ImpactAlpha, May 12 – The war in Ukraine and high gas prices gave oil and gas interests an opening to push back against efforts to wind down fossil-fuel production. Now, with U.S. midterm elections looming, a broader backlash has erupted against environmental, social and governance, or ESG investing.

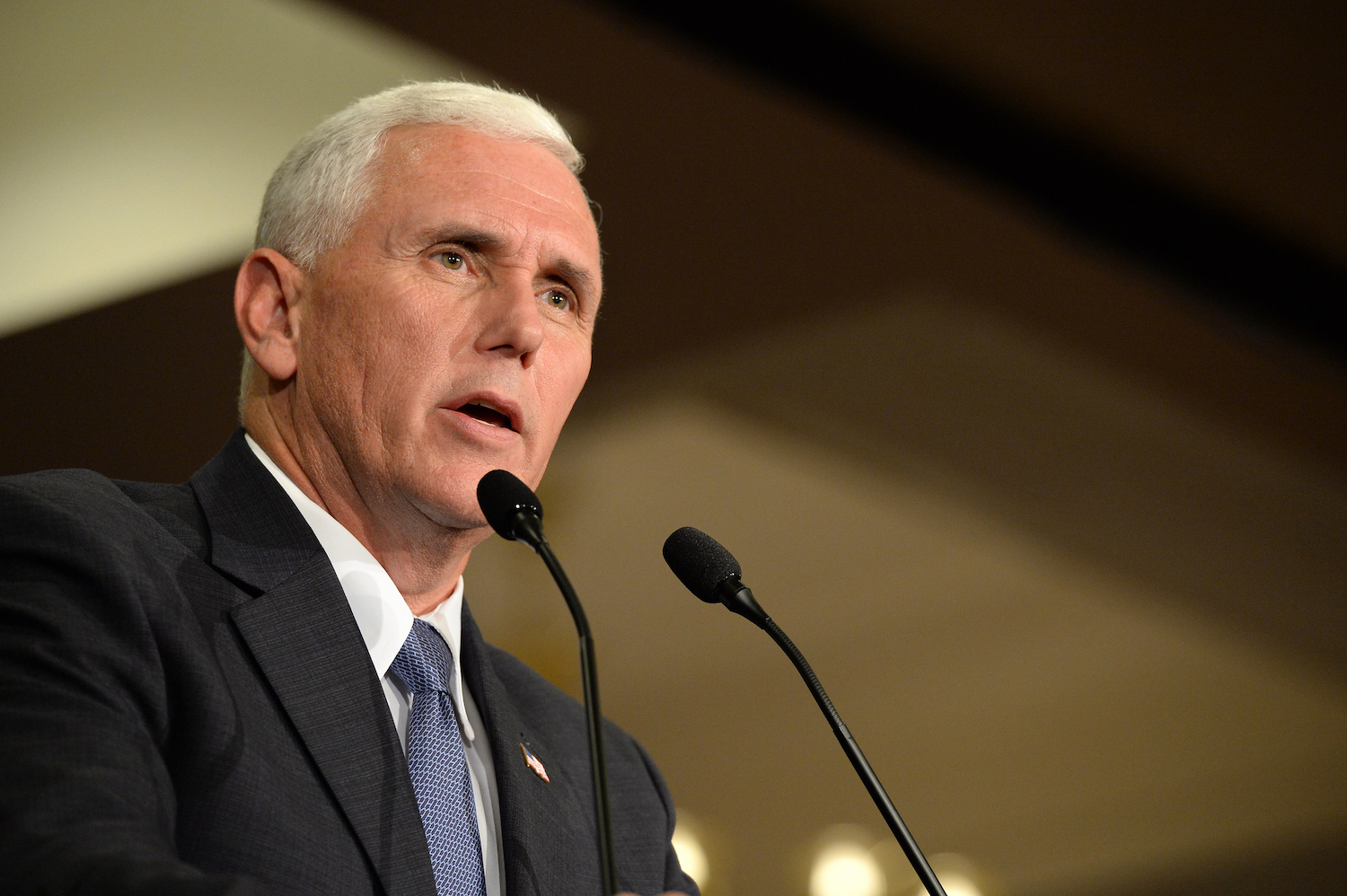

Former Vice President Mike Pence is calling on states to rein in investment funds “pushing a radical ESG agenda.” Electric vehicle billionaire Elon Musk has called corporate ESG “the Devil Incarnate.” Billionaire investor Peter Thiel says, “When you think ESG, you should be thinking Chinese Communist Party.”

Move over, critical race theory. ESG is the newest front in the overheated culture wars.

ESG emerged as a risk-management approach in the past decade, as it became clear that many “non-financial” factors are, in fact, material to companies’ performance, and thus should be managed and disclosed to investors. One irony of the emerging backlash is that many advocates of the approach think ESG doesn’t go far enough in driving actual impact on environmental and social challenges, in particular climate change.

An additional irony is that opponents of ESG are trying to bring the force of government to preclude investment managers from performing what many see as their fiduciary duty to manage material risks to their portfolios. Usually laissez-faire politicians and billionaires are railing against the free market’s move to increasingly integrate ESG considerations into investment decision-making.

The backlash is “pro-risk and anti-free enterprise,” as Andrew Behar of the shareholder advocacy group As You Sow puts it.

At least 50 “anti-ESG” shareholder proposals have been filed at companies this year, twice as many as last year. The proposals have garnered, on average, a mere 3% of shareholder votes.

“We get the sense that the intent behind some of these proposals is less to offer a constructive path to change and more to disrupt a movement that is gaining steam,” wrote Ruth Saldanha at Morningstar.

Pressure tactics

The ESG backlash faces strong headwinds, as companies voluntarily move to mitigate climate risks and increasingly recognize the business case for diversity and inclusion. Assets that account for ESG total more than $40 trillion and are approaching one-third of global assets under management.

“We have such a clear risk argument and such clear demand from investors,” says Ceres’ Kirsten Spalding. “I think it would be very hard to go back on this level of engagement for the investment community.”

But opponents are angling to push back against additional entrenchment of ESG approaches. Billionaires like Musk, Thiel and Marc Andreessen may just be venting against anything that constrains their personal prerogatives (cf. Bitcoin). Thiel and investor Bill Ackman are backing Strive Asset Management, an “anti-woke” fund manager who urges companies to steer clear of social and environmental issues (Strive has raised just $20 million).

Once satisfied with mere disclosure, investors are now pressing for data that demonstrates a company’s progress on social and climate performance. The Securities and Exchange Commission is considering rules to mandate comprehensive climate reporting and is expected to propose disclosure guidelines for human capital management and other “S” issues as well.

The political pressure may have played a role in the SEC’s decision to extend the public comment period on its proposed climate ruling. Congressional Republicans had accused the S.E.C. of relying on short comment periods to push “a scorched earth rule-making agenda.”

Fossil-fuel interests have targeted ESG practices to stall movement toward divestment of oil and gas stocks and restrictions on bank financing for exploration and drilling. Texas’ Gov. Greg Abbott is calling for the state’s pension funds to blacklist BlackRock and other large asset managers for using ESG in investment decisions. West Virginia’s Board of Treasury Investment dropped BlackRock funds from its portfolio in January.

“It’s denial of the complexity of late-stage capitalism,” says Heidi Welsh of the Sustainable Investment Institute, and “the many challenges that affect companies and investors in a complicated world.”

ESG opponents may be counting on the perception of controversy to give proponents cold feet – or an excuse to conduct business as usual. BlackRock this week announced new “stewardship” guidelines that dial back its support for climate proposals it deems too “prescriptive.”

Noting the geopolitical situation, energy market pressures and inflation, BlackRock indicated it might not support shareholder proposals calling for an end to financing for fossil fuel companies, requiring alignment “solely” with 1.5 degree warming scenarios for banks and energy companies, absolute Scope 3 emissions reduction targets, and taking positions on corporate lobbying. That’s a far cry from BlackRock chief Larry Fink’s full-throated calls for climate action.

And indeed, shareholder proposals to end fossil fuel financing at Citigroup, Bank of America and Wells Fargo received scant support.

The backlash so far may be a warm-up for amped up attacks ahead of the midterm election in November and presidential contest in 2024.

In Houston this week, Pence called out BlackRock for supporting Engine No. 1’s campaign to elect three independent directors to ExxonMobil’s board last year. Those “environmentalists,” said Pence, “are now working to undermine the company from inside.” (Reality check: the new directors include the former executive chairman of Marathon Petroleum, a former executive of the oil refiner Neste’s renewable products unit, and a former U.S. assistant secretary of energy. Exxon, by the way, remains a climate laggard).

“Liberal activist investors are forcing private companies to abide by ESG investing principles elevating left wing environmental, social and corporate governance goals over the interests of the business shareholders or employees,” Pence said.

Beyond ESG

The scattershot attack from the right has almost eclipsed the more fundamental critique that ESG is largely focused on risks to companies, not risks to the world. A Bloomberg examination last year of ESG ratings determined that ESG is a risk mitigation strategy for companies that doesn’t necessarily translate into positive impact.

“Many experienced ESG investors are very clear about the value of their approach and about its limits,” Amit Bouri of the Global Impact Investing Network wrote in ImpactAlpha in February.

Tesla, for example, the world’s largest maker of electric vehicles, gets a worse ESG rating than at least two oil majors, OMV AG and Repsol, according to the ratings agency Sustainalytics, in part over a number of labor-related issues. Nia Impact Capital recently removed Tesla stock from its client portfolios “given the lack of effective response to the lawsuits on racial discrimination experienced in Tesla factories,” Nia’s Kristen Hull wrote in an update.

“Stop the outrageous false ESG assessments, where Tesla gets a bad grade, but an oil company can get a good grade. Total gaming of the system!,” Musk, yes, tweeted.

“Tesla is not denouncing ESG investments, added Hiro Mizuno, formerly of the Japan Government Pension Investment Fund and who now sits on Tesla’s board, “but urges ESG rating schemes to fairly evaluate a company’s positive impacts as well as negative impacts.”

Tesla’s recent impact report drives home the point. “As the world needs to strive for a substantial positive impact, we won’t be referring to ESG in this report,” Tesla writes in a forward to the report. “Instead, we’ll talk about Impact.”

Now that’s a conversation worth having.