Editor’s note: ImpactAlpha contributing editor Imogen Rose-Smith, a longtime senior writer for Institutional Investor, contributes a bi-weekly column on the policies, practices and strategies of the largest asset allocators, including pensions, foundations, and endowments. As Imogen says, she’s “tracking what investors do, not just what they say.”

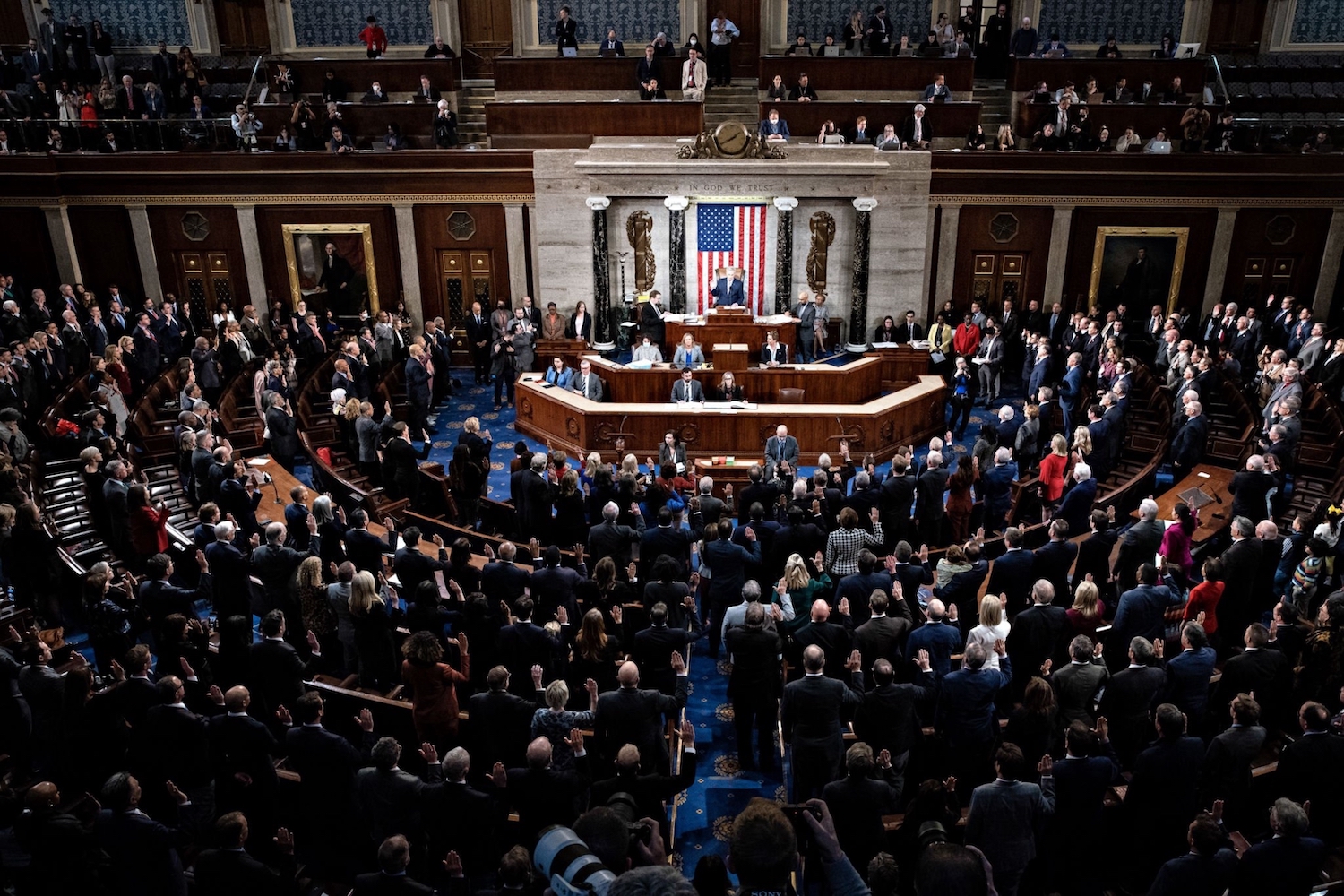

ImpactAlpha, Jan. 11 – When they’re not looking at dick pics from Hunter Biden’s laptop, the Republican majority in the U.S. House of Representatives is promising to make combating ESG a top priority for the new legislative session (hey, blame them, not me, for lowering ImpactAlpha’s tone).

And that has rather flipped the script on the relationship between the GOP and business, and between ESG and U.S. corporations.

Being “anti-corporate” used to be the province of the left. But the GOP’s “culture wars” agenda is putting it at odds with core members of the very business communities they are supposedly so supportive of. Business, at least big business, doesn’t necessarily mind ESG regulation and might positively encourage it.

In many cases the things that sustainable investors want – say, action on climate change, and protection for LBGTQ+ workers – are actually good for business. Or at least bad for competitors. Climate rules, for example, raise the barriers to entry. And since most large businesses operate globally, U.S. rules probably just standardize the inevitable.

Small businesses, however, tend to dislike anything that smacks of more regulation (and higher costs). That makes it easy to make anti-ESG a rallying cry and a popular punching bag for the MAGA crowd.

But that doesn’t make being anti-ESG actually good for business. Rather, “anti woke” is often really really bad business. It’s hard to build successful companies around protectionism and hate.

Hearts and minds

The campaign against ESG is landing at the doorstep of the largest pro-business lobbying organization on the planet.

“House Republicans Plan To Investigate Chamber Of Commerce If They Take The Majority,” was the headline of a prescient article last September by Ryan Grims of The Intercept.

That’s “a stunning turnaround” from just a few years ago, Grims noted. Republicans have long been all chummy-chummy with the Chamber. Now the lobbying group has run afoul of the GOP by speaking up in favor of ESG.

Grims quotes the Chamber’s statement on climate change last year, when it said that “for many companies, climate change and carbon emissions impact long-term value, thereby becoming a factor that retirement fund managers should take into consideration.”

There has always been a tension within the Republican party between corporate titans and small-business conservatives. The Chamber’s perspective moved over time from the latter to the former. But the small-business crowd came to feel that what was “good for General Motors, they said, was not necessarily good for them.”

The Republican Party and the Chamber have polarized to opposite sides of the conservative movement, Grims explained, reawakening a disagreement that dates back at least to Barry Goldwater conservative movement of the 1950s and ’60s.

The small to medium business community became a backbone of the far-right, MAGA, Trump wing of the GOP. Think Hobby Lobby, or the web design company that refused to make websites for gay weddings, and so on (though, obviously, #notallsmallbusinessowners.)

And small businesses tend to hate anything that looks like regulation – including ESG. So as the Republican party cleaves even more to the right, and splits with a more pro big business Chamber so it opens up space for an allegiance between ESG, business, and responsible investors.

Fiduciary follies

Another reason the Chamber of Commerce matters so much to the ESG discussion is everyone’s favorite topic – ERISA. The Employee Retirement Income Security Act of 1974 governs how private – i.e. corporate – pension plans are managed. It is overseen and enforced by the U.S. Department of Labor.

As is by now well-known, the past five administrations have ping-ponged back and forth in their guidance to pension plan fiduciaries with regard to the use of ESG in ERISA pension plans. Biden’s DOL issued its final rule on ESG and ERISA fiduciaries in November, reversing the Trump administration’s reversal.

One issue is the use of ESG funds on 401(k) platforms and/or the consideration of ESG factors when making investment decisions. A second matter considers under what circumstances ERISA fiduciaries can vote their proxies against company management.

In general, the pro-ESG and impact forces have wanted DOL to be in favor of the consideration of ESG factors in investing, and allowing proxy voting in favor of ESG-friendly measures such as measuring a company’s carbon footprint and board diversity.

Conversely, corporations historically have not tended to be in favor of ERISA plans being active on ESG issues. The Chamber has led the charge against greater incorporation of ESG for ERISA fiduciaries.

This old-guard corporate anti-ESG view at least makes some kind of sense. For example, the defense company Lockheed Martin, which has a large well-respected defined-benefit pension plan, does not want to be in a position where, say, its pension plan is choosing to invest in funds that exclude arms companies, or voting proxies against Lockheed Martin’s own management.

It does not have to be the case, however. In Europe, for example, many large corporations are in favor of integrating ESG into their pensions. The British Telecom Pension Scheme, one of the largest defined benefit pension plans in the U.K. with more than $12 billion in assets under management, was a founding signatory to the United Nations-supported Principles for Responsible Investment back in 2006, and founded the sustainable investment firm Federated Hermes.

I recently asked a long time leader in corporate shareholder responsibility, why Europe and U.K. corporations, and their pension funds, were seemingly more open to ESG than their U.S. contemporaries. He said Europeans and Brits largely believe in climate change. And they tend to have more faith in institutions than their U.S. counterparts.

Given the examples from across the pond, business does not have to be anti ESG. If I were one of the groups actively fighting the ESG backlash, I’d be encouraging corporations to voice their support for sustainable investment.

There have to be more companies than Salesforce that support the Security and Exchange Commission’s proposal on climate-change disclosure.

Not the happiest place on earth

Big businesses are starting to favor ESG because, increasingly, sustainability and inclusion mean good business.

If we are honest, back in the early days of the responsible investment movement, much of the activism tried to get companies to stop doing things that were arguably money makers, such as doing business in apartheid South Africa and using slave labor. A company could make more money by ignoring the guidance of responsible investors.

Now, however, sustainable investors want businesses to start doing things that make money – for example by reducing waste, increasing resiliency, attracting diverse talent, or appealing to changing consumer tastes.

The anti ESG – or anti “woke capitalism” – movement, however, can distort those positive investment outcomes by feeding good business decisions into the meatgrinder of Republican culture wars.

The Walt Disney Co., for example, is hardly an ESG darling. It is easy to take the media and entertainment company to task over its representations of gender and race, as well as corporate governance matters such as executive compensation and, ironically, how much it spends on corporate lobbying.

Last year, when the Florida state legislature passed its anti LBGTQ+ “Don’t Say Gay” legislation, Disney eventually did the right thing from an ESG perspective and by its employees. Disney, which is headquartered in California, has 70,000 employees and one of its largest theme parks in Florida.

After initially staying silent, Disney eventually moved against the bill, saying it would stand by its LBGTQ+ employees. In March, then CEO Bob Chapek wrote an open letter to employees, saying, it is “clear that this is not just an issue about a bill in Florida, but instead yet another challenge to basic human rights. You needed me to be a stronger ally in the fight for equal rights and I let you down. I am sorry.”

All hell broke loose. Florida Gov. Ron DeSantis, who has perfected a brand of conservative populism that capitalizes on distrust of big business and Wall Street, worked to revoke Disney’s special tax status in the state. “You’re a corporation based in Burbank, California, and you’re going to martial your economic might to attack the parents of my state?” DeSantis thundered. “We view that as a provocation, and we’re going to fight back against that.” DeSantis carried through on his threat and signed a bill to revoke Disney’s tax status.

So much for business friendly Republicans. As Bloomberg’s Business Week recently explained: “The Secret to Ron DeSantis’s Success? Ignore Donald Trump—and Attack Business Instead.”

Disney’s share price got hosed, the company missed its quarterly earnings and Chapek was forced to resign (for this and other reasons). The board brought back his predecessor, Bob Iger (well-remembered by corporate governance experts for his massive executive compensation packages). Iger also pledged to stand by Disney’s LBGTQ+ employees, and indeed had spoken out against “Don’t Say Gay.”

No matter. According to the Financial Times, Florida lawmakers are now working to restore the law, which basically allows Disney to act as a private government within its state (very ESG!). Disney now looks likely to go ahead with its delayed plan to relocate an additional 2,000 jobs from California to Florida.

Just like anti-ESG pension and treasury legislation is costing red states, so it seems anti-ESG business policies come at a cost to the states that enact them.

“Tax officials and lawmakers have warned that dissolving Disney’s private government threatens to shift an enormous financial burden to taxpayers and potentially transfer a $1 billion debt load to the state,” the Financial Times reports (though DeSantis disputes this characterization).

It’s amazing that a GOP governor can make political hay out of attacking one of his own state’s major employers.

Oh Elon!

And then, of course there’s Twitter.

The whole situation reminds me of the scene from the 1979 film Apocalypse Now, about the Vietnam war, where Captain Ben Willard, Martin Sheen’s character, visits Marlon Brando’s Colonel Kurtz, a blubbery beached whale hauled operating his own rogue militia. Brando asks Sheen, who has been sent to kill Kurtz, “Are my methods unsound?”

Sheen, who has descended into the depths of hell to make this journey, replies, “I don’t see any method at all, sir.”

Twitter is Musk’s Heart of Darkness. I see little or no method at all to what Musk is actually doing. There are clearly agendas and grudges, but no actual plan. Musk might as well have taken a giant pile of $44 billion and burned it.

According to data from research firm Pathmatics, as reported in The Wall Street Journal last month, about 70% of Twitter’s top 100 ad spenders from before Mr. Musk’s takeover weren’t spending on the platform. About 89% of Twitter’s $5.1 billion in 2021 revenue came from ads.

Twitter recently announced that it would take political advertising again, something former CEO Jack Dorsey banned in 2019. Bringing back political advertising adds to corporate advertisers’ concerns that Twitter is becoming a toxic hellhole filled with disinformation and hate speech.

Musk has been clear that, whether or not he bought Twitter for a lark or by accident, he wants to push back on so-called “cancel culture” and the liberal media. He has reinstated Trump, as well as neo-Nazis and other charmers. Research shows that the volume of hate speech has gone up since Musk took over in November. Musk has said that “hate speech impressions” had fallen, a claim that is widely questioned.

Musk also temporarily kicked off a bunch of journalists for being mean to him and sharing information about his private jet. The Twitter chat where Musk appears and tells journalists they are not special is worth a listen. And for the record, journalists are special, and the First Amendment is a thing.

Musk’s Twitter debacle is also contributing to Tesla’s falling share price. Stocks in the automatic car manufacturer fell by 14% on Jan. 2 after the company failed to deliver as many vehicles as anticipated in the fourth quarter. Even Musk ultra-fan, ARK Investments’ Cathie Wood, has admitted that Musk’s antics may put some consumers off buying Tesla cars.

Being anti-woke is just bad business.

Don’t bank on the backlash

Case in point: In October The Wall Street Journal detailed the chaotic founding of GloriFi a new bank “aimed at people who see Wall Street as too liberal.”

GloriFi attracted some big name investors, including notorious libertarian tech billionaire Peter Thiel, and hedge fund founder and Republican mega-donor Ken Griffin. GloriFi co-founder and CEO Toby Neugebauer saw a market made up of the “many Americans have come to believe big banks have moved too far left, and that customers want a bank that reflects their conservative values.”

“It is about my friends that played football at ‘Friday Night Lights,’ he said. “And they don’t feel loved. They don’t feel respected.”

The Journal described a chaotic start-up environment at the Texas based start-up. GloriFi “missed launch dates, blaming faulty technology and failures by vendors, and laid off dozens of employees. It stumbled with products; for instance, a plan to make a credit card out of the same material used for shell casings failed when the company realized the material could interfere with security chips and potentially be too thick for payment terminals, according to people familiar with the matter.”

There were also allegations that Neugebauer, previously the co-founder of a private equity firm that invested in oil and gas, had a volatile temper and drank on the job, a charge Neugebauer dismissed. Unable to secure additional funding, GloriFi was forced to shut down in late November.

It couldn’t have happened to a nicer bank. Still, just because these types of businesses are a bad idea doesn’t mean they won’t continue.

Especially if they are funded by right-wing tech billionaires. One of Eurasia Group’s 10 risks for 2023 is “tech centibillionaire.” Is the “tech centibillionaire a bigger threat to global instability than Putin or Xi?” the research group asks. “It’s unclear but the right question to ask and a critical challenge for the world’s democracies, highlighting the vulnerability of representative political institutions and the growing allure of state control and surveillance.”

The populist political allure of being anti-ESG is going to continue, powered by calculating politicians like DeSantis and ax-grinding billionaires like Musk and Thiel. By the way, a major DeSantis donor is hedge fund manager Paul Tudor Jones, also the founder of corporate ESG rating not-for-profit Just Capital. Make of that what you will.

The new paradigm puts ESG investors in the curious position of being pro-business and pro-innovation. The realignment has its own dangers and contradictions. But if those are the cards the MAGA grandstanders are dealing, let’s play them for real progress for workers, communities and the planet.

Imogen Rose-Smith is a contributing editor at ImpactAlpha. A longtime senior writer for Institutional Investor, she was most recently a fellow in the Office of the Chief Investment Officer of the University of California. Catch up on all of Imogen’s Institutional Impact columns.