Wealthy individuals and family offices are an under-tapped source of catalytic capital.

Family offices and High Net Wealth Individuals (HNIs) can operate without the financial return parameters or fiduciary obligations that most institutions must follow. That means that they can seek out opportunities that maximize combined impact and financial returns, rather than focusing on a financial return benchmark.

And the appetite is there. Through a series of focus groups and surveys, Toniic recently collected feedback from more than 90 impact investors about their motivations, strategies and barriers when it comes to catalytic capital. About 30% of the investors said they are open to accepting lower or uncertain returns for the same risk as commercial investors “most of the time,” and about 60% “some of the time.”

Almost a third of the investors also said that they are willing to take more risk for the same expected return as commercial investors “most of the time” and about 55% “some of the time.”

They also signaled they are willing to accept longer time horizons than commercial investors: 90% of respondents indicated that they do it most or some of the time. Patient capital is extremely valuable for a company seeking early investors to validate innovative business models, technologies, or distribution channels.

With guidance from the Catalytic Capital Consortium, or C3, which provided grant support, Toniic defined catalytic capital as a subset of impact investing that targets impact opportunities that market rate capital is unable to reach on its own, primarily due to capital gaps. It consists of debt, equity, guarantees, and other investments that accept additional risk and/or concessionary returns relative to a conventional investment to generate positive impact or enable third-party investment that otherwise would not be possible. Toniic’s goal is to share best practices with the broader market to support efficient and effective use of this vital financing around the world.

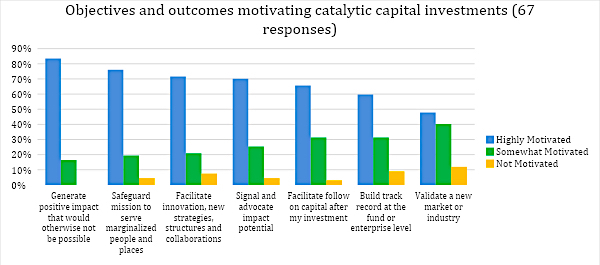

The motivations driving HNI and family office investment in catalytic capital falls into three broad categories:

- Personal: A personal interest in supporting individuals/enterprises/funds that cannot attract market rate capital.

- Systemic: a broader set of passions and concerns around the need for systemic change

- Evidence of impact: opportunities to make a direct, tangible difference.

Many HNIs and family offices said they seek to contribute money, time, and talent to the impact of an enterprise or fund, rather than just its financial success. The primary motivating factor was to “generate positive impact that would otherwise not be possible.”

To that end, many investors require evidence of counterfactual impact to deploy catalytic capital. In simple terms, that means comparing what likely happens in a world where the investment is made to what likely happens in a world in which it is not. Thinking this way can help investors focus on investor impact additionality, as well as on providing a framework to understand the more nuanced impacts of their investments.

Unlocking impact

Toniic believes that there is potential to unlock more catalytic capital from these investors. As one investor in our focus group told us, “my catalytic capital is making the biggest difference of all my capital.”

The survey responses also point to relatively untapped potential to engage HNI investors and family offices in catalytic investment opportunities at a later / last stage of a raise. Some 79% of surveyed investors said they look for opportunities to close out a round “some of the time” or “would consider” doing so in the future.

Many HNI and family office impact investors are attracted to very high-risk propositions with the potential to scale. They are motivated by opportunities to help accelerate the growth of an early-stage venture, or to create momentum for a new idea or initiative addressing an important social or environmental issue.

In addition to deploying capital, investors may embrace actions that catalyze transactions and impact. For instance, it is common for investors to actively engage with portfolio companies and lend their reputation to help attract others. Activities like this help enhance the effectiveness of catalytic capital in achieving its intended goals.

Capacity Constraints

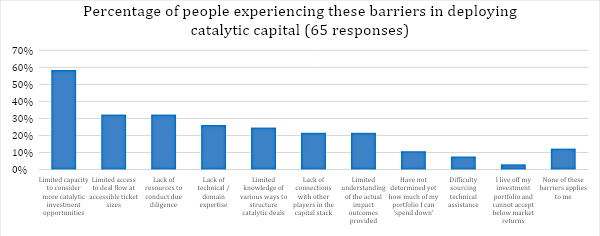

Even among HNI and family office investors that are attracted to catalytic capital opportunities, the overwhelming majority (90%) are currently limited in increasing their portfolio allocation to this end. Their reasons vary, but our research suggests most stem from resource constraints other than capital. A large portion of focus group participants cited their “limited capacity,” defining those limits as personal bandwidth, team members that can provide support, and/or the ability to access shared resources. They also noted a lack of resources to conduct due diligence as well as limited access to deal flow at accessible ticket sizes.

HNIs and family offices often don’t have the same capacity that some of their foundation and institutional counterparts do to execute catalytic capital deals.

Overcoming Barriers

Our investors expressed that they like to work with other leaders and innovators, especially more institutional investors, to assess the need for catalytic capital and share due diligence. But some indicated that their opportunities to do so are limited. They noted a lack of connections with other players in the capital stack and limited access to deal flow at accessible ticket sizes (institutional investors tend to invest higher tickets).

Our research indicates a critical need to develop more formal and structured ways to connect HNIs and family offices with other investors so they can learn about and participate in catalytic investment opportunities. Given their constraints, initiatives that leverage collaborations and shared resources among these investors could help them deploy more Catalytic Capital.

Among survey respondents, relatively high levels of support exist for the following options:

- Access to a “due diligence directory” of organizations referred by peer impact and catalytic investors

- Access to a “Catalytic Capital bureau” with resources for shared research and due diligence guidance

- A dedicated knowledge resource with case studies, primers, perspectives from practitioners, discussion of challenges, etc.

- Expansion of impact monitoring and measuring tools within existing resources to better quantify the impact of financial tradeoffs

- Workshops on specific areas, e.g. specific geographies, themes, SDGs

Education

Another gap, particularly for those new to catalytic capital investing, is a basic education in how these deals work and how to participate. Toniic has released a free investor Catalytic Capital Course to address this knowledge gap, with tools and resources to further build the capacity of Catalytic Capital investors.

Toniic is also engaging with other network partners to overcome barriers to greater deployment of Catalytic Capital by engaging different investor demographic groups and welcomes engagement with others similarly motivated.

Catalytic vs. Concessionary

For many HNI and Family Office investors, it is challenging to determine when Catalytic Capital is really needed to achieve significant impact. At times, they are uncertain if an enterprise or fund has an innovative approach to address a complex problem, or if instead they are merely asking the investor to subsidize an inferior investment opportunity.

To address this challenge, Toniic developed a Catalytic Investment Decision Model, available here. The model helps an investor weigh the potential impact of an investment against the “implied subsidy” (relative to market rate).

Collaboration

Given the inherently collaborative nature of this form of investing and the impact investing community in general, these barriers could be efficiently addressed with shared resources that meet these needs. Our research points to specific, actionable steps the field can take to unlock far more catalytic capital from private asset owners.