TGIF, Agents of Impact!

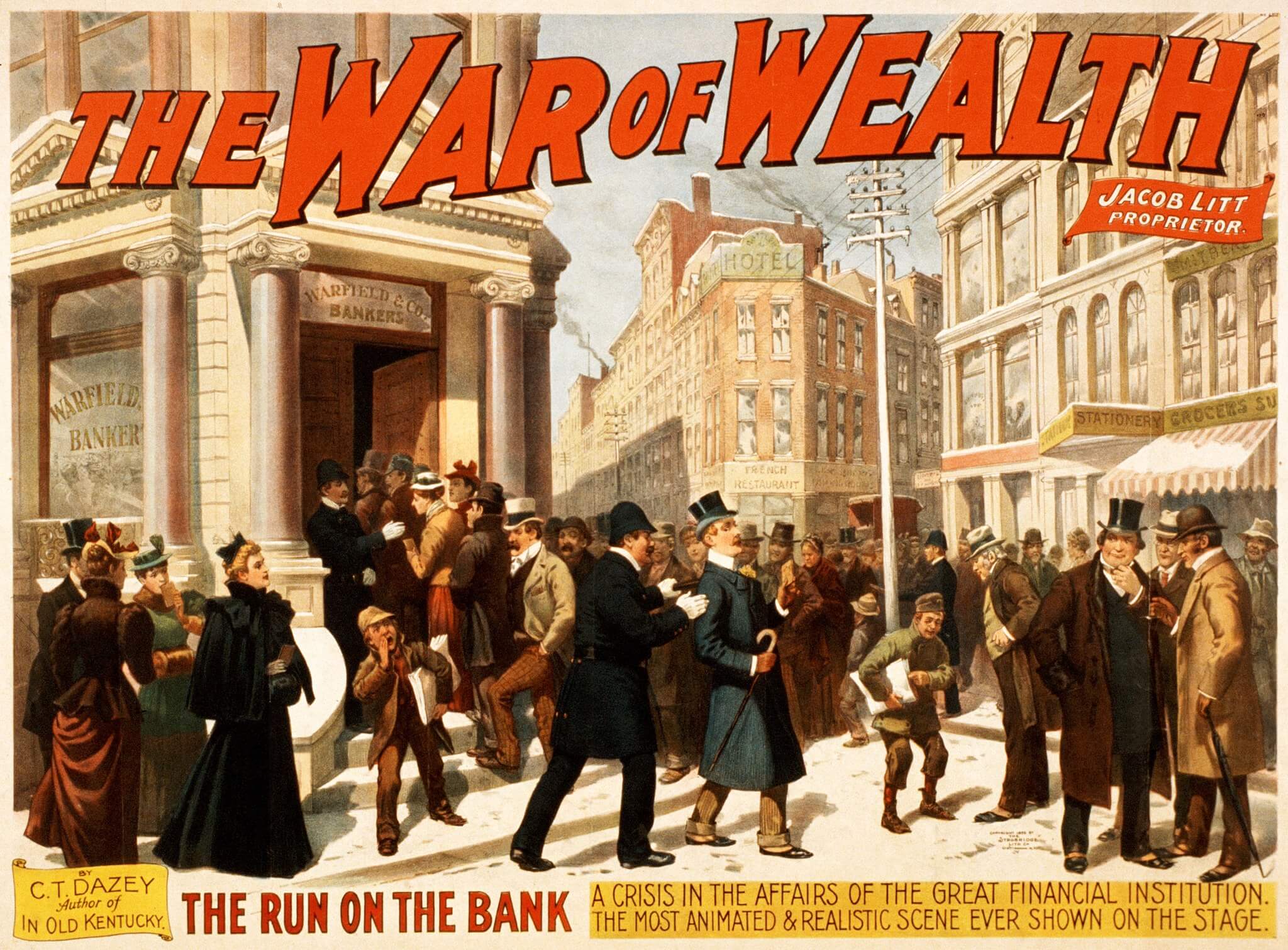

Banking impact. March madness, indeed. The annual basketball tournament in the U.S. has so far been overshadowed by the global financial scare sparked by last week’s massive run on Silicon Valley Bank. After the feds, and the Fed, bailed out depositors, attention turned to the startup and climate tech ecosystem in which the bank was so deeply embedded. Silicon Valley Bank was rare in its willingness to provide startups with “venture debt.” The bank claimed to finance more than 60% of all U.S. community solar projects. It was one of the few banks to offer dollar accounts to Latin American tech startups and “back-leverage debt financing” to help companies take advantage of renewable energy tax credits. Silicon Valley Bank even backed first-of-a-kind deployments of promising climate solutions, bridging a critical gap on the way to full-scale commercialization. “There was no other bank, regional or national, that was as deeply involved or as good a partner as Silicon Valley Bank,” as Todd Johnson of Activate, the fellowship network spun out of U.S. National Laboratories, told ImpactAlpha.

In a possible silver lining, the bank’s implosion could result in broader distribution of such important financial services. Private equity firms like Apollo, KKR and Blackstone are circling Silicon Valley Bank’s loan book, reflecting the opportunities they see in financing the green upgrade. Alternative lenders that mobilized for the immediate crisis are rebooting for the longer term. More broadly, a growing mix of funders are stepping up to build a diverse startup and climate tech ecosystem. ImpactAlpha’s Roodgally Senatus caught up with Kapor Capital’s Freada Kapor Klein and Mitch Kapor, who have a new book on their decade of seeding companies like BlocPower, Bitwise, Promise and Aclima. The Los Angeles Cleantech Incubator backed ChargerHelp! to roll out EV chargers and green jobs in underserved communities. About one-quarter of the 163 fund managers in this year’s ImpactAssets 50 list are focused on climate. Even BlackRock – whose chairman Larry Fink walked a fine line on ESG in his annual letter, as contributing editor Imogen Rose-Smith detailed in her latest column – affirmed its responsibility “to play a constructive role in the transition” to a low-carbon economy.

Back to those brackets. In the spirit of the season, ImpactAlpha has kicked off Metrics Madness, in partnership with the Southern Reconstruction Fund, to identify the best metrics to guide investment strategies for bridging racial-wealth gaps and accelerating racial wealth-building. Please nominate your preferred metric for inclusion in next week’s bracket. Over the next two weeks, we’ll air out the debates and sort out the contenders. Then join Southern Reconstruction Fund’s Napoleon Wallace (see, “Agent of Impact”) and leading agents of impact measurement and management for the fun and fruitful finale of Metrics Madness on Wednesday, March 29 (RSVP today). The just transition is green, diverse and surprisingly resilient. The smart money is betting on it. – Amy Cortese

The Week’s Podcast

Ben McAdams: Marrying public real estate and private capital (podcast). What is the net worth of Salt Lake City? It’s a relatively straightforward exercise to total up the balance sheet of a company or an individual. But many cities don’t know what they own, much less what it’s all worth. As mayor of Salt Lake County a decade ago, Ben McAdams was frustrated that there wasn’t $500,000 in a $1.3 billion annual budget for a promising early-childhood education program (so he helped craft one of the country’s first social impact bonds). But an effort he led to map the value of the city’s underutilized real estate yielded an impressive number: at least $15 billion, and up to $45 billion if properties are developed thoughtfully. “I found out there is actually money under our mattress,” McAdams tells David Bank on this week’s Impact Briefing podcast. “It’s real estate that is just forgotten.”

After his single term in Congress (as a Democrat from a deep red state), McAdams has been working with a half-dozen cities to tap the riches in underutilized public real estate. His “Putting Assets to Work” policy incubator is working with Atlanta, Cleveland, Annapolis, Chattanooga, Lancaster, Calif., and Harris County, Texas, which have similarly found billions in untapped assets. The next step is to help cities deploy those assets to generate income that will fund essential services. A city that contributes, say, a $5 million parcel toward a $20 million housing project (with private investors supplying the rest) could earn 25% of the rental income. At scale, McAdams says, “You’re funding education. You’re solving affordable housing. You’re solving homelessness. You are investing in roads and bridges and filling potholes. And then you’ve still got enough money left to cut taxes.” Some of the cities are close to closing their first deals; Sorenson Impact Group is incubating a “community equity fund” based on McAdams’ work. “It’s real revenue that’s out there,” he says, “if we can just figure out the right systems and then bring in the private capital to do it.”

- 🎧 Impact Briefing. Listen in to David Bank’s full conversation with Ben McAdams on this week’s episode. Follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

Sponsored by CalCEF Innovations

Seeking proposals for a China climate ETF or mutual fund. California Clean Energy Fund (CalCEF) Innovations, a nonprofit public benefit corporation, is seeking proposals from sustainable financial advisors and fund management companies that specialize in the development of climate-aligned exchange-traded funds and mutual funds, as well as the marketing of those investment products to U.S.-based retail and institutional investors. The purpose of the request for proposals is to expand China-focused, climate-aligned investment product offerings for the U.S. market through the development of a climate-friendly fund product – in the form of an ETF, index fund or mutual fund that tracks a designated climate index. The RFP will offer a sponsorship of up to $300,000 to deliver the fund. All work required for regulatory approval must be concluded by Oct. 31.

- How to apply. All proposals must be submitted by Friday, March 31. For more information read the full RFP.

The Week’s Dealflow

Dealflow spotlight: Emerging market investors spot opportunities in essential products and services. Economic uncertainty has kept many investors out of emerging markets. Seasoned impact investors know where to spot steady and growing opportunities. “These are such essential services that we know businesses will continue to have these needs,” said Amee Parbhoo of Accion Venture Lab, which invested in three companies in Asia introducing financial services to small businesses in manufacturing, logistics and agriculture.

- Africa’s value chains. In Uganda, woman-led Inua Capital this week closed $8 million for its first fund to invest in small and growing businesses that are strengthening production and supply chains for essential goods and agriculture. “We import a substantial amount of our essential goods, and that is a real risk for us as a nation,” said Inua’s Kim Kamarebe. Investing in those value chains “makes very strong financial sense because in tough times, these are the resilient businesses.” Renew Capital invested in Kenya’s Badili to improve affordable online and mobile access.

- Latin flavor. Elevar Equity sees similar opportunities in Latin America, where the firm is increasing its investment activity with a new regional fund. (It’s also, for the first time, raising a dedicated fund for India.) Elevar has backed skills training and job placement startup Galena, small business logistics and financial services provider Fairplay, and community-centric grocery provider Favo. “There is a lot of resilience within lower-income and underserved communities,” Elevar’s Johanna Posada told ImpactAlpha. “People will continue to spend on basic services.”

- Share this post.

Agrifood investing. Gaia Impact Fund and Schneider Electric invested in Singapore-based agtech venture Agros, which supports small farmers in Cambodia and Myanmar… Patagonia’s food and beverage group acquired climate-friendly snack company Moonshot.

Carbon markets. Carbonomy scored $16 million to help farmers adopt sustainable farming practices and link them to carbon markets… Tyson Foods’ venture group invested in Athian, a carbon credit marketplace for corporate buyers in the livestock industry.

Catalytic capital. Swiss development finance institution SDC invested 15 million Swiss francs in BUILD Fund for gender-based investments in Zambia and Zimbabwe… Caisse Régionale de Refinancement Hypothécaire raised $274 million for affordable housing in West Africa.

Clean energy. Berlin’s Trawa raised €2.4 million to help Europe’s small and medium-sized businesses switch to clean energy… Denmark’s Copenhagen Infrastructure Partners acquired a controlling stake of South African renewable energy developer Mulilo… Mirova SunFunder secured $171 million to finance the energy transition in emerging markets… Estonia’s Roofit.Solar secured €6.4 million to help European homeowners switch to rooftop solar power… RSF Social Finance extended a $5 million loan to Sunwealth to support community solar projects in the U.S.… Solarcycle raised $30 million to recycle and remanufacture solar panels.

Clean tech. Germany’s Intelligent Fluids secured €10 million to develop non-toxic and biodegradable cleaning agents… Los Angeles Cleantech Incubator backed ChargerHelp and Repurpose… Off-highway vehicle electrification company ZeroNox to go public via SPAC as deadline looms.

Green infrastructure. British International Investment and Metito Utilities to invest in water infrastructure in Africa… Jordan’s first green bond secured $50 million from the International Finance Corp.

Renewable fuels. Chicago-based ClearFlame Engine Technologies raised $30 million to help heavy industry transition from diesel fuel to cleaner biofuels… Montreal-based Airex Energy raised C$38 million to convert biomass into biofuels.

Returns on inclusion. Bank of America invested in seed-stage venture fund BFM Fund, for Black Founders Matter… Accial Capital secured $35 million to finance women-led businesses in Latin America and Asia.

The Week’s Talent

Carol Adams, professor of accounting at Durham University Business School, is named chair of the Global Sustainability Standards Board. She takes the reins from Judy Kuszewski… Alex Amouyel is stepping down as MIT Solve’s executive director to join Newman’s Own Foundation as president and CEO… Eric Wilburn has resigned as Earthshot Labs’ head of product.

David Barley, former director of Mirova’s sustainable oceans fund, joined Gravis Capital Management as an investment director… May Ng, formerly with Annie E. Casey Foundation, will join the Robert Wood Johnson Foundation as chief investment officer. Ng will replace Brian O’Neil, who announced his retirement last year.

Loïc Comolli, ex- of NESsT, joined the Schmidt Family Foundation to focus on U.S. food and agriculture investments… Climate consultant Monica Araya was named executive director of international programs at the European Climate Foundation… US SIF named Maria Lettini its new chief executive officer. Lettini, currently executive director of FAIRR Initiative, will succeed Lisa Woll starting May 15.

Jessica Brooks, ex- of Sunwealth, was named chief development officer for Capital Link. Brooks will remain a Sunwealth advisory board member (see, “Agent of Impact: Jessica Brooks”)… Federico Mambelli, ex- of Sagana, joined Lendable as a quantitative data associate… EY promoted Michelle Davies to global sustainability legal services leader, a new role.

The Week’s Jobs

💼 Share the week’s impact jobs. Want to post a job in The Brief? Drop us a note.

New York

The Ford Foundation seeks a mission investments technology fellow… The Rockefeller Foundation has an opening for an executive director to lead the economic opportunity coalition secretariat… The Open Society Foundations is looking for an associate director of climate justice for a two-year contract.

The Global Impact Investing Network seeks a director of communications… Goldman Sachs is recruiting a nature-based solutions investment associate… Franklin Templeton is looking for a sustainable investments research analyst.

Other East Coast locations

In Washington, D.C., Accion seeks a director of public relations and communications, and World Wildlife Fund is looking for an aquaculture impact investment intern… Brown Brothers Harriman is hiring a sustainability analyst in Boston… New Jersey Community Capital has an opening for a fund development specialist… Arctaris Impact Investors is looking for a private equity investment analyst and associate.

West Coast

In San Francisco, the San Francisco Employees’ Retirement System has an opening for an ESG investment officer, the Draper Richards Kaplan Foundation has an opening for an analyst, Cisco Foundation is recruiting a climate impact investments portfolio associate… BlocPower is recruiting clean energy project associates in Oakland, San Jose and other locations.

Enterprise Community Partners seeks a manager of investment communications in Los Angeles… Occam Advisors is hiring an analyst in Portland… Starbucks is hiring a coffee sustainability data impact lead in Seattle… In the Mountain zone, Bridge Investment Group is looking for an ESG analyst in Sandy, Utah.

Global locations

In Singapore, GenZero is recruiting an ESG and impact measurement senior associate and several other roles, GIC is recruiting an assistant vice president for sustainable investing research, and IIX has an opening for a marketing and advocacy senior executive.

In London, Snowball is hiring an impact investing manager and associate, Cambridge Associates is looking for a sustainable and impact investment analyst, and Acumen is looking for a program associate for its Acumen Academy. Elsewhere in Europe: LEGO Group is hiring a senior global sustainability manager in Denmark… Morgan Stanley’s Inclusive Ventures Group is looking for an investment analyst in Budapest.

In Latin America, Alinea International seeks a contractual executive director for its Aliados de Impacto initiative in Lima, Peru… The Climate and Land Use Alliance is looking for a strategic communications director in Colombia and Peru…The Nature Conservancy is looking for a director of development… Inconfin is on the hunt for an agro/food portfolio analyst in Bogota.

Root Capital seeks an East Africa portfolio manager in Nairobi and a Ghana portfolio manager… Fidelity Investments is looking for an ESG research lead in Bangalore… responsAbility is hiring a climate finance investment analyst in Mumbai… The Ford Foundation seeks a regional director in Beijing.

Remote jobs

Nia Impact Capital is hiring an operations and communications associate… Women’s World Banking is hiring a global head of brand, marketing and communications… Sagana Capital seeks an investment manager and a consulting director… Upaya Social Ventures seeks a communications manager.

That’s a wrap. Have a wonderful weekend.

– March 17, 2023