Hi there, Agents of Impact!

Welcome to Open, ImpactAlpha’s free weekly newsletter with the top news and opportunities in impact investing and sustainable finance.

✅ ImpactAlpha’s impact fund databases. The Liist, featured below in “must reads,” is a monthly list of impact funds actively raising capital. In recent months, we’ve also launched databases of funds investing in the ownership economy and those making deals at the intersection of climate + gender. We’ll be launching more impact fund databases soon. Subscribers to ImpactAlpha have full access. You, too, can gain access with an ImpactAlpha subscription. Take 25% off.

In this week’s Open:

- ‘Impact alpha’ investors

- Six inclusive economy funds

- Green jobs in Africa

- Psychedelic M&A

Ok, let’s dig in. – Dennis Price

Must-reads on ImpactAlpha

- ‘Impact alpha’ investors. “What investors are seeing is the ability to create a new economy that is not extractive, that is more just, that addresses the needs of the 21st century,” Nancy Pfund of DBL Partners told ImpactAlpha. DBL is a pioneer among the growing ranks of investors that believe delivering outsized impact can drive outsized financial returns or, we daresay, impact alpha. Take a peek.

- Six inclusive economy funds. Fund and investment managers are building out strategies that share ownership, transfer agency and create wealth from real estate, businesses and the green transition. This month’s Liist of impact funds that are in the market raising capital includes community-centric investors like Kensington Corridor Trust in Philadelphia. View all six.

- Green jobs in Africa. Demand for renewable energy, climate-resilient infrastructure and sustainable agriculture is fueling a global green jobs boom, declare Dalberg’s Charlie Habershon, Kusi Hornberger and Inês Charro. That’s spurring upskilling initiatives for Africa’s youth across the continent, as Lucy Ngige and Jessica Pothering report.

- EV glass: Half-full or half-empty? The electric-vehicle transition in the US has turned volatile; that will help sort the ultimate winners from the faint of heart, reports David Bank from the BNEF Summit. Take a swig.

- Land sharing to accelerate the transition. Small operators and public agencies that have relied on oil and gas revenues are installing solar panels and wind turbines on federal lands where pumpjacks and gas rigs have long dominated, as Amy Cortese reports. Go deeper.

- Climate + gender. For investors who want to leverage two huge value-drivers, Heading for Change’s Natalie Shriber suggestssix questions to level up investments in climate + gender. Collect all six.

Sponsored by Tideline

The alpha in impact. What distinguishes impact-led value creation activities from those of traditional or ESG-oriented investors? Tideline and Impact Capital Manager’s forthcoming research report, “New frontiers in value creation,” identifies key characteristics of effective impact value creation. Join Tideline and Impact Capital Managers on Thursday, Feb. 8 for a discussion with leaders from Citi, EQT Group, HCAP Partners, Nuveen and W.K. Kellogg Foundation on effective and financially-material impact value creation.

- RSVP today for “New frontiers in value creation.”

Agents of Impact

🏃🏾♀️ People on the move

- Former Massachusetts Gov. Deval Patrick, previously with Bain Capital, joins Vistria Group as a senior adviser.

- ImpactAssets Capital Partners promotes Houda Ferradji and Helena Hong to investments principal and Siobhan King to portfolio management director.

- Veris Wealth Partners names Eric Hsueh, formerly of Bivium Capital Partners, as director of investments.

The Week’s Call

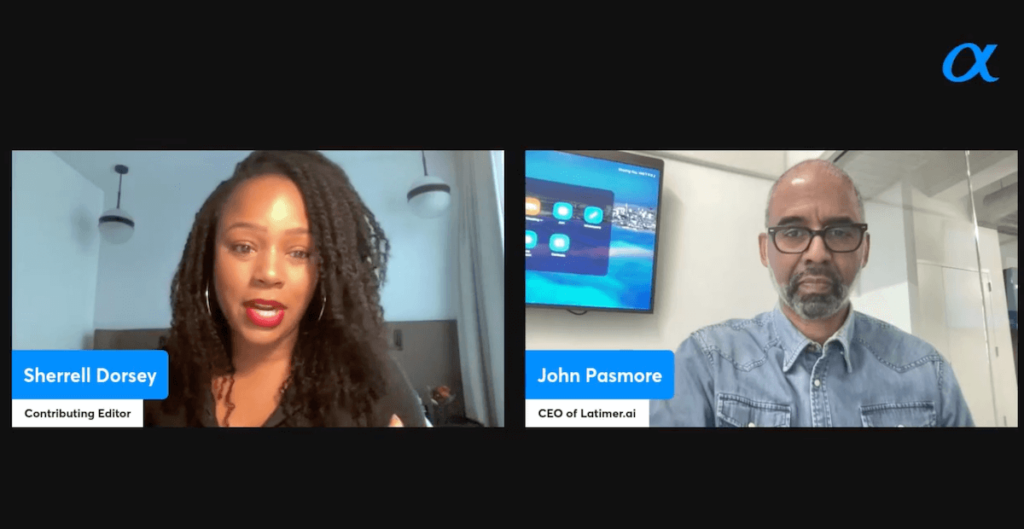

🔌 Plugged In: Building an inclusive AI with ‘BlackGPT’ (video)

Pressure has been building on Meta, Google, Microsoft and OpenAI to address bias in large language models and get right the stories of Black history and culture. “Black and Brown people should own their stories,” Latimer.ai’s John Pasmore told Plugged In host Sherrell Dorsey. Latimer recently released its own beta “BlackGPT,” loaded with Black historical and cultural facts, including from Amsterdam News, the nation’s oldest Black newspaper. If the tech giants eventually get the story right, great, says Pasmore, “I think we should build it ourselves. They can take our API, and always be correct.”

Short Signals: What We’re Reading

🤩 Out of the labs. Direct air capture, synthetic biology, COs-based green products, and fusion energy are among the five game-changing technologies that may be poised for a breakout “ChatGPT” moment. (BCG).

👩🏽🦱👨🏾🦲👩🏻 Diverse unicorns. Of the 1,000 unicorns minted in the past decade, 38 are Black or Latino founded. The billion-dollar babies, including Rihanna’s Savage X Fenty and fintech Brex, are valued at a collective $109 billion. Their most active investor: Tiger Global management. (Harlem Capital)

⏩ Blended finance trends. More nature and climate finance, solutions tailored to local needs, catalytic philanthropy and better measurement and accountability are among the trends driving blended finance in 2024. (UBS)

🤹 Multi-asset class impact. How can impact investors break out of siloed asset classes? More tactical asset allocation is one strategy identified by Impact Frontiers, which explores the issue in a new report. (Impact Frontiers)

😵💫 Psychedelic M&A. Fierce Biotech counted three M&A deals and a half-dozen partnerships in the burgeoning psychedelic therapy field last year (for background, see, “Investors in psychedelics aim to disrupt mental health economics – and outcomes”). Otsuka scooped up Mindset Pharma, MPM BioImpact grabbed Reunion Neuroscience, and Cybin acquired Small Pharma. (Psychedelic Alpha)

Get in the Game

💼 Step up

- Temasek is looking for an impact investing associate in Singapore.

- New Energy Nexus is on the hunt for a CEO.

- Black Farmer Fund seeks a development and investor relations director.

SUBSCRIBER BENEFIT: Visit ImpactAlpha’s Career Hub for more impact investing jobs. Contact us for job postings.

🤝 Meet up

Don’t miss these upcoming ImpactAlpha partner events:

- Feb. 26-28: Neighborhood Economics (San Antonio)

- Feb. 27-29: FLII 2024 (Mérida)

SUBSCRIBE (save 25%) for discounts on partner events.

- Partner with us, including by sponsoring this newsletter. Get in touch.

- Get ImpactAlpha for Teams. Save with substantial group discounts. Start here.