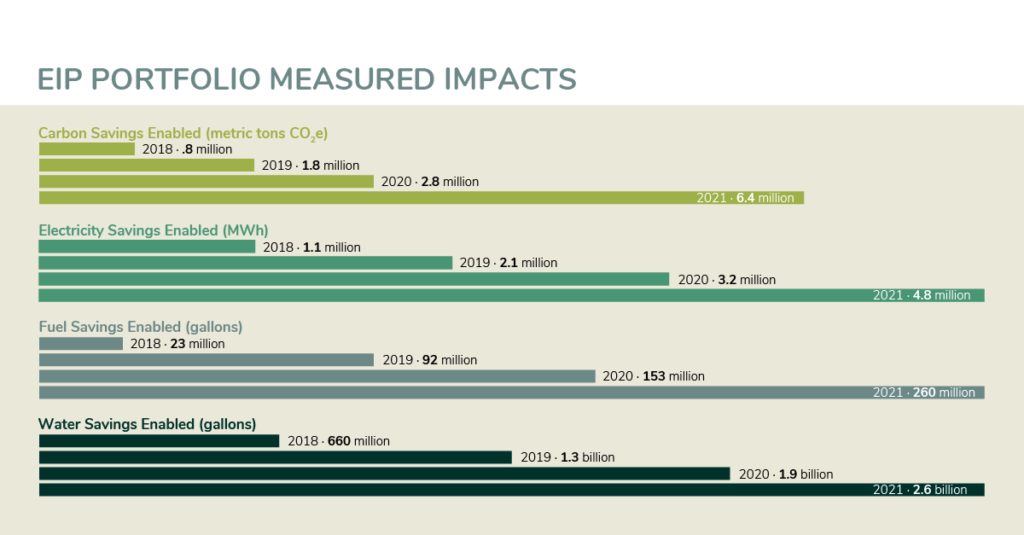

At Energy Impact Partners, we just released our 2022 Impact and ESG report, our fourth consecutive public accounting for our environmental and ESG performance. Among other outcomes, we are proud that the annual carbon savings enabled by actual portfolio company sales increased 225% to 6.4 million metric tons and the lifetime savings from these sales almost doubled to 75.5 million metric tons from last year’s estimates. Water, sulfur dioxide, and nitrogen oxide enabled savings also increased 37%, 29%, and 25% respectively.

We’re also pleased that our non-carbon KPIs and ESG metrics continued to improve, if not quite so dramatically. Total customers, a number that reflects the reach of our technologies, increased 24% within our coalition and 45% overall, with EIP-supported sales reaching over $1 billion in cumulative bookings for our portfolio companies, primarily through collaborations with our partners and select deals with others in the energy ecosystem where EIP has played a hands-on role. Over 15,000 jobs were supported by our portfolio companies in 2021 (compared to 3,500+ in 2020) and 95% of our companies have a DE&I policy or are in the process of adopting one (compared to 83% in 2020).

Since our platform’s whole mission is the clean energy transformation, we have invested a lot in carbon measurement capabilities – in-house and in our investment portfolio. This year, with the help of our portfolio company Greenly, we did a complete Scope 3 footprint for our operations. Although Scope 3 calculations can be challenged by a lack of data, Greenly’s extensive library of emissions data factors and our relatively straightforward operating model allowed us to get a good handle on this part of our footprint.

We recognize that data limits are severe for some companies’ scope 3 efforts and we agree that it is always important to ensure that the added value of a Scope 3 calculation exceeds the effort and noise in the data.

We will continue to push hard to improve our impact and ESG metrics — more carbon savings enabled, more diversity in our sector, lower environmental impacts, and improved social metrics. But there are also other important aspects of impact investment that we’re focusing on beyond the pure assessment and expression of our impact data.

Greater transparency

First off, transparency. As noted, we have been publishing a public report for several years. This year we released both a report and a technical appendix which contains even more detail for practitioners and other interested stakeholders. We think that greater transparency is a tool unto itself to accelerate our own impact as well as the impact of the climate tech sector as a whole.

We are a bit surprised that – so far – very few of our adjacent funds do thorough public reporting, and most do none at all. As we released our report, we surveyed a sample of 96 private equity and venture funds at least partly oriented to clean energy or other impacts. Of these 96, only 38 published any sort of public impact report and only 15 produced complete carbon impact numbers.

Creating a public impact report with carbon savings analyses and ESG metrics for almost 60 companies requires quite a large team effort. One might think that we did this because the securities regulators in the U.S. and Europe are taking hard looks at environmental and climate claims and starting to propose regulations for the public markets.

Actually, we made a decision well before there were any signs of regulatory interest – we simply think public reporting is the right thing to do. However, with heightened regulatory interest the case for high-quality, transparent reporting only gets stronger.

Last year we launched the Frontier Fund, a platform for deep decarbonization technologies at an earlier stage than our other funds. Unlike the companies in our other funds, these venture-stage technologies are not yet selling products, and therefore lack current sales data to use as the basis for measuring enabled carbon savings. Instead, we are using ten-year forecasts of sales along with a careful assessment of the competing technologies our companies will replace to project ten-year savings.

Without a significant explanation for these calculations, it would be nearly impossible for our readers to understand where our numbers came from. Accordingly, we have published a technical appendix that explains each company’s calculation in some detail and also provides some useful background information.

We recognize that much of the data needed to do impact calculations can be highly business-sensitive, and may not be able to be revealed in public reports. We faced this constraint in our technical appendix and worked closely with our portfolio companies to reveal enough to make the calculations credible but still protect confidential information (and we’re proud to say that our companies were all highly supportive of this effort). We think this is vastly better than publishing a few opaque sentences about calculations like this, much less nothing all.

Reporting standards

The second broad issue we are working on – in this case with a great group of peers – is greater standardization. We’re proud to sit on the steering committee of Project Frame, Prime Coalition’s budding effort to create greater standardization in PE and VC impact reporting. The coalition has made great strides in the past year, recently taking on Keri Browder as Executive Director, rounding out the steering committee, and issuing its second white paper.

Our plans for this year center on creating a major series of white papers on several aspects of impact reporting, culminating in a guide that can be used for common reporting standards. In addition to the info on Frame’s website, page 30 of our new report explains how we align our reporting with the emerging Project Frame approach.

One carbon reporting innovation we introduced this year was ownership-weighting our enabled carbon impacts. Like many other funds, we supply only some of the capital our companies need to do the carbon-saving work that they do each day. While it is important to understand the companies’ full results, we think it is also important to weight our own claims of enabling savings by the share of capital we provide. Among other things, this makes it more appropriate to compare our share of the savings we are enabling with our own carbon footprint – a figure analogous to a carbon savings ROI.

This year our share of enabled portfolio annual savings – conservatively excluding lifetime savings and Frontier projections – was about 520,000 metric tons, over 50x our footprint. We look forward to talking further to many peers and stakeholders about whether this new addition to our reporting is useful.

Diversity

We have also highlighted the diversity, equity, and inclusion of our portfolio companies and EIP in our report. We are working to increase our team’s diversity along multiple dimensions and slowly making progress. Beyond our four walls, we want to increase diversity broadly across our sector, where only 2% of all venture capital goes to female founders and 1% to Black founders.

Last year we launched the Elevate Future Fund, open only to founders and executive teams from underrepresented groups, or companies whose customers are traditionally underserved communities. Beyond making investments, Elevate is leveraging our huge investor coalition — over 50 of the largest utilities and industrial firms in the world — to increase supply chain diversity in the energy space. This summer, we have 10 interns from underrepresented groups working across EIP.

We have much to do improving our impact measurement and reporting, as a firm and as an industry. Nonetheless, we feel that we have strong tailwinds, and that impact reporting will expand, improve, and become more transparent in the next several years.

Peter Fox-Penner is Partner & Chief Impact Officer, Gabriella Rocco is Associate, ESG & Impact, and Morgan Sheil is Associate Vice President, ESG & Impact at Energy Impact Partners.