Impak Battles, an ImpactAlpha series with impak, a Montreal-based impact ratings agency, assesses the positive and negative impact of corporate operations. Each month, the agency uses its impak Score rating methodology in a head-to-head assessment of two representative companies. Earlier editions: Nestlé vs. Danone, Engie vs. Enel, Novartis vs Sanofi and Crédit Agricole vs. BNP Paribas. Next up: A comparison of the two European energy companies. Face-off!

Editor note on guest commentator. VEGA Investment Managers is an investor in Neste Oyj through its VEGA Transformation Responsable fund, which uses the impak analysis to evaluate portfolio companies. Impak has asked the company to share its analysis on Neste Oyj for the purposes of this post. (VEGA Investment Managers is a subsidiary of Natixis.*)

Since the 1980s, it seems as if no other sector could better incarnate the global capitalist villain than the oil and gas industry, in particular for their role in climate change. This remains true to a lot of people, yet some of these companies have started a clear shift towards different forms of renewable energies. With the climate and social crises already changing global economies, the golden age of fossil fuel is fading away and a new mindset is taking its place.

This face-off is with two European energy companies: French energy company Total, a recognized powerhouse, and Finnish company Neste Oyj, the David to this Goliath.

Data are based on both companies’ 2018 public financial and extra-financial statements, compiled using impak’s rating methodology and aligned with the Impact Management Project framework. The methodology follows the IMP classification: A (act to avoid Harm), B (benefit stakeholders), C (contribute to solutions) and Z (does or may cause harm).

COVID-19 response

COVID responses are not part of the current analysis, but it remains important to keep the following in mind for future impact statements and impact growth.

Total has provided French health care establishments and senior homes with gasoline vouchers worth up to 50 million euros to be used in Total stations. The French energy company has also implemented strict measures such as dividing the number of employees by three in its workplaces and switching to remote work when possible. Total mentioned that it will not seek support from the French government for COVID-related financial problems.

As for the Finnish Neste Oyj, it says it has supplied more than 1.6 billion gallons of renewable diesel across various cities and businesses to keep necessary vehicles moving.

Positive impacts

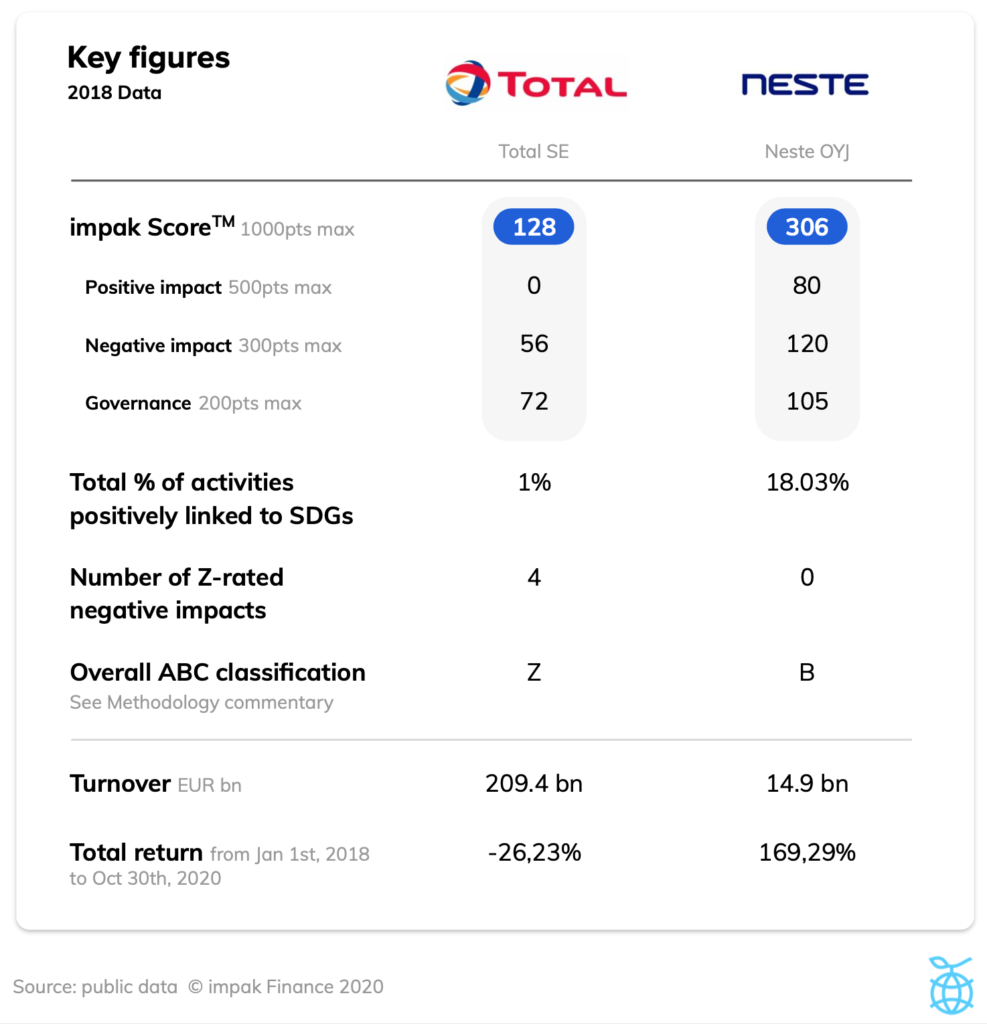

Total: 0/500

Total’s most significant material positive impact is the sale of renewable electricity to client companies, which represents a total of 1% of its activities. Its other positive impact accounts for 0.02% of its activities and relates to the sale of solar products to underserved populations. This last impact is rated C, which means that according to the IMP framework, it contributes to solutions (see methodology note below). The level of intentionality, reporting, and research and development for Total’s second positive impact is strong compared to other impacts from CAC 40 companies.

Neste Oyj: 80/500 *Winner*

Neste Oyj dedicates 18.03% of its activities to three material positive impacts, which are closely connected. The Finnish company uses animal fat from the food industry’s waste and vegetable oil processing waste and residues (first impact) to produce renewable energy (second impact), that is then sold to other companies to help them limit their greenhouse gas emissions (third impact). Neste also produces biofuels from waste, but the lack of information prevents us from considering it in our analysis.

Why VEGA chose NESTE Oyj?

The only energy company in the VEGA fund, Neste Oyj, has 70% of its revenue coming from traditional oil products. However, this number is decreasing, and most of its investments are now made in its renewable activities. A gradual shift towards renewable energy that began more than 10 years ago resulted in the group becoming a leader in renewable diesel, a high performance biofuel developed through advanced technology, and in innovating renewable petroleum products. Thanks to solid fundamentals, Neste’s strategy focusing on high quality renewable fuel growth presents competitive benefits (analysis completed on 16 November 2020).

Negative impact mitigation

Total: 56/300

Out of 10 material negative impacts, 4 are rated Z, meaning that they cause or may cause harm. This high number explains why the Group has lost 100% of its positive impact score. Let’s take a closer look at the Zs. One is linked to Sustainable Development Goal No. 8: Decent work and economic growth, and is due to the high number of short and long-term accidents and chronic illnesses within Total’s workforce.

A second Z refers to hazardous and non-hazardous waste production, mostly due to the refining-chemistry branch which relates to SDG No. 12: Responsible consumption and production.

Total earned a third Z as it fails to acknowledge and mitigate its negative impacts on SDG No. 14: Life below water, mainly related to its activities on water pollution, contribution to climate change and ocean noise. As for its last Z-rated impact, it relates to business ethics, an outcome of SDG No. 16: Peace, justice and strong institutions, and is due to a fine in 2018 for a bribery case in Iran.

Neste Oyj: 120/300 *Winner*

A very rare occurrence in our impak Battles, Neste Oyj has no negative impact which is rated Z, meaning they have had no convictions since 2018, and that they mitigated and reported information on their eight material negative impacts.

For a company that still produces traditional crude oil refining as a main business line, and for companies marketing fuel, lubricants, and solvents, the fact that Neste has no Z-rated impact is noteworthy.

Governance

Total: 72/200

Neste Oyj: 105/200 *Winner*

This is by far the highest sub-score for Total. In fact, when looking at the details, Total scores higher than Neste for impact integration. This means that stakeholders are represented in the governance structure as governance body members, who take part to some extent in the business’s decision-making process. However, Neste Oyj gets the maximum points on some aspects, notably: it clearly identifies its mission which includes an environmental and social issue as well as a solution to these issues, and it identifies the opportunities to increase positive impacts and reduce negative impact along its value chain.

The Winner: Neste Oyj (306/1000)

The battle felt as if one of the two companies already knew what the future holds and had taken actions to have its share of the pie. With a strong shift towards renewable energy, Neste Oyj is the prominent winner of this battle. It demonstrates a clear plan to mitigate all of its material negative impacts and acheived an impak Score more than twice that of Total.

Total has an impak Score of 128 out of 1,000, way below CAC 40’s average Score of 206. Although it mitigates some of its negative impacts, the low percentage of activities dedicated to positive impacts remain too thin to embody a significant change in the company’s old habits.

Specificity of the sector

Energy, no matter what form it takes, is essential to human life. With the state of the world today and the phenomenal growth in sustainable investments in the last few months, the transition to renewables presents a big and growing opportunity. According to Allied Market Research, the renewable energy sector is expected to reach $1,512.3 Billion by 2025, and the oil and gas laggards will have to decide soon enough whether they finally want a piece of that cake or not.

Methodological notes

It should be said that both companies count a few other potential positive impacts that were not taken into account because of a lack of information or because they represent less than 0,01% of the companies’ total activities.

Note that according to our methodology, the level of penalties in case of a Z is based on 3 different factors: the type of Z (does cause harm or may cause harm), the repetition of the Z through time and, only in the case of a Z ”does cause harm”, whether or not corrective actions have been implemented.

Two positive impacts can overlap—for example, if the same product is certified Fair Trade AND Organic. The percentages of activities linked to these impacts are therefore not cumulative.

Duration is the timeframe for which the stakeholder experiences the outcome, and Depth is what is defined as the degree of change for the beneficiaries. Both relate to the How Much dimension, one of the 5 dimensions defined by the IMP.

DISCLAIMER:

Information contained in these articles is provided solely for informational purposes and therefore does not constitute advice on or an offer to buy or sell a security. impak Finance is not liable for the induced consequences when third parties use these opinions either to make investment decisions or to make any kind of business transaction. This information is subject to impak Finance’s terms of use and compliance policies.

*VEGA Investment Managers is not liable in any way for the information contained in these articles. The analysis of VEGA IM does not constitute an advice for investment or a recommendation.