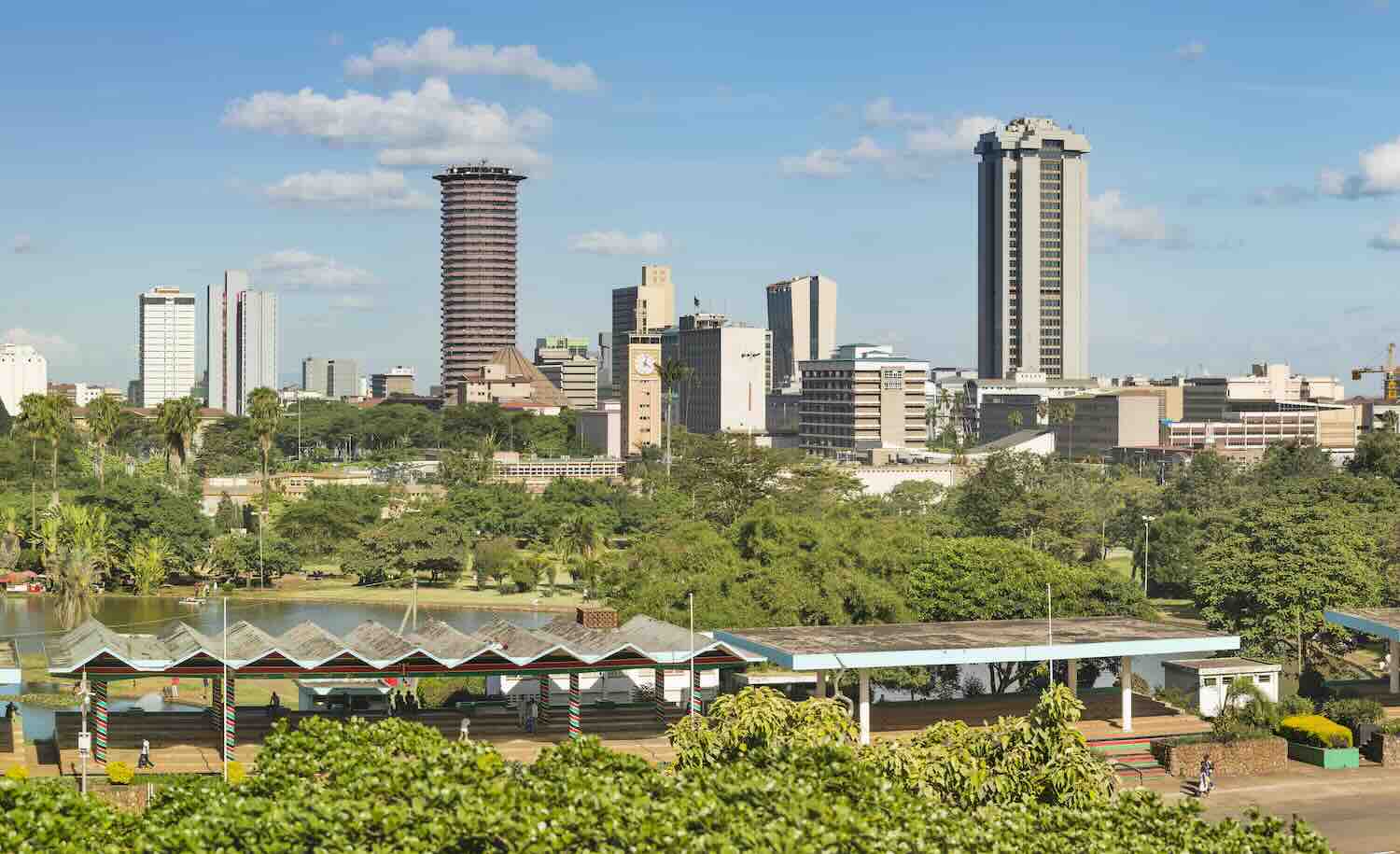

ImpactAlpha, Feb. 26 – Climate concerns figured prominently in conversations among investors, development agencies, startups and corporations at this week’s Africa Tech Summit in Nairobi. A common refrain: Africa is not Silicon Valley… and the expectation of sky-high returns from climate tech startups is unfair.

“The best thing we can do is seed that early stage of innovation and produce as many climate tech startups as we can,” said Mercy Corps Ventures’ Scott Onder.

“Over time, we can prove out – just as we did with fintech, logistics and distribution – that some of these models can be highly scalable to serve tens, if not hundreds of millions of users, that they can be viable from a profitability standpoint, and [that] exits will come as a result.”

The impact investing arm of the nonprofit Mercy Corps is looking to take on more risk to produce a vibrant pipeline of innovations that later-stage investors can support in coming years.

What’s hot: fintech, water and energy

Fintech, water and energy were the in-crowd at the summit.

Water and energy have been a sweet spot for climate investments, noted Maelis Carrarro of Catalyst Fund. Almost three-quarters of the $3.4 billion in climate tech funding in Africa from 2019 to 2023 went to the energy and water sectors, she said.

The fund backed nine African startups and is on the hunt for companies with solutions for waste management, data insights and Internet of things, sustainable materials and smart building, insect protein and efficient water consumption.

Mercy Corps Ventures is looking to support more fintech companies that provide credit, insurance and supply chain financing that can help businesses and communities adapt to a changing climate.

“Embedding fintech and credit into climate solutions will make climate-smart practices affordable for farmers, like in purchasing solar irrigation systems,” Onder said.

De-risking climate investment in Africa

Private investment is key to narrowing Africa’s $1.6 trillion sustainable financing gap. An additional $194 billion is needed each year to achieve the Sustainable Development Goals by 2030, according to an African Union report.

Yet private investors have been spooked by negative perceptions (or misperceptions), a lack of infrastructure, policy constraints, currency fluctuations and political instability in some regions. Philanthropic investment and mixed or blended capital were flagged as solutions by conference attendees.

“To de-risk, we actually need to lean into more risk, especially at the earliest stages of innovation,” said Onder of Mercy Corps Ventures.

The venture firm has a family of funds ranging from concessional and catalytic to market-based investing. For very early stage ventures, “it can take an extra one or two years for climate entrepreneurs to raise their first round of venture capital,” explained Onder. “We’re using philanthropic capital to be able to pilot test very early stage startups in different areas like AI and data analytics and regenerative agriculture.”

Note to investors: Africa is not Silicon Valley

African founders should ignore Silicon Valley definitions of scale, says Rachel Macauley at the Draper Richards Kaplan Foundation, which has backed farmer financing, clean energy, last mile health, affordable housing and school feeding ventures.

“I think the definition for exits in Africa is going to be highly localized, likely through M&As which are already happening quietly,” Macaulay said. If investors don’t have people on the ground, they should, she added.

Startups to watch

T-Bin Limited, a maker of AI- and solar-powered smart waste bins, was one of the climate tech startups at the summit. Also well represented were creative startups that cater to Africa’s underserved populations – the bread and butter of the continent’s tech ecosystem.

Rwanda Pindo, deploys AI phone calls to spread messages about health and agricultural practices. Blockchain-anchored fintech Kotani Pay enables remittances to people without bank accounts. The startup is teaming up with Refugee Integration Organisation and Impact Market to send universal basic income transfers to refugees in Kenya and Ghana. And Kenya’s AgNexus provides insights on farmers’ spending on seeds and fertilizers to agricultural input suppliers.