ImpactAlpha, September 28 — Black ownership was the theme that echoed through the Walter E. Washington Convention Center at last week’s annual legislative conference of the Congressional Black Caucus Foundation.

The five-day event convened Black innovators, politicians, public and business leaders to discuss innovative solutions and scale up existing strategies to foster wealth creation, good health and wellbeing in Black communities.

“We haven’t made a significant improvement in the Black homeownership rate since the Fair Housing Act was passed, and that really is a travesty,” said Kevin Blackburn of the Federal Home Loan Bank. In 1968, he said, there was a 27 percentage-point gap between white and Black homeownership. That gap has grown, to about 30 percentage points.

Through a partnership with the Urban Institute, Federal Home Loan Bank is digging into the barriers to access to Black homeownership.

“There are those forces that are active today that don’t want us as a people to achieve, they don’t want us to advance and they don’t want us to buy the block back,” Blackburn said.

Blackburn says the bank’s down payment-assistance program has deployed roughly $141 million over the past two decades to help Black families in the US that earn less than 80% of their areas’ median income to purchase homes (see, “Dearfield Fund secures $7.5 million to help Black first-time homeowners make down payments”).

Buying back the block

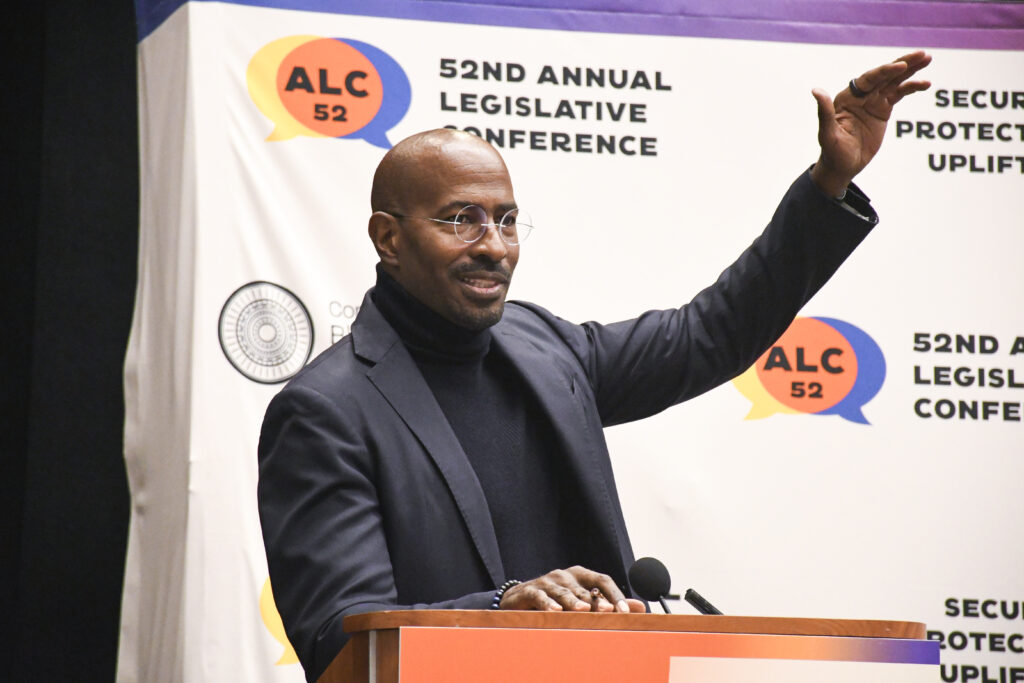

“Home is very precious to us,” said CNN commentator Van Jones, who wears many hats as founder of several social enterprises: Color of Change, Green for All and Dream Corps, firing up the crowd.

“We were kidnapped and stolen from our home, and when we were finally allegedly free, we left the South and moved up north looking for a new home,” Jone said.

Actor-turned-developer Malik Yoba, born in New York, is investing his own capital to buy and develop real estate in his home city. His firm, Yoba Development, targets sustainable and affordable mixed-use development projects in transitioning neighborhoods. Through a recent effort with New York City, Yoba helped launch a real estate development curriculum for local high-school students.

“We’re so tired of people coming and building in our neighborhoods, where we say, ‘Here they come, building something we can’t afford,’” says Yoba during the panel discussion. “The question I always ask is ‘Who’s they? And how do we become them?’”

Denise Scott, president of the Local Initiatives Support Corp., or LISC, runs a team that deploys from $1.5 billion to $2 billion a year in equity, debt and grants, as well as technical assistance and training, to developers of color.

“My parents bought a house when I was a baby and that house put three kids in college,” said Scott. “By the time we were ready to go to college, it was there for them to pull out the equity. So owning real estate is a big damn deal and we have to get with it.”

Wells Fargo Foundation announced a new $500,000 grant to the National Association of Real Estate Brokers to train young Black developers. The Black Real Estate Developers Academy is a partnership with Enterprise Community Partners.

“The work that needs to be done within our community can only be done in partnership with those who truly have a hand or fingers on the pulse of what’s happening in the community,” says Wells Fargo Foundation’s Otis Rolley.