000 houses.

Today, as the United Nations marks the International Day of Forests, this success story should be a clarion call for the United States to enlist more private landowners like Fred van Eck as allies in the fight against climate change. It would be a surprisingly fruitful endeavor: about 60% of the forests in the United States are privately owned. Working forests like van Eck’s – those managed for the production of timber or fiber – offer one of our best hopes to cut emissions by 2030 in line with the Paris Agreement.

Small caps of forests

As Fred van Eck knew well, a sound financial investment strategy is a diversified one – portfolios need a mix of blue chips, startups, and small caps to avoid risk and increase the likelihood of sustained returns. In the world of forests, blue chips are our old-growth forests in national and state parks – the equivalent of keeping money under the mattress; startups are the popular tree-planting initiatives – glitzy and potentially high-yield, but ultimately risky; and the small caps are the privately owned working forests – best for both preservation and growth, they’re the sweet spot of the smart investor.

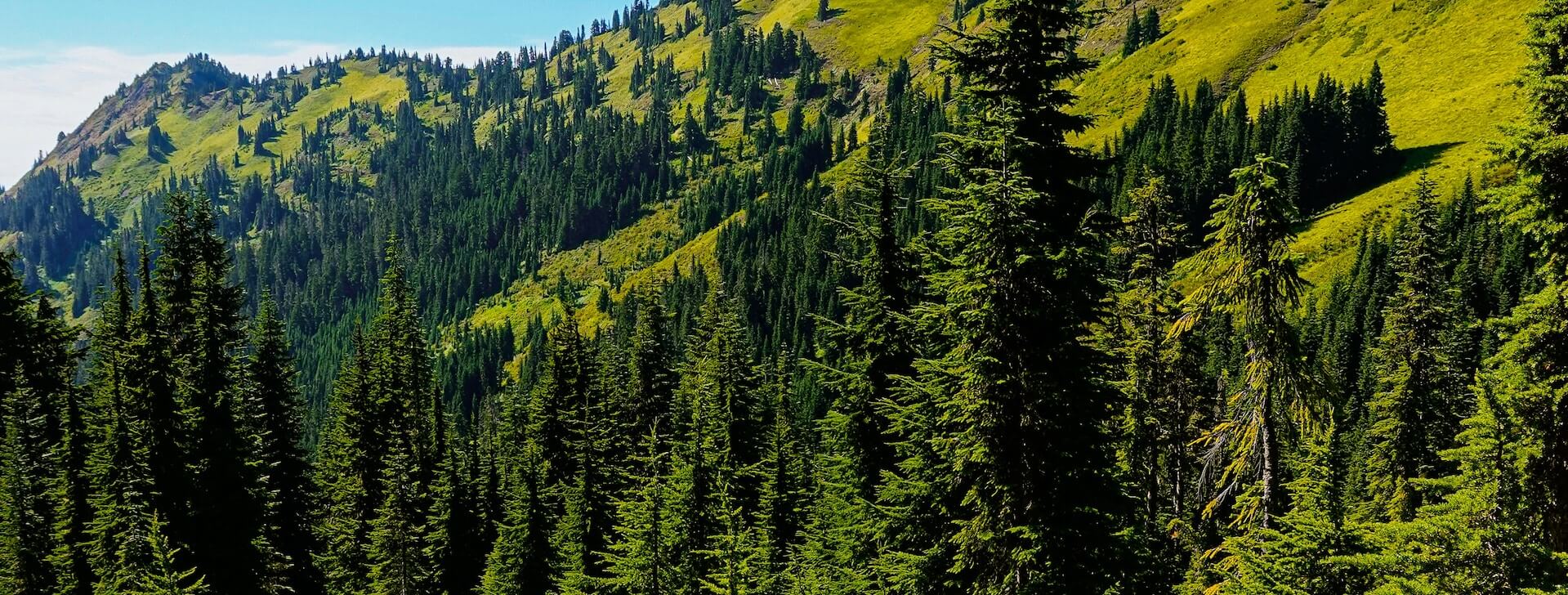

Like established companies with consistent earnings and sizable dividends, old-growth forests – especially temperate rainforests in the Pacific Northwest – are the nation’s most biodiverse and carbon-dense. They hold far more carbon than younger forests, with one study showing that the largest trees account for 42 percent of stored forest carbon. These forest assets – our “blue chips” – receive federal and state protection against development, so they’re least at risk.

On the other end of the spectrum are the popular tree-planting initiatives with ambitious goals of planting between one billion to one trillion trees over the next decade. Investing in new trees, like investing in startups, is a riskier business. Transforming newly planted trees into carbon-eating forests takes decades of intensive management. Climate stresses, such as extreme weather and invasive pests and diseases, can result in sudden failure. By the time these forests – provided they survive – are mature enough to capture carbon, it will be too late.

This brings us to the small caps of forests: the privately owned, working forests across the United States, which receive no protection under federal or state law. We lose 2.2 million acres of privately owned forest – an area the size of Delaware – in the U.S. every year to development alone. Like small-cap stocks, investing in privately-owned forests offers the best returns: with smart management and conservation, a working forest can be transformed into one that sequesters vast amounts of carbon – and is more climate resilient – in just ten years.

Conservation easements

The van Eck forests evolved into powerful weapons in the fight against climate change thanks to the use of working forest conservation easements – permanent legal agreements that protect the forests by prioritizing the restoration and maintenance of their naturally carbon-rich and climate-resilient qualities.

Conservation organizations and land trusts work with private landowners to help them reap the rewards of sustainable management. Owners are compensated for the opportunity cost of foregoing the use of their forests for timber production and development and, instead, prioritizing their use as carbon sponges and managing them for climate adaptation. It’s a climate-friendly and financially savvy choice that is a win-win: owners are able to continue to profit from sustainable timber and natural resource production, while the land is protected from development in perpetuity.

So how can we accelerate the use of forest conservation easements in the climate change fight?

We must increase the public investment in forest conservation and restoration so it’s equivalent to what we are spending on other proven climate solutions. For example, California Governor Gavin Newsom has proposed $15 billion for climate-fighting transportation projects, but the state has dedicated only $10-20 million a year to secure the future of its forests.

Policy accelerator

Some states have crafted innovative incentives to help protect and sustain working forests. Colorado increased the value of tax credits for conservation easements to 90 percent of the property value, making it just as profitable to preserve forests as to log them. At the federal level, a minor tweak to the USDA’s Forest Legacy Program would go even further in transforming private forests into powerful climate change-fighting tools. The program currently only allows government agencies to hold conservation easements, something many private forest owners object to. By simply allowing accredited land trusts and conservation nonprofits to hold easements, many more private landowners would join the program.

But Congress and state lawmakers must act now and invest wisely if we hope to mitigate the impact of climate change by 2030. In the U.S., privately owned forests offer the best investment for both short- and long-term returns. Luckily, millions of acres of private forests, like the van Eck forests, have the potential to become part of the climate solution, delivering far-reaching benefits to the climate, the environment, and our economy.

Laurie Wayburn is the co-founder and president of Pacific Forest Trust, a nonprofit dedicated to conserving private, working forests to mitigate climate change. Jan van Eck is the CEO of VanEck, a global investment management firm.