Greetings, Agents of Impact!

⏰ Join tomorrow’s Agents of Impact Call. Impact activity is stirring in the stodgy municipal bond market. Tim Coffin of Breckinridge Capital Advisors, Heron’s Barbara VanScoy and Lourdes Germán of Public Finance Initiative will offer their reactions on “How asset allocators are driving racial equity in municipal bonds.” Explore strategies with Preeti Bhattacharji of J.P. Morgan Private Bank, Renaye Manley of the Service Employees International Union, and Harvard’s David Wood, tomorrow June 14, at 10am PT / 1pm ET / 6pm London.

- Last chance to RSVP (All are welcome. This subscriber-only call is open to all, thanks to Robert Wood Johnson Foundation. For unlimited access to all of our subscriber-exclusive events, stories, and more, take advantage of this special introductory offer and save 25%.

- Catch up quickly. Read, “How ‘racial equity audits’ could mitigate risks in municipal bond markets.”

In this week’s Open:

- Institutional climate opportunity

- Auditing racial equity

- Asia’s appetite for impact

- AI + climate = job creation

Let’s jump in. – Dennis Price

Must-reads on ImpactAlpha

- Institutional climate opportunity. Institutional-sized deals are helping institutional investors get over their clean tech hangover, argues contributing editor Imogen Rose-Smith. “From food systems to energy infrastructure, ‘sustainable’ is the opportunity now.”

- Auditing racial equity. Corporations from Google to BlackRock have undertaken racial equity audits to ferret out discriminatory business practices. Investors are now looking to such audits to address racial equity risks in the municipal bond markets.

- Diversity in private equity. In a guest post, Khalida Ali of Vista Equity Partners lays out three actionable steps that any private equity firm can take to capture the benefits of diversity and inclusion.

- Next-gen impact investors. Common Future’s Eric Horvath is broadening the impact talent pipeline by helping public policy students at The City College of New York bring their lived experiences to their goals as impact investors.

Sponsored by Hope Credit Union

⚡ Brighter futures begin with HOPE – and you

Since 1994, Hope Credit Union has provided critical financial resources to more than two million people across the US South in some of the nation’s most impoverished regions.

You can make an impact in these communities, too. Make a socially responsible investment in HOPE’s mission with a Transformational Deposit. Hope offers two flexible account options, including certificates with 12- to 60-month terms, or money market accounts that allow you to access your funds up to six times per month.

Your deposit will empower life-changing economic opportunities in low-wealth, underbanked communities in Alabama, Arkansas, Louisiana, Mississippi and Tennessee. You can help from wherever you are. See how to promote financial equity for those who need it most.

Agents of Impact

🏃🏿♀️ On the move

- Ajay Banga, the former Mastercard chief, formally takes over the World Bank leadership from David Malpass.

- Former HUD Secretary Shaun Donovan is named CEO of Enterprise Community Partners.

- Rodney Foxworth steps down from Common Future to launch Worthmore, an impact investing and venture development firm. Common Future’s Sandhya Nakhasi, Jennifer Njuguna and Jessica Feingold will share CEO duties.

Impact Briefing

🎧 On the podcast

Contributing editor Imogen Rose-Smith joins host Brian Walsh to discuss why institutional impact investors are doubling down on climate investing, despite the ESG backlash. Plus the headlines.

- Listen to the latest episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

Charting the energy transition

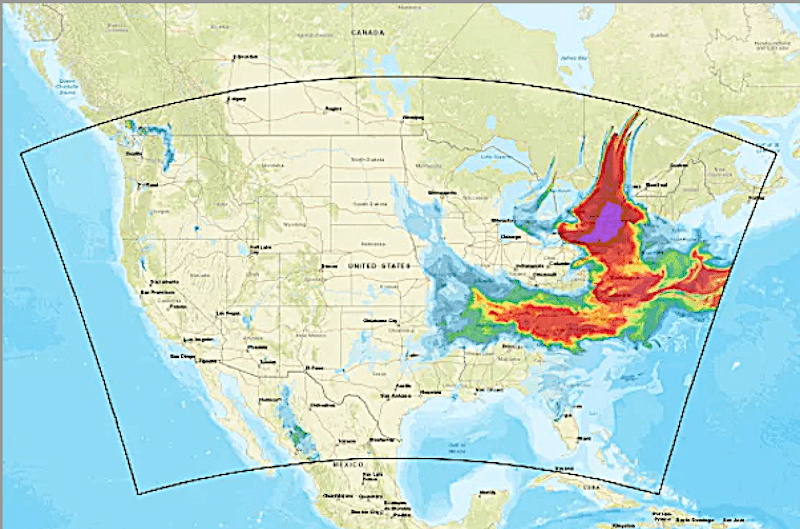

📊 Wildfires drive home costs of climate inaction

The costs of climate change are increasingly hard to ignore. Eight of the worst wildfire seasons on record have also occurred in the past decade, as large swaths of Canada and the US were reminded last week. The Canadian wildfires pushed air quality indexes above 400 in parts of the densely populated East Coast, endangering health and disrupting everything from flights to baseball games. That such disruptions are not factored into economic accounts of climate costs suggests how much we underestimate the true impact of global warming – to health, ecosystems and the economy.

- Climbing costs. Florida is grappling with ballooning insurance costs for hurricanes and floods. State Farm and AllState will no longer insure homes in California because of wildfire risks. Arizona is putting the brakes on new housing development around Phoenix due to dwindling groundwater supplies.

- Keep reading.

Deal Spotlight

💸 Leapfrog Investments highlights Asia’s appetite for impact

Asia’s growing wealth – and with it, private and institutional investors’ capital – is driving more Asian asset owners into impact investing. Last week, Hong Kong-based insurance firm AIA made a $200 million investment in LeapFrog Investments, which has a 14-year track record of investing in insurance, health care and financial services for billions of emerging global consumers.

- Asia opportunity. Investors from Asia once made up only 5% of LeapFrog’s limited partner base. Now they’re close to 30%. “These are not your 100% impact investors. They’re very experienced commercial investors, and they’re very much focused on returns,” LeapFrog’s Yalin Karagodan told ImpactAlpha.

- Read the full spotlight.

Six Signals

📈 Supply-demand mismatch. Demand for scaled impact investment products outstrips supply. The clearest demand is for products with greater ambition and alignment to drive positive impact while simultaneously reducing any negative externalities. (World Economic Forum)

🏢 US manufacturing boom. The manufacturing share of construction spending is at 30-year high. The spike is driven by manufacturing spending on computers / electronics (with incentives from the CHIPS Act) and electric vehicles (with a boost from the IRA). (Joey Politano / Bloomberg)

🤖 AI + climate = job creation. Big data analytics, climate technologies and cybersecurity are expected to be the biggest drivers of job growth over the next five years. Agriculture technologies and AI will be disruptive but result in net positive gains. Only two technologies are expected to result in net losses: humanoid robots and non-humanoid robots. (World Economic Forum)

👷🏾 Resilient workforce. An accelerator in Detroit is working with Black, Indigenous and other contractors of color to prepare diverse contractors to develop and install resilient power systems. (Clean Energy State Alliance)

⚡ Energy efficiency has energy. US sales of residential heat pumps passed gas furnaces for the first time last year, making up 53% of heating system sales. Global energy efficiency investment in 2022 was about $600 billion. (Utility Dive)

☀️ Electric India. The Indian government will not consider proposals for new coal plants for five years. Instead, it will focus on growing renewables and batteries, according to the updated national electricity plan. (AP News)

Get in the Game

💼 Step up

- New York State Insurance Fund is looking for a senior ESG and sustainability lead.

- Coca-Cola Foundation is hiring a senior director of impact investing in Atlanta.

Don’t miss dozens of more impact jobs curated this week on ImpactAlpha.com.

🤝 Meet up

Don’t miss these upcoming impact investing events:

- June 20-22: Asian Venture Philanthropy Network Global Conference 2023 (Kuala Lumpur)

- July 13-14: Africa Impact Summit, hosted by GSG, African national advisory boards for impact investing, and the University of Cape Town’s Bertha Center (Cape Town)

- August 27-30: Latimpacto’s 2023 Conference (Rio de Janeiro)

📬 Get ImpactAlpha Open in your inbox each Tuesday

Don’t be a stranger. Connect with us. Tell us who you are and what you’re up to. Share your news, tips, data points, introductions and high-impact ideas, to [email protected].

See you back here next Tuesday!

Partner with us, including by sponsoring this newsletter. Get in touch.

Get ImpactAlpha for Teams. Save with substantial group discounts. Start here.