ImpactAlpha, May 20 – Some impact investment funds are reconsidering their portfolios and restructuring arrangements with companies hard hit by the COVID crisis. Others are pressing ahead with new investments in sectors that stand to grow in the emerging business environment.

Bain Capital Double Impact is doing both.

The private equity firm’s $390 million impact fund announced new investments in edtech company PresenceLearning and health services firm Broadstep Behavioral Health, seizing on opportunities that are proving pandemic resistant, managing partners Iain Ware and Peter Spring tell ImpactAlpha.

Another company in the Double Impact portfolio, Sustainable Restaurant Group, this month filed for bankruptcy amid a bitter dispute with its former CEO, who was ousted by the company’s board.

Back in 2018, Bain “called a trend” toward healthy and sustainable eating and took a stake in the Portland, Ore.-based restaurant. One of the company’s restaurants, Bamboo Sushi, is considered one of the first certified sustainable sushi restaurants. With Bain’s help, SRG expanded from five to 10 sustainable seafood restaurants.

But the company couldn’t weather the coronavirus business disruptions. Amid local shutdowns, it shuttered all 10 locations and furloughed or fired 90% of its employees.

Dual realities

The split-screen at Bain Capital Double Impact reflects the dual realities of impact investing in the time of coronavirus. Some ventures in edtech, healthtech and fintech are poised for rapid growth as consumers adapt to the new normal of distance learning, telehealth and mobile money. Restaurants and other businesses, sustainable or not, have been hit hard by shutdowns, social distancing and supply-chain disruptions.

Newer entrants into impact investing, including major private-equity firms like TPG and KKR as well as Bain, will be scrutinized for how they operate in the newly volatile marketplace. Many impact investors have shown flexibility and patience, cutting interest rates, extending repayment schedules and finding other ways to help companies extend their cash runways.

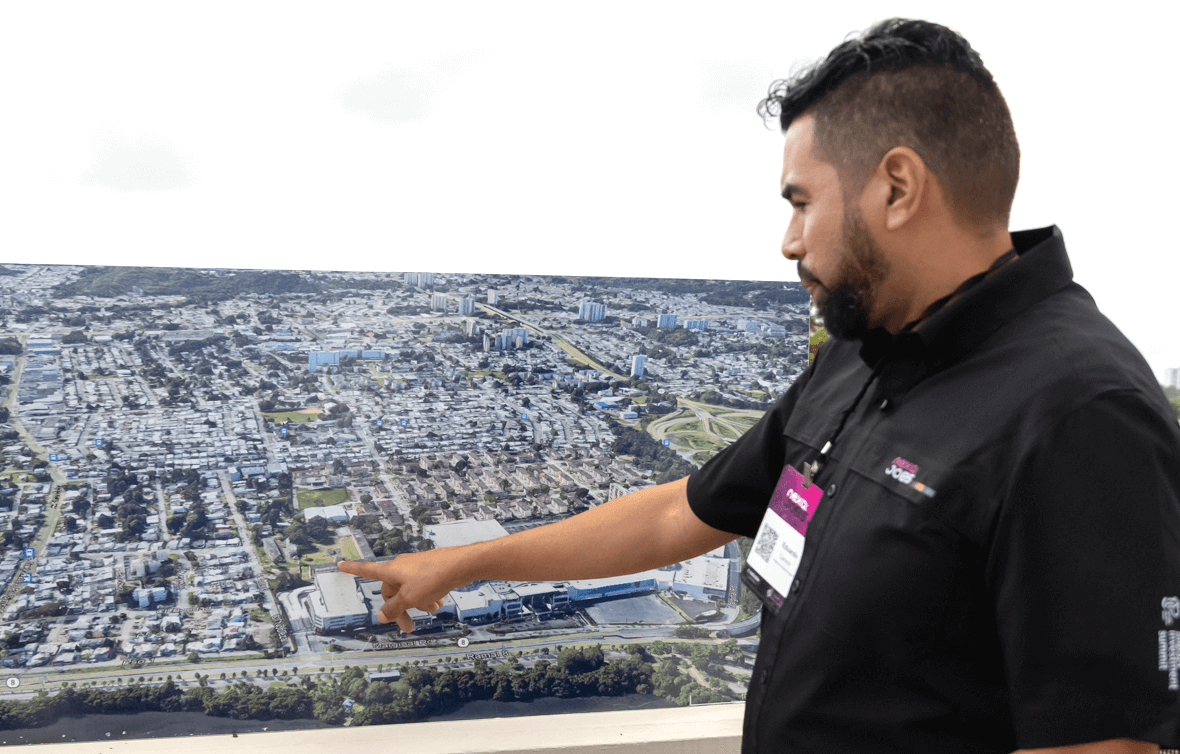

‘Neighborhood investment company’ helps Los Angeles residents buy back the block

But private-equity investors are well-versed in the opportunities the need for new infusions of additional capital presents for extracting concessions and gaining additional leverage over portfolio companies. The appropriate sharing of upside potential and downside risk may not be known until the crisis has passed.

“With the right approach and mindset, there’s an opportunity for private equity to drive powerful impact,” Ware told ImpactAlpha. What matters, he adds, is “How can we find the companies with really positive social and environmental benefits? How can we work alongside the management teams to maximize that impact?”

Restaurant restructuring

The restructuring efforts at Sustainable Restaurant Group are a reminder of how quickly once-friendly relations can turn acrimonious. The cessation of normal business operations cut the chain’s cash flow, making SRG and its restaurants “incapable of meeting their obligations in the ordinary course, including obligations to employees, landlords, vendors, suppliers and other creditors and claimants,” Matthew Park, SRG’s interim CEO, declared in an affidavit to the bankruptcy court.

Last month, the company’s former CEO, Kristofor Lofgren, filed suit against Bain Capital Double Impact and its board representative, Christopher Cozzone, as first reported in the Portland Business Journal. The complaint alleges a deliberate effort on the part of Bain Capital to secure greater ownership in the company and remove Lofgren as CEO. Lofgren asserts he was attempting to “secure any additional funding and renegotiate leases to ride out the potential pandemic and maintain the company’s value.” Lofgren did not respond to requests for comment.

In his complaint, Lofgren says Cozzone saw the COVID crisis as an opportunity to secure greater ownership of the company for Bain and moved to accelerate Lofgren’s planned departure as CEO. Lofgren says Cozzone told him he would “move to the Bain Capital playbook.”

In a statement, the parent entity for SRG, Sustainable Restaurant Holdings, called Lofgren’s complaint “yet another attempt to manipulate and pressure Sustainable Restaurant Holdings into paying him money he is not owed.” Lofgren was ousted by the company’s board after an audit turned up accounting discrepancies that he claims were inadvertent mistakes.

Park, in his affidavit, says Sustainable Restaurant Holdings in March hired BMO Capital Markets, which reached out to 30 possible investors to raise additional capital or sell the business. “It became clear that the needed incremental financing was not available in the current market conditions,” he states.

Per the bankruptcy filing, Bain Capital entities own 39.2% of SRG, up from the 23% stake it acquired in 2018. Cozzone has left Bain Capital to pursue “another opportunity,” a Bain Capital spokesman said. According to his LinkedIn page, Cozzone this month became a director at French private equity firm Astorg in New York. He referred ImpactAlpha’s inquiries to Bain Capital.

Bain’s investment managers declined to comment on the civil suit, but say the bankruptcy restructuring is the best path forward for SRG as it looks for a buyer. The company’s stated goal in filing for Chapter 11 protections is to “preserve value for its stakeholders, including its employees and creditors,” and to restart operations and reopen restaurants after the COVID shutdown period.

Growth sectors

While many businesses have been hammered by the COVID-related shutdowns, others sectors are poised to grow. PresenceLearning, which provides online special education-related services like speech pathology and behavioral and mental health to under-resourced K-12 schools, has seen an uptick in demand for its platform as schools navigate the transition to online learning.

“The company has seen a lot of interest from school districts trying to get through this period and contingency planning, and looking for ways to optimize their resources,” said Ware.

Bain Capital led the company’s $27 million Series D round, citing an opportunity to “accelerate universal K-12 access to remote special education related services, during COVID-19 closures and beyond.”

Broadstep, which provides health and mental support services for individuals with intellectual and developmental disabilities in four states, has been deemed an essential business in the crisis and is continuing to serve patients with few reliable alternatives for specialized care. Bain closed its investment in Broadstep, then called Phoenix Care Systems, in December. It took the company through a rebranding process, recruited a new CEO, and helped the company launch Broadstep University, an online career training program for Broadstep’s frontline care workers.

“Our growth plans remain the same,” in spite of the pandemic, said Spring. “We’re looking at growth through organic expansion—new homes, new geographies—and for acquisition opportunities.”