ImpactAlpha, June 28 – The backlash against ESG is not (yet) hampering impact investing. It may even be driving some institutional investors toward investments more intentionally aimed at positive measurable social or environmental impact.

Investing in communities, supporting workers and holding polluters accountable “has incredible resonance with a broad base of the population, across the political spectrum,” the Global Impact Investing Network’s Amit Bouri said in a briefing on the group’s latest survey of more than 300 global impact investors.

Pension funds and insurance companies have boosted their impact funding at a compound annual rate of 32% and now make up 27% of the capital raised by the surveyed impact fund managers.

“The transition to impact investment managers suggests a growing appetite for more active approaches to generate impact on issues that matter to pensioners or insurance clients,” the GIIN states.

Macro uncertainties

The survey aimed to shed light on investor sentiment in what the GIIN last year estimated is a $1 trillion market. Investors, including banks, foundations and investment managers, plan to pull back and invest an estimated $36 billion this year, down from $55 billion in 2022. Bucking the trend: family offices, which plan to boost their investments.

The dry powder is accumulating. The investor subset raised an average $153 million last year, up from $29 million in 2017. And investment managers across all asset classes are feeling optimistic: they plan to raise an average of $160 million in 2023, up from $85 million in 2022.

Private and public

Private equity and private debt, traditional impact strongholds, accounted for 26% and 22% of allocations. But public debt was the fastest-growing asset class over the five-year period, albeit starting from a small base.

Allocations to publicly-traded bonds and loans more than doubled in the five year period and represented 14% of broader asset allocations last year, as rising rates – and emerging fixed income impact strategies – make such investments more attractive. Impact investors put another 14% to work in public equities.

“We’re seeing more and more investors think about how to achieve impact in listed equities and public debt,” said Bouri. The GIIN earlier this year introduced guidance for impact in public equities.

Financial and social returns

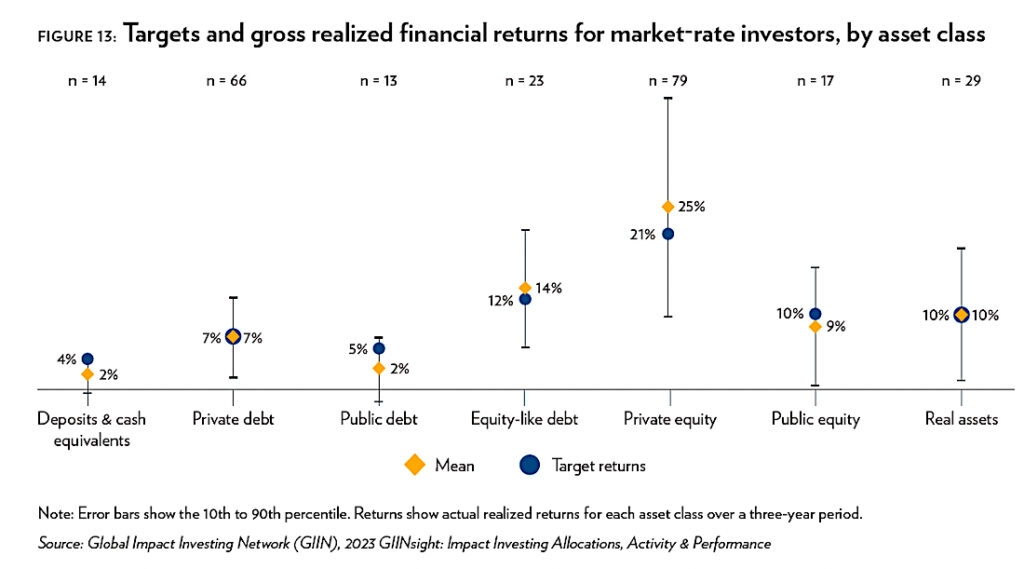

Three quarters of surveyed investors target market-rate returns – and they are meeting or exceeding those targets. Some 79% said financial returns were in-line or outperforming expectations; 88% said the same of impact expectations.

Just 11% of investors in advanced markets did not hit financial targets, compared to 22% of emerging market investors. Among a subset of investors tracked over five years, housing investments saw the biggest growth.

Most investors continued to focus on basic needs, including energy, financial services and healthcare. Still lagging: education (2%) and water, sanitation and hygiene (2%).

For the below-market rate investors in the survey, high net worth individuals and family offices are by far the biggest sources of capital. Just 11% of investors in developed markets did not hit financial targets, compared to 22% of emerging market investors.