ImpactAlpha, Oct. 1 – Metrics. Standards. Dimensions. Frameworks. SDGs. Cathy Clark of the Center for the Advancement of Social Entrepreneurship at Duke University’s Fuqua School of Business joined Agents of Impact Call No. 31 to help make sense of the alphabet soup of impact measurement and management. Clark was joined by Courageous Capital’s Laurie Spengler and Calvert Impact Capital’s Beth Bafford.

“Knowing the basics of impact measurement and management is table stakes for a career in impact investing and sustainable finance,” we wrote in the lead to this week’s call. On the call, Laurie Spengler of Courageous Capital Advisors went further. “It’s why we are here as impact investing professionals.”

For impact investors, says Spengler, impact measurement and management done well answers the important questions. What is the capital doing? What impact is it having on people’s lives? What is changing in the places where the capital flows to? “That’s the centerpiece, that’s the core question,” says Spengler.

The answers to those questions are becoming increasingly important as investors move to align with the U.N. Sustainable Development Goals, or simply seek to navigate oncoming climate and racial-justice oriented regulations.

Clark previewed CASE’s new free online Coursera course, “Impact measurement and management for the SDGs,” that it released the United Nations Development Programme, the arm of the U.N. that created the SDGs. The course, which can be completed in a weekend, takes participants through the “four universal steps” of impact measurement and management (set strategy, integrate, optimize and reinforce). Think of it as a Netflix binge for impact management, says Clark.

In set strategy, for example, participants are introduced to the “ABC classification levels” to help them set their impact investment goals.

A — Investments that integrate ESG factors to start to avoid or reduce some of their harmful impact can fall into the “A” category.

B – Investments that are working to create positive benefits for stakeholders, such as thematic investments in specific solution areas, would fall into the “B” category.

C – Investments working toward a measurable impact outcome for which the population or environment is currently underserved would be in the “C” category.

Each type of investment strategy “requires different information and requires different management,” says Clark.

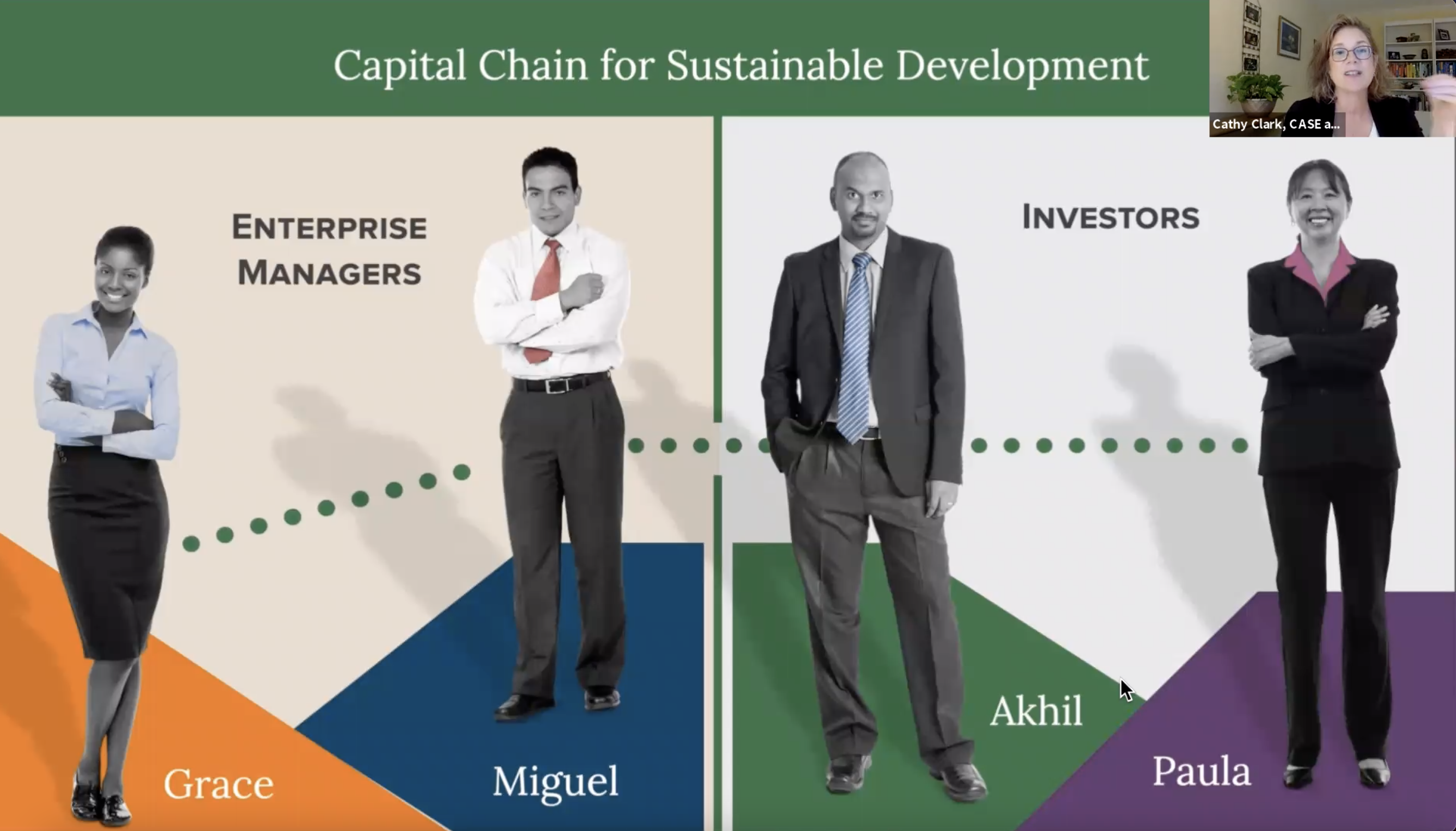

Participants take the course from the perspective of roles in the investment value chain. There’s Grace, an owner of a small business in South Africa; Miguel, a vice president at a multi multinational agricultural firm in Brazil; Akhil, an impact fund manager in India; and Paula, “the asset owner,” who works at a family office.

“It’s a teaching shortcut,” says Clark, that allows “you to see how this is done from the perspective of different people in the value chain.”

The course is timely, said Bafford. “Whether we’ve been in the industry for a year or 25 years, all of us are really trying to get sharper on our practices and making sure that we are keeping an eye on the continued best practices in the industry.”

Impact investors must get better at listening, said Bafford. The industry needs to try “to get more active, direct feedback from the people we are trying to help.”

Clark and ImpactAlpha’s David Bank dangled the ‘Optimizing for Impact’ challenge” for those still hesitant to dive in:

1. Complete the Coursera course.

2. Add the certificate of completion to your LinkedIn profile.

3. Share your updated profile. ImpactAlpha will recognize the first 100 Agents of Impact to do so, who also will receive a small prize from CASE.