On the opening day of the COP28, the loss and damage fund to help vulnerable countries cope with the impact of climate change was officially launched. With this, the global discourse on climate finance for adaptation and resilience is gaining momentum, and rightfully so.

However, the discussion around finance is more than determining the flows of capital – climate justice must become the focal point of the broader climate finance narrative, given the interconnectedness of environmental sustainability and social equity.

As we grapple with the impending climate crisis, it is becoming increasingly evident that financial inclusion plays a pivotal role in the pursuit of climate justice.

Imbalance of climate finance

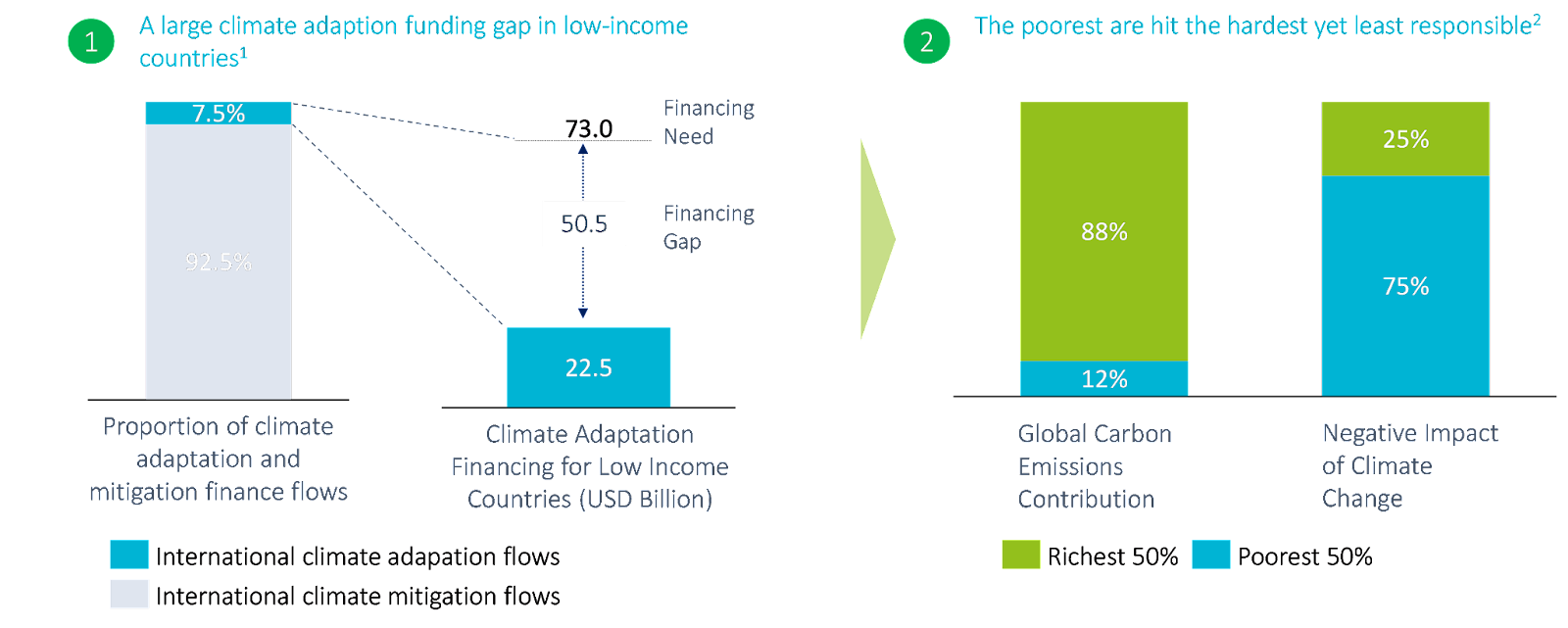

We encounter two glaring issues in the state of climate finance today. First, climate finance, which is critical for both climate mitigation and adaptation, falls short of the colossal requirements on the adaptation side. Over 92% of the climate finance is directed towards climate mitigation efforts, leaving a meager share for adaptation and resilience building. This imbalance underscores a critical deficiency in our approach, leaving an annual financing gap of USD $50.5 billion in climate adaptation financing for low income countries.

Second, the most vulnerable people, who mostly live and work in the global south are least responsible yet the hardest hit. The share of emissions of the poorest 50% globally is at a measly 12%, however, they face up to 75% of the negative impacts of climate change. It is thus a moral imperative that climate finance works for the people that are affected the most by climate change.

Resilience-building

Resilience building is the linchpin of climate justice, particularly for the most vulnerable populations in emerging economies. To sound like a broken record, climate change isn’t a distant threat but a pressing reality. People’s capacity to withstand the adverse effects of a changing climate hinges on their ability to adapt, and this adaptation requires financial resources. It is crucial to highlight this issue through real-world examples.

The Horn of Africa is experiencing its most severe drought in 40 years, directly affecting around 50 million people and putting an additional 100 million at risk in the wider area. Human-induced climate change is a key factor behind this devastating drought, with five consecutive seasons of below-average rainfall and higher temperatures. The region is grappling with acute food insecurity, potentially leading to famine for 20 million people. At least 4.35 million individuals require humanitarian aid, and 180,000 refugees have fled Somalia and South Sudan to Kenya and Ethiopia.

It is estimated that the ongoing drought would not have occurred in a world 1.2 degrees Celsius cooler, emphasizing the significant impact of climate change on drought frequency, making events like the current one around 100 times more likely. These findings emphasize the vulnerability of communities to climate change and underscore the pressing need for financing climate adaptation and resilience building efforts.

Role of financial institutions

To effectively address the pressing need for climate resilience and the allocation of funds, financial institutions will play a pivotal role in enabling autonomous adaptation. To meet the objectives of large scale funds such as the loss and damage fund, these institutions can provide significant local know-how, a crucial asset as adaptation efforts are highly localized. Their established relationships with end clients provide a unique advantage, allowing for the development of tailor-made financial products that support communities in developing their own resilience strategies.

For instance, consider a recent encounter with one of our end clients in Kenya. When we met them, they told us how they had utilized a home improvement loan for a purpose beyond conventional uses. In addition to building a concrete roof on their home, they used part of the loan to construct a rainwater harvesting tank to conserve water, given the drought in the country. This innovative adaptation strategy, born out of local need, highlights the importance of financial institutions in enabling climate-resilient practices.

However, directing funds alone is not sufficient. Many financial institutions are currently ill-equipped to fully support their clients in climate adaptation endeavors. They require not only financial assistance but also non-financial support to navigate the complexities of climate-related financial products and risk assessment.

Three-stage solution

To address this issue comprehensively, we propose a three-fold approach that financial institutions can adopt, focusing on intention, system, and solution.

- Intention: Financial institutions must commit to having a climate strategy. They should make a conscious decision to lend to clients who share this commitment. This will serve as a powerful catalyst for directing financial resources towards climate adaptation.

- System: The financial sector should invest in building tools and knowledge to analyze climate risks and the specific needs of their investees. Data-driven insights are crucial in identifying where financial support is most needed. These institutions should strive to assess climate risks accurately and comprehensively.

- Solution: Finally, financial institutions must create both financial and non-financial products tailored to the needs of their investees. These products should not only provide financial assistance but also offer guidance and support in implementing climate-resilient practices.

For instance, a financial institution operating in Bangladesh might develop specialized agricultural insurance products for small farmers, along with providing training and guidance on climate-resilient farming techniques. Similarly, a bank in Peru could offer low-interest loans to businesses looking to invest in cyclone-resistant infrastructure.

The pursuit of climate justice necessitates a reevaluation of climate finance. It requires a more equitable distribution of resources, with a stronger emphasis on grassroots resilience building. Financial institutions, with their capacity to drive change, are well-positioned to lead the way. However, this endeavor demands a comprehensive approach encompassing intention, system, and solution, and a commitment to understanding the unique climate challenges faced by their clients.

As we navigate the tumultuous waters of climate change, financial inclusion emerges as the linchpin of climate justice, bridging the gap between mitigation and adaptation. It’s a shift that not only aligns with the principles of climate justice but also secures a more sustainable and equitable future for all.

Paul Buysens, Co-CEO, and Kapil Kanungo, private equity and fund development manager, work at Incofin Investment Management.

Incofin is a leading impact investor headquartered in Belgium, managing and manages over $1.4 billion of assets under management across in private debt and private equity. For more information, visit www.incofin.com.