Greetings, Agents of Impact! Welcome to this week’s ImpactAlpha Open, our weekly impact investing briefing read by more than 20,000 professionals.

In this week’s newsletter:

- Impact in listed equities

- April’s Liist of impact funds

- Seeding health innovation

- Rewilding animals as a climate solution

Ok, let’s jump in. – Dennis Price

Must-reads on ImpactAlpha

- Impact in public equities. It’s long been something of a truism among impact investors that it’s not possible to demonstrate true impact in public stock markets. The Global Impact Investing Network has introduced guidance for impact in listed equities that attempts to raise the bar, and clarify how impact strategies in listed equities differ from ESG approaches and other sustainability-related strategies.

- The Liist (April). Just in time for Earth Day (Apr. 22), fund managers with new models for restoring land and marine ecosystems, while building healthy, resilient food systems and communities anchor this month’s Liist of impact funds raising capital, report ImpactAlpha’s Jessica Pothering and Roodgally Senatus.

- Wealth, ownership and ‘quality adjusted life years’ (video). The search for a universal metric to guide investments in racial justice and equitable wealth-building was… aspirational. “We are still a little ways away from the winner, but we have found a pool of possible winners that could all make sense,” Southern Reconstruction Fund’s Napoleon Wallace said, summing up ImpactAlpha’s Agents of Impact Call No. 50. Read the Call recap and watch the video replay.

- Catch up quickly. ImpactAlpha’s David Bank compiles efforts chasing the holy grail of a universal metric for racial equity and wealth-building.

- Community banking assets. A resilient banking system that makes capital accessible to un- and under-banked customers requires government investment in market infrastructure for community finance, Calvert Impact’s Beth Bafford and Pacific Community Ventures’ Bulbul Gupta argued in a guest post.

- Skill sets for The Great Deployment. As the climate-solutions deployment phase gains steam, knowledge of permitting and zoning, pre-construction design, and local engagement and politics is needed to push solutions past initial demonstrations to successful project implementation, climate strategist Chante Harris writes in a guest post.

Upgrade to All-Access

⚡ Stay ahead of the curve

Executives at Morgan Stanley, Ford Foundation, Kapor Capital, Dalberg and hundreds of other institutions start their day with ImpactAlpha to stay informed and track trends in impact investing and sustainable finance. You can too with an all-access subscription.

Agents of Impact

🌱 Chris Sacca: ‘Cheaper, better, faster, stronger, simpler and just plain cooler’

If climate tech is the new software, Chris Sacca is the new, well, Chris Sacca. The Google executive turned venture capitalist made early bets on Twitter, Uber, Instagram and Stripe, catapulting him to the top of the Silicon Valley league tables. Now, Sacca has turned to a new passion: combating climate change, or in his colorful phrasing, “unf**cking the planet.” With Lowercarbon Capital, Sacca is amassing a portfolio of “kickass companies” tackling some of the thorniest climate challenges.

- Keep reading Chris Sacca’s profile by ImpactAlpha’s Amy Cortese.

🏃🏿♀️ On the move

- LeapFrog Investments names Rob Leary, ex- of Nuveen and Olayan Group, as senior advisor to Leapfrog’s leadership team.

- Jen Sullo, former global head of sustainable investing solutions at Goldman Sachs, joins Earth Finance as managing director of asset management and investing solutions.

- Stifel Financial Corp. scooped up three former Silicon Valley Bank bankers with deep climate tech connections. Jake Moseley, Matt Trotter and Ted Wilson, will join the St. Louis-based investment bank as managing directors.

Impact Briefing

🎧 On the podcast

From Austin, I joined host Brian Walsh to discuss Texas’s surprising role as the U.S. leader in clean energy – and how the oil-pumping state might yet wrest defeat from the jaws of victory. Plus, the headlines.

- Listen to the latest episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

Deal Spotlight

💸 Climate tech in Europe

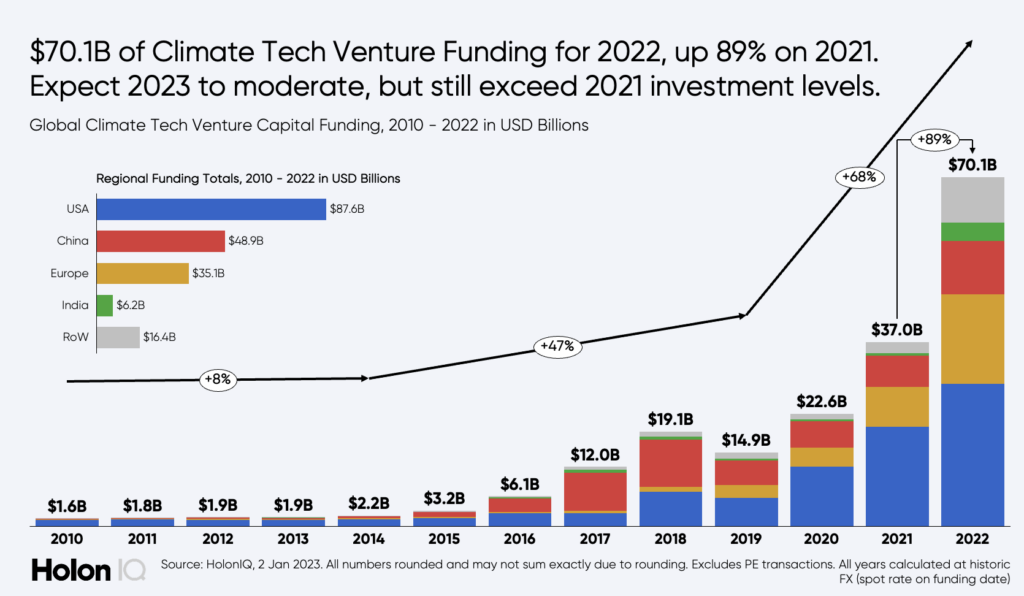

Climate tech is the fastest-growing venture capital sector in Europe. Of the $70.1 billion in funding deployed to global climate tech ventures last year, close to $18 billion went to startups in Europe. The European Commission last month set out its Green Deal Industrial Plan, an answer to the Biden administration’s industrial policy that is supercharging clean tech investment in the U.S.

- Follow the money. Copenhagen-based Agreena raised €46 million ($50 million) to help farmers in Europe transition to more regenerative practices and generate revenues from soil carbon credits. Finland’s Carbonaide secured €1.8 million to ramp up production of its carbon-negative concrete. Off the mainland, U.K.-based Mixergy landed £9.2 million ($11.4 million) for its energy-efficient and renewables-compatible hot water tanks.

- Read the full spotlight.

Six Signals

👩🏽🦱🧑🏼🦱👨🏾🦲👩🏻 Inclusion alpha. Cambridge Associates plans to increase investments in money-management firms owned by women and minorities to about $82 billion over the next two years, roughly 15% of the firm’s assets under advisement. (Bloomberg)

⚕️ Seeding health innovation. Among more than 35 VC funds with at least a fifth of their investments in healthcare startups (and at least 20% in seed): Acumen America, Impact Engine, J-Ventures and Abell Foundation (Betaboom).

🤖 AI and disability. From robot avatars and brain signals to bionic limbs, new tech is expanding opportunities for millions of people living with disabilities. (Bloomberg)

🌱 Climate tech dilemma. More than a fifth of all VC investments into climate-tech startups last year were in deals with participation from oil and gas companies: $6.79 billion out of a total $36.47 billion. (Pitchbook)

🐺 Rewilding as a climate solution. Wildebeest populations are shown to reduce wildfires. Sea otters restore tropic cascades in coastal kelp forests. Grey wolves can have positive effects in forests. Research shows that restoring wild animals can enhance natural carbon capture and storage. (Nature / Cain Blythe)

🌏 Resilient energy and food systems in Asia. Sustainability-linked loans, remittances, Islamic finance, blended finance and even crowdfunding can be harnessed and targeted to grow financing for sustainable energy and food systems in Asia and the Pacific. (Asia Development Bank)

Get in the Game

💼 Step up

- Bill & Melinda Gates Foundation is hiring an investment officer for its strategic investment fund in Seattle.

- New York Life Investments seeks an impact investing senior associate.

- In Singapore, IIX seeks a credit portfolio management associate, and Temasek is hiring a sustainable solutions assistant vice president.

Check out the week’s full list of impact jobs on ImpactAlpha.com.

🎬 Take action

- Impact Frontiers and The Predistribution Initiative seek input on their Investor Contribution 2.0 project, which is developing resources to help investors measure, manage and report on their positive and negative contributions to impact and systematic risk.

- VC Include is accepting applications for its 2023 fellowship for historically underrepresented first-time fund managers.

🤝 Meet up

Don’t miss these upcoming ImpactAlpha partner events:

- April 13: Founders First’s webinar, “Innovating for Equity in an Uncertain Economy.”

- April 24-26: Neighborhood Economics’ “National conversation with local impact,” in Jackson, Miss.

- April 24-26: Big Path Capital’s MO Summit in Austin, Texas.

Get ImpactAlpha Open in your inbox each Tuesday

📬 Sign up for FREE.

Don’t be a stranger. Connect with us. Tell us who you are and what you’re up to. Share your news, tips, data points, introductions and high-impact ideas, to [email protected].

See you back here next Tuesday!