Impak Battles, an ImpactAlpha series with impak, a Montreal-based impact ratings agency, assesses the positive and negative impact of corporate operations. Each month, the agency uses its impak Score rating methodology in a head-to-head assessment of two representative companies. Earlier editions: Nestlé vs. Danone and Engie vs. Enel. A comparison of the two European pharmaceutical companies. Face-off!

In these trying times, pharmaceutical and biomedical companies’ efforts to fight COVID-19 are in the headlines. And as investors reallocate their portfolios, we thought we’d look deeper at the impact of two giants from the Pharma sector: The Swiss Novartis and the French Sanofi.

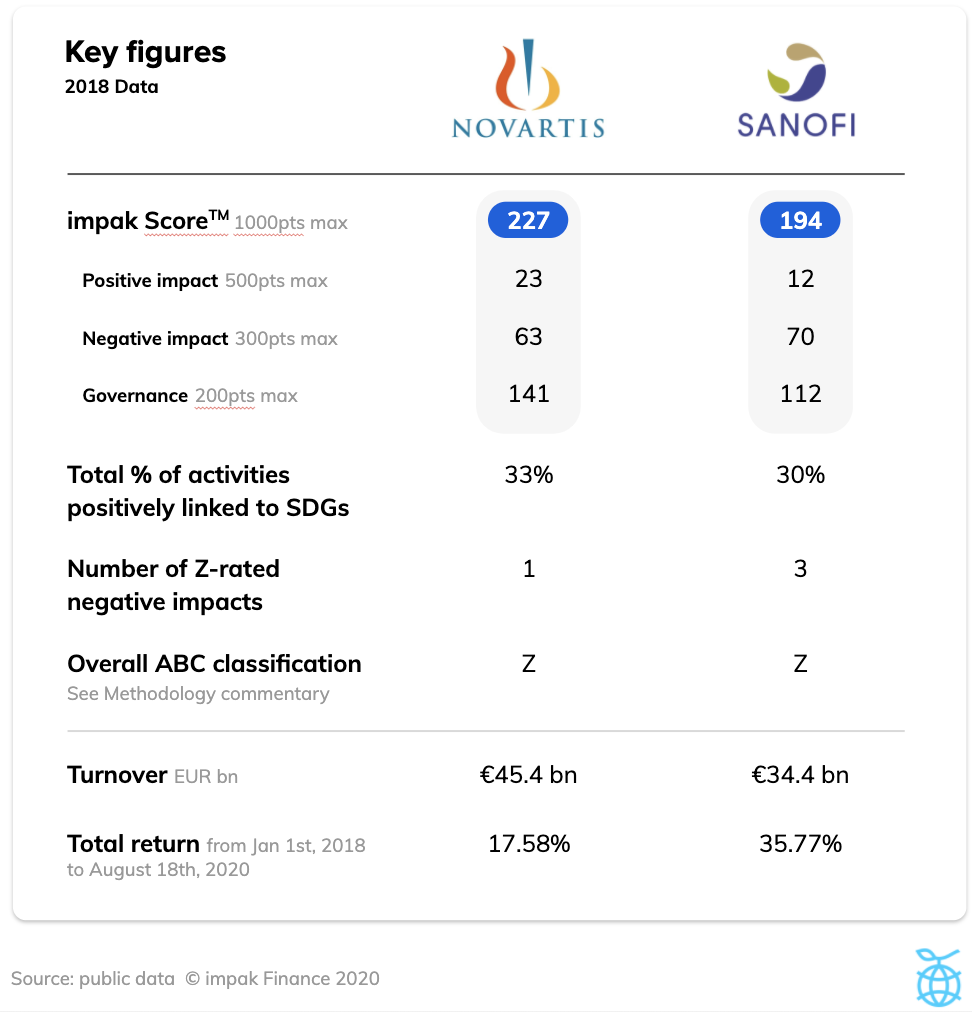

Looking at past impact data is a fair predictor of future sustainability actions. Here is a quick overview of the social and environmental impact of both companies, based on their 2018 impact statements and impak Score.

COVID-19 response

While not part of this analysis, it is relevant to note the companies’ responses to the coronavirus crisis. Sanofi is working with Translate Bio, the Biomedical Advanced Research and Development Authority, and GSK on a vaccine. Sanofi France also donated €100 million euros to public hospitals and nursing homes.

Similarly, Novartis donated $20 million in grants to public health initiatives as well as being part of the COVID-19 Therapeutics Accelerator. AveXis, a Novartis company, has begun manufacturing the AAVCOVID vaccine currently in preclinical studies. Finally, Novartis launched a not-for-profit portfolio to help low-income and lower-middle-income countries access affordable medicines to treat COVID-19. For both companies, questions remain as to whether vaccines will be affordable or not. To be continued.

Positive impacts

Novartis: 23/500 *Winner*

Novartis dedicates 29% of its activities to one outcome linked to UN Sustainable Development Goal No. 3: developing medicines to treat cancers, diabetes, respiratory and cardiovascular diseases. The firm’s other three positive impacts represent 4%, which means Novartis dedicates a total of 33% of its activities to positive impact generation.

Sanofi: 12/500

Sanofi, on the other hand, has three positive impacts totaling 30% of its activities. Its highest percentage for a positive impact is 22%, for the outcome linked to SDG No. 3 “Partnership and healthcare product manufacturing and distribution in order to increase access to treatments for non communicable diseases.”

Negative impact mitigation

Novartis: 63/300

Novartis has 10 identified material negative impacts on people and the planet, including nine “A”s and one “Z”—a Z results in the company’s positive impact score being penalized according to a set of rules evaluating the seriousness of the Z (see Methodological notes). This Z, linked to SDG No. 16, is the consequence of its many convictions and ongoing trials related to business ethics (bribery, data manipulation, etc.), like the $195 million fine to Sandoz (one of Novartis’ subsidiaries) for four antitrust issues. One of the 2018 ongoing trials resulted last June in Novartis agreeing to pay the US Securities and Exchange Commission $642 million for bribing foreign health workers to use Novartis-branded products.

Sanofi: 70/300 *Winner*

Sanofi has eight identified material negative impacts including five “A”s and three “Z”s: two Zs, linked to SDG No. 16, are due to convictions regarding corruption and a defective drug issue in France and the Philippines (Depakine and Dengvaxia). The other Z is linked to SDG No. 3, particularly the access and affordability target, due to the company’s opaque drug-pricing system in the US— strongly related to the 170% insulin price increase from 2010 to 2018— and shortage of medicines across Europe.

Novartis’ slightly lower negative impact score is explained by the fact that, although Sanofi has three Zs, it seems to mitigate its other negative impacts well and with a good level of transparency. Novartis lags behind in that regard.

Governance

Novartis: 141/200 *Winner* Sanofi: 112/200

Here lies the most significant difference in sub-scores between the two companies. The discrepancy is mainly due to the fact that Novartis’ mission includes environmental and social issues as well as a solution to these issues, which is a key factor in driving impact. Sanofi is not as precise. Note that Novartis is in partnership with the Impact Management Project.

The winner: Novartis (impak Score: 227/1000)

Global goals

One could wonder why a pharmaceutical company doesn’t have 100% of their activities linked with SDG No. 3. Well, it turns out SDG No. 3 has a big focus on addressing health in developing countries—where the need is much higher—and therefore on affordability. Hence, either companies do not provide enough data to adequately link their activities to the SDG, or certain drugs or R&D do not qualify.

Methodological notes

Data are based on both companies’ 2018 public financial and extra-financial statements, compiled using impak’s rating methodology available on www.impakfinance.com, and aligned with the Impact Management Project (IMP) framework.

The methodology follows the IMP classification: A (Act to avoid Harm), B (Benefit stakeholders), C (Contribute to solutions), and Z (Does or may cause harm).

It should be said that both companies count a few other potential positive impacts that were not taken into account because of a lack of information or because they represent less than 0,01% of the companies’ total activities.

Note that according to our methodology, the level of penalties in case of a Z is based on 3 different factors: the type of Z (does cause harm or may cause harm), the repetition of the Z throughout time and, only in the case of a Z ”does cause harm”, whether or not corrective actions have been taken.

Two positive impacts can overlap—for example, if the same product is certified Fair Trade AND Organic. The percentages of activities linked to these impacts are therefore not cumulative.

Duration is the timeframe for which the stakeholder experiences the outcome, and Depth is what is defined as the degree of change for the beneficiaries. Both relate to the How Much dimension, one of the 5 dimensions defined by the IMP.

DISCLAIMER: Information contained in these articles is provided solely for informational purposes and therefore does not constitute advice on or an offer to buy or sell a security. impak Finance is not liable for the induced consequences when third parties use these opinions either to make investment decisions or to make any kind of business transaction. This information is subject to impak Finance’s terms of use and compliance policies.

impak, the independent impact rating agency, regularly publishes content providing transparent data on the social and environmental impact of companies. By doing so, it aims to accelerate the transition towards a stakeholder economy generating an overall more positive contribution to society.