This year’s Ben Affleck and Matt Damon movie, Air, is a classic story of American enterprise. It features people and organizations once on the margins but now central to our pop culture narrative: Nike in its early days; marketing executive Sonny Vaccaro, ever on the sidelines of the court; and an upstart player named Michael Jordan, who was just launching his NBA career.

By the movie’s end — and in real life — wealth has flourished: for shareholders, for executives and for Michael Jordan and his family.

But here’s a puzzle: Why Jordan, and not many others? He is not the first basketball star to receive a massive sneaker sponsorship, nor the first to sign a player-driven product marketing deal. Yet, the success of the Air Jordan made Michael Jordan one of the richest athletes in the history of the sport and changed the economic trajectory of the Jordan family. What was different about the Air Jordan story?

One word: Ownership. In his deal with Nike, Jordan gets 5% of the earnings from Jordan Brand, netting him more than $1 billion.

Many Black families today are excluded from ownership. The racial wealth gap and today’s levels of wealth inequity in the United States are staggering. The tremendous wealth generated by the richest country in the world is concentrated in the hands of fewer and fewer people. We are in an existential crisis that we can say, without hyperbole, threatens the very fabric of our democracy.

We see an opportunity to build a different path. The roots of wealth creation in this country come from owning assets — land, houses, businesses, and at one point in our ugly history, people. Despite efforts to ensure greater equity, there are countless examples where policies have prevented Black households from owning assets both directly and indirectly. These include redlining, predatory lending, and discriminatory housing practices like devaluing homes in Black neighborhoods. Attempts to rectify those policies have led to backlash. The homeownership rate for Black households is 45% – the lowest among any racial group – compared to 75% for White households.

The philanthropic sector, including impact investors, with the support of policy makers, have an opportunity to turn this around with a very simple strategy: making ownership of assets that appreciate in value more accessible, particularly for people of color. Doing so will dramatically reduce the racial wealth gap.

We are on the cusp of catalyzing an ownership movement.

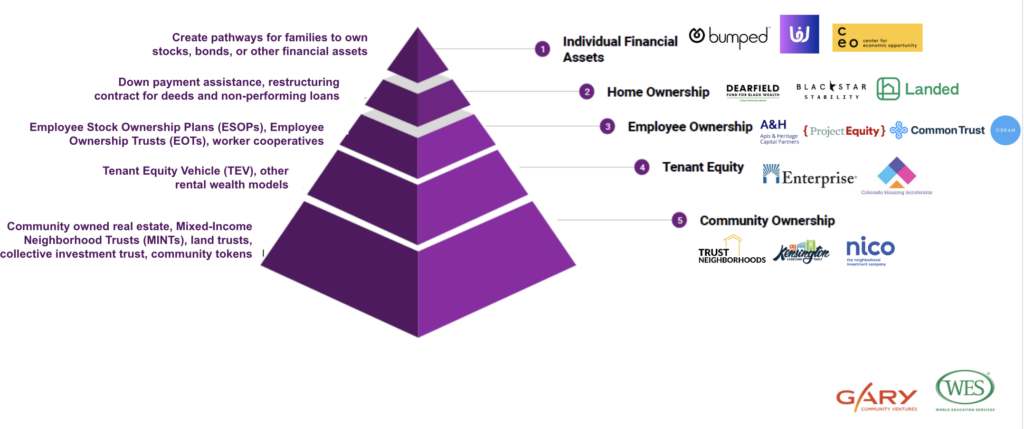

Ownership pyramid

Ownership is having a moment right now. More conference panels and industry articles are highlighting asset ownership as a compelling impact investment strategy. There is a growing list of investable opportunities and funders interested in the space. However, the managers of the emerging funds still often operate at limited scale.

To truly close the racial wealth gap, we must do more. We must supercharge this moment and turn it into a movement. More funders and impact investors need to lean in, to scale solutions and unlock access to wealth for historically underinvested in and overlooked communities.

Foundations and philanthropic institutions – including our own, Gary Community Ventures and World Education Services (WES) – are supporting innovative capital tools. We have developed a framework that can serve as a compass to invest with an ownership lens. Our framework describes a range of models and innovative approaches to build pathways for ownership, equity, wealth creation, and power-building for underinvested in and overlooked households and communities. The underlying theses:

- Balance-sheet assets. Low-income families, especially households of color, should have assets on their balance sheet that can appreciate in value. This often, but not always, means owning some form of appreciable assets.

- Wealth generation. We need models that are not dependent on forcing families to save based on their income. We are excited for passive wealth-generating strategies, whereby low and middle-income families can build wealth by living in a home, working in a job, or even by being a renter.

- Community-wide. These new models create accessible opportunities for underinvested in and overlooked communities to begin to build wealth at scale.

The ownership pyramid includes specific strategies and examples that Gary Community Ventures and WES have invested in:

- Individual Financial Assets: This includes expanding individuals’ access to stocks, bonds, and other financial assets. We see opportunities for expansion through employer match 401(K) accounts, public-sponsored or matched savings plans, and other fintech models that allow for more people to participate in financial markets.

A significant disparity exists when it comes to stock ownership. The wealthiest 10% of Americans own about 89% of all stocks, while the rest of the country owns little to no stock. One organization that we’ve invested in, Bumped, is a platform that gives banks, brands, and businesses the ability to reward customers in fractional shares of stock. Another fintech startup, Woveo, is unlocking financial opportunities for new immigrants in Canada by helping them build credit and establish strong financial foundations — which has traditionally been a major barrier to economic mobility. - Home Ownership: Increased access to home ownership among lower- and middle- income families of color can have a dramatic impact in bridging the racial wealth gap. This is an area where we see significant opportunity for investments, grants, fintech models, and policy change.

Gary launched and WES invested in the Dearfield Fund for Black Wealth, which helps communities build a foundation of intergenerational wealth and financial well-being, primarily through home ownership. It offers Black and African American first-time homebuyers access to no-interest down payment funds that can be applied toward the purchase of a new home. Upon selling or refinancing, homeowners then return the amount they received from the Dearfield Fund plus five percent of the home’s appreciation in value to ensure that the Dearfield Fund can continue to operate.

- Employee Ownership: The majority of the low- and middle- income workforce in the U.S. is employed at small and medium businesses and there is a huge untapped opportunity to unlock broad-based employee ownership in these businesses. We are seeing the emergence of new capital tools and funds using employee ownership as a pathway to address the racial wealth gap.

A great example of this is Apis & Heritage Capital Partners (A&H), a private equity firm that buys small businesses employing majority workforces of color and transitions the companies to 100 percent employee-owned businesses. Through this approach, A&H seeks to close racial wealth gaps and break the cycle of intergenerational poverty. A&H also helps to build worker power by installing democratic governance practices in its companies to ensure that employee-owners can have input in the operations of the businesses they own.

- Tenant Equity and Renter Wealth: We are seeing the emergence of innovative approaches that offer renters a share of upside in multi-family properties where they rent. We call these approaches tenant equity. Given the growth of multi-family rental housing as a common asset class in the balance sheets of impact investors, we feel there is a tremendous opportunity to share some of this upside with renters.

One solution that Gary invested in is the Colorado Housing Action Initiative, which offers two strategies — debt and equity — geared toward filling affordable housing funding gaps and delivering risk-adjusted returns to mission-aligned partners, and is supporting tenants’ path to financial well-being and home ownership.

- Community Ownership: At the bleeding-edge of solutions are approaches where we start sharing prosperity and wealth generated in the entire neighborhood with people who live there and are key to the economic fabric of that community. Models that bolster community ownership include approaches like neighborhood real estate investment trusts and community investment trusts.

WES invested in Kensington Corridor Trust , which leverages a neighborhood trust model to acquire, redevelop, and manage mixed-use real estate property in order to build and maintain collective neighborhood ownership and control in perpetuity, while reinvesting income into community programs. Through community ownership, Kensington Corridor Trust directs investments that preserve culture and affordability while building neighborhood power and wealth, and supporting anti-gentrification and anti-displacement movements.

These approaches do not necessarily require concessionary capital from impact investors. Ownership-led approaches can be a tremendous source of alpha for private market actors.

Sharing a small part of equity upside with those that are integral to creating value (workers, homeowners, community members) can be good for the investment overall. Many private equity funds are starting to realize this.

What started as a small experiment among a small group of impact investors truly has the potential to positively shift our capital markets and create an equitable form of American prosperity.

Smitha Das is director of mission and impact investing at World Education Services. Santhosh Ramdoss is CEO of Gary Community Ventures.