ImpactAlpha, Nov. 29 – Wealthy families are feeling the pull of climate investing.

CREO, a nonprofit that for more than a decade has worked with family offices and foundations to help them invest in climate solutions, sees a shift. “Many families investing in climate for the first time are coming to CREO with more ambitious climate aspirations,” says the group’s Regine Clement. But they may not know where to begin, or how to optimize their investments for impact.

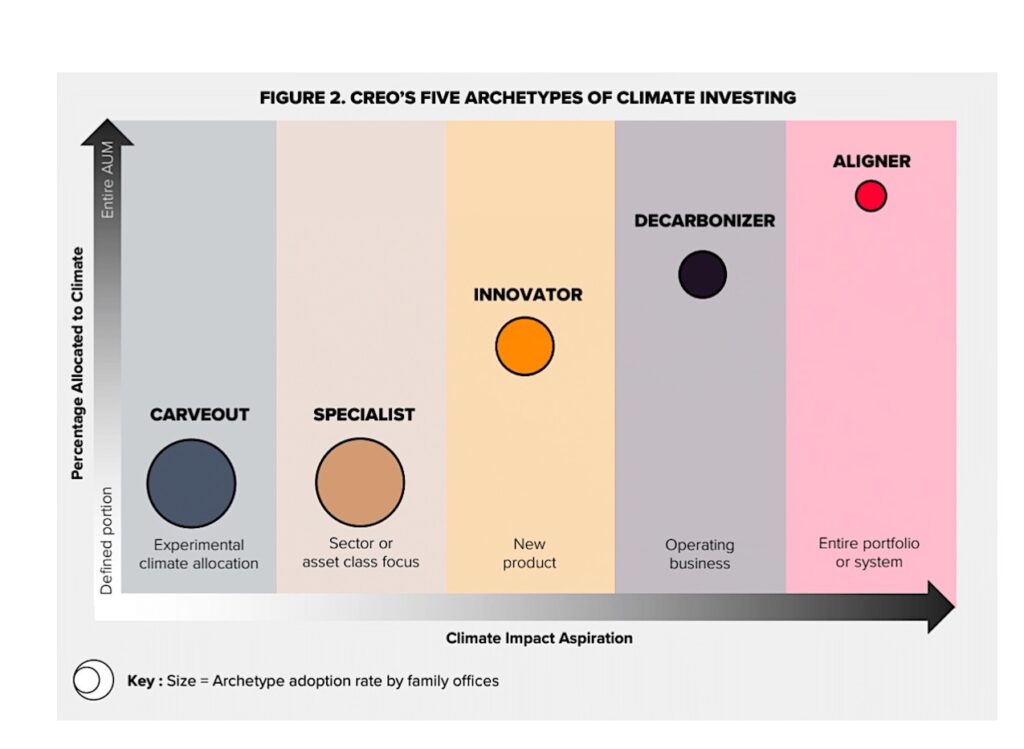

In a new report, CREO distills its experience into five archetypes to help guide families wherever they are on their journey. From “Carve-outs” to “Aligners,” there is no one path, says CREO. But “all families can see themselves in at least one of the archetypes, in whole or part, whatever the stage or experience of their climate investing or philanthropic activities.”

Keeping it tight

“Carve-outs” allocate a portion of their assets to climate-related activities with clear impact and investing goals. “Specialists” focus their allocation on a specific sector or asset class, for example, venture investments in sustainable food companies, and often supplement the focus with philanthropic or concessionary capital.

These are the most common archetypes and provide a wide range of return opportunities.

Raised ambitions

“Innovators” find that they can have more impact by creating their own products and aggregating capital, such as a long-short public equity fund for climate-committed companies, or a blended capital fund for high impact emissions-reduction projects.

“Aligners” look to dovetail all of their investing activities, from philanthropy to shareholder engagement, with their climate goals. While best done in stages, “more families are considering alignment earlier in their climate investing journey,” notes CREO, and pursuing “a whole portfolio approach including real estate, public equities, fixed income and bonds, and alternative investments.”

Decarbonizers

Many wealthy families operate or control their own companies, offering an opportunity to green their businesses and increase value. CREO reports “rapidly growing interest” from family-owned businesses committing to net zero plans.

Bonus: “Decarbonizers” can create synergies by leveraging investment portfolios to support decarbonization goals.