Greetings, Agents of Impact!

Featured: ImpactAlpha Original

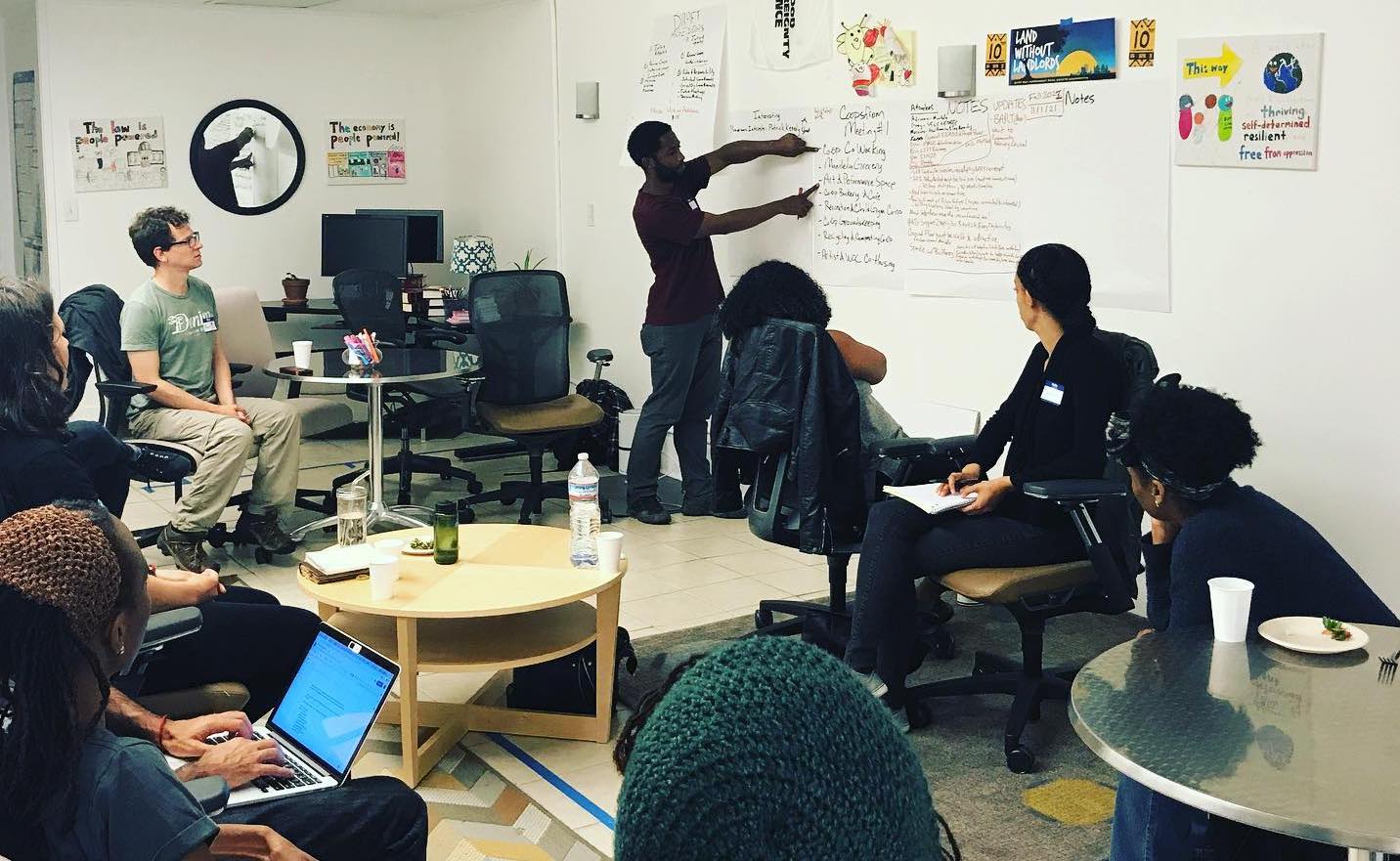

Reviving a Black cultural corridor in West Oakland – as a community-led cooperative. In another era, Esther’s Orbit Room helped make West Oakland the “Harlem of the West,” hosting the likes of B.B. King, James Brown and Billie Holiday. Noni Session had grown up less than a dozen blocks away. So when the club, vacant for a decade, went up for sale last year, she pounced. Sessions now heads the East Bay Permanent Real Estate Cooperative, a community-led group that acquires properties for permanent community use and takes them off the market in fast-gentrifying Oakland. The co-op is part of a new crop of neighborhood trusts and other vehicles aiming to sustain affordability in cities by putting ownership and control of neighborhood assets into the hands of low-income residents and their allies (see Voices, below). Other experiments underway include the Kensington Corridor Trust in Philadelphia and the Mixed Income Neighborhood Trust, or MINT, in Kansas City (see, “Neighborhood trusts are taking on speculators and building community wealth”). To Sessions, Esther’s Orbit Room seemed the perfect anchor for the revival of West Oakland. “This feels in some ways like a legacy project to me.”

Esther’s is the first phase of a broader vision developed with local residents: a community-governed Black Cultural Corridor. The $4.8 million project includes a bar and performance venue, a cafe, juice bar and coffee shop, galleries for fine arts, dance and healing arts, and affordable homes for up to 10 artists – all at half of the going market rate. The real estate cooperative has raised more than $3 million in no- and low-interest loans from lenders including Kataly Foundation and the San Francisco Foundation, and is looking to secure the rest by offering shares, starting at $1,000, in a cooperative housing and land fund. The shares accrue at a target 1.5% interest for a minimum five-year term; each investor-owner gets a single vote. The co-op “is a beautiful example of what it looks like to have community-owned and community-governed projects that create shared prosperity,” says Kataly’s Nwamaka Agbo. Such projects can help “transition out of an economic system that’s deeply rooted in extraction into a more just, equitable and sustainable economy going forward.”

Keep reading, “Reviving a Black cultural corridor in West Oakland – as a community-led cooperative,” by Amy Cortese on ImpactAlpha.

Impact Voices: Pass the Mic

Centering community voices and power in investment processes. Many mission-driven investors and developers seek community input to increase their projects’ chances of success. “These benefits, however, focus on the project itself and accrue to the project developers,” Transform Finance’s Andrea Armeni, Shante Little and Curt Lyon write in a guest post on ImpactAlpha. “They are not focused on whether the community itself is made better off by it.” Redressing such imbalances: dozens of locally-driven funds and trusts across the U.S. that give communities real agency in investment decisions in order to build long-term power for participants. Transform Finance assessed the models of grassroots community-engaged investment and found that “these elements of power building are the key to long lasting, transformative change.”

- Community governance. Real estate developments that share decision-making power with community members include The East Bay Permanent Real Estate Cooperative (see above), which allows residents of California to invest in local housing projects at a low minimum and gain a stake in most project decisions. Philadelphia’s Kensington Corridor Trust shares decision-making authority with local business and cultural leaders, community development finance institutions and nonprofit partners. Community-governed enterprise investment funds like the REAL People’s Fund, founded by six grassroots organizations in the Bay Area, and the Boston Ujima Fund, are delegating investment decisions to residents and community groups.

- Process matters. The community advisory body of Candide Group’s Olamina Fund has investment veto power. The Solidago Foundation helped bring together the founding board for the REAL People’s Fund and put community groups in control of the fund’s design. Regardless of the specific outcomes of an investment, write the Transform Finance team, such processes “can create power where the affected stakeholders are meaningfully engaged.”

- Keep reading, “How to center community voices and power in the investment process,” by Andrea Armeni, Shante Little and Curt Lyon on ImpactAlpha.

Dealflow: Follow the Money

Indigenous Growth Fund raises $150 million to back Native lenders in Canada. The fund will invest in Aboriginal Financial Institutions, or AFIs, to get more capital flowing to underserved Indigenous businesses. The evergreen fund, managed by the National Aboriginal Capital Corporations Association, an umbrella network for Canada’s roughly 60 AFIs, reached its first close with backing from the Business Development Bank of Canada, Export Development Canada and Farm Credit Canada.

- Native impact. Last month, Vancouver-based Raven Indigenous Capital Partners raised $25 million to invest in Indigenous-led, early-stage startups in Canada. Native-led CDFIs in the U.S. are developing unique financial services to overcome the barriers to lending to businesses on tribal lands (see, “Native-led financial institutions tackle challenges of lending to businesses in Indian Country”).

- More.

Vietnamese e-motorbike venture Dat Bike secures $2.6 million. Motorcycles and scooters are the main form of transport in Vietnam’s cities, and the main source of toxic air pollution. Adoption of cleaner, electric versions is surging, thanks to a growing number of affordable options from China, Japan and Vietnam’s own manufacturers. Ho Chi Minh City-based Dat Bike’s model costs roughly 40,000,000 Vietnamese dong ($1,730)—less than other locally made models. The company is eying expansion to neighboring countries. Its pre-Series A round was backed by Jungle Ventures.

- Transport transition. Dat Bike’s e-motorcycle and e-scooter competitors in Vietnam include Vinfast, part of the automotive conglomerate VinGroup, as well as PEGA and Son Ha Group. In Rwanda, Kigali-based Ampersand raised $3.5 million this month to boost adoption of e-motorcycles. In India, Gurgaon-based Oye Rickshaw raised $3.3 million for its electric-rickshaw ride-hailing service.

- Check it out.

Dealflow overflow. Other investment news crossing our desks:

- Three German pensions back Catella Residential Investment Management’s $570 million green residential housing fund.

- The Episcopal Church’s Pension Fund discloses that it committed $20 million to Turner Capital’s second Multifamily Impact Fund (see, “Turner Impact Capital closes $357 million affordable workforce housing fund”).

- Fintech Plentina secures $2.2 million to boost access to credit in the Philippines through alt-credit scoring and digital lending.

- Austria’s Revo Foods clinches €1.5 million to make plant-based, 3D-printed ‘salmon.’

- India’s Mister Veg raises $570,000 to expand plant-based meat and seafood products for Indian consumers.

Agents of Impact: Follow the Talent

Former Proterra CEO Ryan Popple and Francesca Whitehead, ex- of KKR’s Global Impact Fund, join G2VP to focus on sustainable industrial transformation… Treasury Secretary Janet Yellen names John Morton, ex- of Pollination, to lead Treasury’s new Climate Hub… Emerson Collective is hiring an associate or senior associate of energy and environment in Palo Alto, Calif… Global Development Incubator is looking for a global coordinator and project developer in agricultural finance in Washington, D.C…. Clean Edge seeks a part-time analyst in Portland… CapShift is hiring a marketing director.

Predistribution Initiative is hosting “ESG 2.0: Measuring and Managing Investor Risks Beyond the Enterprise-level,” Wednesday, April 28… George Mason University’s Center for Social Science Research, Department of Sociology and Anthropology, and Democratizing NoVA project are hosting a discussion on systemic crises, movements and change with Wisconsin Rep. Mark Pocan, Gar Alperovitz of The Democracy Collaborative, and Kali Akuno of Cooperation Jackson, tomorrow, April 21.

Thank you for your impact.

– April 20, 2021